Recreational products manufacturer American Outdoor Brands (NASDAQ: AOUT) announced better-than-expected revenue in Q1 CY2025, with sales up 33.8% year on year to $61.94 million. Its non-GAAP profit of $0.13 per share was significantly above analysts’ consensus estimates.

Is now the time to buy American Outdoor Brands? Find out by accessing our full research report, it’s free.

American Outdoor Brands (AOUT) Q1 CY2025 Highlights:

- "A portion of our anticipated fiscal 2026 demand was accelerated by retailers who acted to secure inventory of our most popular products – and our new products – including the ClayCopter™ and the BUBBA SFS Lite™. In many cases, those decisions were not only a reflection of excitement around our innovation pipeline, but also a prudent step by our partners to get ahead of a dynamic tariff environment and broader consumer uncertainty."

- Revenue: $61.94 million vs analyst estimates of $48.46 million (33.8% year-on-year growth, 27.8% beat)

- Adjusted EPS: $0.13 vs analyst estimates of -$0.11 (significant beat)

- Adjusted EBITDA: $3.46 million vs analyst estimates of $621,000 (5.6% margin, significant beat)

- Operating Margin: -1.5%, up from -11.9% in the same quarter last year

- Free Cash Flow Margin: 11.7%, down from 30.6% in the same quarter last year

- Market Capitalization: $139.2 million

Company Overview

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ: AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

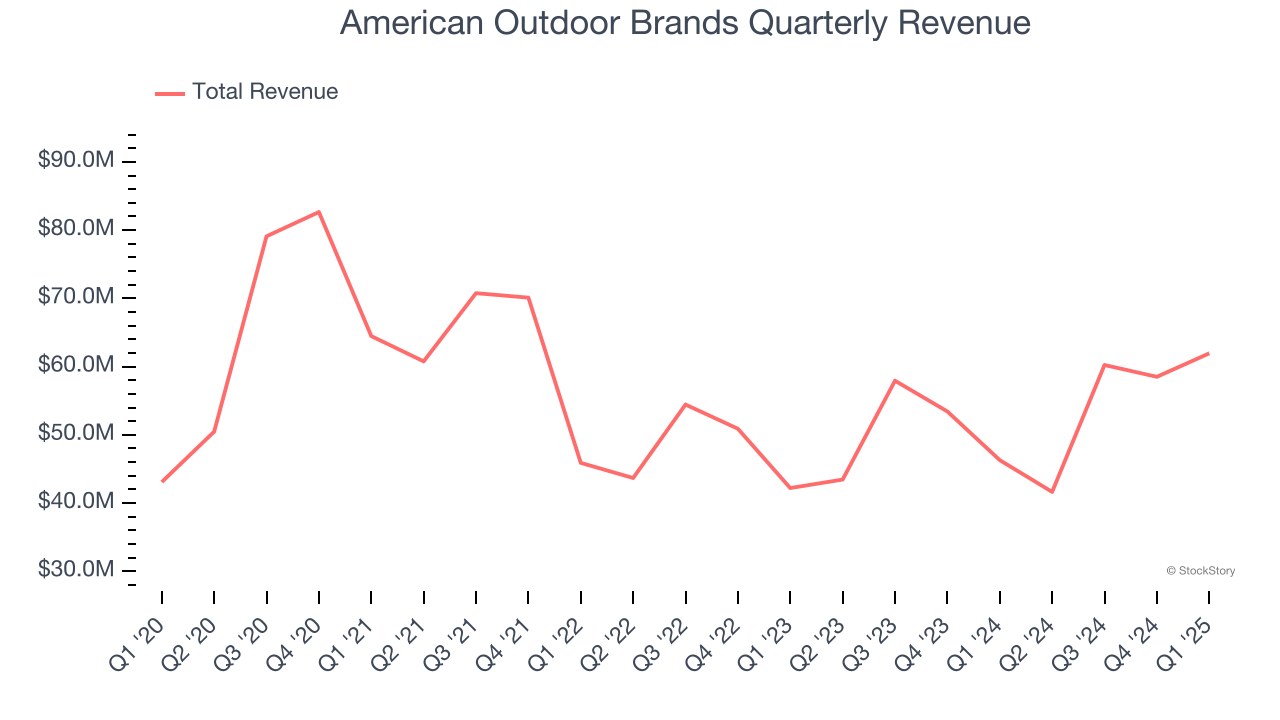

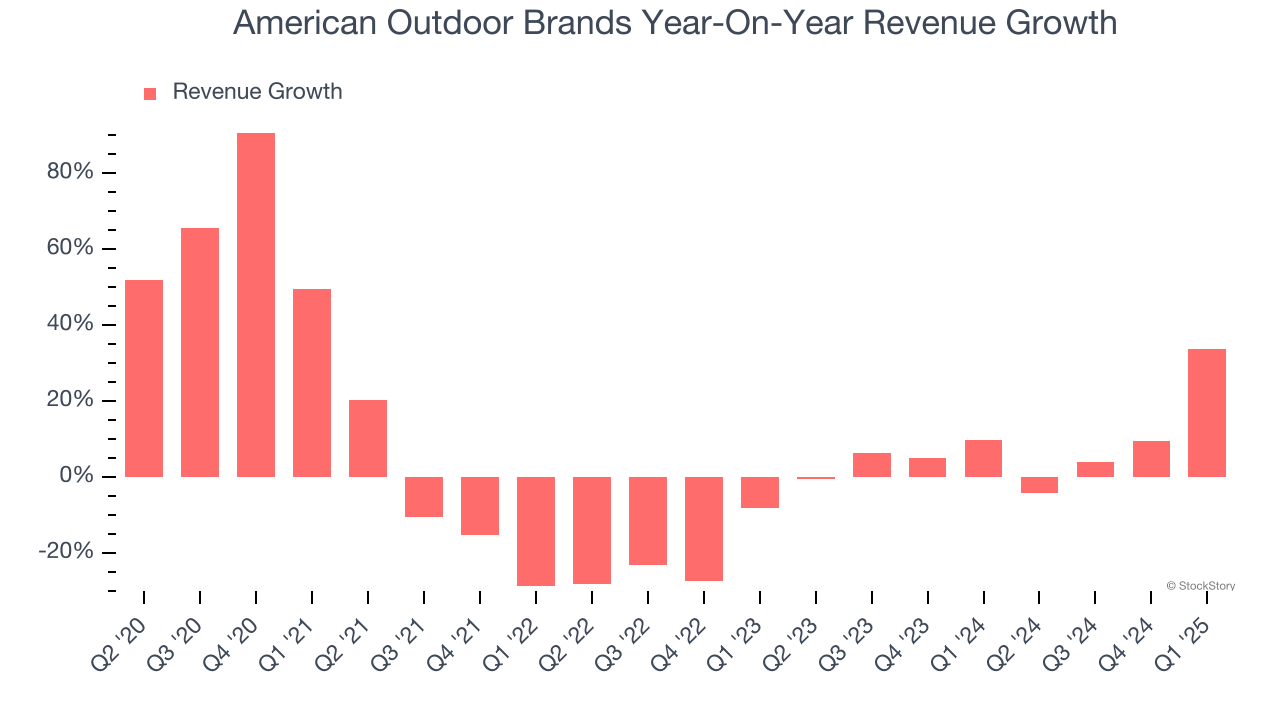

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, American Outdoor Brands’s sales grew at a sluggish 5.8% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. American Outdoor Brands’s annualized revenue growth of 7.8% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, American Outdoor Brands reported wonderful year-on-year revenue growth of 33.8%, and its $61.94 million of revenue exceeded Wall Street’s estimates by 27.8%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

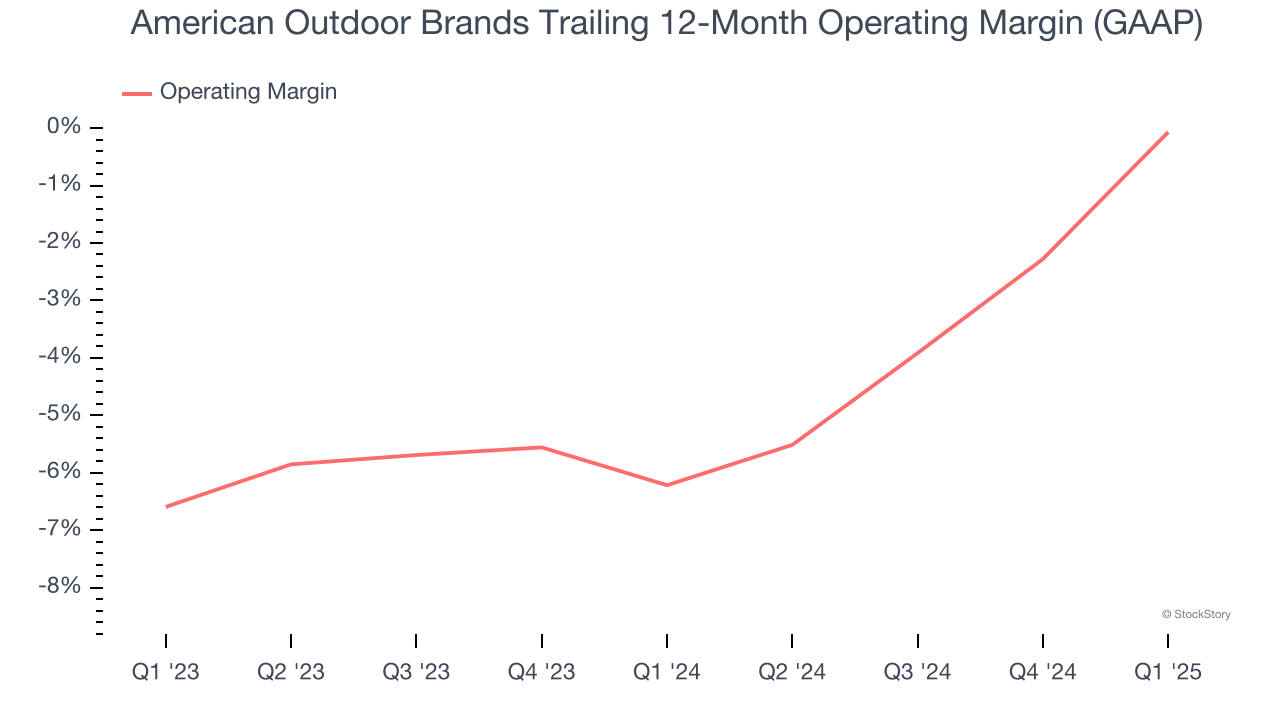

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

American Outdoor Brands’s operating margin has been trending up over the last 12 months, but it still averaged negative 3% over the last two years. This is due to its large expense base and inefficient cost structure.

American Outdoor Brands’s operating margin was negative 1.5% this quarter. The company's consistent lack of profits raise a flag.

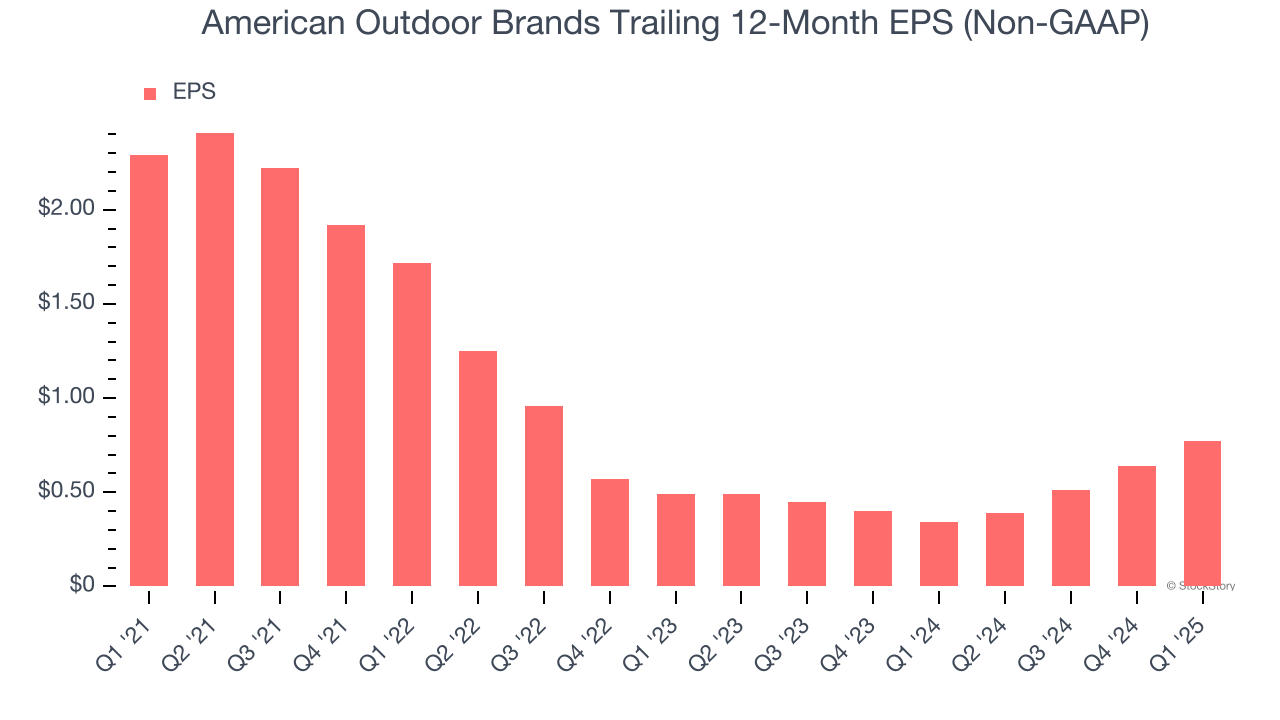

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

American Outdoor Brands’s full-year EPS dropped 135%, or 23.9% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, American Outdoor Brands’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, American Outdoor Brands reported EPS at $0.13, up from $0 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects American Outdoor Brands’s full-year EPS of $0.77 to shrink by 24%.

Key Takeaways from American Outdoor Brands’s Q1 Results

We were impressed by how significantly American Outdoor Brands blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Management said that "A portion of our anticipated fiscal 2026 demand was accelerated by retailers who acted to secure inventory of our most popular products – and our new products – including the ClayCopter™ and the BUBBA SFS Lite™. In many cases, those decisions were not only a reflection of excitement around our innovation pipeline, but also a prudent step by our partners to get ahead of a dynamic tariff environment and broader consumer uncertainty." Zooming out, we think this quarter featured some important positives. The stock traded up 13.2% to $13.65 immediately following the results.

Sure, American Outdoor Brands had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.