Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at TPI Composites (NASDAQ: TPIC) and its peers.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 18 renewable energy stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 5.2% while next quarter’s revenue guidance was 1.1% above.

Luckily, renewable energy stocks have performed well with share prices up 12.4% on average since the latest earnings results.

TPI Composites (NASDAQ: TPIC)

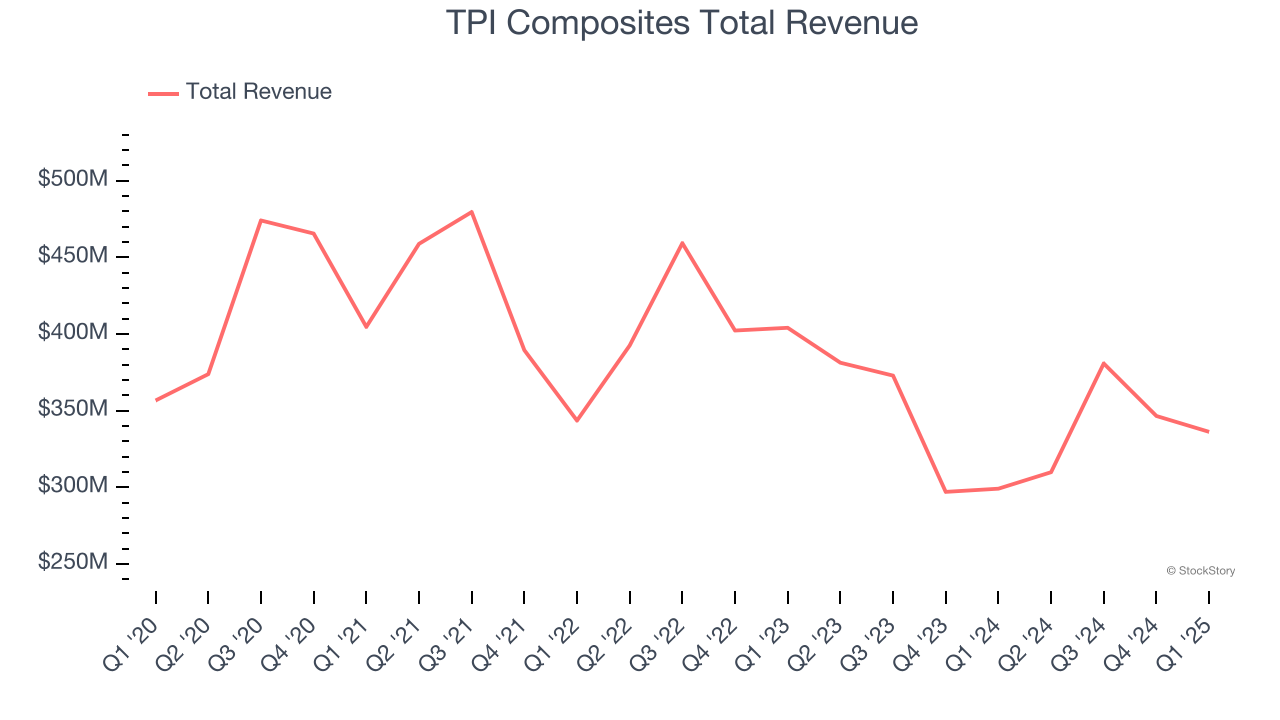

Founded in 1968, TPI Composites (NASDAQ: TPIC) manufactures composite wind turbine blades and provides related precision molding and assembly systems.

TPI Composites reported revenues of $336.2 million, up 12.4% year on year. This print exceeded analysts’ expectations by 6.9%. Despite the top-line beat, it was still a mixed quarter for the company with full-year revenue guidance beating analysts’ expectations but a significant miss of analysts’ adjusted operating income estimates.

”In the first quarter, TPI achieved 14% year-over-year growth in sales and drove positive cash flows from operating activities despite a challenging geopolitical and operating environment. The various economic challenges presented in the markets where we operate continue to create uncertainty in the industry’s near-term outlook and continue to challenge our operations. We are continuing to focus on maximizing value and ensuring that we have sufficient liquidity. Additionally, we are working with a committee of our Board of Directors and with advisors to conduct a strategic review of our business and evaluate potential strategic alternatives focused on optimizing our capital structure for the current and future environment,” said Bill Siwek, President and CEO of TPI Composites.

Interestingly, the stock is up 16.3% since reporting and currently trades at $1.14.

Read our full report on TPI Composites here, it’s free.

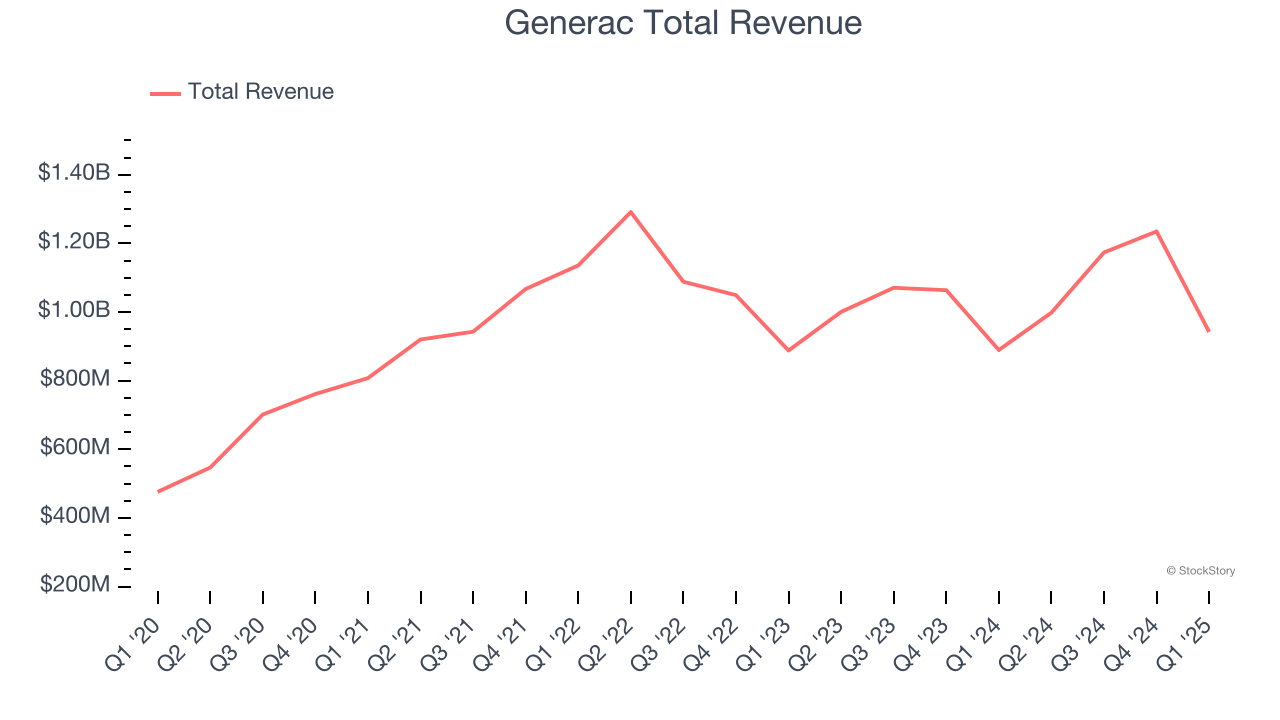

Best Q1: Generac (NYSE: GNRC)

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE: GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $942.1 million, up 5.9% year on year, outperforming analysts’ expectations by 2.3%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 9.9% since reporting. It currently trades at $124.38.

Is now the time to buy Generac? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Blink Charging (NASDAQ: BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ: BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $20.75 million, down 44.8% year on year, falling short of analysts’ expectations by 24.3%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Blink Charging delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is flat since the results and currently trades at $0.87.

Read our full analysis of Blink Charging’s results here.

American Superconductor (NASDAQ: AMSC)

Founded in 1987, American Superconductor (NASDAQ: AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

American Superconductor reported revenues of $66.66 million, up 58.6% year on year. This result beat analysts’ expectations by 10.6%. Overall, it was a stunning quarter as it also put up a solid beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The stock is up 22.2% since reporting and currently trades at $29.60.

Read our full, actionable report on American Superconductor here, it’s free.

ChargePoint (NYSE: CHPT)

The most prominent EV charging company during the COVID bull market, ChargePoint (NYSE: CHPT) is a provider of electric vehicle charging technology solutions in North America and Europe.

ChargePoint reported revenues of $97.64 million, down 8.8% year on year. This print came in 3.2% below analysts' expectations. Overall, it was a softer quarter as it also logged a significant miss of analysts’ EBITDA and EPS estimates.

The stock is down 21.5% since reporting and currently trades at $0.70.

Read our full, actionable report on ChargePoint here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.