Over the past six months, European Wax Center has been a great trade, beating the S&P 500 by 7.6%. Its stock price has climbed to $5.50, representing a healthy 8.7% increase. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy European Wax Center, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is European Wax Center Not Exciting?

We’re happy investors have made money, but we don't have much confidence in European Wax Center. Here are three reasons why EWCZ doesn't excite us and a stock we'd rather own.

1. Same-Store Sales Falling Behind Peers

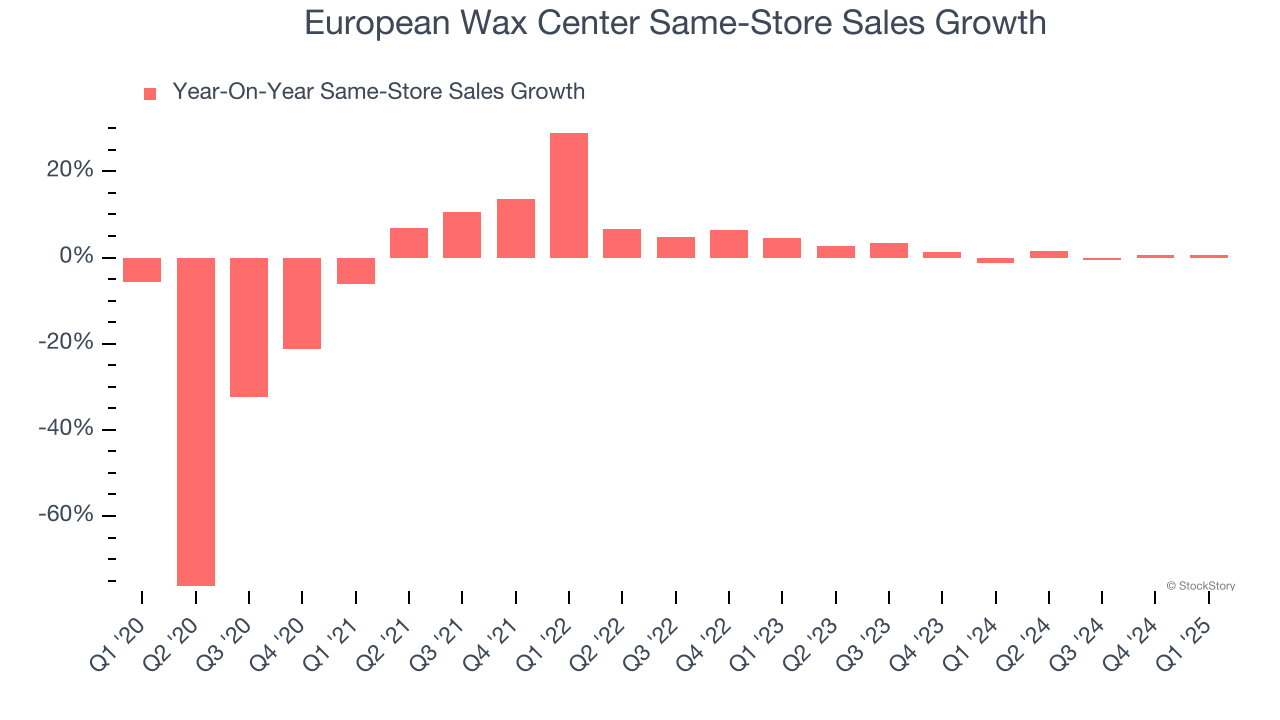

Investors interested in Leisure Facilities companies should track same-store sales in addition to reported revenue. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into European Wax Center’s underlying demand characteristics.

Over the last two years, European Wax Center’s same-store sales averaged 1.1% year-on-year growth. This performance was underwhelming and suggests it might have to change its strategy or pricing, which can disrupt operations.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect European Wax Center’s revenue to drop by 1.4%, a decrease from its 7.6% annualized growth for the past five years. This projection is underwhelming and implies its products and services will face some demand challenges.

3. EPS Growth Has Stalled

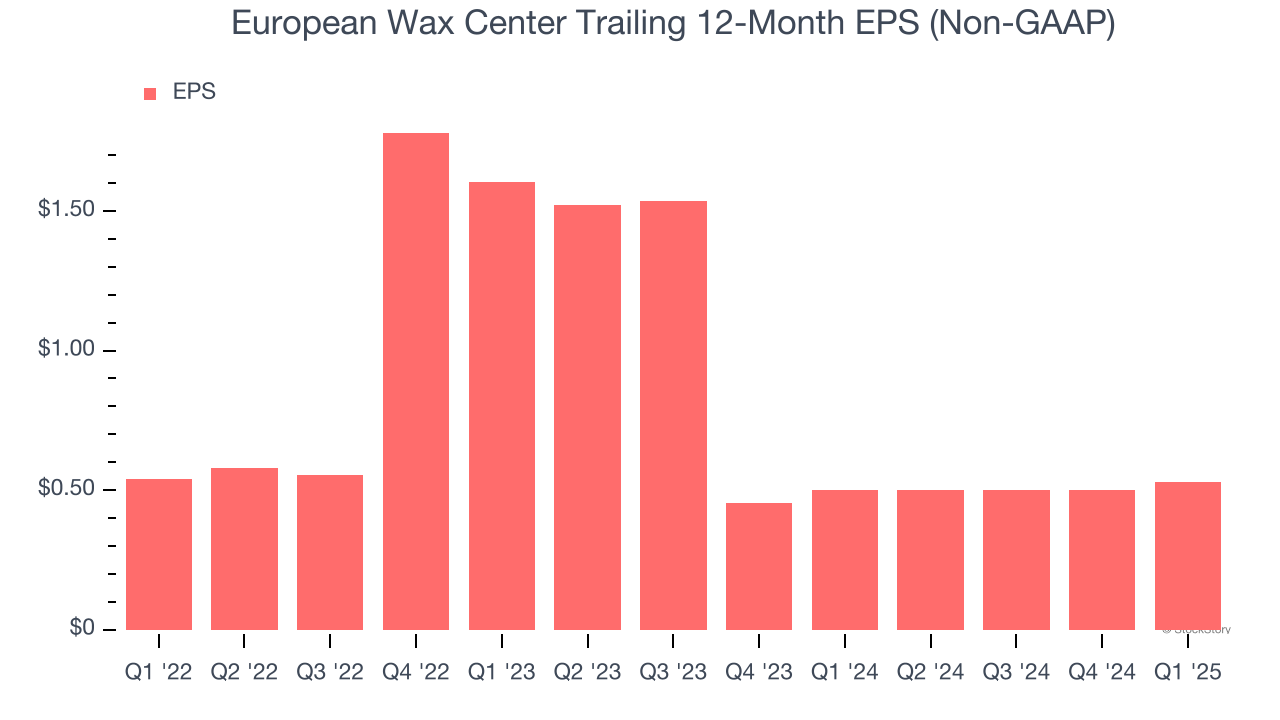

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

European Wax Center’s full-year EPS was flat over the last three years, worse than the broader consumer discretionary sector.

Final Judgment

European Wax Center isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 17.9× forward P/E (or $5.50 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than European Wax Center

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.