IT solutions provider CDW (NASDAQGS:CDW) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 6.7% year on year to $5.20 billion. Its non-GAAP profit of $2.15 per share was 9.5% above analysts’ consensus estimates.

Is now the time to buy CDW? Find out by accessing our full research report, it’s free.

CDW (CDW) Q1 CY2025 Highlights:

- Revenue: $5.20 billion vs analyst estimates of $4.94 billion (6.7% year-on-year growth, 5.3% beat)

- Adjusted EPS: $2.15 vs analyst estimates of $1.96 (9.5% beat)

- Operating Margin: 7%, in line with the same quarter last year

- Free Cash Flow Margin: 5%, down from 7.5% in the same quarter last year

- Market Capitalization: $21.6 billion

"The team delivered an excellent start to 2025, as they once again helped customers navigate dynamic market conditions and accomplish mission critical outcomes," said Christine A. Leahy, chair and chief executive officer, CDW.

Company Overview

Serving as a crucial bridge between technology manufacturers and end users since 1984, CDW (NASDAQ: CDW) is a multi-brand provider of information technology solutions that helps businesses and public sector organizations select, implement, and manage hardware, software, and IT services.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $21.33 billion in revenue over the past 12 months, CDW is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. For CDW to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

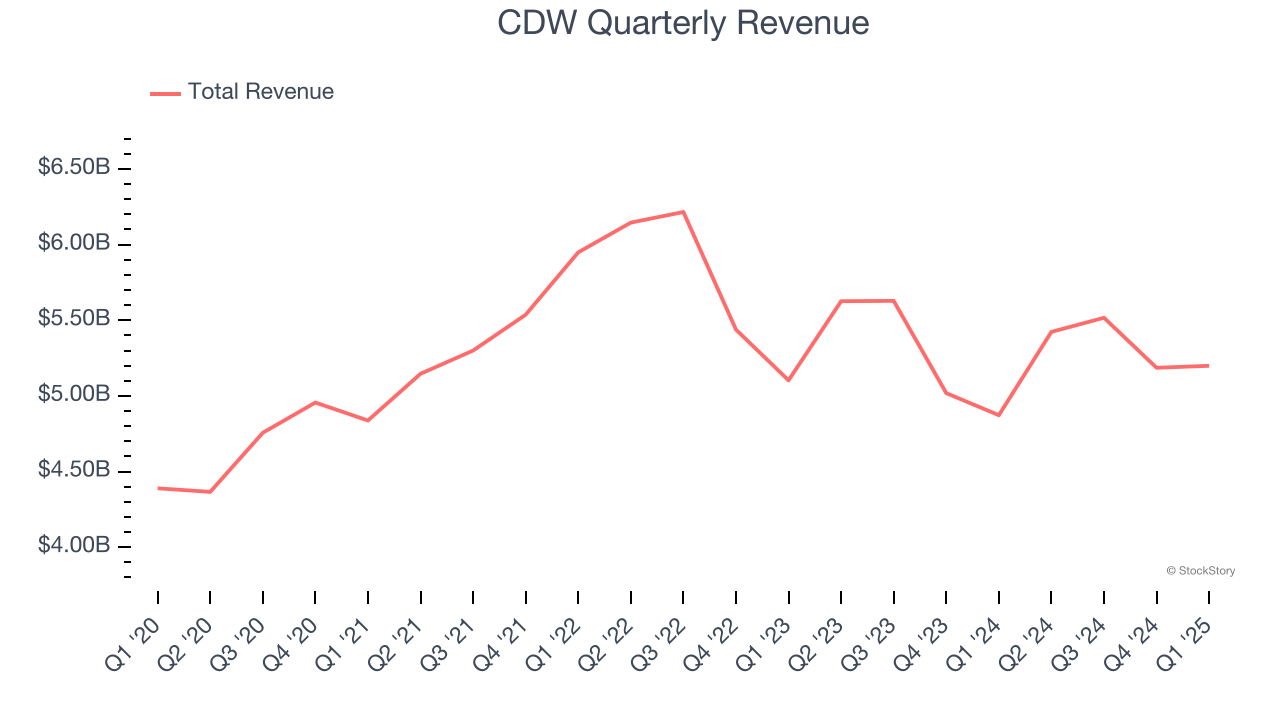

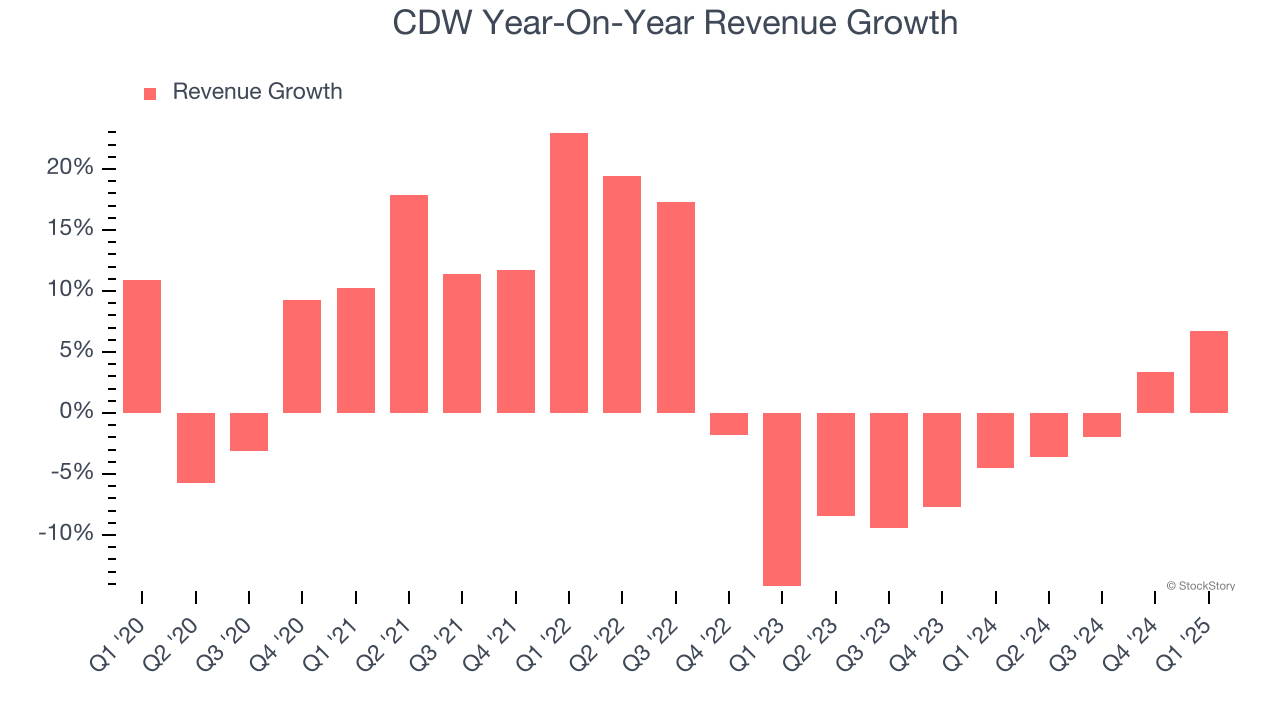

As you can see below, CDW’s 2.9% annualized revenue growth over the last five years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. CDW’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.5% annually.

This quarter, CDW reported year-on-year revenue growth of 6.7%, and its $5.20 billion of revenue exceeded Wall Street’s estimates by 5.3%.

Looking ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

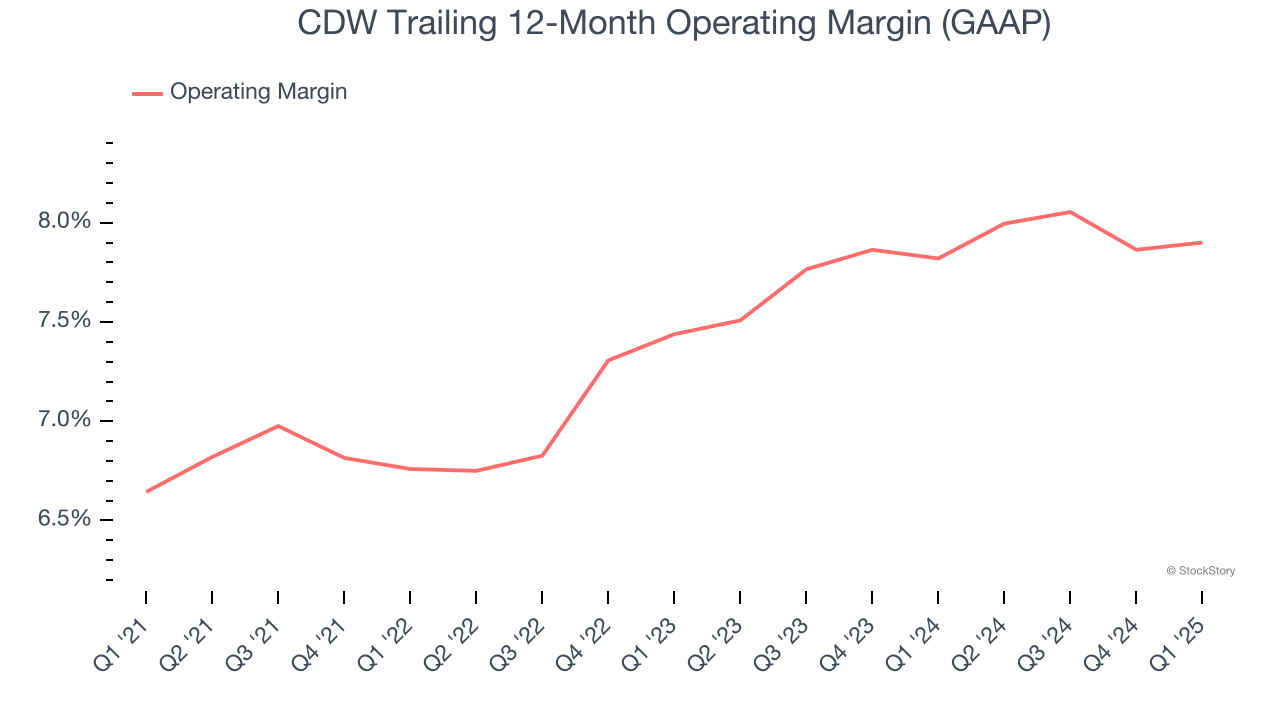

CDW was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.3% was weak for a business services business.

On the plus side, CDW’s operating margin rose by 1.3 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, CDW generated an operating profit margin of 7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

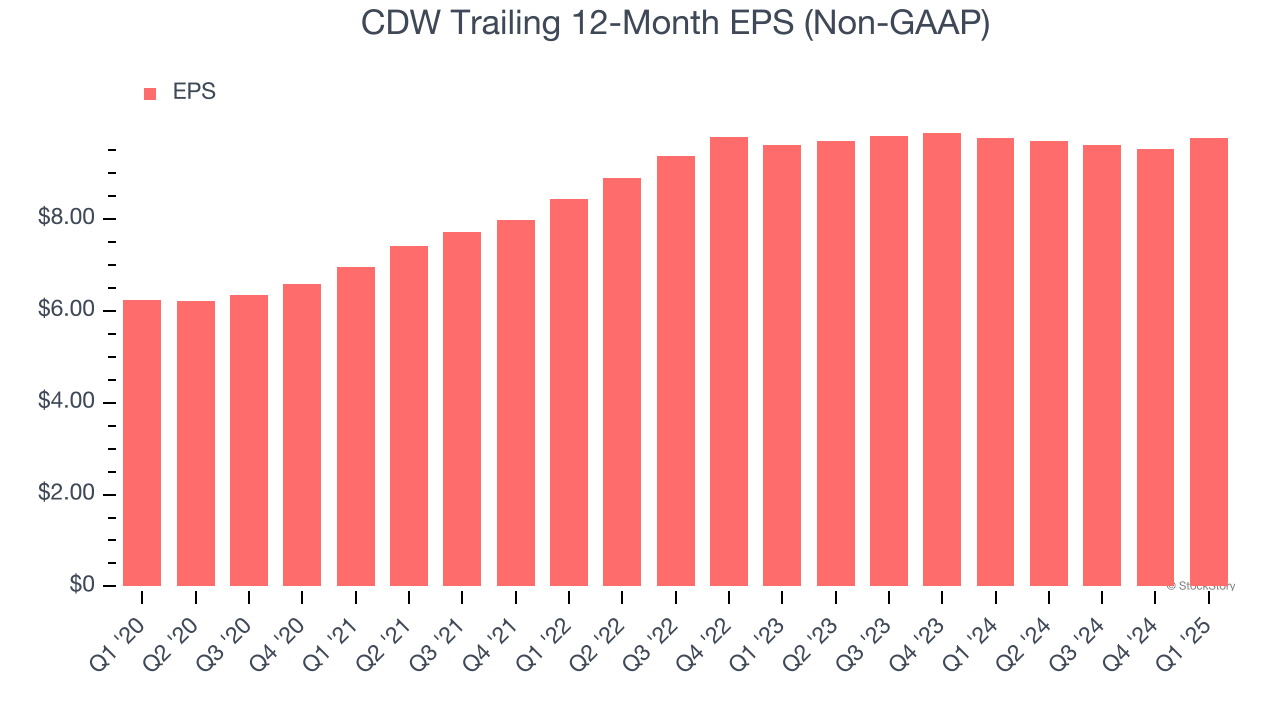

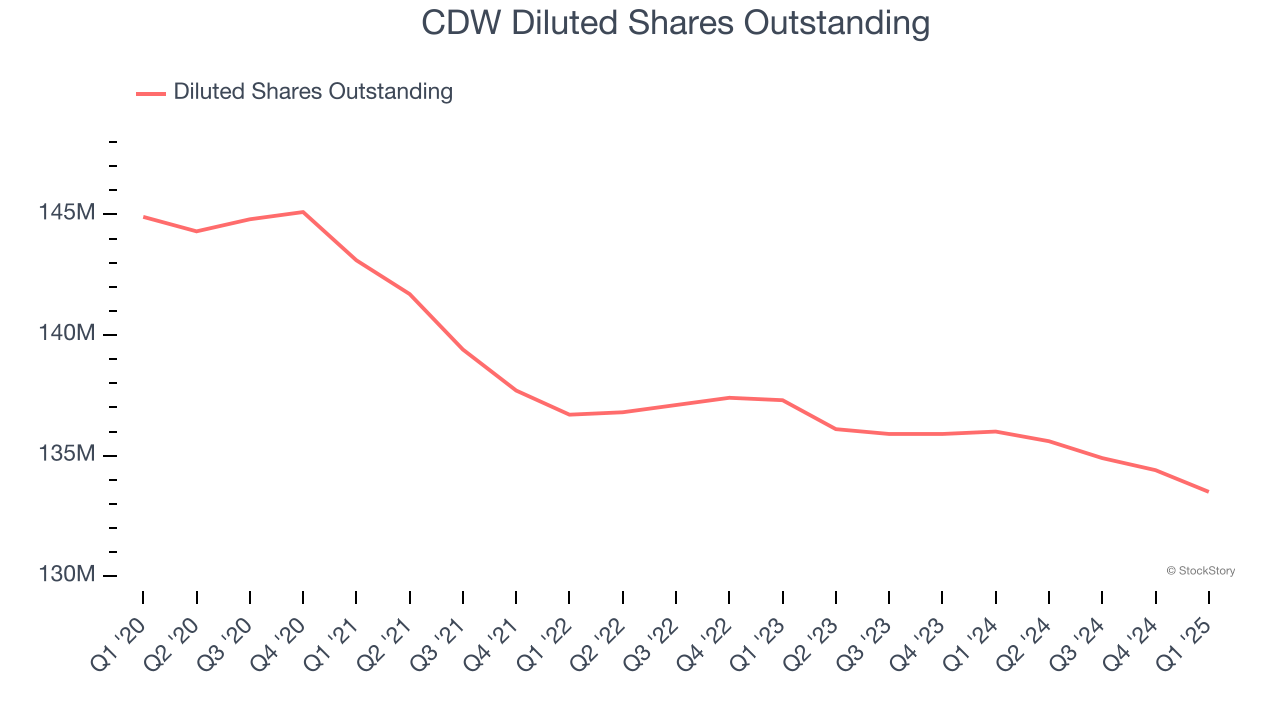

CDW’s EPS grew at a solid 9.3% compounded annual growth rate over the last five years, higher than its 2.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into CDW’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, CDW’s operating margin was flat this quarter but expanded by 1.3 percentage points over the last five years. On top of that, its share count shrank by 7.9%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q1, CDW reported EPS at $2.15, up from $1.92 in the same quarter last year. This print beat analysts’ estimates by 9.5%. Over the next 12 months, Wall Street expects CDW’s full-year EPS of $9.75 to stay about the same.

Key Takeaways from CDW’s Q1 Results

We were impressed by how significantly CDW blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $163.93 immediately following the results.

Is CDW an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.