Caterpillar has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 5.7% to $383.80 per share while the index has gained 4.5%.

Is there a buying opportunity in Caterpillar, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Caterpillar Not Exciting?

We're sitting this one out for now. Here are three reasons why there are better opportunities than CAT and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

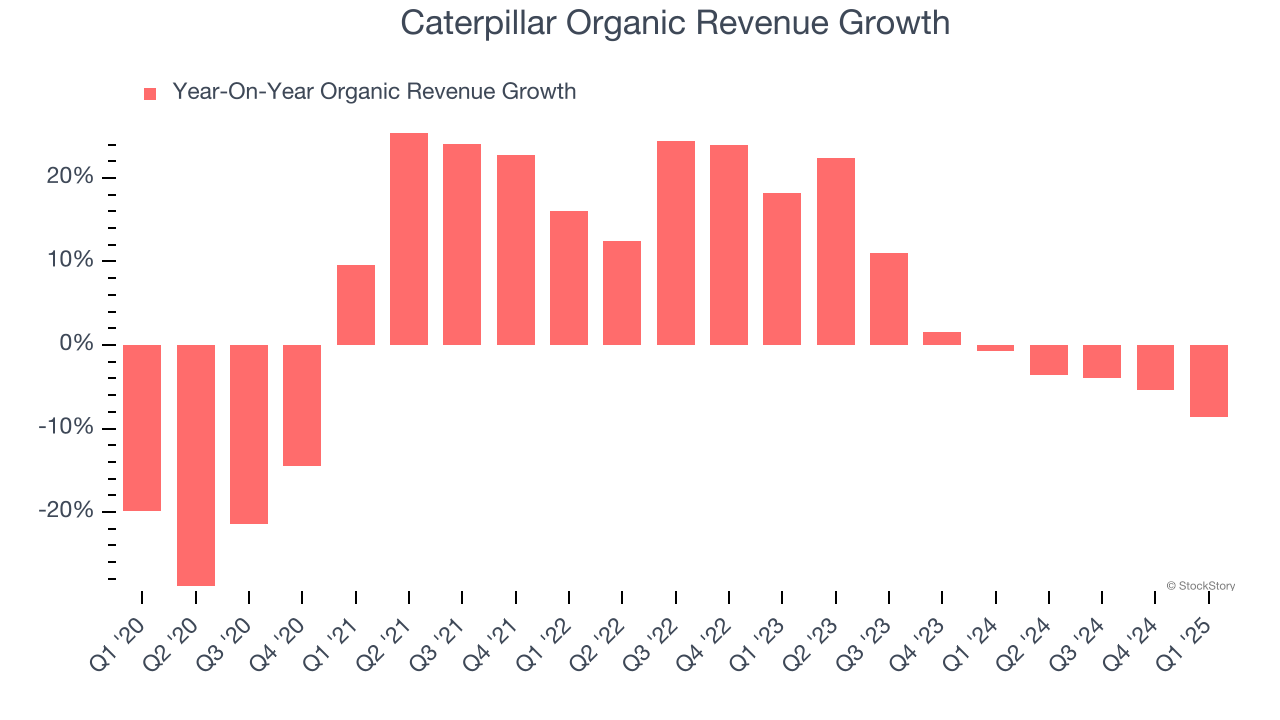

We can better understand Construction Machinery companies by analyzing their organic revenue. This metric gives visibility into Caterpillar’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Caterpillar’s organic revenue averaged 1.6% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Caterpillar’s revenue to stall, close to its 4.4% annualized growth for the past five years. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

3. Low Gross Margin Hinders Flexibility

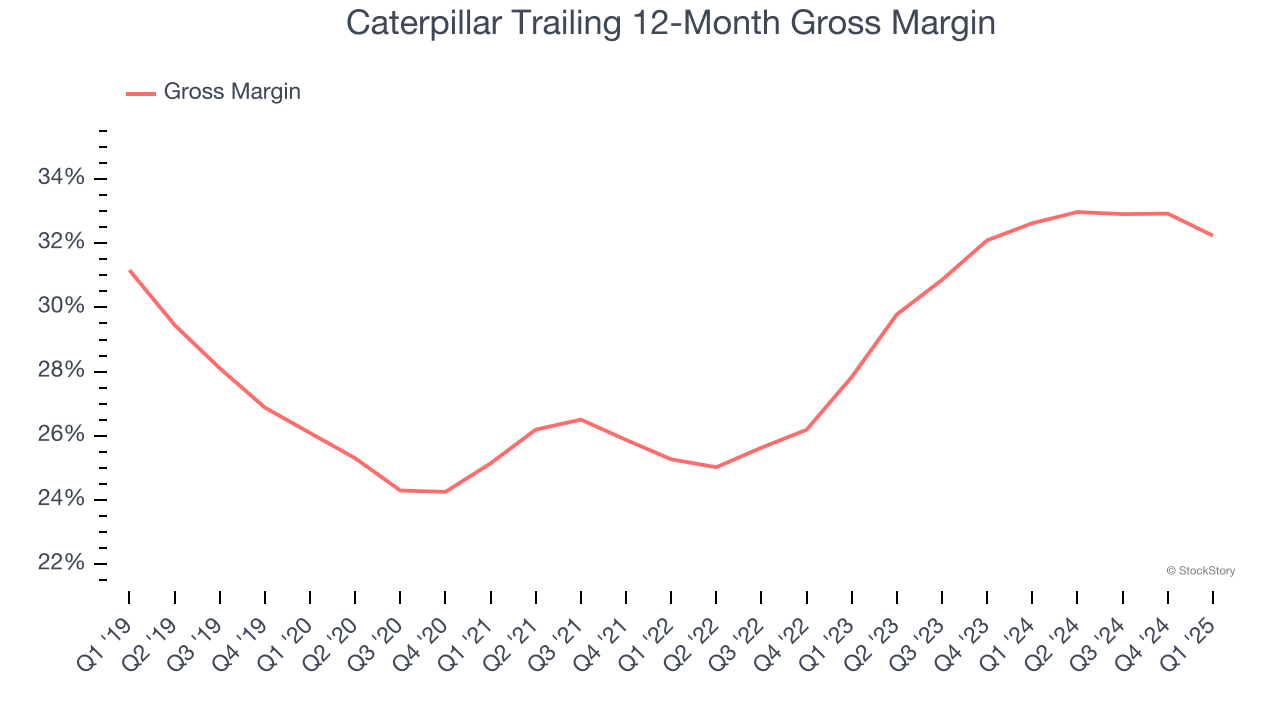

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Caterpillar’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 29% gross margin over the last five years. Said differently, Caterpillar had to pay a chunky $70.95 to its suppliers for every $100 in revenue.

Final Judgment

Caterpillar isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 19.8× forward P/E (or $383.80 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Caterpillar

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.