What a brutal six months it’s been for F&G Annuities & Life. The stock has dropped 22.7% and now trades at $32.14, rattling many shareholders. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy FG? Find out in our full research report, it’s free.

Why Are We Positive On FG?

Founded in 1959 and serving approximately 677,000 policyholders who rely on its financial protection products, F&G Annuities & Life (NYSE: FG) provides fixed annuities, life insurance, and pension risk transfer solutions to retail and institutional clients.

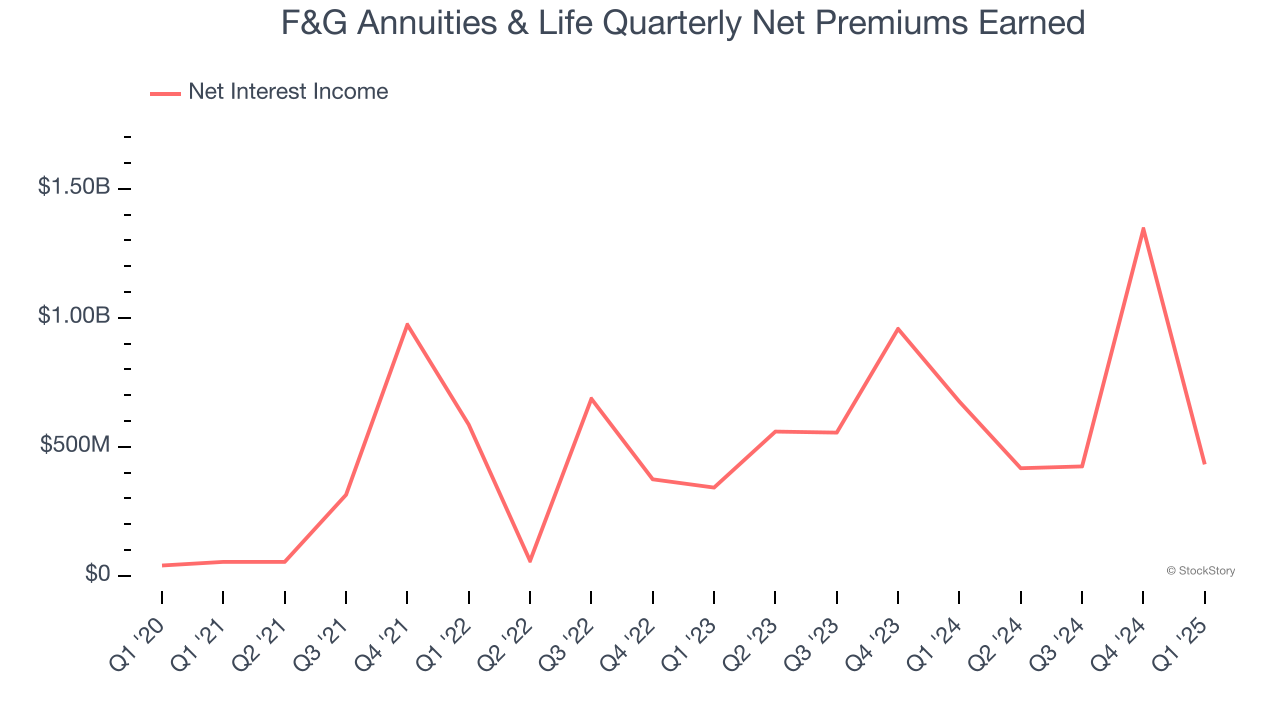

1. Net Premiums Earned Skyrockets, Fueling Growth Opportunities

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

F&G Annuities & Life’s net premiums earned has grown at a 33.9% annualized rate over the last two years, much better than the broader insurance industry.

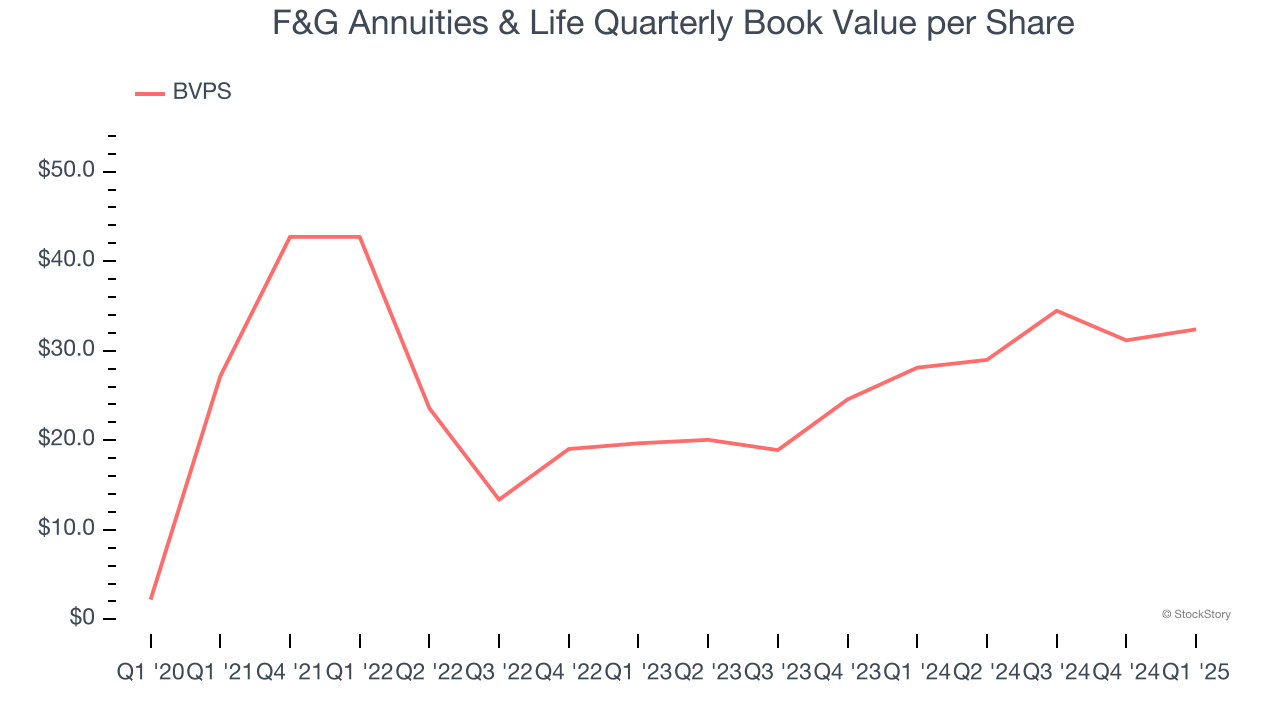

2. Growing BVPS Reflects Strong Asset Base

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

F&G Annuities & Life’s BVPS increased by 71% annually over the last five years, and although its annualized growth has recently decelerated to 28.3% over the last two years (from $19.66 to $32.39 per share), we still think its performance was incredible.

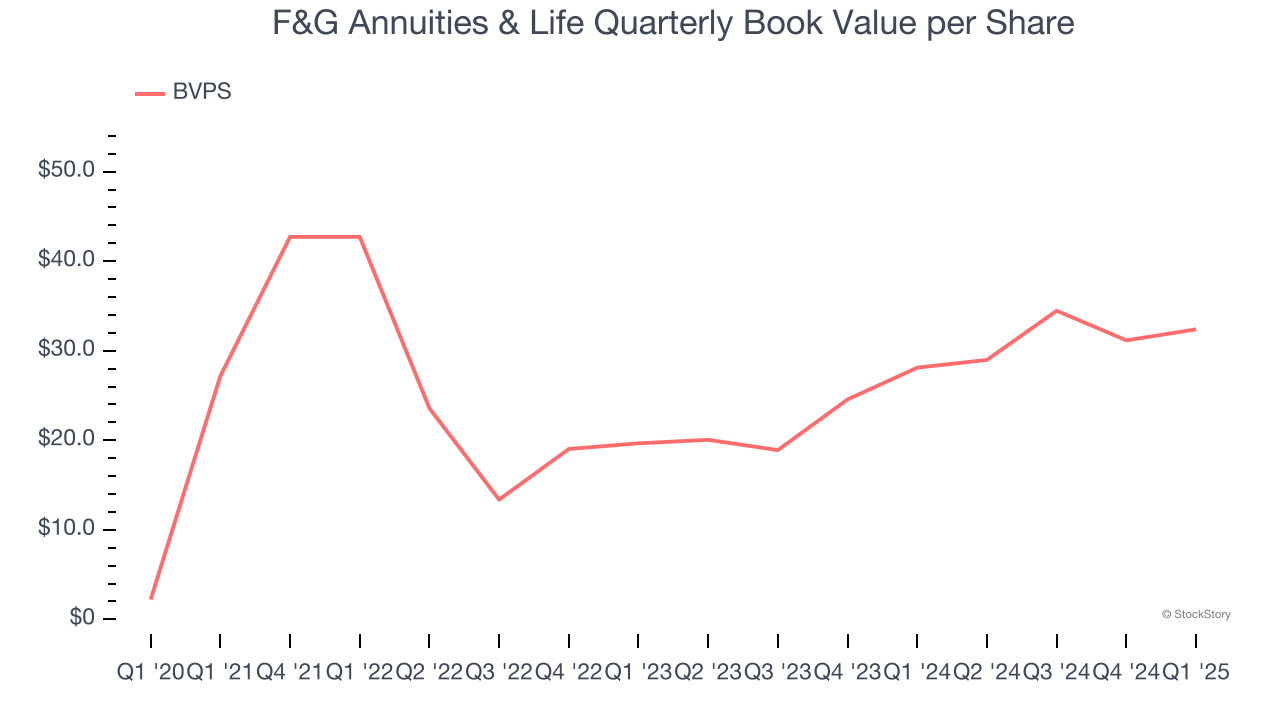

3. Projected BVPS Growth Is Remarkable

The key to book value per share (BVPS) growth is an insurer’s ability to earn underwriting profits while generating strong returns on its float - Warren Buffet’s secret sauce.

Over the next 12 months, Consensus estimates call for F&G Annuities & Life’s BVPS to grow by 50.3% to $47.27, elite growth rate.

Final Judgment

These are just a few reasons why we're bullish on F&G Annuities & Life. With the recent decline, the stock trades at 1× forward P/B (or $32.14 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.