What a brutal six months it’s been for Illumina. The stock has dropped 33.6% and now trades at $89.03, rattling many shareholders. This may have investors wondering how to approach the situation.

Is now the time to buy Illumina, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Illumina Will Underperform?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why ILMN doesn't excite us and a stock we'd rather own.

1. Declining Constant Currency Revenue, Demand Takes a Hit

Investors interested in Genomics & Sequencing companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Illumina’s control and are not indicative of underlying demand.

Over the last two years, Illumina’s constant currency revenue averaged 2% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Illumina might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

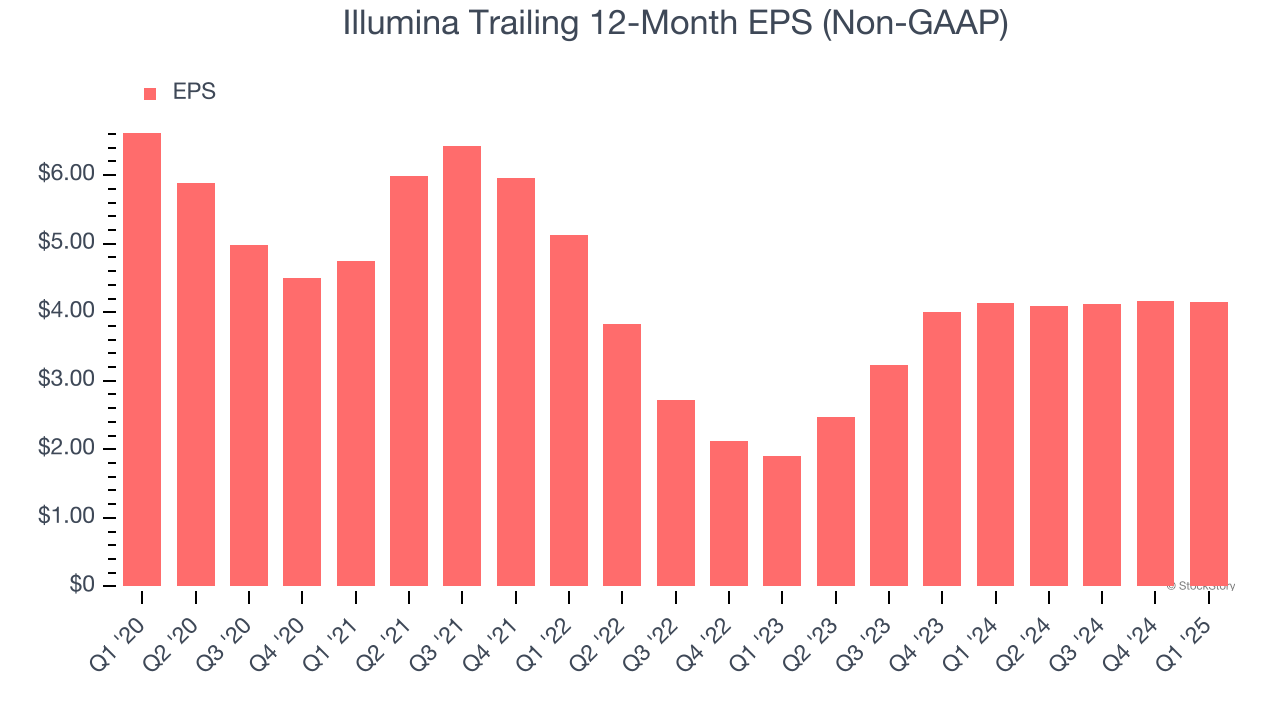

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Illumina, its EPS declined by 8.9% annually over the last five years while its revenue grew by 4%. This tells us the company became less profitable on a per-share basis as it expanded.

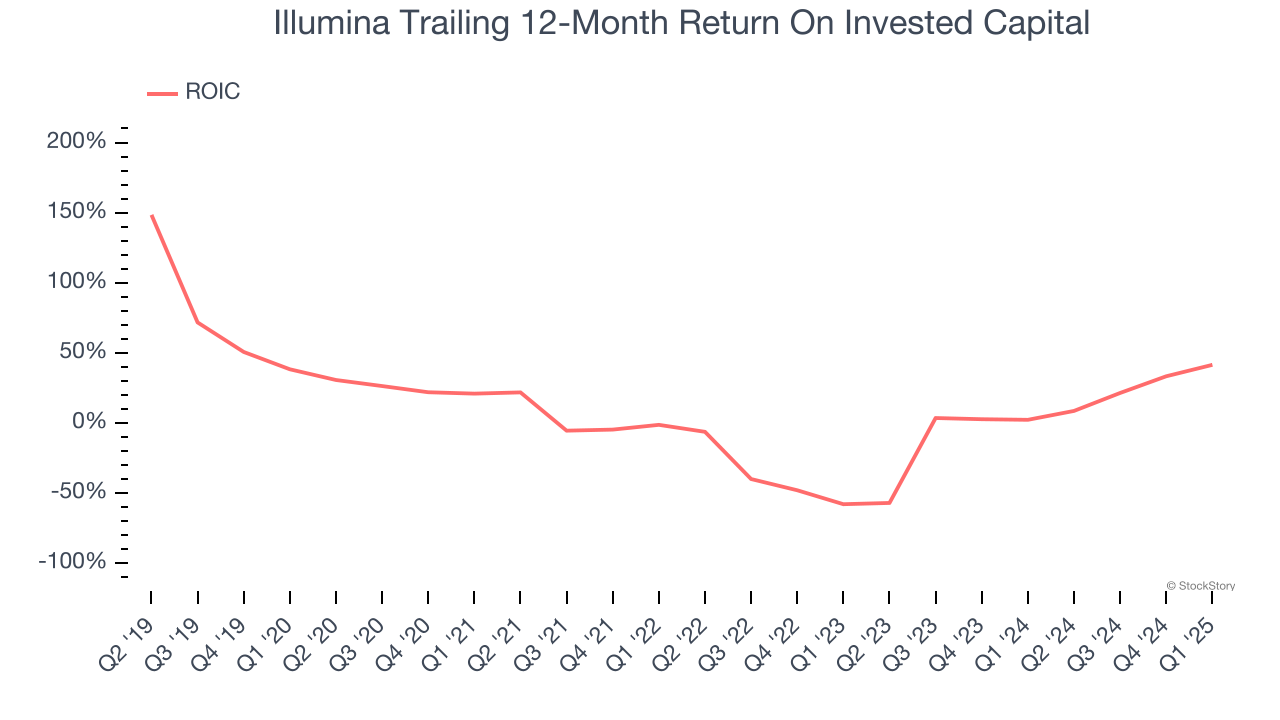

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Illumina historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.2%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

Final Judgment

Illumina doesn’t pass our quality test. Following the recent decline, the stock trades at 19.4× forward P/E (or $89.03 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. We’d suggest looking at our favorite semiconductor picks and shovels play.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.