Over the past six months, First Financial Bancorp’s stock price fell to $24.41. Shareholders have lost 16.7% of their capital, disappointing when considering the S&P 500 was flat. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in First Financial Bancorp, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is First Financial Bancorp Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why we avoid FFBC and a stock we'd rather own.

1. Lackluster Revenue Growth

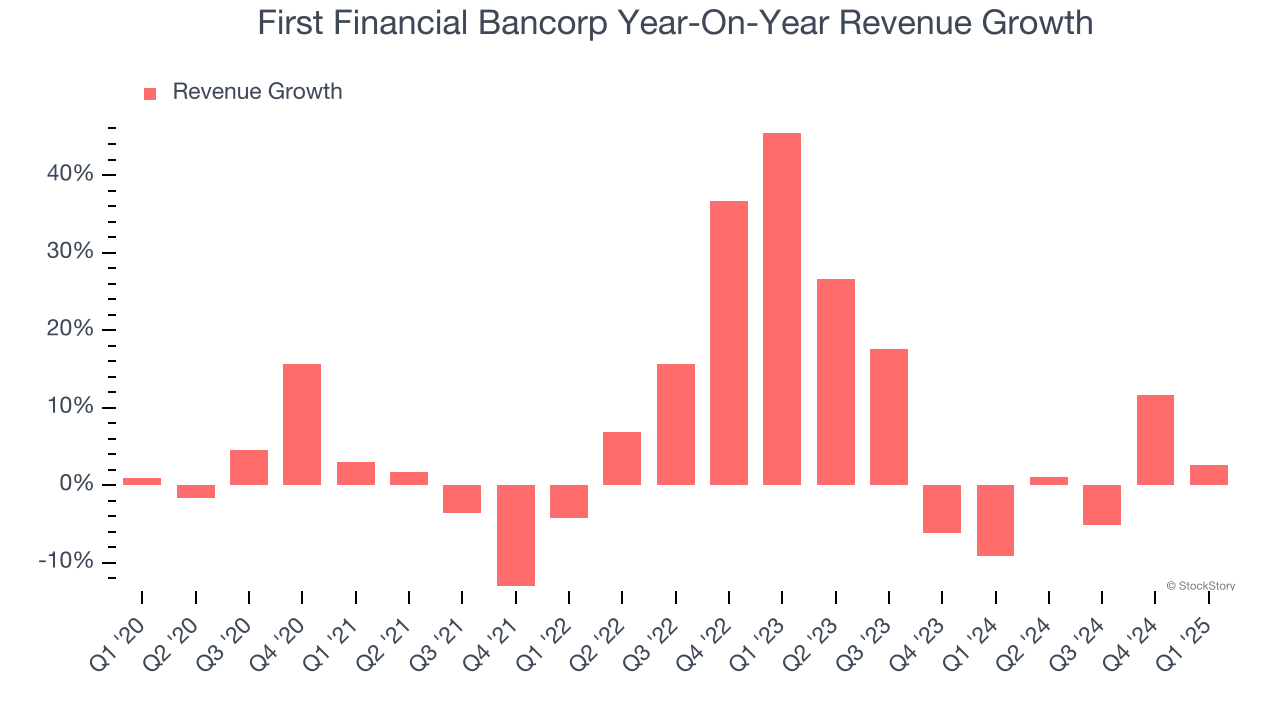

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and inflation readings. First Financial Bancorp’s recent performance shows its demand has slowed as its annualized revenue growth of 4% over the last two years was below its five-year trend.

2. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect First Financial Bancorp’s net interest income to rise by 1.2%, a slight deceleration versus its 3.5% annualized growth for the past two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

3. Substandard TBVPS Growth Indicates Limited Asset Expansion

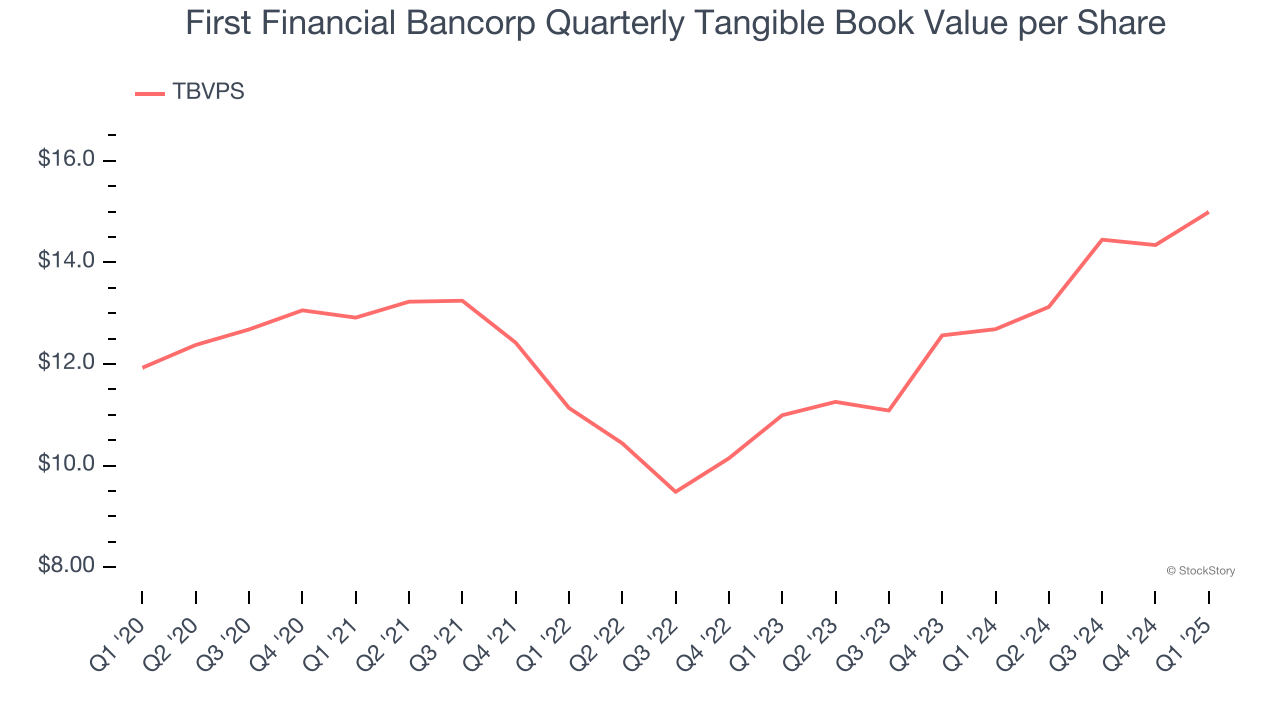

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Disappointingly for investors, First Financial Bancorp’s TBVPS grew at a mediocre 4.7% annual clip over the last five years.

Final Judgment

First Financial Bancorp isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 0.9× forward P/B (or $24.41 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of First Financial Bancorp

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.