The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Seagate Technology (NASDAQ: STX) and the rest of the semiconductors stocks fared in Q1.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, the Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 0.8% below.

Luckily, semiconductors stocks have performed well with share prices up 16.8% on average since the latest earnings results.

Seagate Technology (NASDAQ: STX)

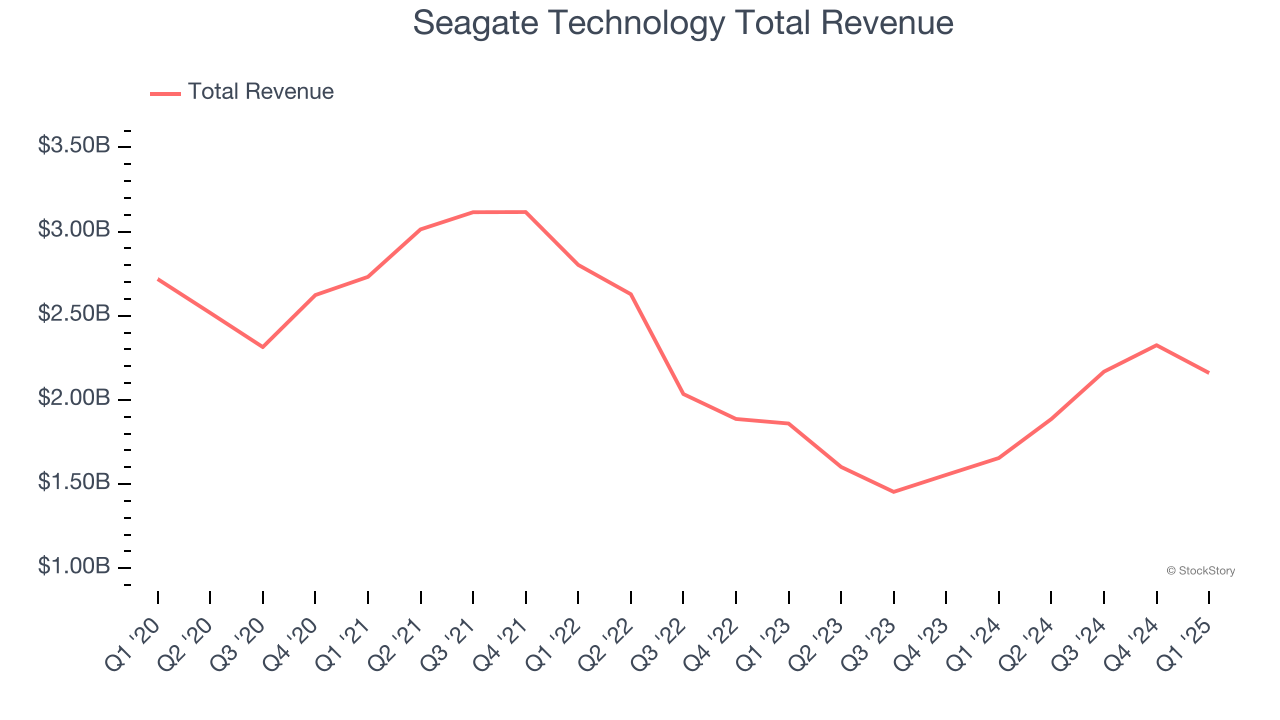

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ: STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $2.16 billion, up 30.5% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

"Seagate delivered another solid quarter of profitable year-on-year growth and margin expansion, elevating our non-GAAP EPS to the top of our guidance range. Our performance underscores the structural enhancements we’ve made to our business model and healthy supply/demand environment for mass capacity storage," said Dave Mosley, Seagate’s chief executive officer.

The stock is up 53.8% since reporting and currently trades at $125.50.

Is now the time to buy Seagate Technology? Access our full analysis of the earnings results here, it’s free.

Best Q1: Penguin Solutions (NASDAQ: PENG)

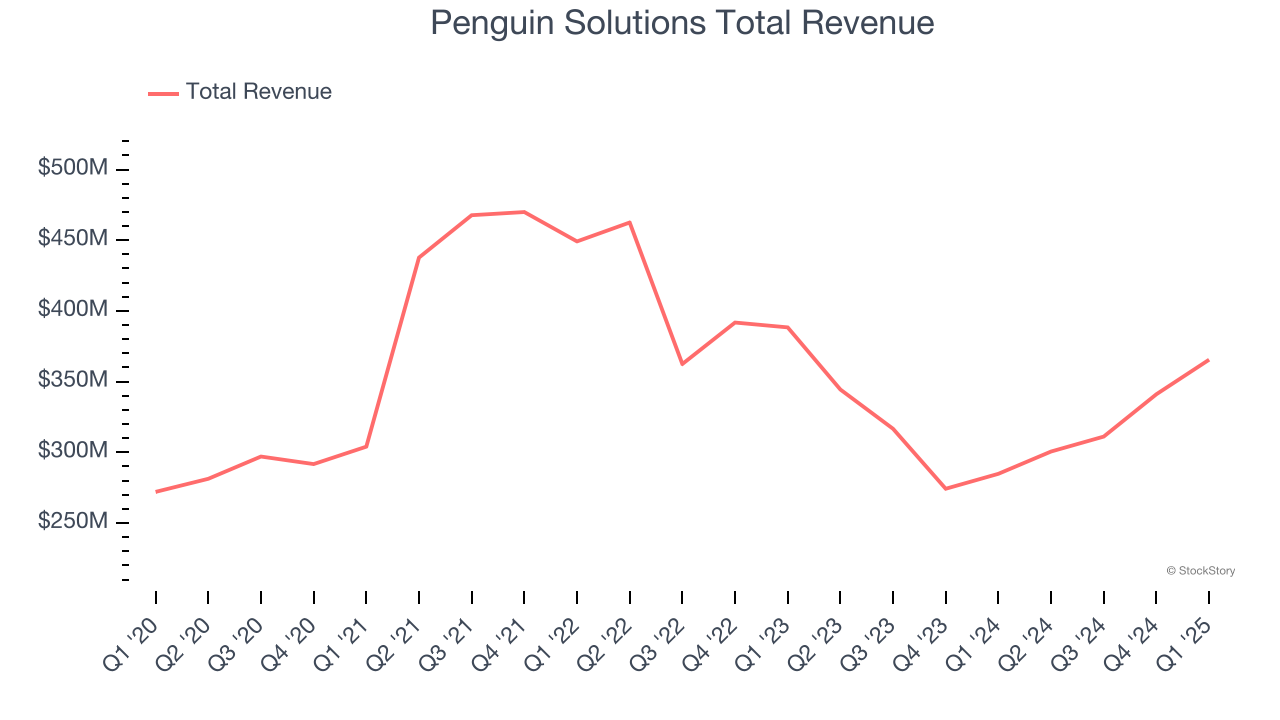

Based in the US, Penguin Solutions (NASDAQ: PENG) is a diversified semiconductor company offering memory, digital, and LED products.

Penguin Solutions reported revenues of $365.5 million, up 28.3% year on year, outperforming analysts’ expectations by 6.1%. The business had a stunning quarter with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 11.1% since reporting. It currently trades at $20.06.

Is now the time to buy Penguin Solutions? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Photronics (NASDAQ: PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ: PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $211 million, down 2.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 5.1% since the results and currently trades at $19.06.

Read our full analysis of Photronics’s results here.

Allegro MicroSystems (NASDAQ: ALGM)

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ: ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

Allegro MicroSystems reported revenues of $192.8 million, down 19.9% year on year. This number beat analysts’ expectations by 4.3%. Overall, it was a very strong quarter as it also recorded a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

The stock is up 59.9% since reporting and currently trades at $29.89.

Read our full, actionable report on Allegro MicroSystems here, it’s free.

Entegris (NASDAQ: ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ: ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $773.2 million, flat year on year. This result lagged analysts' expectations by 2.1%. Overall, it was a softer quarter as it also logged a significant miss of analysts’ EPS estimates and an increase in its inventory levels.

The stock is down 4% since reporting and currently trades at $79.62.

Read our full, actionable report on Entegris here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.