Root has been on fire lately. In the past six months alone, the company’s stock price has rocketed 75.3%, reaching $128 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Root, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Root Not Exciting?

We’re glad investors have benefited from the price increase, but we're swiping left on Root for now. Here are two reasons why there are better opportunities than ROOT and a stock we'd rather own.

1. Declining BVPS Reflects Erosion of Asset Value

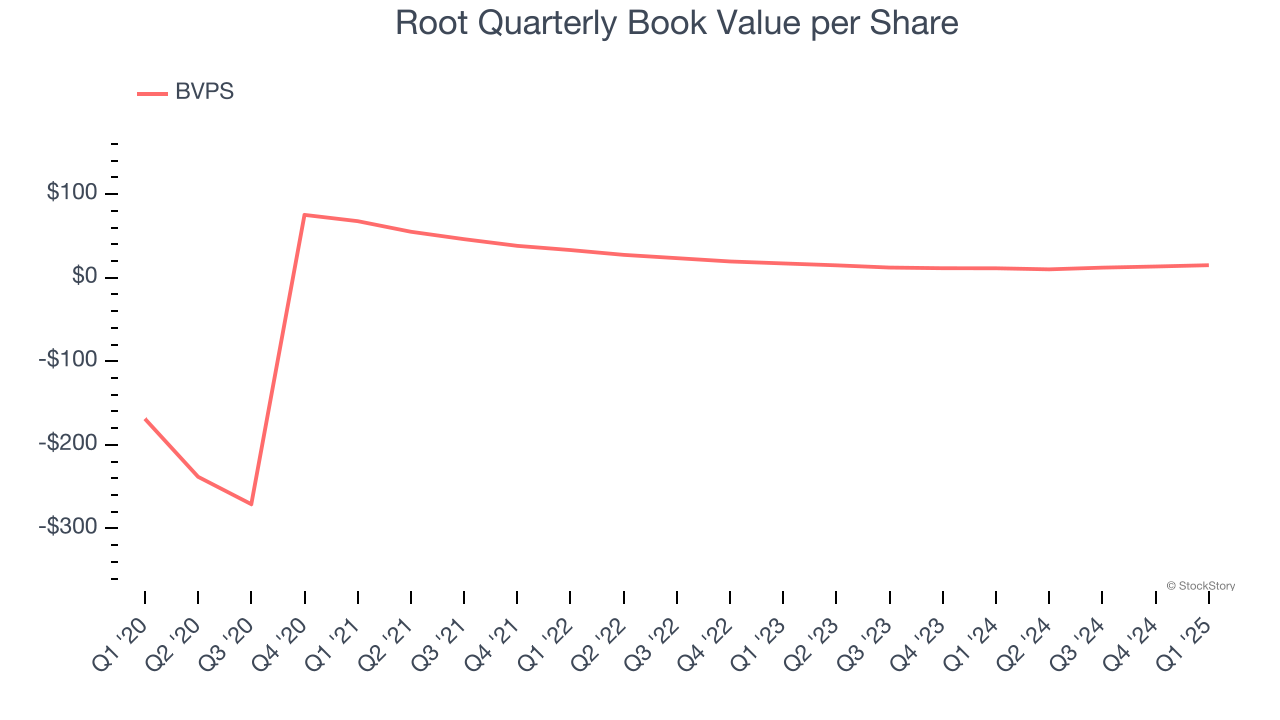

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

To the detriment of investors, Root’s BVPS declined at a 6.4% annual clip over the last two years.

2. Previous Growth Initiatives Have Lost Money

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Root has averaged an ROE of negative 96.1%, a bad result not only in absolute terms but also relative to the majority of insurers putting up 7.5%+. It also shows that Root has little to no competitive moat.

Final Judgment

Root isn’t a terrible business, but it isn’t one of our picks. After the recent rally, the stock trades at 5× forward P/B (or $128 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Like More Than Root

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.