Looking back on safety & security services stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Brink's (NYSE: BCO) and its peers.

Rising concerns over physical security, cybersecurity threats, and workplace safety regulations will present opportunities for companies in this sector. AI and digitization will enhance surveillance, access control, and threat detection, which could benefit key players in Safety & Security Services. These trends could also introduce ethical and regulatory concerns over data privacy and automated decision-making in security operations, giving rise to headline risks. Finally, increasing scrutiny on private security practices and evolving criminal justice policies again mean that companies in the space need to operate with the utmost care or risk being the poster child of abuse of power.

The 5 safety & security services stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.2% since the latest earnings results.

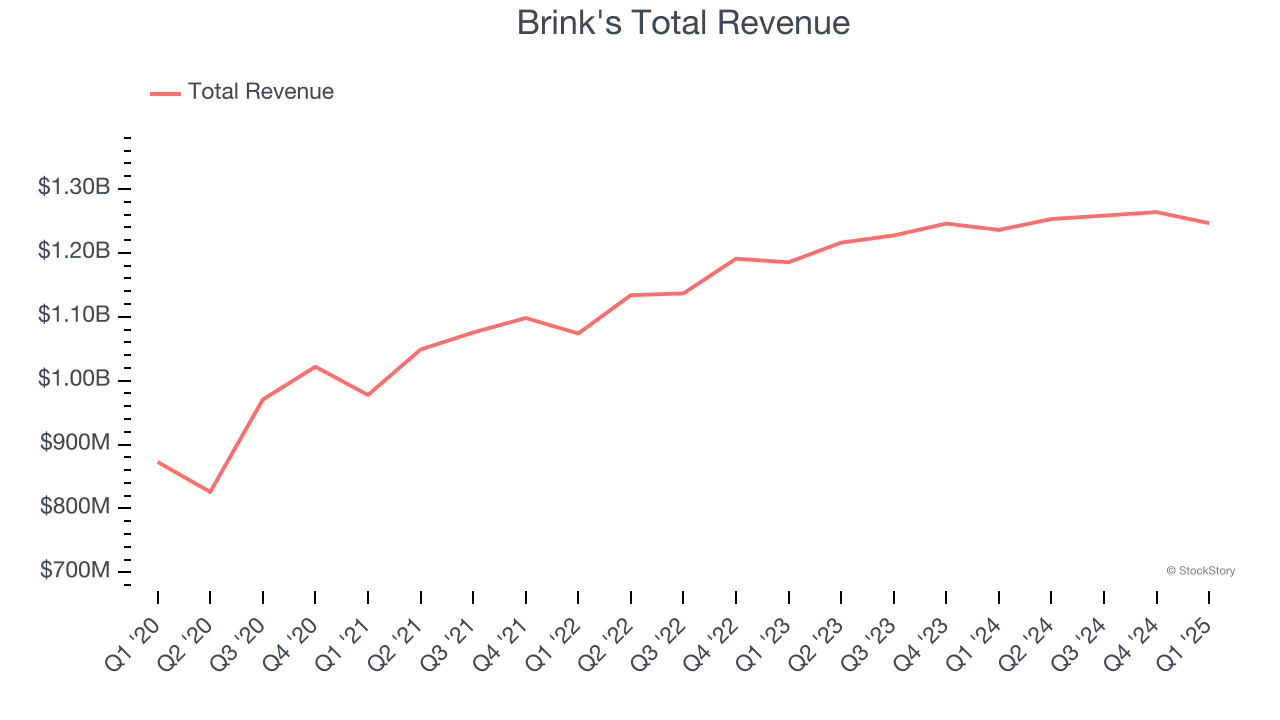

Brink's (NYSE: BCO)

Known for its iconic armored trucks that have been a fixture in American cities since 1859, Brink's (NYSE: BCO) provides secure transportation and management of cash and valuables for banks, retailers, and other businesses worldwide.

Brink's reported revenues of $1.25 billion, flat year on year. This print exceeded analysts’ expectations by 2.8%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EPS estimates.

Mark Eubanks, president and CEO, said: “We delivered strong performance in the first quarter with EBITDA and EPS exceeding the top end of our guidance range. Organic revenue growth of 6% included 20% growth in AMS and DRS. On a trailing-twelve month basis, these higher margin recurring revenue offerings now represent over 25% of revenue as we continue to penetrate large addressable markets and convert existing customers. Growth in our cash and valuables business was supported by a year-over-year acceleration in our global services business primarily due to increased movement of precious metals. Operating profit was up 40 basis-points reflecting productivity, especially in North America, and revenue mix benefits partially offset by year-over-year currency headwinds, primarily in the Latin America segment. We remain focused on executing against our capital allocation framework, accelerating share repurchases to over $110 million year to date."

The stock is down 10.4% since reporting and currently trades at $84.54.

Is now the time to buy Brink's? Access our full analysis of the earnings results here, it’s free.

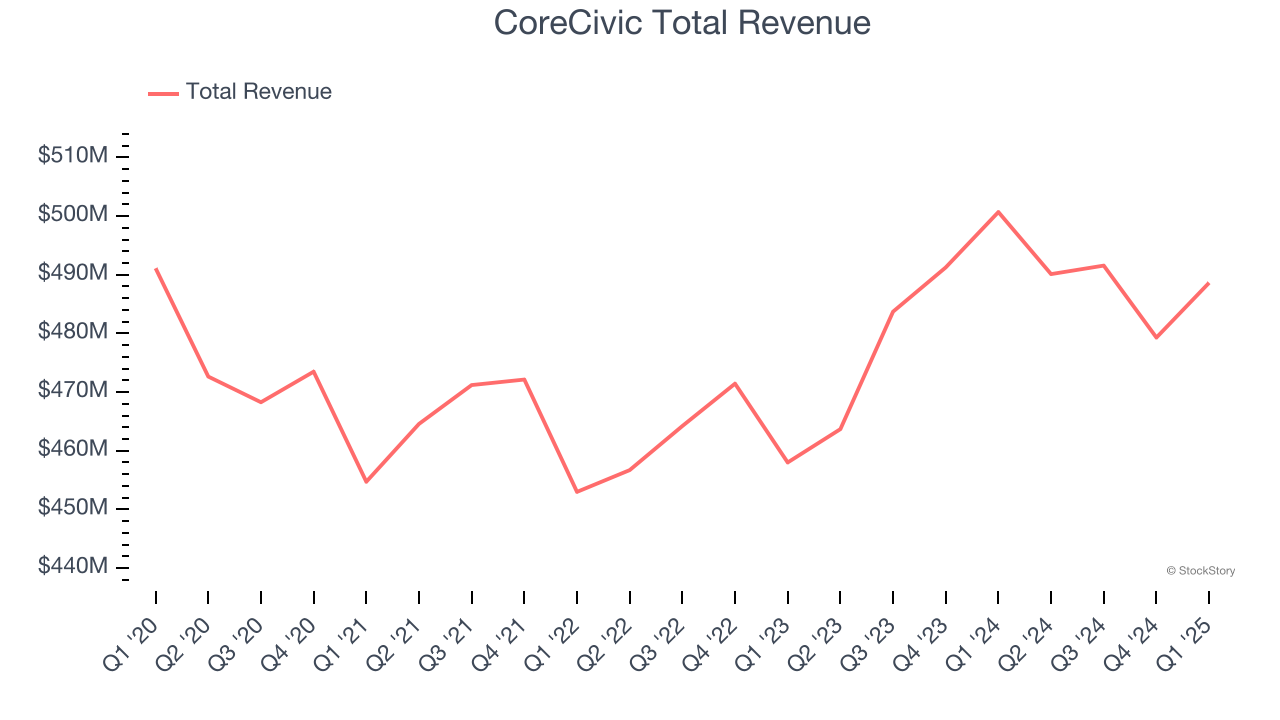

Best Q1: CoreCivic (NYSE: CXW)

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE: CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

CoreCivic reported revenues of $488.6 million, down 2.4% year on year, outperforming analysts’ expectations by 2.5%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates.

The market seems unhappy with the results as the stock is down 1.5% since reporting. It currently trades at $22.29.

Is now the time to buy CoreCivic? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: GEO Group (NYSE: GEO)

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE: GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

GEO Group reported revenues of $604.6 million, flat year on year, falling short of analysts’ expectations by 2%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

GEO Group delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 12.5% since the results and currently trades at $26.50.

Read our full analysis of GEO Group’s results here.

MSA Safety (NYSE: MSA)

Founded in 1914 as Mine Safety Appliances to protect coal miners from dangerous gases, MSA Safety (NYSE: MSA) designs and manufactures advanced safety products that protect workers and facilities across industries including fire service, energy, construction, and manufacturing.

MSA Safety reported revenues of $421.3 million, up 1.9% year on year. This print beat analysts’ expectations by 5%. It was an exceptional quarter as it also produced a solid beat of analysts’ EPS estimates.

MSA Safety scored the biggest analyst estimates beat among its peers. The stock is up 7.2% since reporting and currently trades at $164.83.

Read our full, actionable report on MSA Safety here, it’s free.

Brady (NYSE: BRC)

Founded in 1914 and evolving through more than a century of industrial innovation, Brady (NYSE: BRC) manufactures and supplies identification solutions and workplace safety products that help companies identify and protect their premises, products, and people.

Brady reported revenues of $382.6 million, up 11.4% year on year. This result came in 1% below analysts' expectations. Overall, it was a slower quarter as it also produced a slight miss of analysts’ full-year EPS guidance estimates.

Brady pulled off the fastest revenue growth among its peers. The stock is down 8.9% since reporting and currently trades at $69.47.

Read our full, actionable report on Brady here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.