As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at sales and marketing software stocks, starting with Sprinklr (NYSE: CXM).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

While some sales and marketing software stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.5% since the latest earnings results.

Sprinklr (NYSE: CXM)

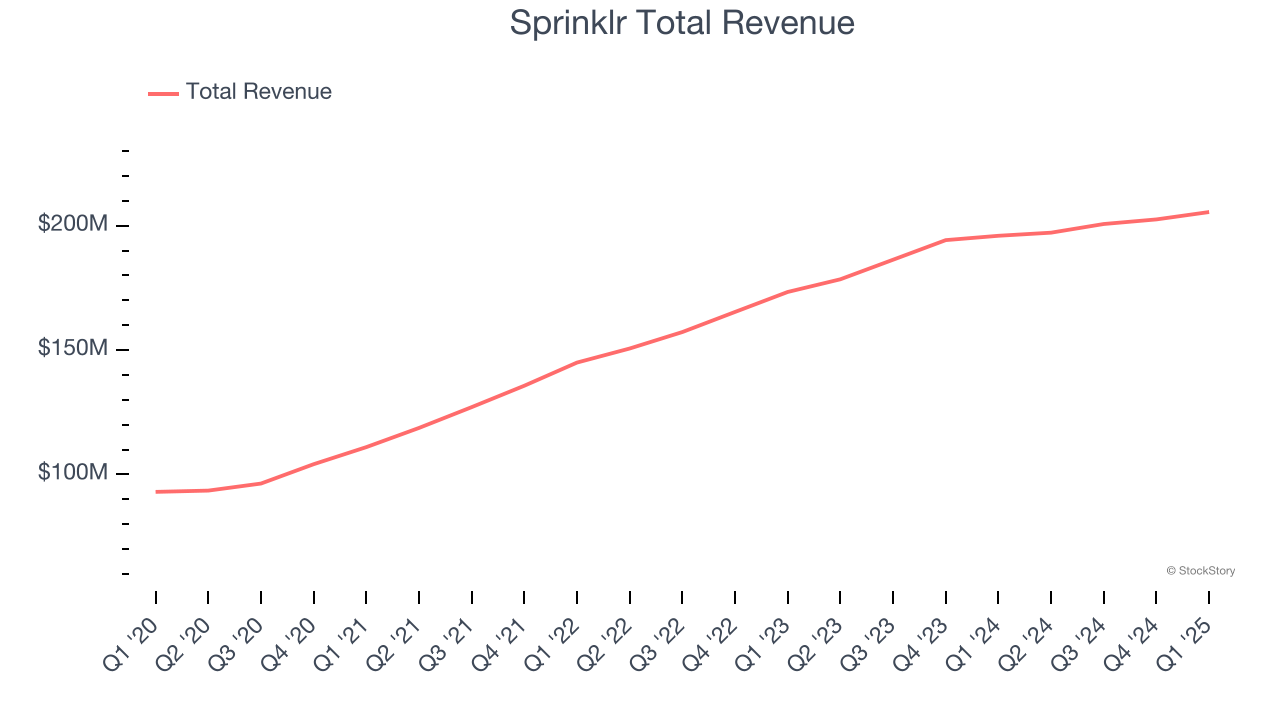

Initially focused only on social media management, Sprinklr (NYSE: CXM) is a leading provider of unified customer experience management software.

Sprinklr reported revenues of $205.5 million, up 4.9% year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

“Our Q1 results reflect solid progress in our transformation to better serve our customers and partners. We are deeply focused on improving our execution and delivering business value to the brands we serve with our AI-native CXM platform. We also generated record free cash flow in the quarter,” said Rory Read, Sprinklr President and CEO.

Unsurprisingly, the stock is down 5.8% since reporting and currently trades at $8.06.

Is now the time to buy Sprinklr? Access our full analysis of the earnings results here, it’s free.

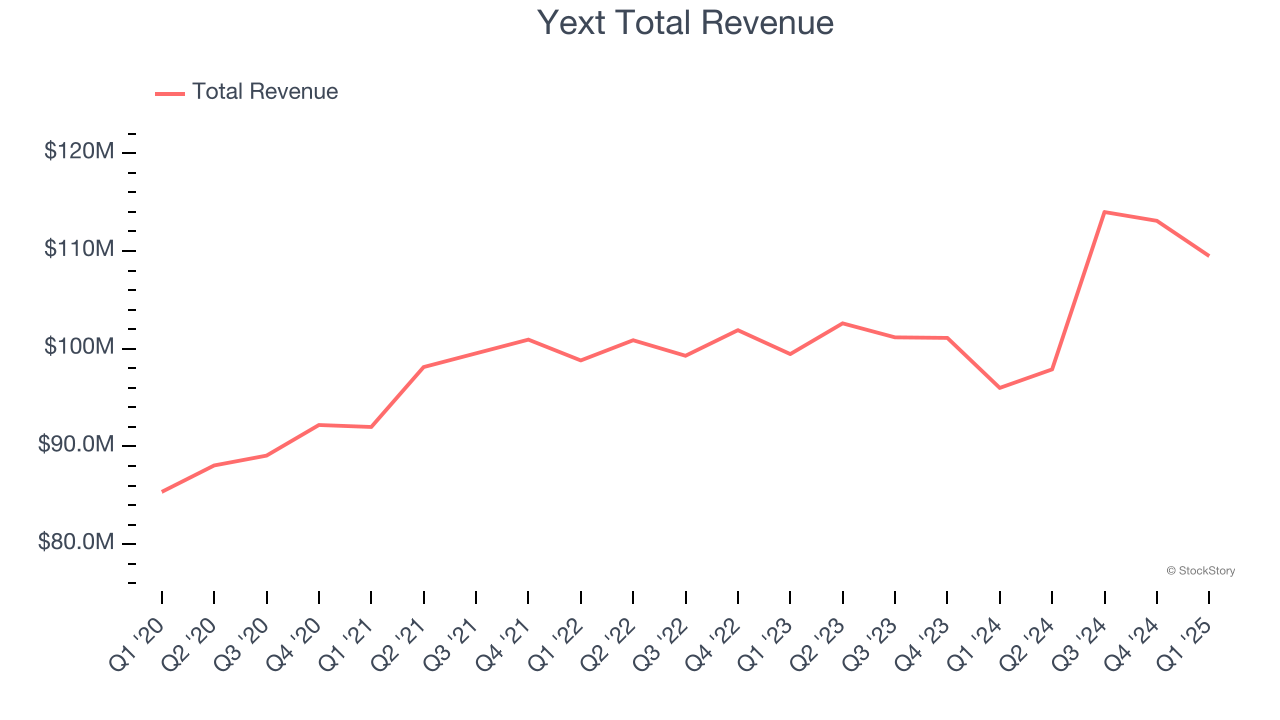

Best Q1: Yext (NYSE: YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE: YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Yext reported revenues of $109.5 million, up 14.1% year on year, outperforming analysts’ expectations by 1.8%. The business had an exceptional quarter with a solid beat of analysts’ annual recurring revenue estimates and an impressive beat of analysts’ billings estimates.

The market seems happy with the results as the stock is up 18.6% since reporting. It currently trades at $8.08.

Is now the time to buy Yext? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Braze (NASDAQ: BRZE)

Founded in 2011 after the co-founders met at NYC Disrupt Hackathon, Braze (NASDAQ: BRZE) is a customer engagement software platform that allows brands to connect with customers through data-driven and contextual marketing campaigns.

Braze reported revenues of $162.1 million, up 19.6% year on year, exceeding analysts’ expectations by 2.2%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 25.8% since the results and currently trades at $26.80.

Read our full analysis of Braze’s results here.

PubMatic (NASDAQ: PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $63.83 million, down 4.3% year on year. This print beat analysts’ expectations by 2.8%. Zooming out, it was a mixed quarter as it also produced an impressive beat of analysts’ EBITDA estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

The stock is flat since reporting and currently trades at $11.05.

Read our full, actionable report on PubMatic here, it’s free.

Zeta (NYSE: ZETA)

Co-founded by former Apple CEO John Sculley, Zeta Global (NYSE: ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $264.4 million, up 35.6% year on year. This number topped analysts’ expectations by 4.1%. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

The stock is down 6.4% since reporting and currently trades at $12.68.

Read our full, actionable report on Zeta here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.