Payment technology company Crane NXT (NYSE: CXT) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 5.3% year on year to $330.3 million. Its non-GAAP profit of $0.54 per share was 4.9% above analysts’ consensus estimates.

Is now the time to buy Crane NXT? Find out by accessing our full research report, it’s free.

Crane NXT (CXT) Q1 CY2025 Highlights:

- Revenue: $330.3 million vs analyst estimates of $317.9 million (5.3% year-on-year growth, 3.9% beat)

- Adjusted EPS: $0.54 vs analyst estimates of $0.51 (4.9% beat)

- Adjusted EBITDA: $61.1 million vs analyst estimates of $60.02 million (18.5% margin, 1.8% beat)

- Management reiterated its full-year Adjusted EPS guidance of $4.15 at the midpoint

- Operating Margin: 11.3%, down from 17.7% in the same quarter last year

- Free Cash Flow was -$32.2 million compared to -$1.7 million in the same quarter last year

- Market Capitalization: $2.73 billion

Aaron W. Saak, Crane NXT's President and Chief Executive Officer, stated: "Our first quarter results were in line with our expectations as we completed the final equipment upgrades needed to prepare for the decade-long growth opportunity from the new U.S. banknote series. While the market remains dynamic, our businesses continue to demonstrate resilience, and we are well-positioned to mitigate the impact of tariffs through pricing, supply chain management and productivity initiatives driven by the Crane Business System."

Company Overview

Born from a corporate transformation completed in 2023, Crane NXT (NYSE: CXT) provides specialized technology solutions for payment processing, banknote security, and authentication systems for financial institutions and businesses.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.50 billion in revenue over the past 12 months, Crane NXT is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

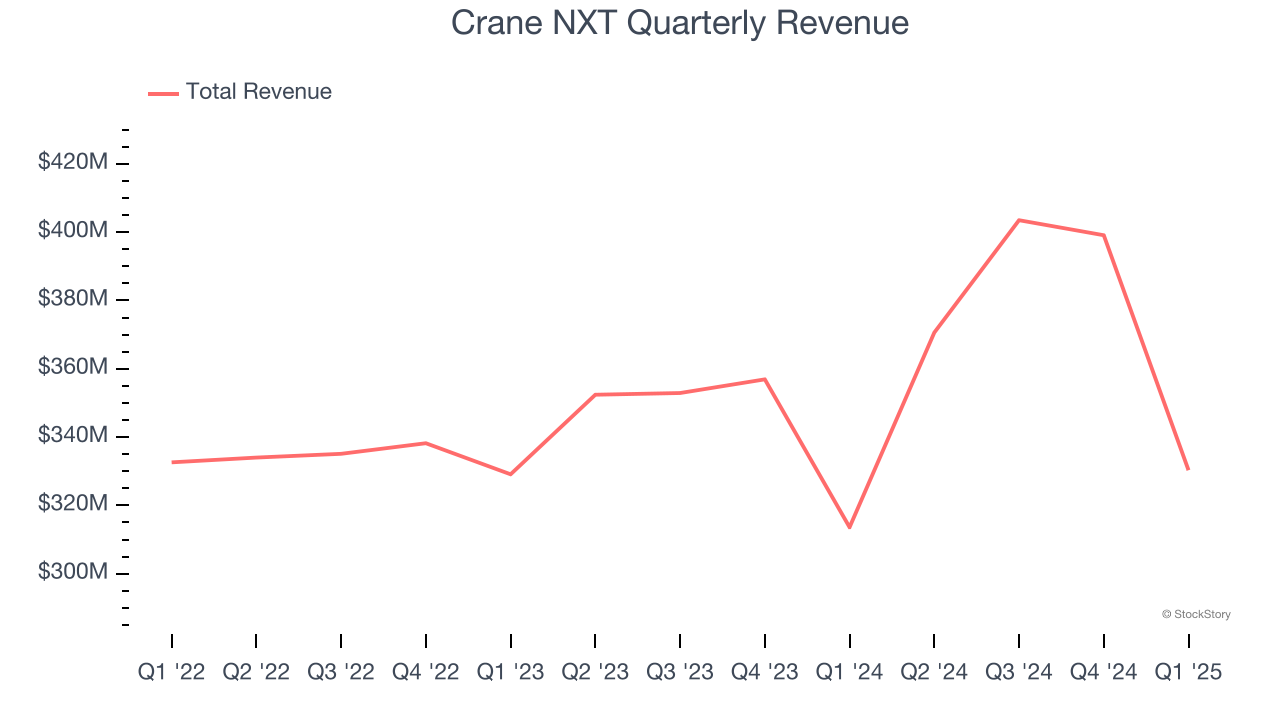

As you can see below, Crane NXT’s 6.1% annualized revenue growth over the last two years was decent. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

This quarter, Crane NXT reported year-on-year revenue growth of 5.3%, and its $330.3 million of revenue exceeded Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

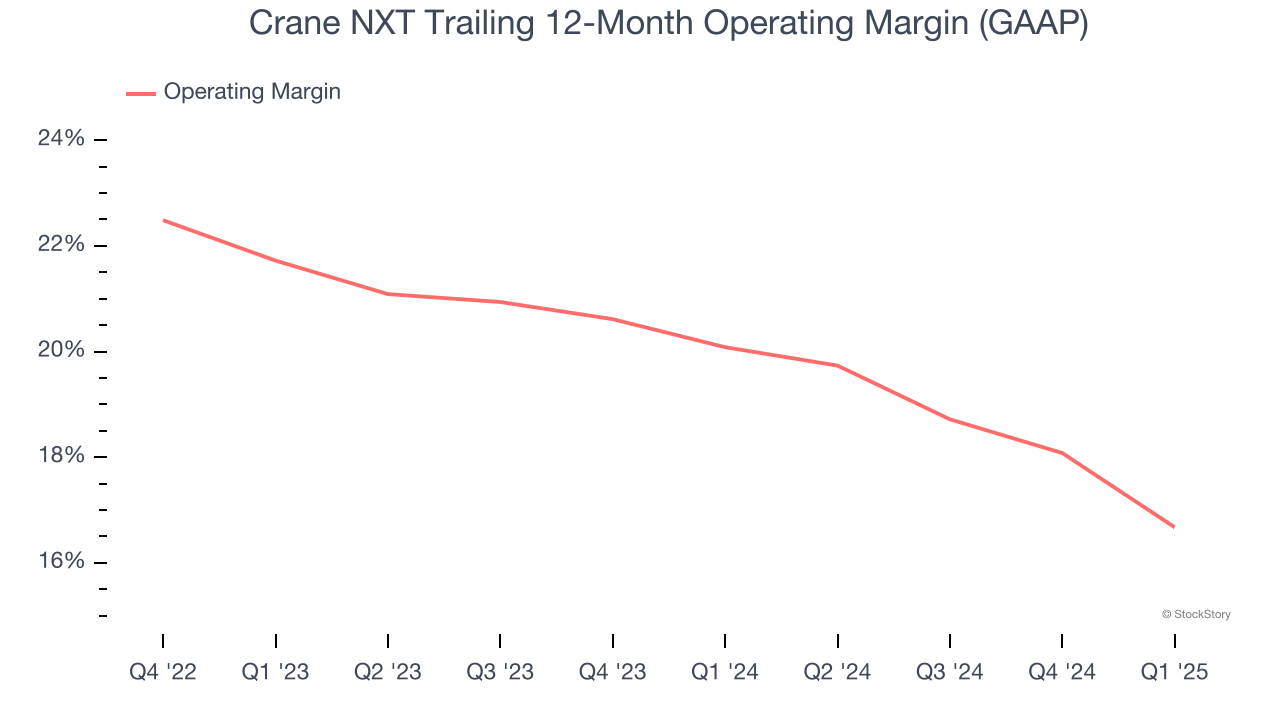

Operating Margin

Crane NXT’s operating margin has shrunk over the last 12 months, but it still averaged 19.7% over the last three years, elite for a business services business. This shows it’s an well-run company with an efficient cost structure.

In Q1, Crane NXT generated an operating profit margin of 11.3%, down 6.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

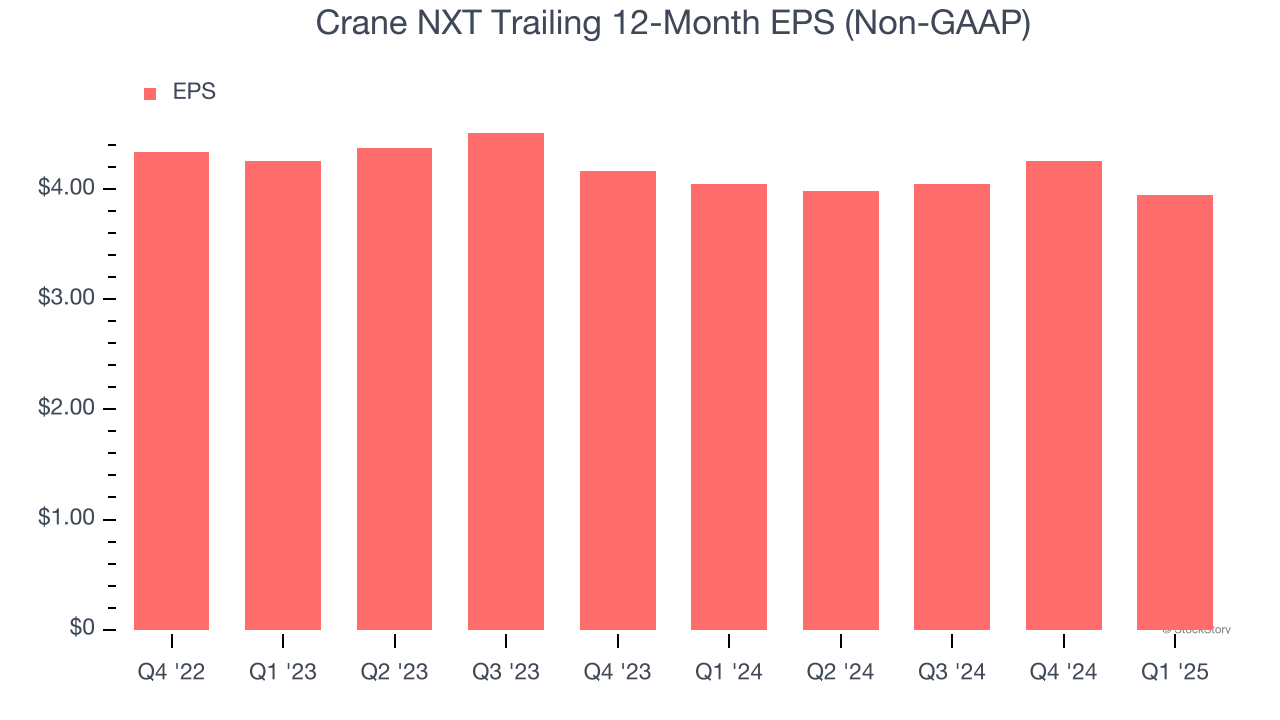

Sadly for Crane NXT, its EPS declined by 3.7% annually over the last two years while its revenue grew by 6.1%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q1, Crane NXT reported EPS at $0.54, down from $0.85 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.9%. Over the next 12 months, Wall Street expects Crane NXT’s full-year EPS of $3.95 to grow 11.3%.

Key Takeaways from Crane NXT’s Q1 Results

We enjoyed seeing Crane NXT beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $47.64 immediately after reporting.

So do we think Crane NXT is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.