Since June 2020, the S&P 500 has delivered a total return of 102%. But one standout stock has doubled the market - over the past five years, Monolithic Power Systems has surged 204% to $687.64 per share. Its momentum hasn’t stopped as it’s also gained 10.9% in the last six months, beating the S&P by 10%.

Is it too late to buy MPWR? Find out in our full research report, it’s free.

Why Are We Positive On Monolithic Power Systems?

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

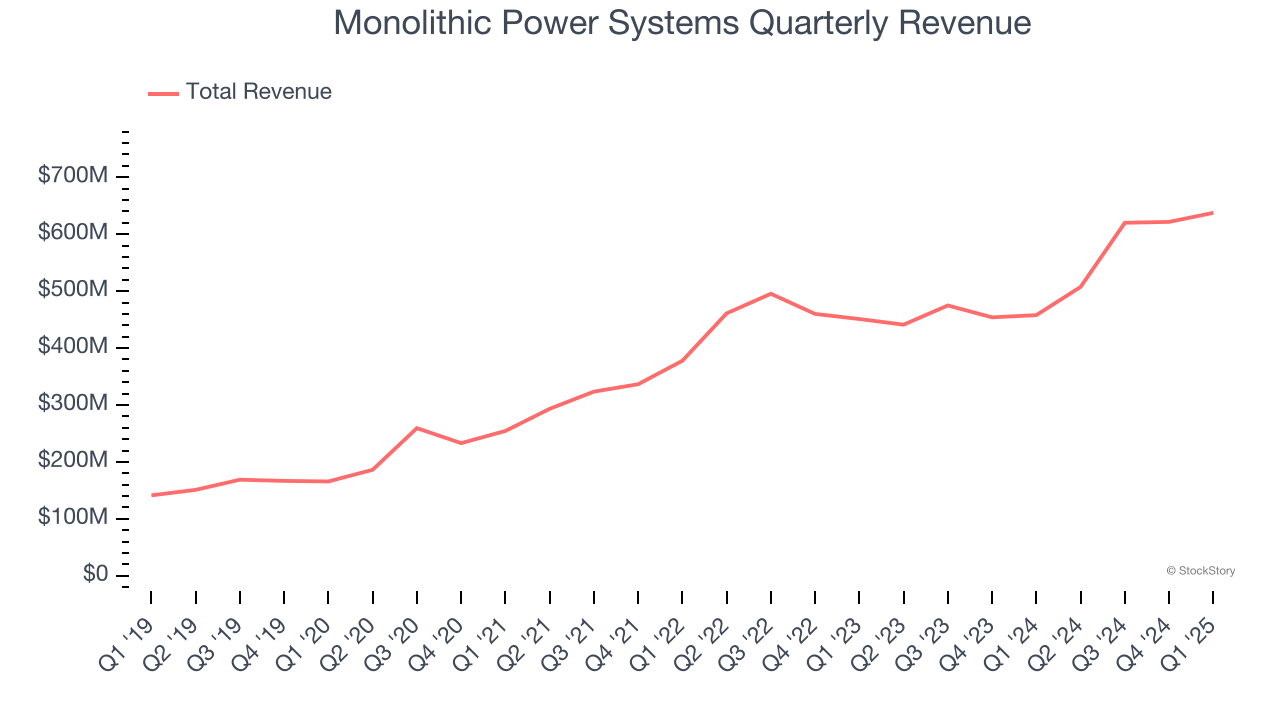

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Monolithic Power Systems’s 29.6% annualized revenue growth over the last five years was incredible. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

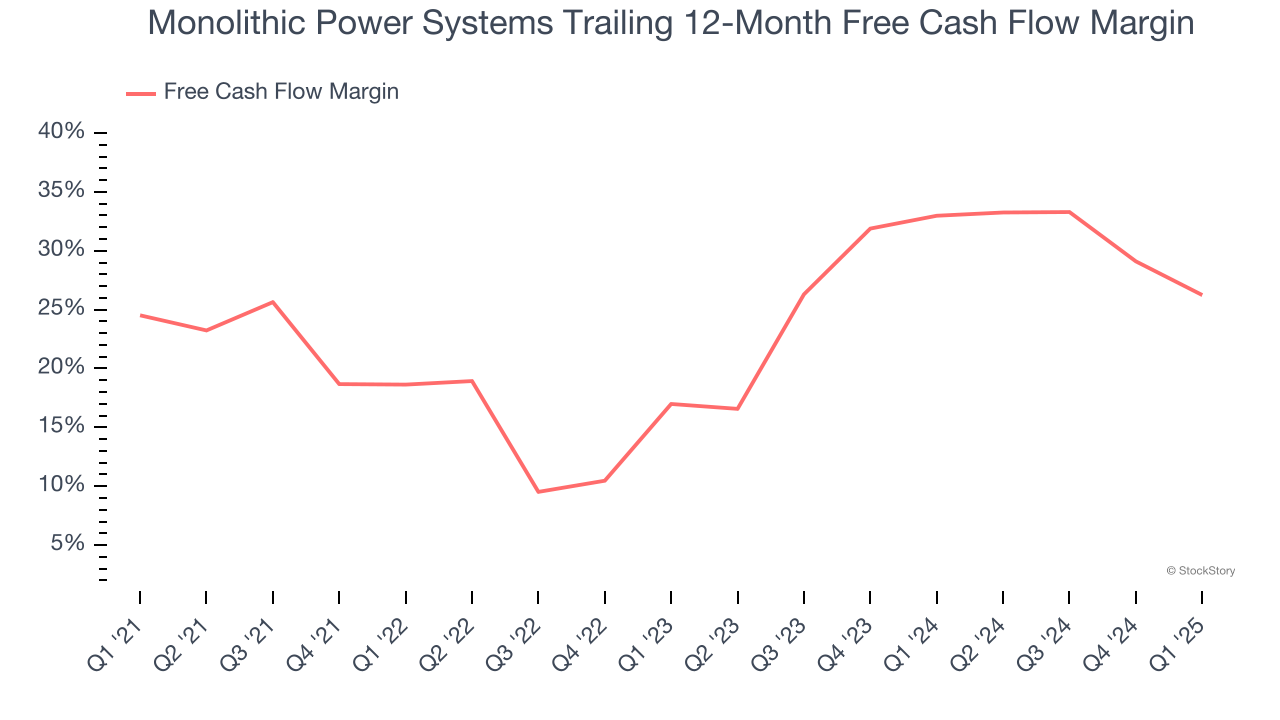

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Monolithic Power Systems has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging 29.2% over the last two years.

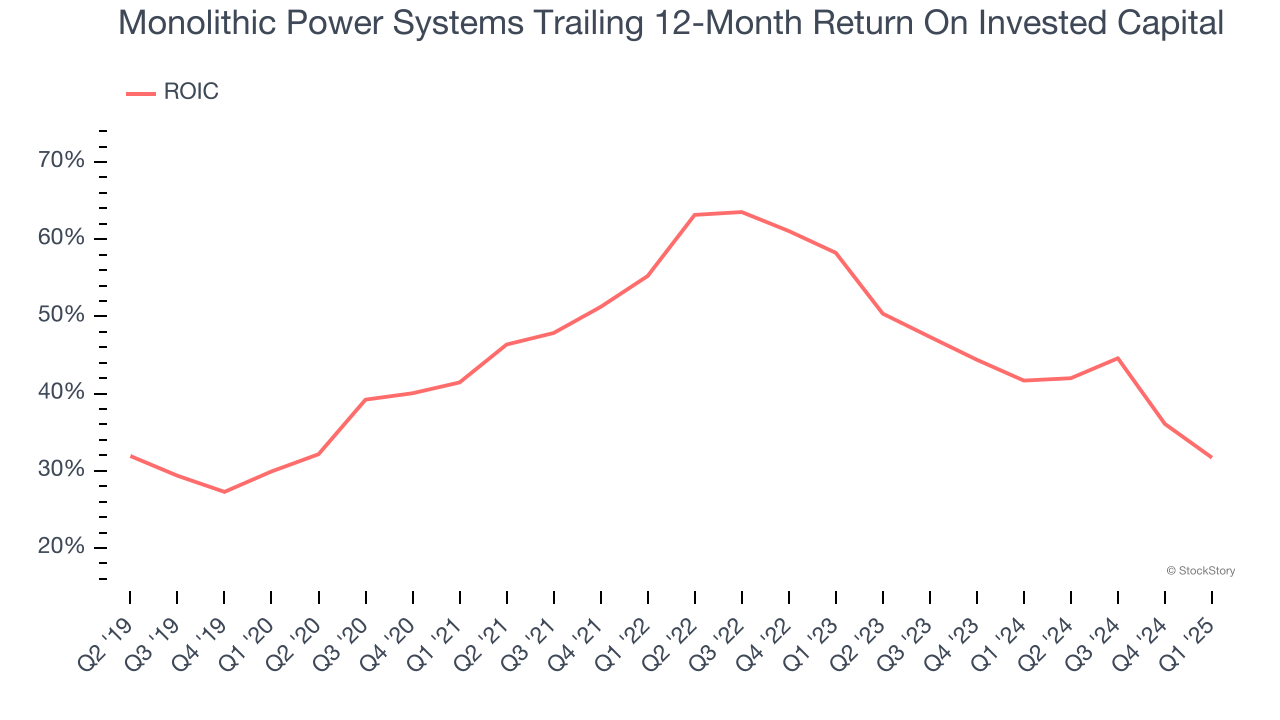

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Monolithic Power Systems’s five-year average ROIC was 45.7%, placing it among the best semiconductor companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why we're bullish on Monolithic Power Systems, and with its shares beating the market recently, the stock trades at 42.1× forward P/E (or $687.64 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.