Snack food company J&J Snack Foods (NASDAQ: JJSF) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 1% year on year to $356.1 million. Its non-GAAP profit of $0.35 per share was 48.5% below analysts’ consensus estimates.

Is now the time to buy J&J Snack Foods? Find out by accessing our full research report, it’s free.

J&J Snack Foods (JJSF) Q1 CY2025 Highlights:

- Revenue: $356.1 million vs analyst estimates of $367.8 million (1% year-on-year decline, 3.2% miss)

- Adjusted EPS: $0.35 vs analyst expectations of $0.68 (48.5% miss)

- Adjusted EBITDA: $26.2 million vs analyst estimates of $35.69 million (7.4% margin, 26.6% miss)

- Operating Margin: 1.7%, down from 5% in the same quarter last year

- Free Cash Flow was $8.94 million, up from -$3.95 million in the same quarter last year

- Market Capitalization: $2.57 billion

Dan Fachner, J&J Snack Foods Chairman, President, and CEO stated, “J & J Snack Foods total net sales for our fiscal second quarter declined 1.0% to $356.1 million as compared to the prior year quarter, which primarily was driven by lower sales in our Frozen Beverage and Food Service segments, partly offset by growth in our Retail business."

Company Overview

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.59 billion in revenue over the past 12 months, J&J Snack Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

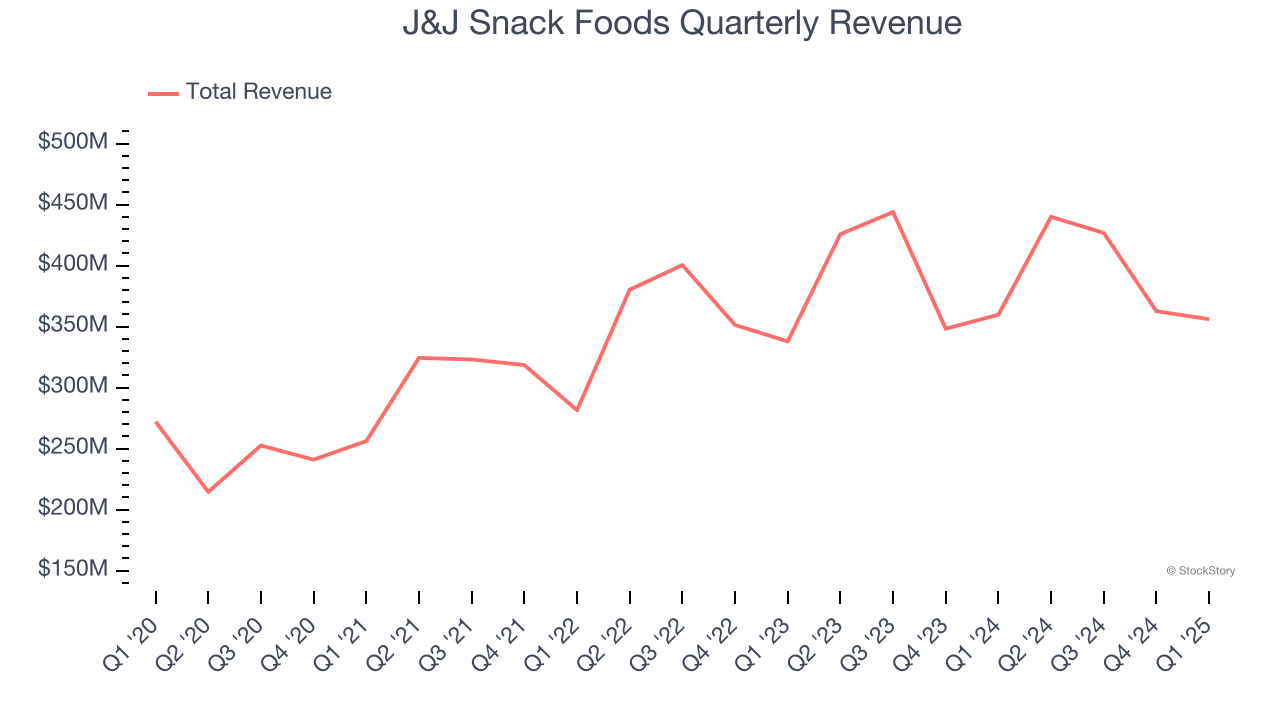

As you can see below, J&J Snack Foods’s sales grew at a decent 8.3% compounded annual growth rate over the last three years. This shows its offerings generated slightly more demand than the average consumer staples company, a useful starting point for our analysis.

This quarter, J&J Snack Foods missed Wall Street’s estimates and reported a rather uninspiring 1% year-on-year revenue decline, generating $356.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

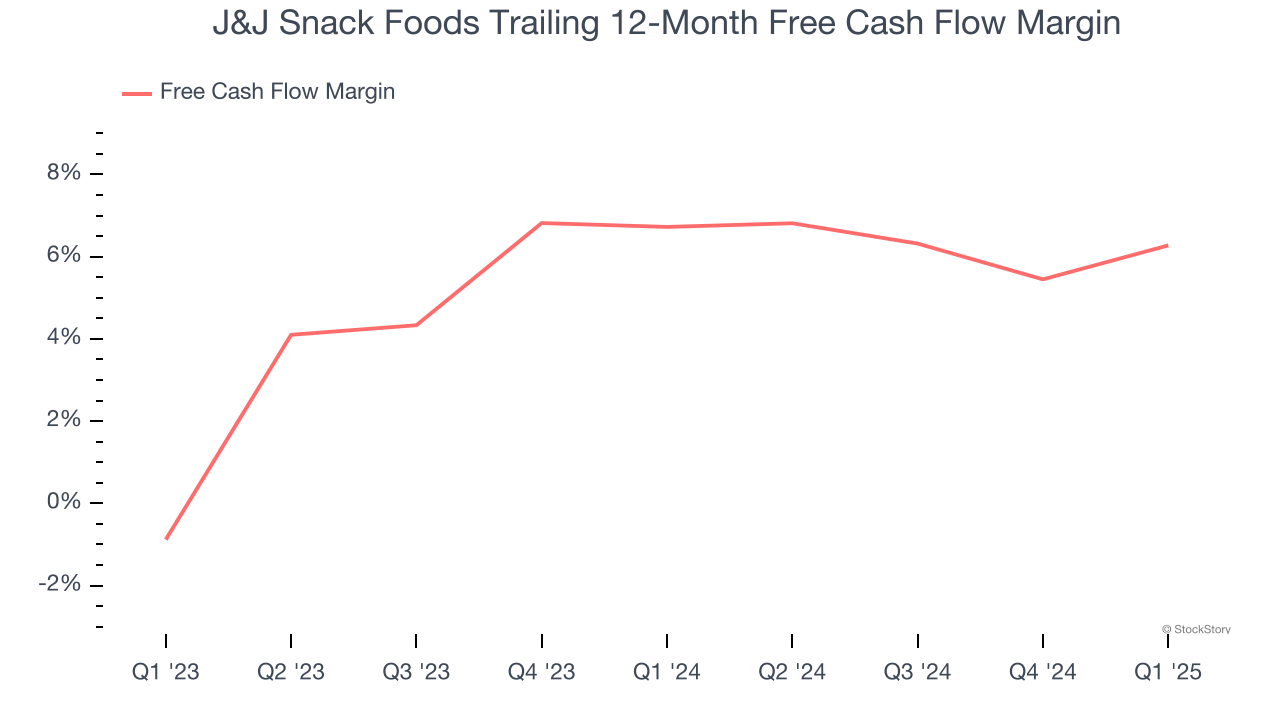

J&J Snack Foods has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.5% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that J&J Snack Foods’s margin was unchanged over the last year, showing it recently had a stable free cash flow profile.

J&J Snack Foods’s free cash flow clocked in at $8.94 million in Q1, equivalent to a 2.5% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Key Takeaways from J&J Snack Foods’s Q1 Results

We struggled to find many positives in these results as its revenue, gross margin, EPS, and EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 6.1% to $123.98 immediately following the report.

J&J Snack Foods didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.