Over the last six months, Erie Indemnity’s shares have sunk to $352.60, producing a disappointing 16.9% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now the time to buy ERIE? Find out in our full research report, it’s free.

Why Is ERIE a Good Business?

Operating under a unique business model dating back to 1925, Erie Indemnity (NASDAQ: ERIE) serves as the attorney-in-fact for Erie Insurance Exchange, managing policy issuance, claims handling, and investment services for this reciprocal insurer.

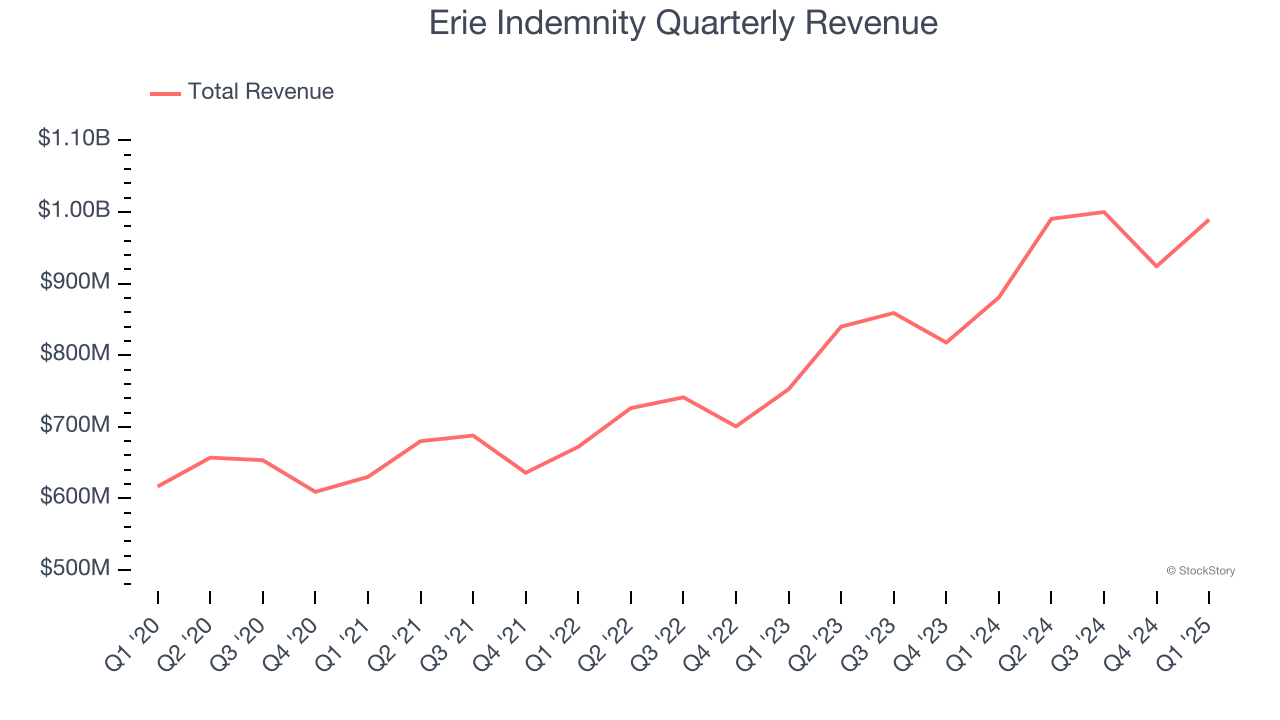

1. Skyrocketing Revenue Shows Strong Momentum

Insurers earn revenue three ways. The core insurance business itself, often called underwriting and represented in the income statement as premiums earned, is one way. Investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities is the second way. Fees from various sources such as policy administration, annuities, or other value-added services is the third.

Luckily, Erie Indemnity’s revenue grew at an impressive 11.2% compounded annual growth rate over the last four years. Its growth surpassed the average insurance company and shows its offerings resonate with customers.

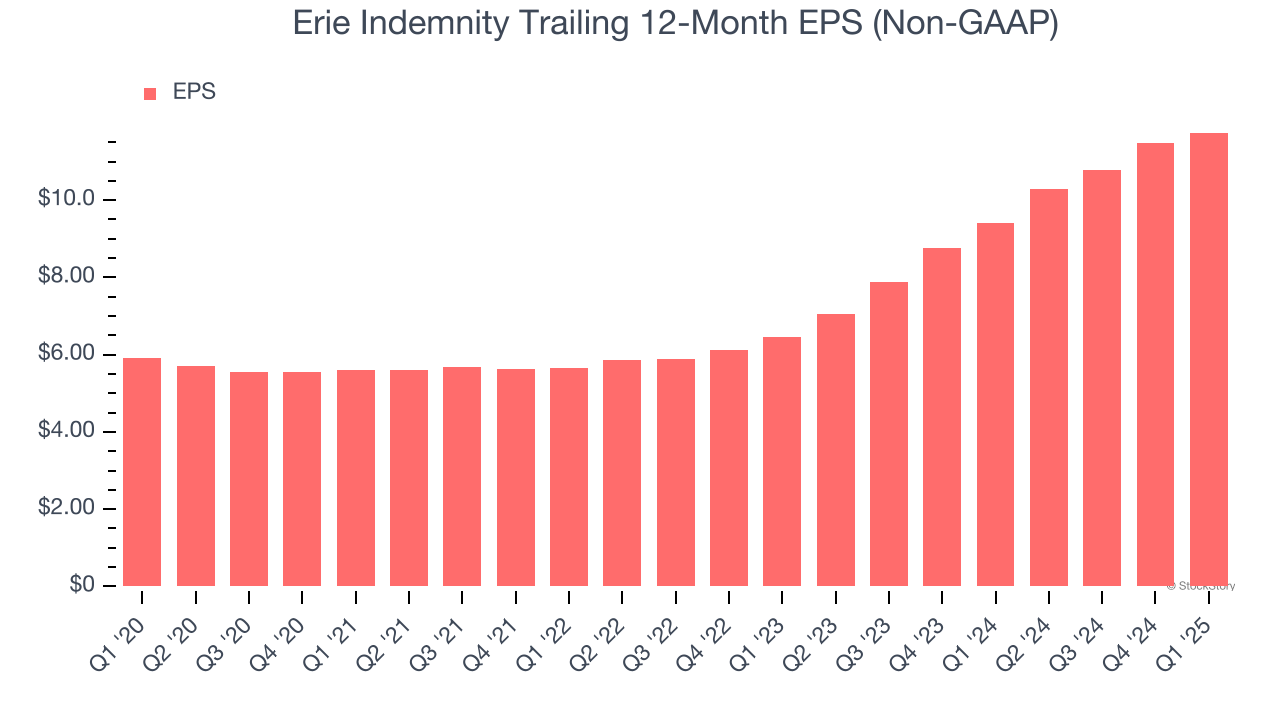

2. EPS Increasing Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Erie Indemnity’s full-year EPS grew at a solid 14.8% compounded annual growth rate over the last five years, better than the broader insurance sector.

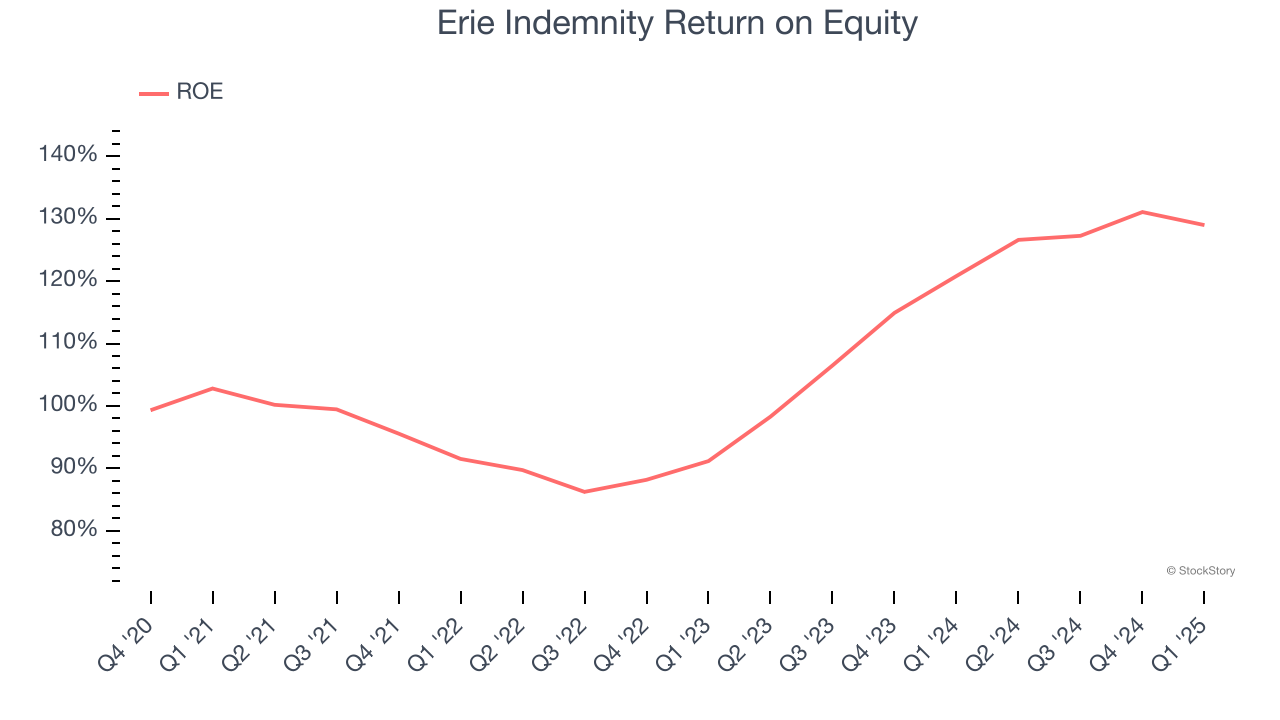

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) is a crucial yardstick for insurance companies, measuring their ability to generate returns on the capital provided by shareholders. Insurers that consistently deliver superior ROE tend to create more value for their investors over time through strategic capital allocation and shareholder-friendly policies.

Over the last five years, Erie Indemnity has averaged an ROE of 26.8%, exceptional for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired. This shows Erie Indemnity has a strong competitive moat.

Final Judgment

These are just a few reasons why Erie Indemnity is a cream-of-the-crop insurance company. After the recent drawdown, the stock trades at $352.60 per share (or a trailing 12-month price-to-sales ratio of 4.6×). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Erie Indemnity

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.