Since December 2024, Advanced Drainage has been in a holding pattern, posting a small loss of 1.5% while floating around $113.06. The stock also fell short of the S&P 500’s 4.5% gain during that period.

Is now the time to buy Advanced Drainage, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Advanced Drainage Not Exciting?

We're sitting this one out for now. Here are three reasons why there are better opportunities than WMS and a stock we'd rather own.

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Advanced Drainage’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.8% over the last two years.

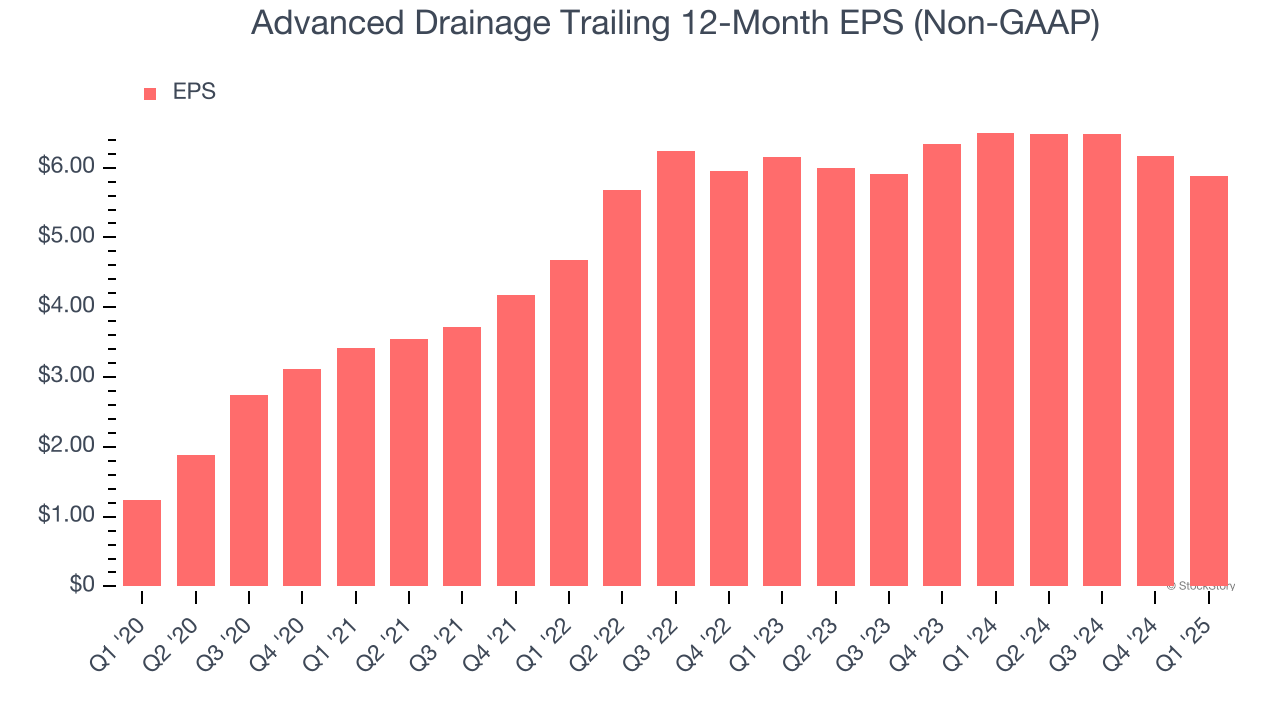

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Advanced Drainage, its EPS and revenue declined by 2.2% and 2.8% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Advanced Drainage’s low margin of safety could leave its stock price susceptible to large downswings.

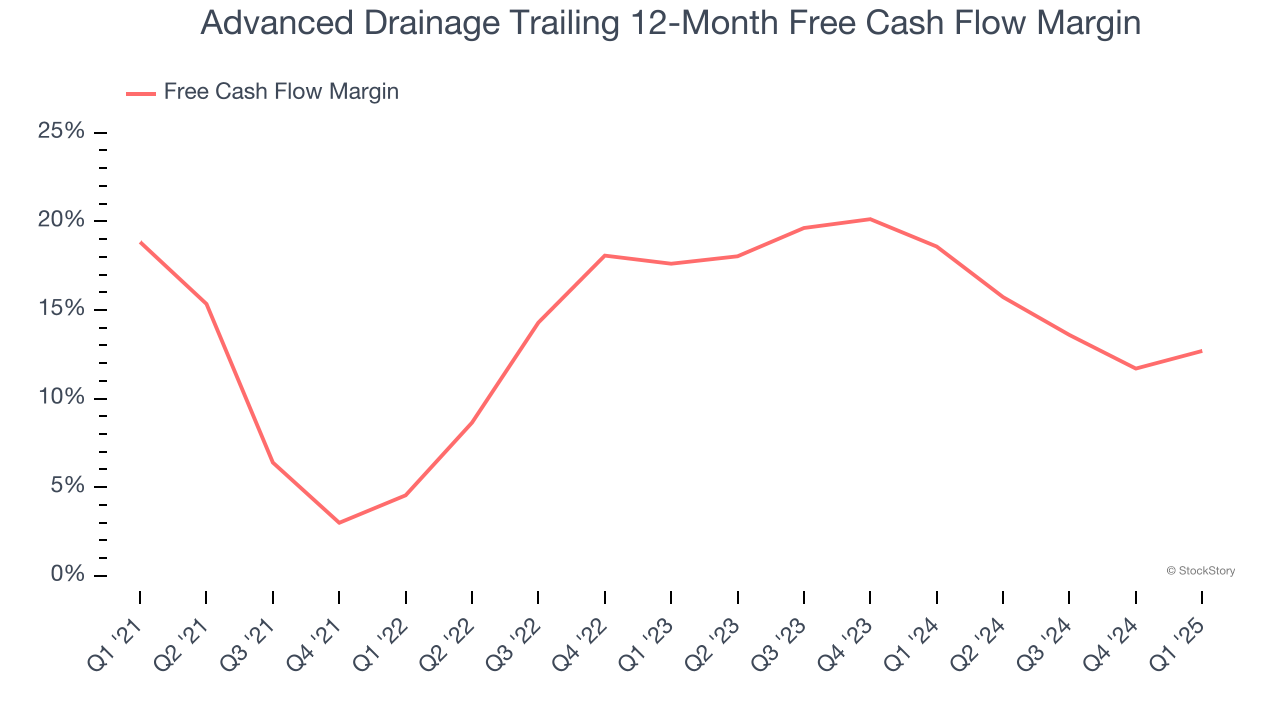

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Advanced Drainage’s margin dropped by 6.1 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Advanced Drainage’s free cash flow margin for the trailing 12 months was 12.7%.

Final Judgment

Advanced Drainage isn’t a terrible business, but it isn’t one of our picks. With its shares lagging the market recently, the stock trades at 18.3× forward P/E (or $113.06 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.