Since December 2024, OFG Bancorp has been in a holding pattern, posting a small loss of 2.1% while floating around $42.45.

Does this present a buying opportunity for OFG? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does OFG Bancorp Spark Debate?

Originally founded in 1964 as a federal savings and loan institution, OFG Bancorp (NYSE: OFG) provides banking and financial services including commercial and consumer lending, wealth management, insurance, and trust services primarily in Puerto Rico and the U.S. Virgin Islands.

Two Things to Like:

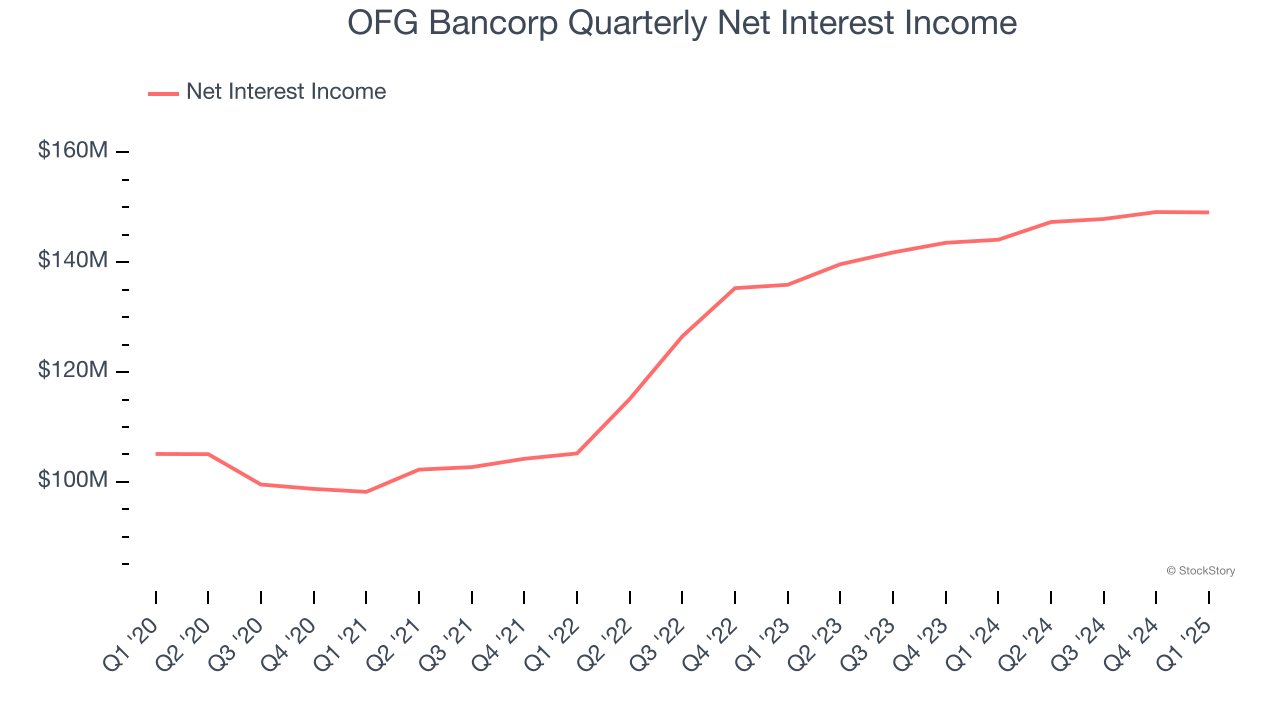

1. Net Interest Income Drives Additional Growth Opportunities

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

OFG Bancorp’s net interest income has grown at a 10.3% annualized rate over the last four years, a step above the broader bank industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

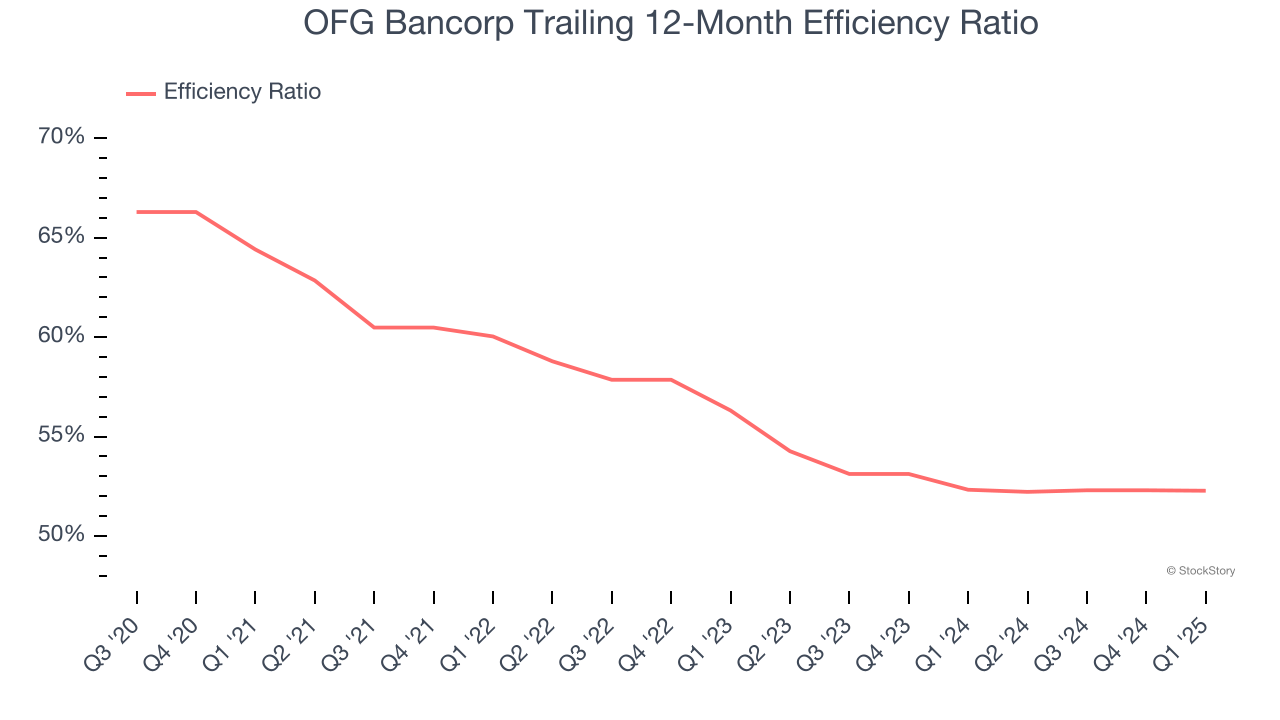

2. Efficiency Ratio Improving, Profits Up

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Markets understand that a bank’s expense base depends on its revenue mix and what mostly drives share price performance is the change in this ratio, rather than its absolute value. It’s somewhat counterintuitive, but a lower efficiency ratio is better.

Over the last four years, OFG Bancorp’s efficiency ratio has decreased by 12.1 percentage points, clocking in at 52.3% for the past 12 months. Said differently, the company’s expenses have grown at a slower rate than revenue, which is always a positive sign.

One Reason to be Careful:

Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect OFG Bancorp’s net interest income to rise by 1.3%, a deceleration versus its 7.6% annualized growth for the past two years. This projection is below its 7.6% annualized growth rate for the past two years.

Final Judgment

OFG Bancorp’s merits more than compensate for its flaws, but at $42.45 per share (or 1.4× forward P/B), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than OFG Bancorp

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.