Looking back on department store stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Nordstrom (NYSE: JWN) and its peers.

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

The 4 department store stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 0.6%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.1% since the latest earnings results.

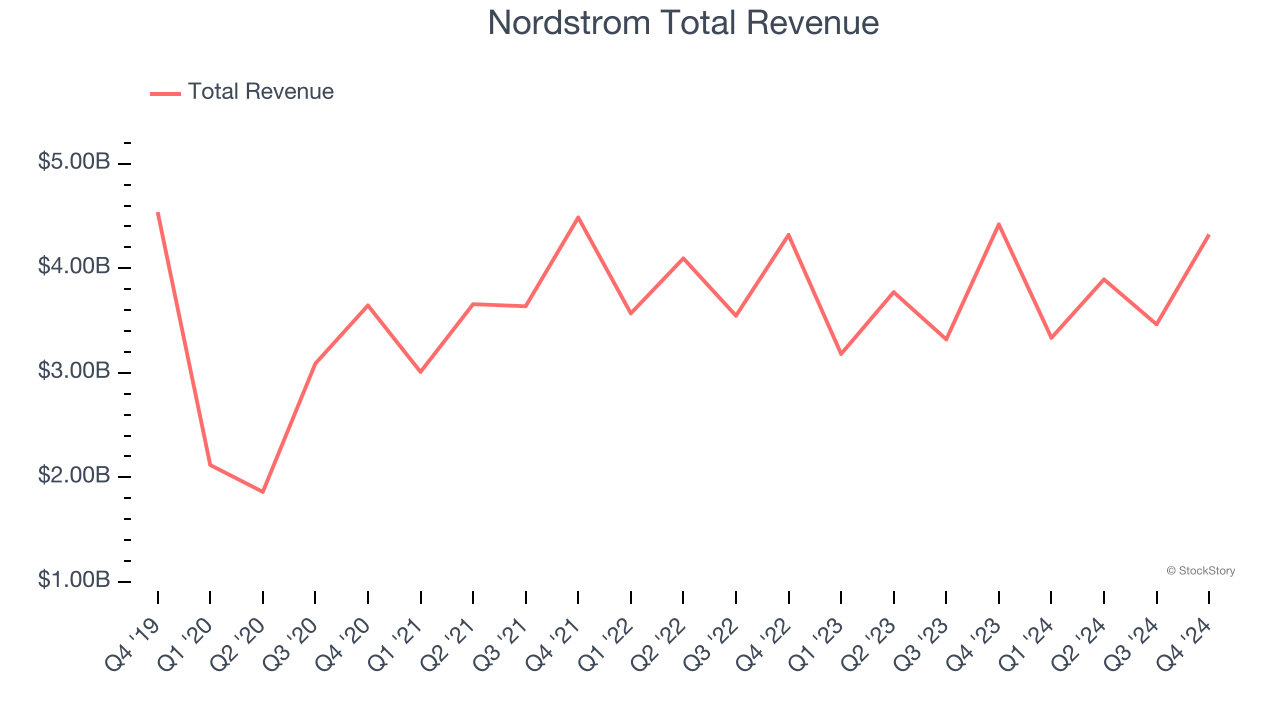

Nordstrom (NYSE: JWN)

Known for its exceptional customer service that features a ‘no questions asked’ return policy, Nordstrom (NYSE: JWN) is a high-end department store chain.

Nordstrom reported revenues of $4.32 billion, down 2.2% year on year. This print exceeded analysts’ expectations by 0.6%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ gross margin estimates but a miss of analysts’ EBITDA estimates.

"Customers responded positively to the strength of our offering across both banners in the fourth quarter," said Erik Nordstrom, chief executive officer of Nordstrom,

Nordstrom scored the fastest revenue growth of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $24.26.

Is now the time to buy Nordstrom? Access our full analysis of the earnings results here, it’s free.

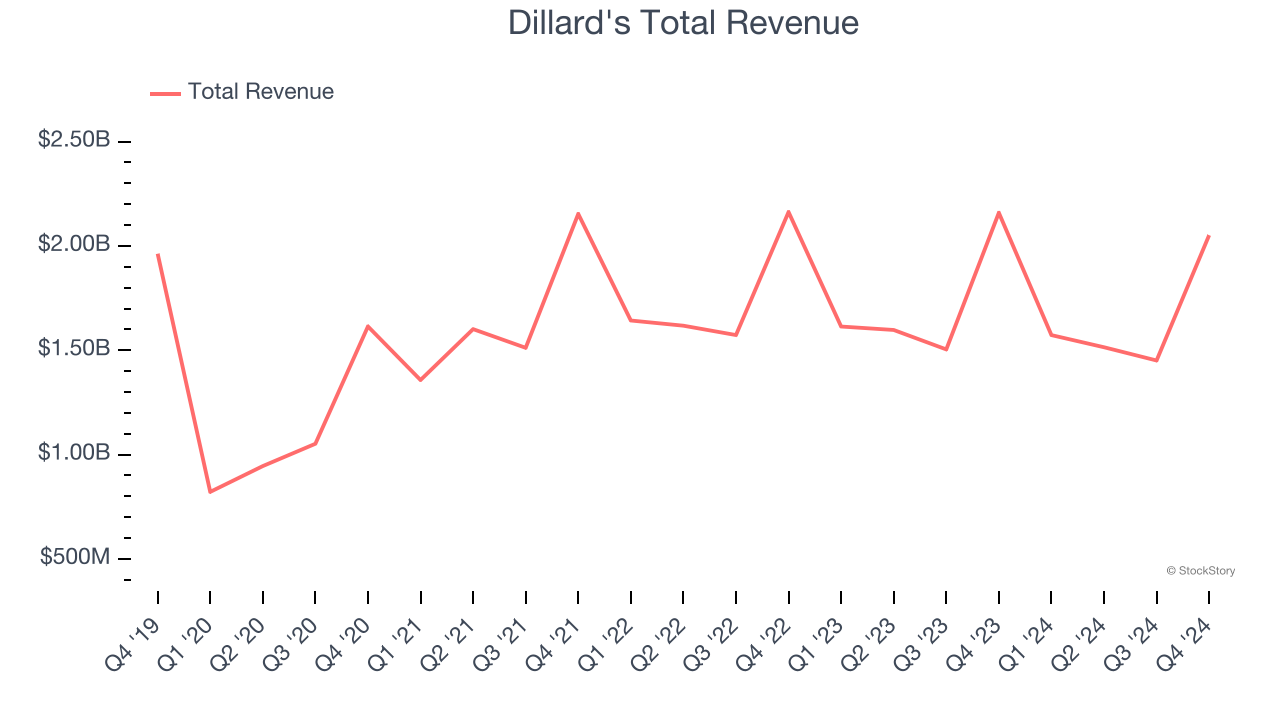

Best Q4: Dillard's (NYSE: DDS)

With stores located largely in the Southern and Western US, Dillard’s (NYSE: DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Dillard's reported revenues of $2.05 billion, down 5% year on year, outperforming analysts’ expectations by 1%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Dillard's achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 20.2% since reporting. It currently trades at $364.34.

Is now the time to buy Dillard's? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Kohl's (NYSE: KSS)

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE: KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Kohl's reported revenues of $5.40 billion, down 9.4% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

Kohl's delivered the slowest revenue growth in the group. As expected, the stock is down 37.5% since the results and currently trades at $7.53.

Read our full analysis of Kohl’s results here.

Macy's (NYSE: M)

With a storied history that began with its 1858 founding, Macy’s (NYSE: M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Macy's reported revenues of $8.01 billion, down 4.4% year on year. This print was in line with analysts’ expectations. More broadly, it was a satisfactory quarter as it also produced a solid beat of analysts’ EBITDA estimates but full-year EPS guidance missing analysts’ expectations significantly.

Macy's had the weakest performance against analyst estimates among its peers. The stock is down 10.5% since reporting and currently trades at $11.91.

Read our full, actionable report on Macy's here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.