Photronics has gotten torched over the last six months - since November 2024, its stock price has dropped 25.2% to $19.41 per share. This might have investors contemplating their next move.

Following the drawdown, is now a good time to buy PLAB? Find out in our full research report, it’s free.

Why Does Photronics Spark Debate?

Sporting a global footprint of facilities, Photronics (NASDAQ: PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Two Things to Like:

1. Operating Margin Rising, Profits Up

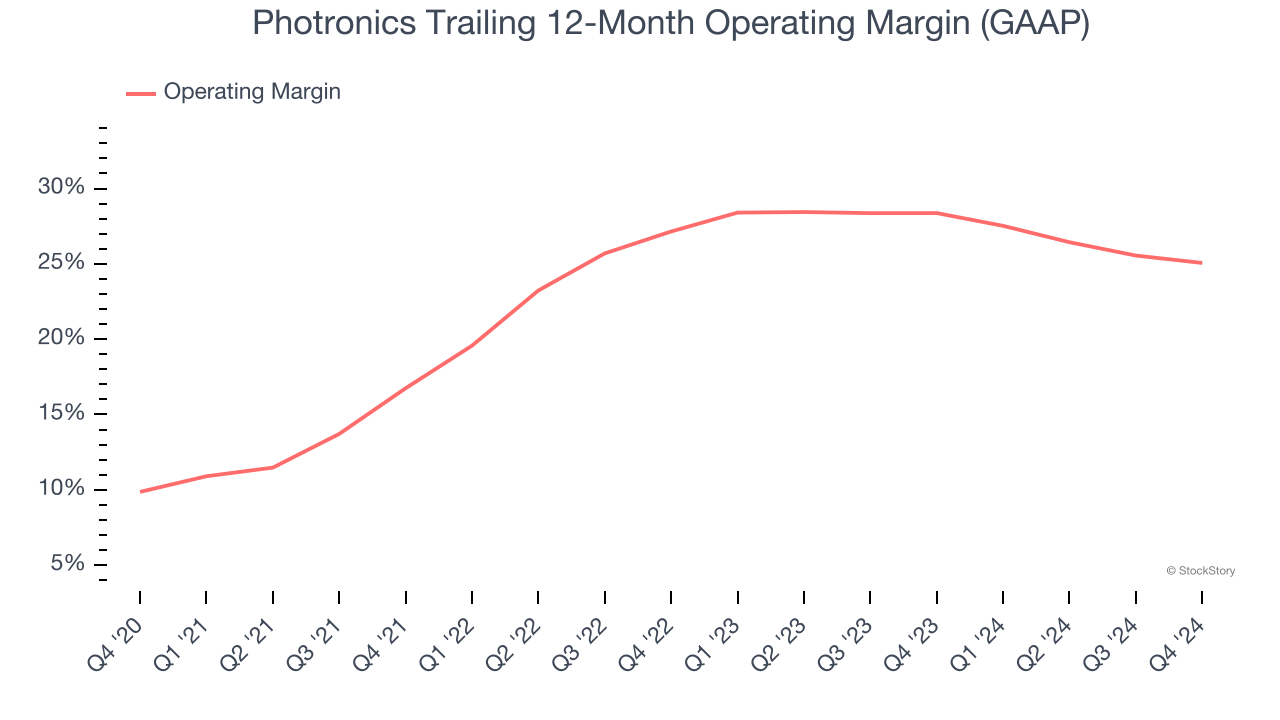

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Analyzing the trend in its profitability, Photronics’s operating margin rose by 15.2 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its operating margin for the trailing 12 months was 25.1%.

2. Increasing Free Cash Flow Margin Juices Financials

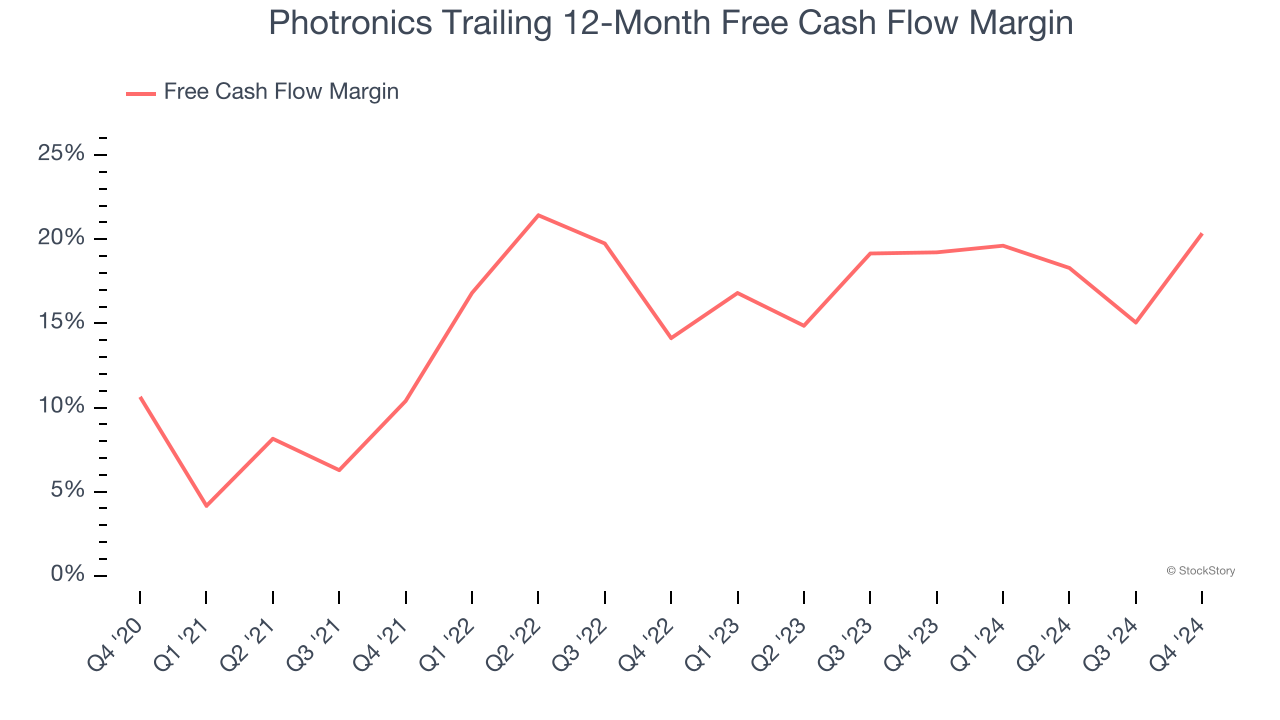

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Photronics’s margin expanded by 9.7 percentage points over the last five years. This is encouraging because it gives the company more optionality. Photronics’s free cash flow margin for the trailing 12 months was 20.4%.

One Reason to be Careful:

Revenue Growth Flatlining

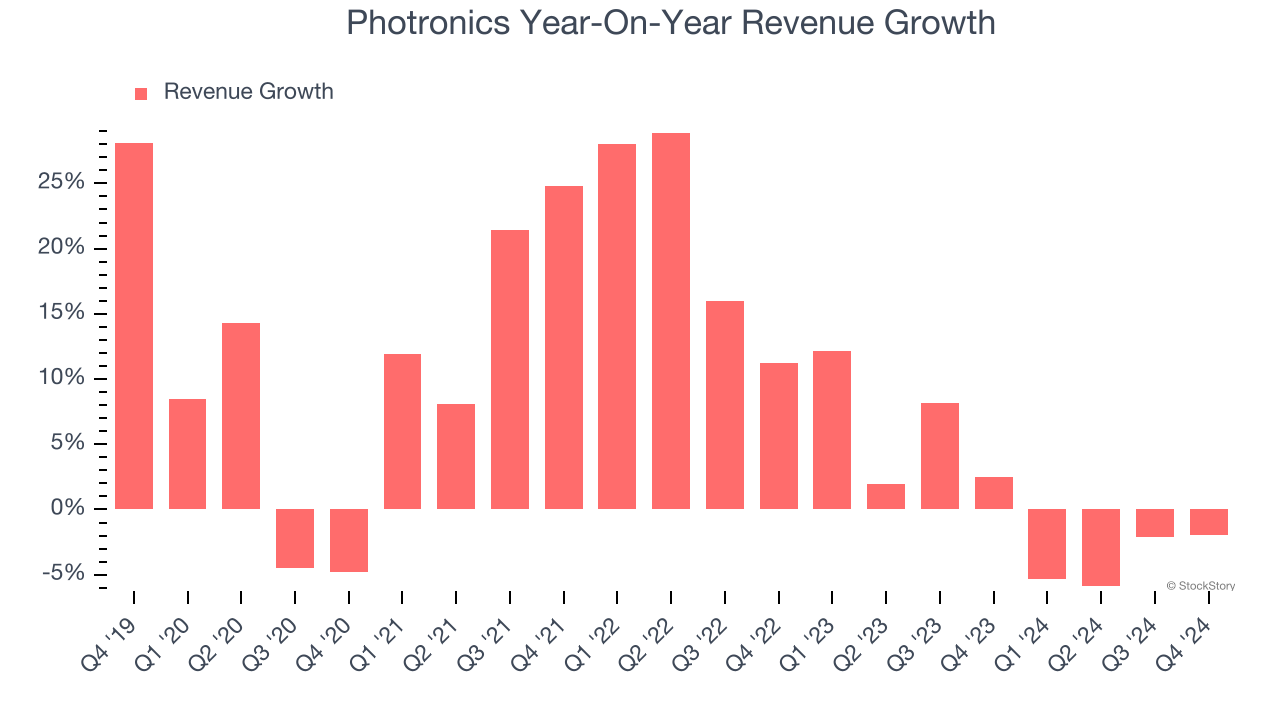

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Photronics’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

Final Judgment

Photronics has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 8.7× forward P/E (or $19.41 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks That Overcame Trump’s 2018 Tariffs

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today.