In a sliding market, Walgreens has defied the odds, trading up to $11.26 per share. Its 25.4% gain since December 2024 has outpaced the S&P 500’s 2.4% drop. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Walgreens, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Walgreens Not Exciting?

Despite the momentum, we're swiping left on Walgreens for now. Here are three reasons why there are better opportunities than WBA and a stock we'd rather own.

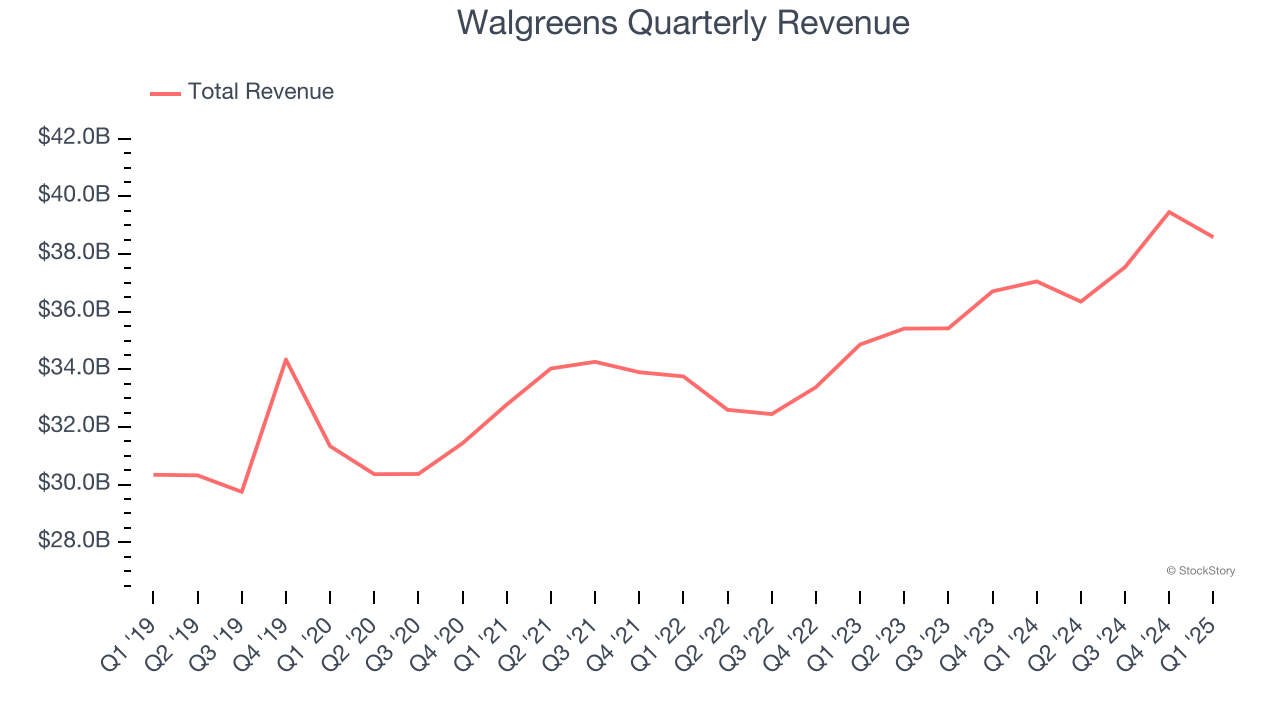

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Walgreens’s 2.9% annualized revenue growth over the last six years was sluggish. This fell short of our benchmarks.

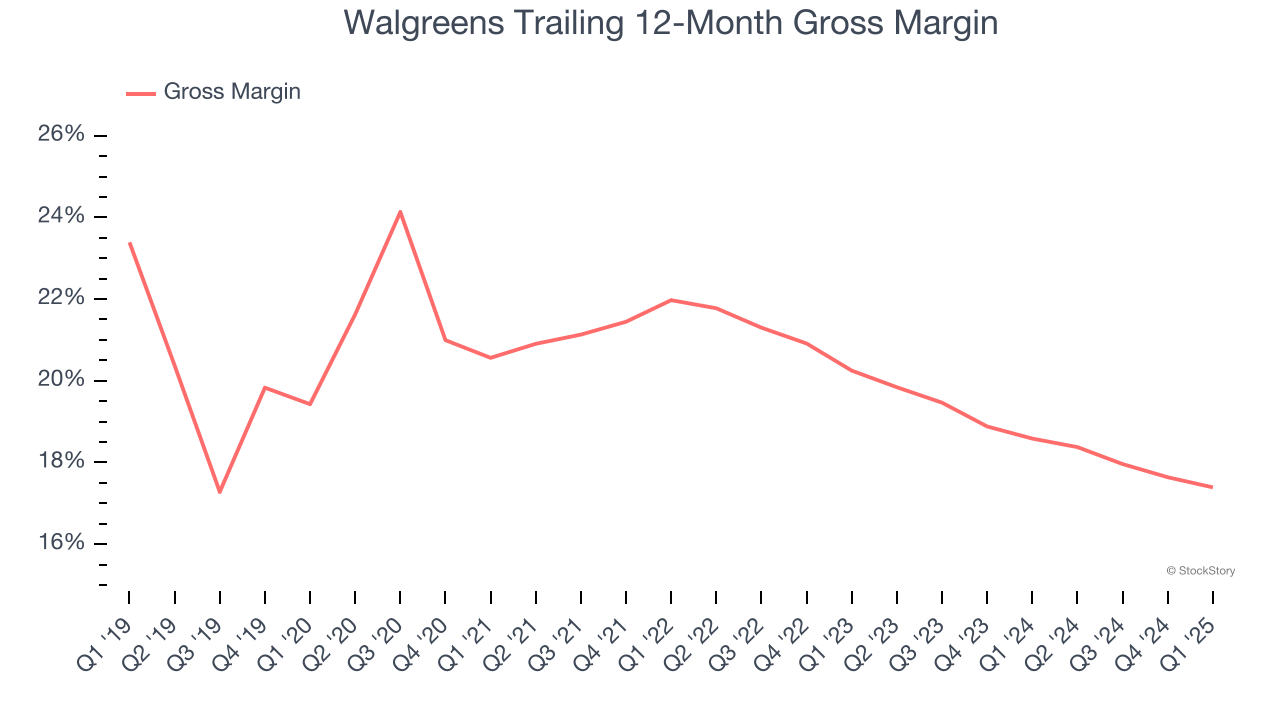

2. Low Gross Margin Reveals Weak Structural Profitability

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Walgreens has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 18% gross margin over the last two years. That means Walgreens paid its suppliers a lot of money ($82.03 for every $100 in revenue) to run its business.

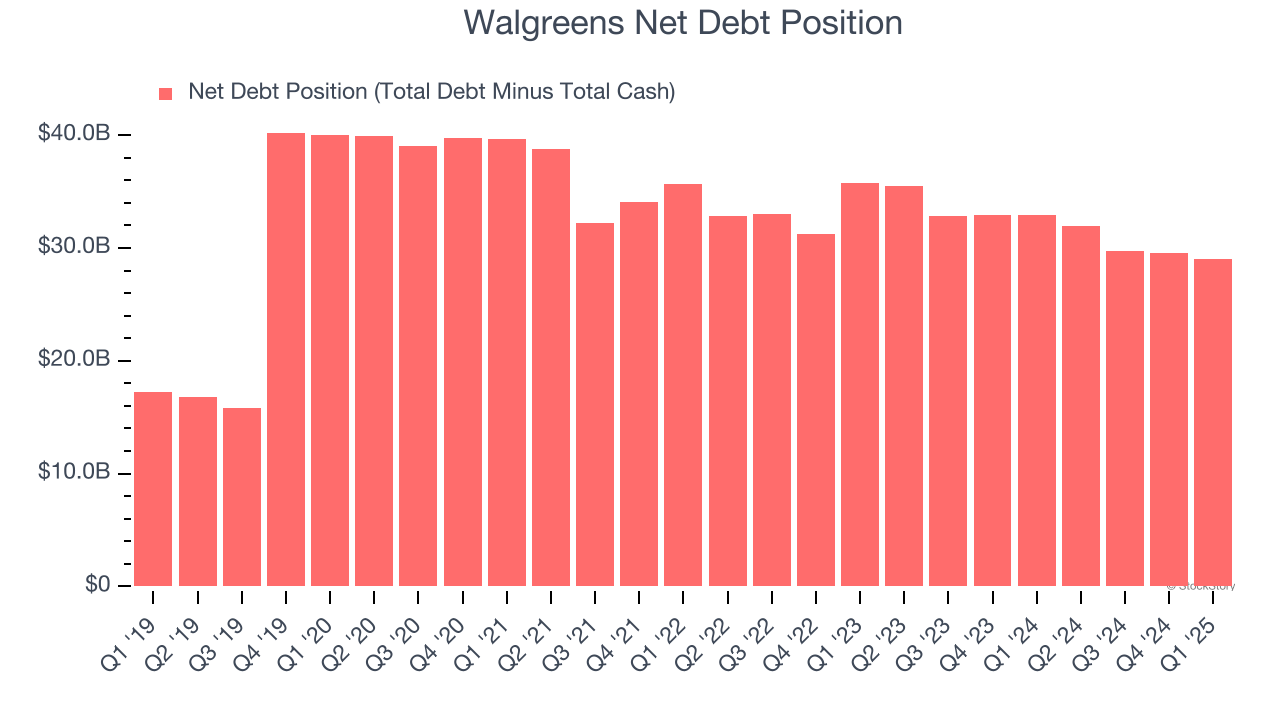

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Walgreens’s $30.13 billion of debt exceeds the $1.13 billion of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $4.45 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Walgreens could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Walgreens can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Walgreens isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 7.4× forward P/E (or $11.26 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Walgreens

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.