Over the past six months, Figs’s shares (currently trading at $5.20) have posted a disappointing 13.3% loss while the S&P 500 was flat. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Figs, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Figs Not Exciting?

Even with the cheaper entry price, we don't have much confidence in Figs. Here are three reasons why you should be careful with FIGS and a stock we'd rather own.

1. Weak Growth in Active Customers Points to Soft Demand

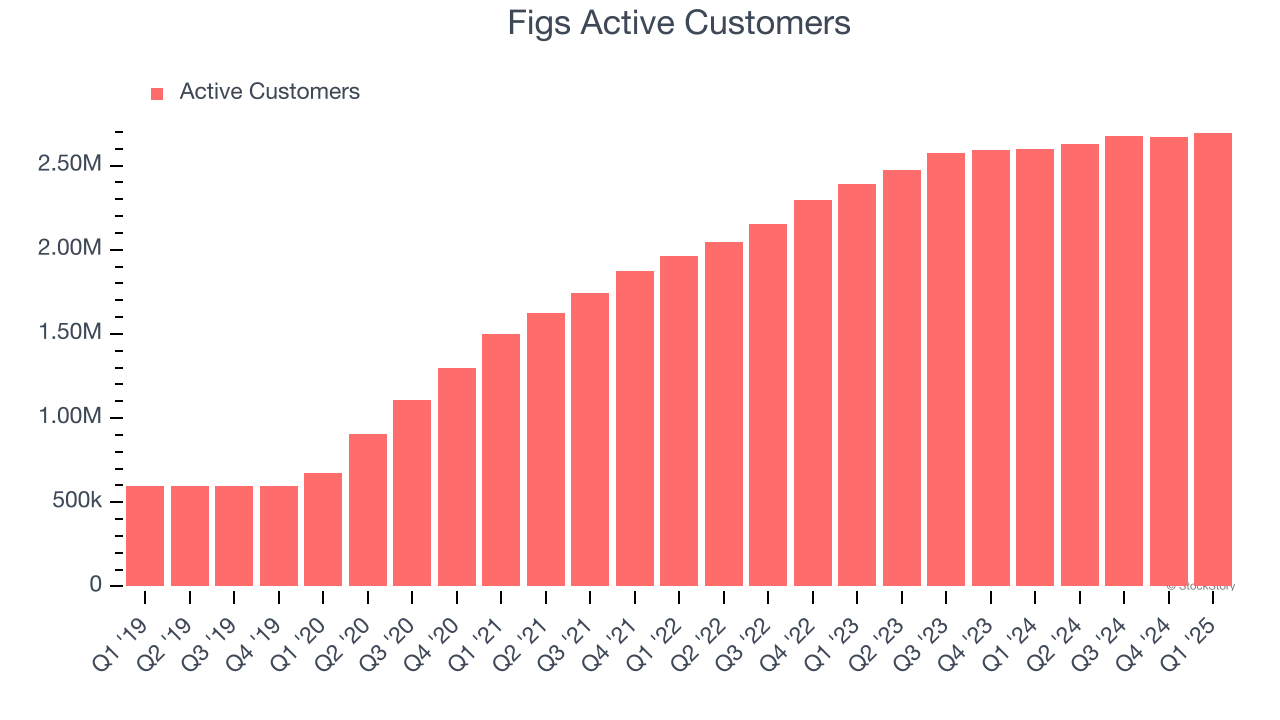

Revenue growth can be broken down into changes in price and volume (for companies like Figs, our preferred volume metric is active customers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Figs’s active customers came in at 2.7 million in the latest quarter, and over the last two years, averaged 9.9% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

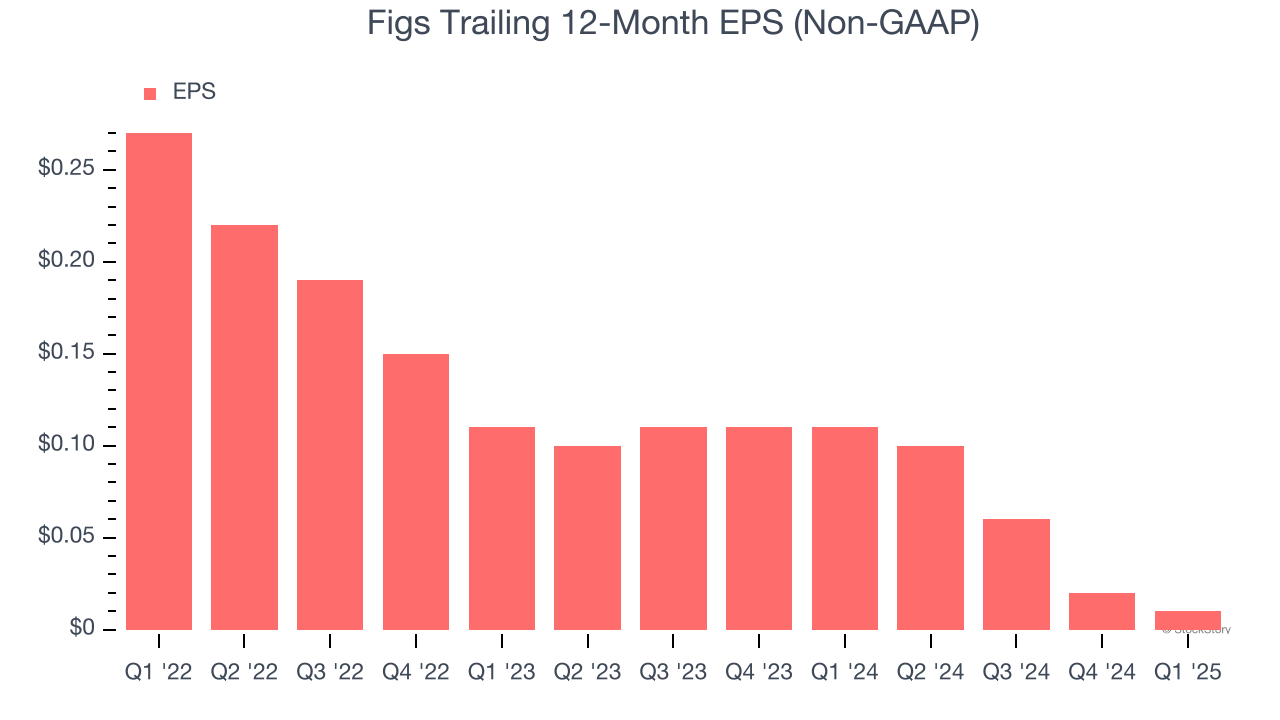

2. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Figs’s full-year EPS dropped significantly over the last three years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Figs’s low margin of safety could leave its stock price susceptible to large downswings.

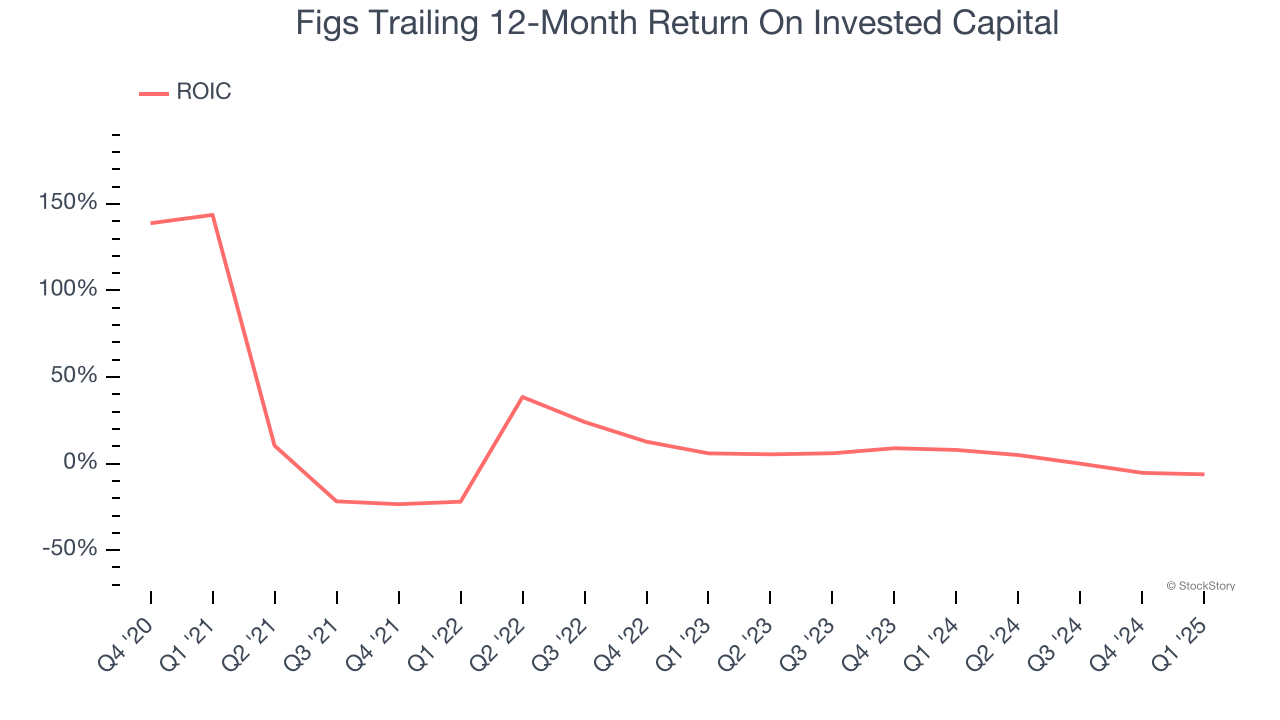

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Figs’s five-year average ROIC was negative 3.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Final Judgment

Figs’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 67.8× forward P/E (or $5.20 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Figs

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.