Over the last six months, Provident Financial Services’s shares have sunk to $16.14, producing a disappointing 13.4% loss - a stark contrast to the S&P 500’s 1.9% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Provident Financial Services, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Provident Financial Services Not Exciting?

Even though the stock has become cheaper, we're cautious about Provident Financial Services. Here are three reasons why we avoid PFS and a stock we'd rather own.

1. EPS Trending Down

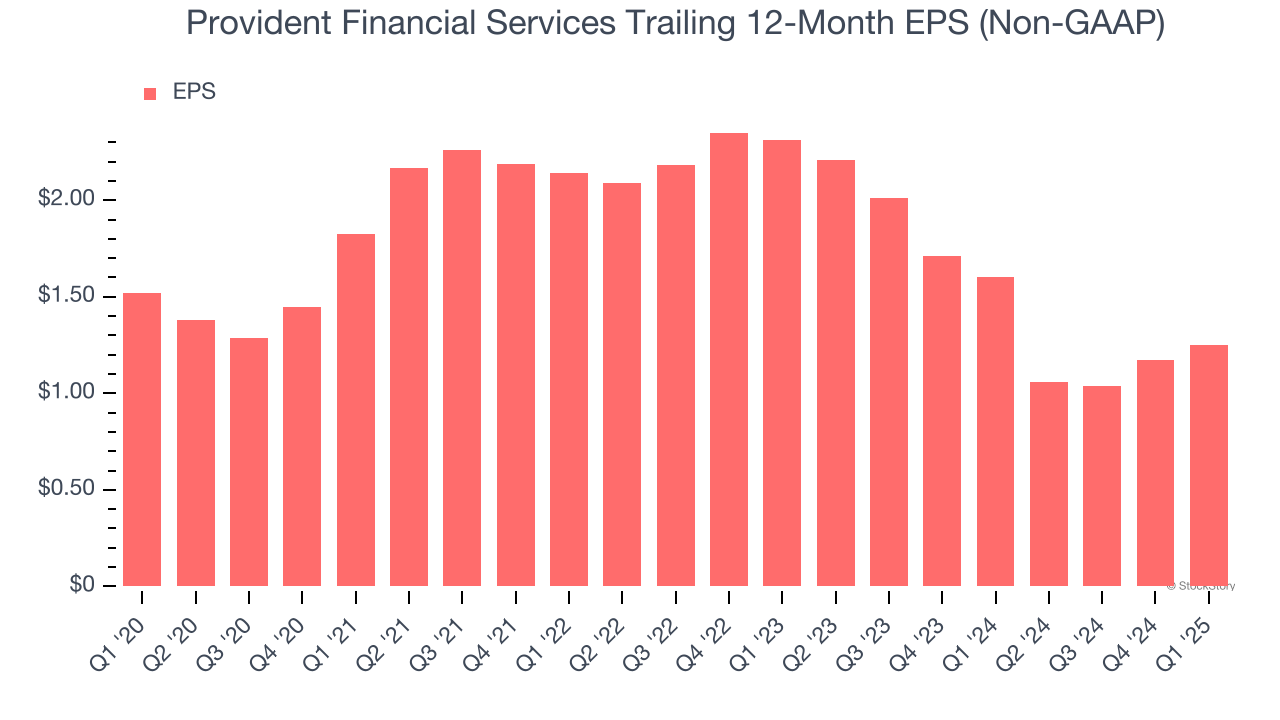

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Provident Financial Services, its EPS declined by 3.8% annually over the last five years while its revenue grew by 16.8%. This tells us the company became less profitable on a per-share basis as it expanded.

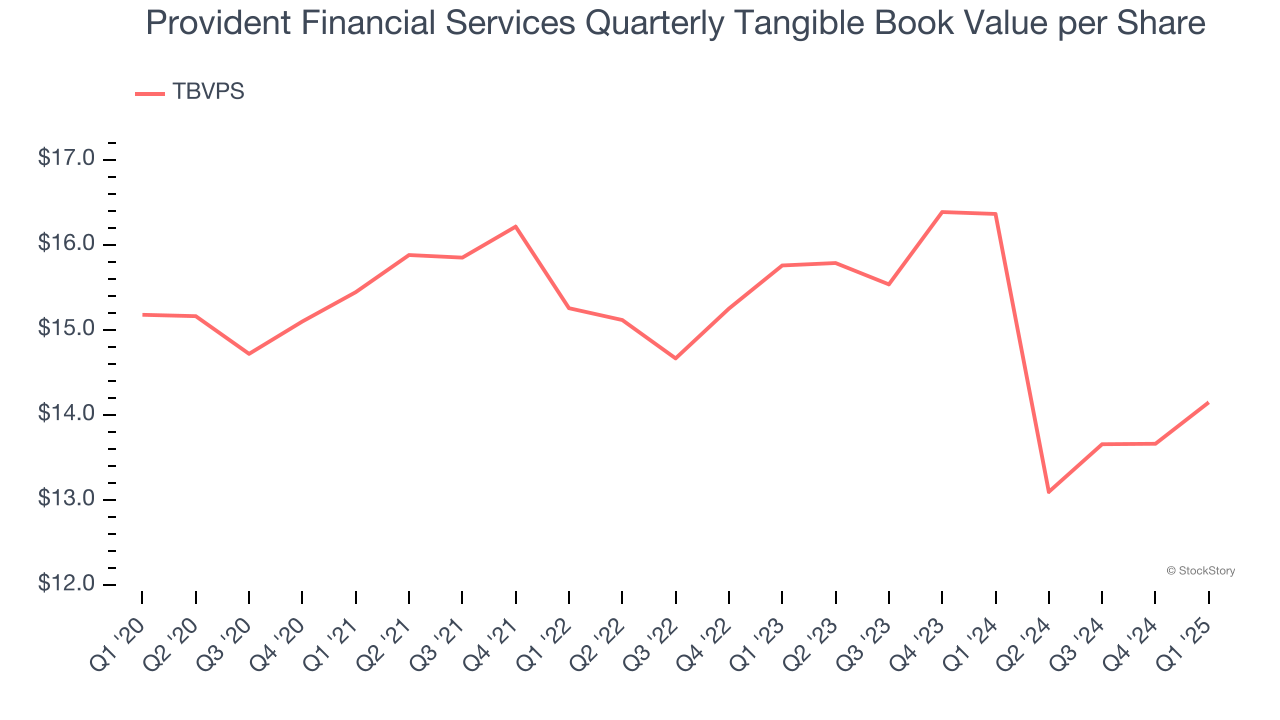

2. Declining TBVPS Reflects Erosion of Asset Value

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

Disappointingly for investors, Provident Financial Services’s TBVPS continued freefalling over the past two years as TBVPS declined at a -5.2% annual clip (from $15.76 to $14.15 per share).

3. High Interest Expenses Increase Risk

Leverage is core to the bank’s business model (loans funded by deposits) and to ensure their stability, regulators require certain levels of capital and liquidity, focusing on a bank’s Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a bank holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all banks must maintain a Tier 1 capital ratio greater than 4.5% On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, banks generally must maintain a 7-10% ratio at minimum.

Over the last two years, Provident Financial Services has averaged a Tier 1 capital ratio of 10.7%, which is considered unsafe in the event of a black swan or if macro or market conditions suddenly deteriorate. For this reason alone, we will be crossing it off our shopping list.

Final Judgment

Provident Financial Services isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 0.8× forward P/B (or $16.14 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Provident Financial Services

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.