Lemonade’s 9.9% return over the past six months has outpaced the S&P 500 by 5.3%, and its stock price has climbed to $42.05 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Lemonade, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Lemonade Not Exciting?

Despite the momentum, we're cautious about Lemonade. Here are three reasons why there are better opportunities than LMND and a stock we'd rather own.

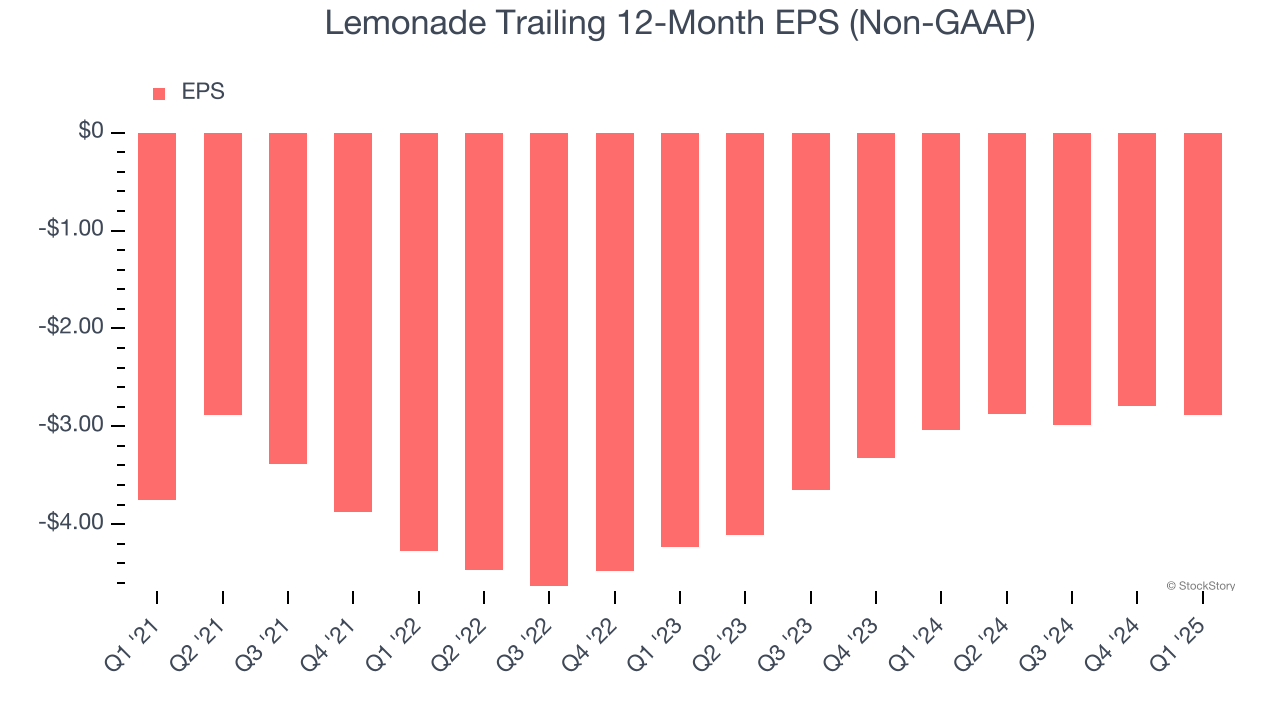

1. EPS Barely Improving

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Although Lemonade’s full-year earnings are still negative, it reduced its losses and improved its EPS by 6.3% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability.

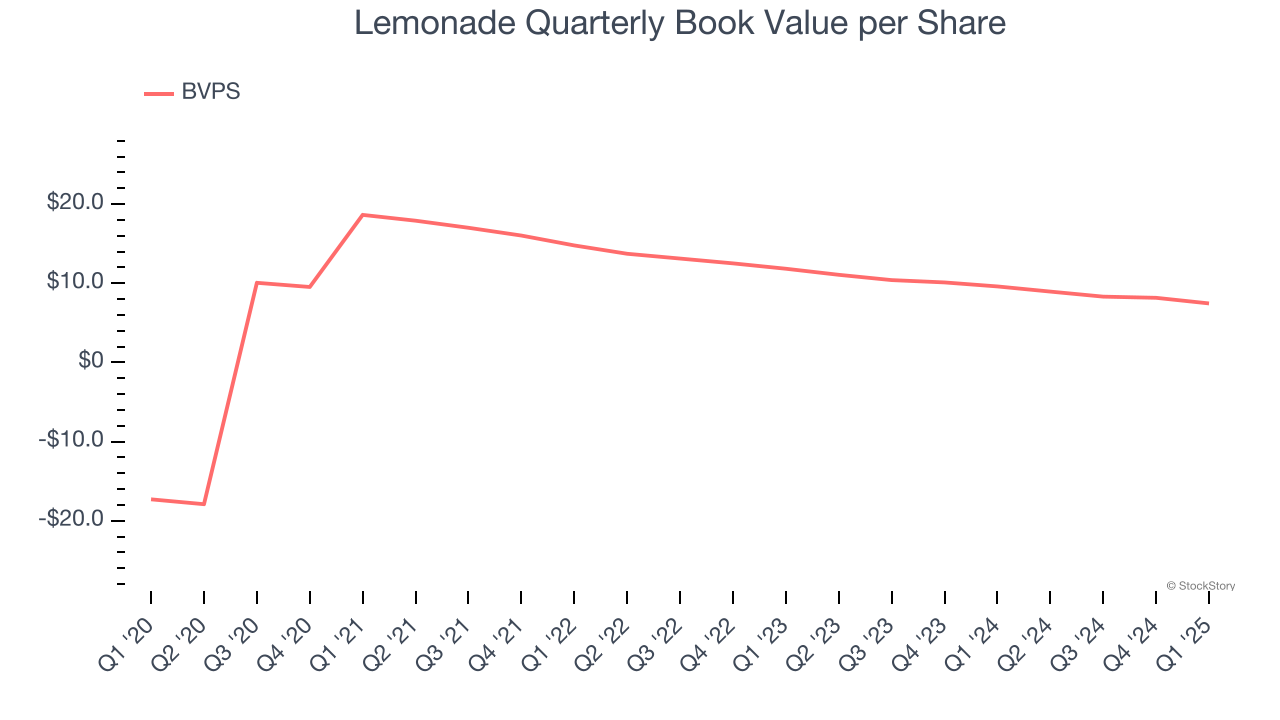

2. Declining BVPS Reflects Erosion of Asset Value

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

To the detriment of investors, Lemonade’s BVPS declined at a 20.6% annual clip over the last two years.

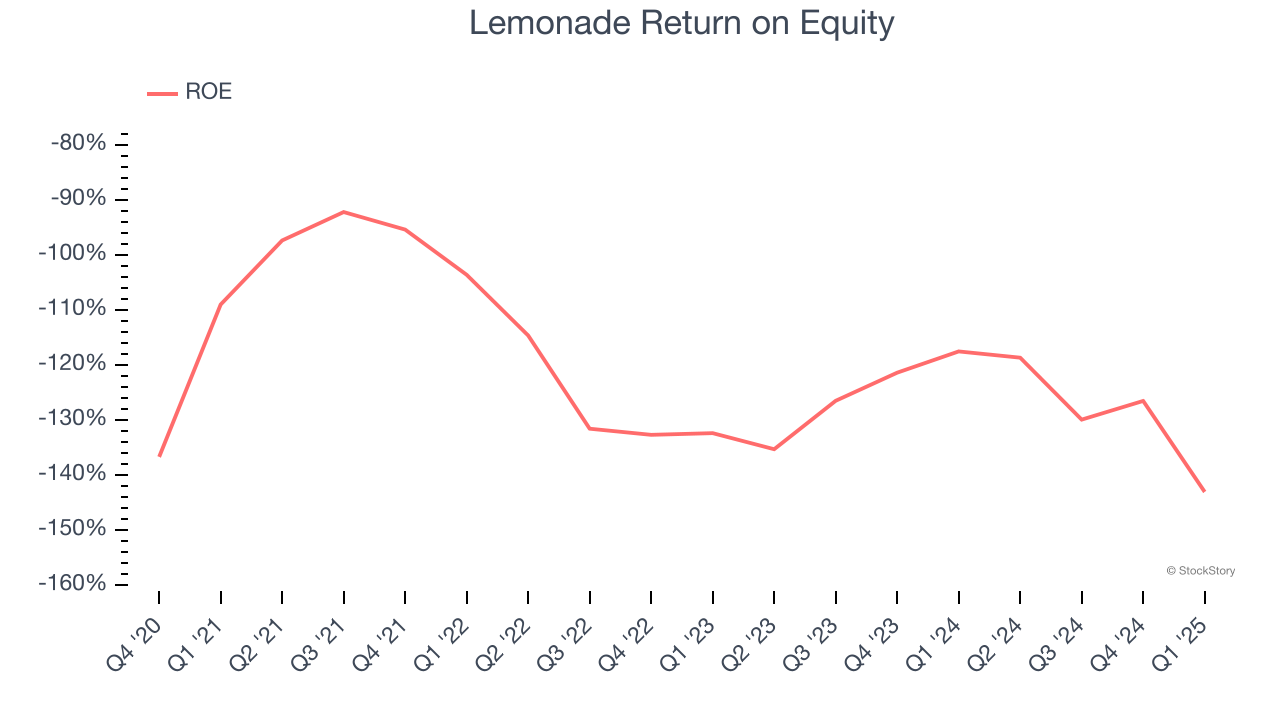

3. Previous Growth Initiatives Have Lost Money

Return on equity (ROE) is a crucial yardstick for insurance companies, measuring their ability to generate returns on the capital provided by shareholders. Insurers that consistently deliver superior ROE tend to create more value for their investors over time through strategic capital allocation and shareholder-friendly policies.

Over the last five years, Lemonade has averaged an ROE of negative 30.3%, a bad result not only in absolute terms but also relative to the majority of insurers putting up 7.5%+. It also shows that Lemonade has little to no competitive moat.

Final Judgment

Lemonade’s business quality ultimately falls short of our standards. With its shares outperforming the market lately, the stock trades at 6.9× forward P/B (or $42.05 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of Lemonade

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.