Fragrance and perfume company Inter Parfums (NASDAQ: IPAR) announced better-than-expected revenue in Q1 CY2025, with sales up 4.6% year on year to $338.8 million. The company expects the full year’s revenue to be around $1.51 billion, close to analysts’ estimates. Its GAAP profit of $1.32 per share was 17.3% above analysts’ consensus estimates.

Is now the time to buy Inter Parfums? Find out by accessing our full research report, it’s free.

Inter Parfums (IPAR) Q1 CY2025 Highlights:

- Revenue: $338.8 million vs analyst estimates of $329.5 million (4.6% year-on-year growth, 2.8% beat)

- EPS (GAAP): $1.32 vs analyst estimates of $1.13 (17.3% beat)

- The company reconfirmed its revenue guidance for the full year of $1.51 billion at the midpoint

- EPS (GAAP) guidance for the full year is $5.35 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 22.2%, up from 21% in the same quarter last year

- Market Capitalization: $3.63 billion

Company Overview

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ: IPAR) manufactures and distributes fragrances worldwide.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.47 billion in revenue over the past 12 months, Inter Parfums is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

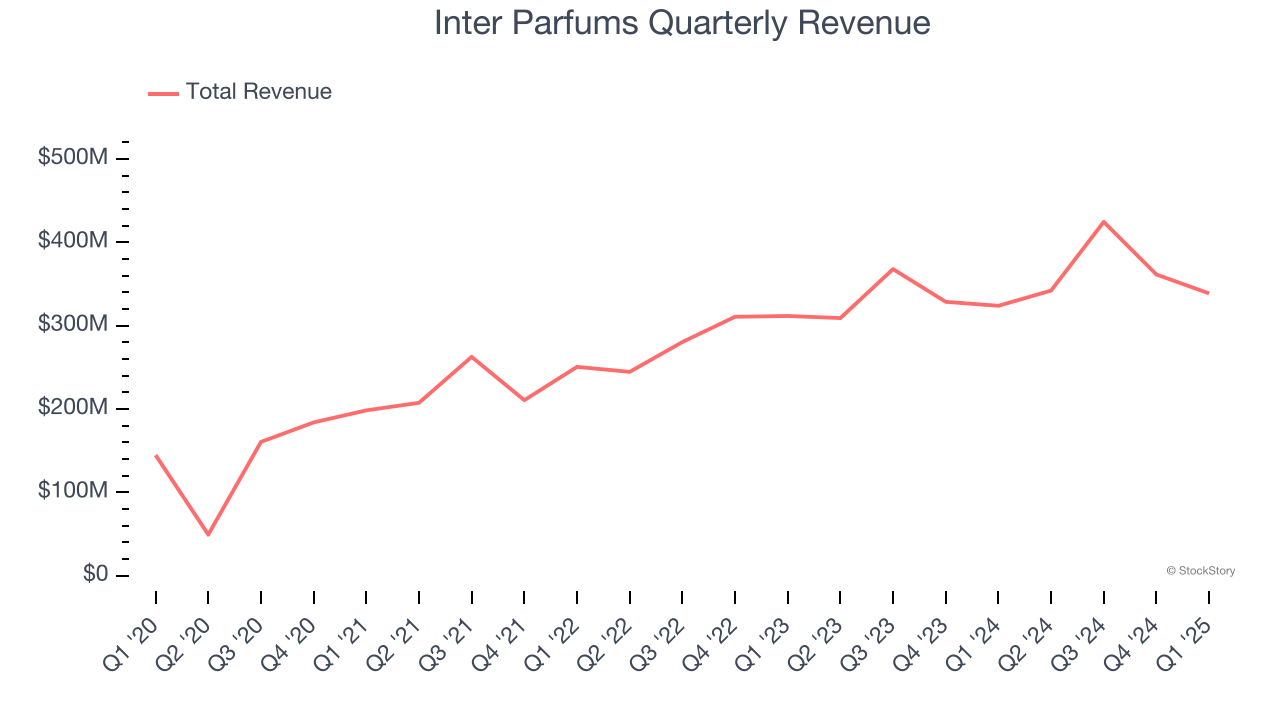

As you can see below, Inter Parfums’s sales grew at an impressive 16.3% compounded annual growth rate over the last three years. This is a great starting point for our analysis because it shows Inter Parfums’s demand was higher than many consumer staples companies.

This quarter, Inter Parfums reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

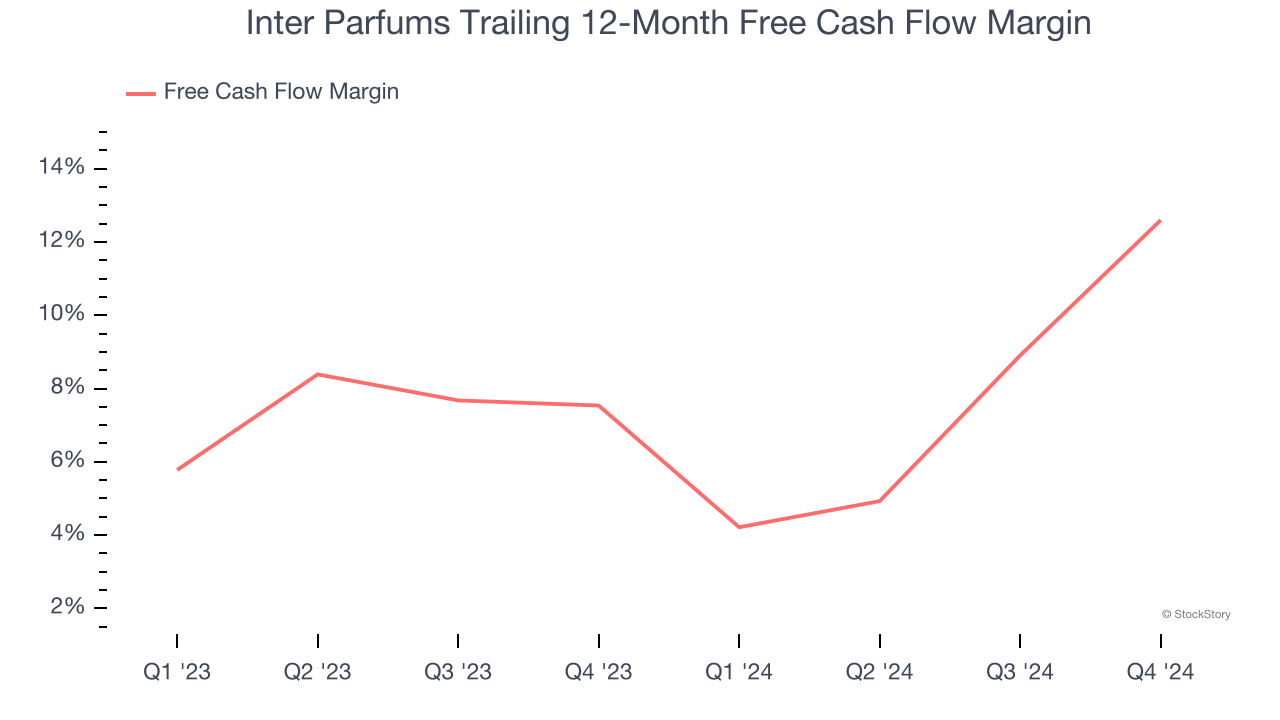

Inter Parfums has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.9% over the last two years, quite impressive for a consumer staples business.

Key Takeaways from Inter Parfums’s Q1 Results

It was encouraging to see Inter Parfums beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 1.7% to $108.50 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.