The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Snap (NYSE: SNAP) and the rest of the social networking stocks fared in Q1.

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

The 6 social networking stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.4% while next quarter’s revenue guidance was 0.9% below.

Thankfully, share prices of the companies have been resilient as they are up 9.7% on average since the latest earnings results.

Snap (NYSE: SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

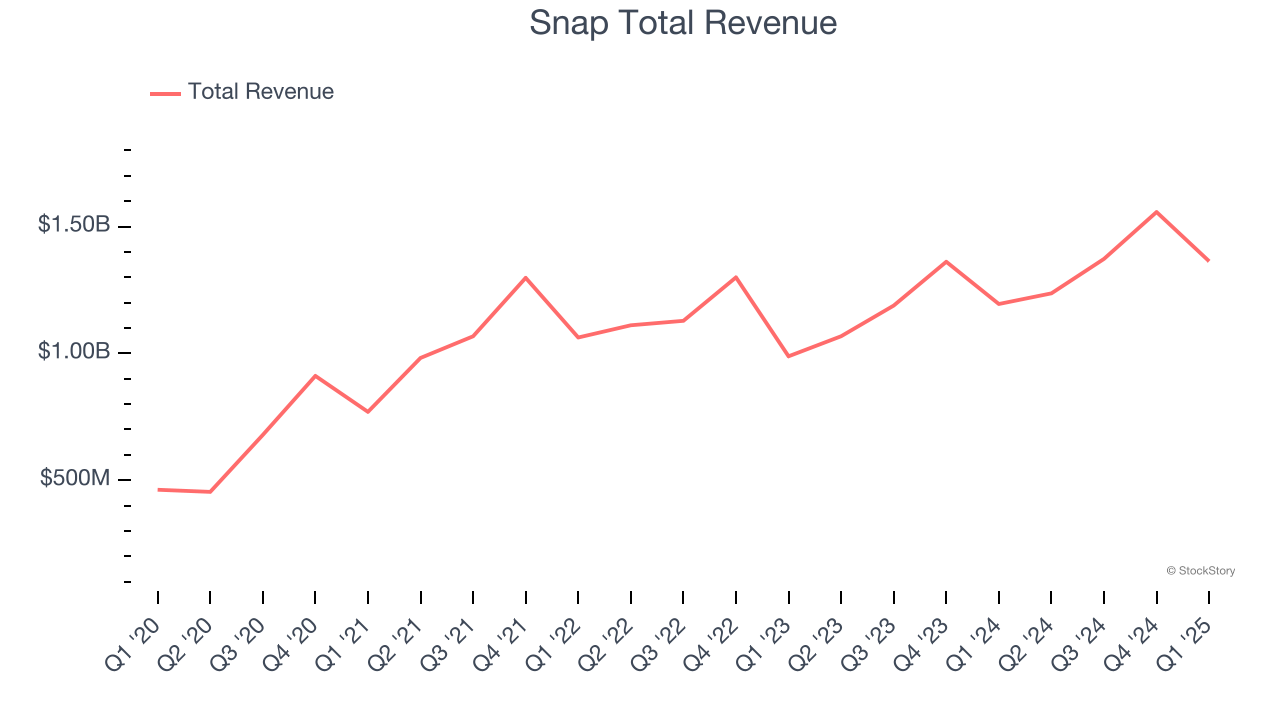

Snap reported revenues of $1.36 billion, up 14.1% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and solid growth in its users.

“We surpassed an important milestone in Q1, with our community growing to over 900 million monthly active users,” said Evan Spiegel, CEO.

Unsurprisingly, the stock is down 10.4% since reporting and currently trades at $8.15.

Is now the time to buy Snap? Access our full analysis of the earnings results here, it’s free.

Best Q1: Nextdoor (NYSE: KIND)

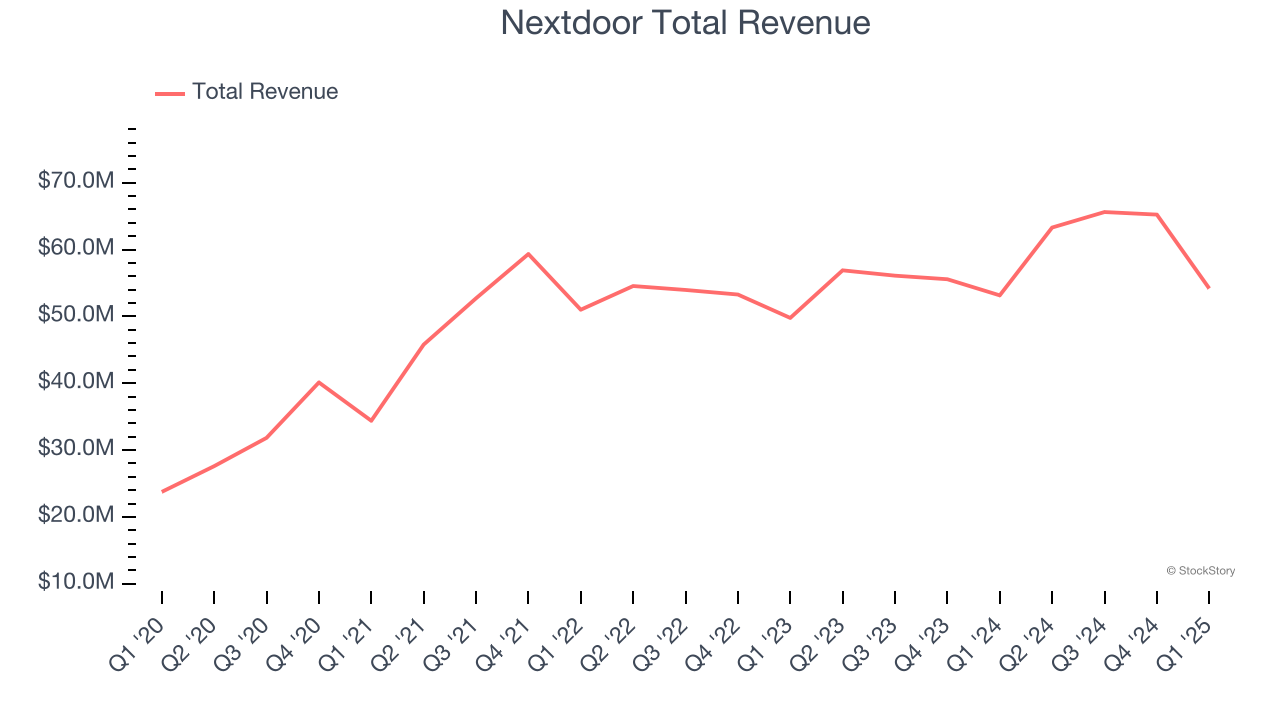

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE: KIND) is a social network that connects neighbors with each other and with local businesses.

Nextdoor reported revenues of $54.18 million, up 1.9% year on year, outperforming analysts’ expectations by 1.8%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ number of weekly active users estimates.

The market seems happy with the results as the stock is up 6% since reporting. It currently trades at $1.60.

Is now the time to buy Nextdoor? Access our full analysis of the earnings results here, it’s free.

Pinterest (NYSE: PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Pinterest reported revenues of $855 million, up 15.5% year on year, exceeding analysts’ expectations by 1%. Still, it was a decent quarter as it posted revenue guidance for next quarter meeting analysts’ expectations.

Pinterest delivered the weakest performance against analyst estimates in the group. The company reported 570 million monthly active users, up 10% year on year. Interestingly, the stock is up 25.8% since the results and currently trades at $35.07.

Read our full analysis of Pinterest’s results here.

Meta (NASDAQ: META)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

Meta reported revenues of $42.31 billion, up 16.1% year on year. This number surpassed analysts’ expectations by 2.3%. Aside from that, it was a decent quarter as it also logged a solid beat of analysts’ EBITDA estimates.

The company reported 3.43 billion daily active users, up 5.9% year on year. The stock is up 27.2% since reporting and currently trades at $696.30.

Read our full, actionable report on Meta here, it’s free.

Yelp (NYSE: YELP)

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE: YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Yelp reported revenues of $358.5 million, up 7.7% year on year. This result topped analysts’ expectations by 1.8%. It was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and full-year revenue guidance meeting analysts’ expectations.

The stock is up 1.3% since reporting and currently trades at $36.18.

Read our full, actionable report on Yelp here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.