Shareholders of AAON would probably like to forget the past six months even happened. The stock dropped 29.6% and now trades at $95.70. This may have investors wondering how to approach the situation.

Following the drawdown, is now a good time to buy AAON? Find out in our full research report, it’s free.

Why Are We Positive On AAON?

Backed by two million square feet of lab testing space, AAON (NASDAQ: AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

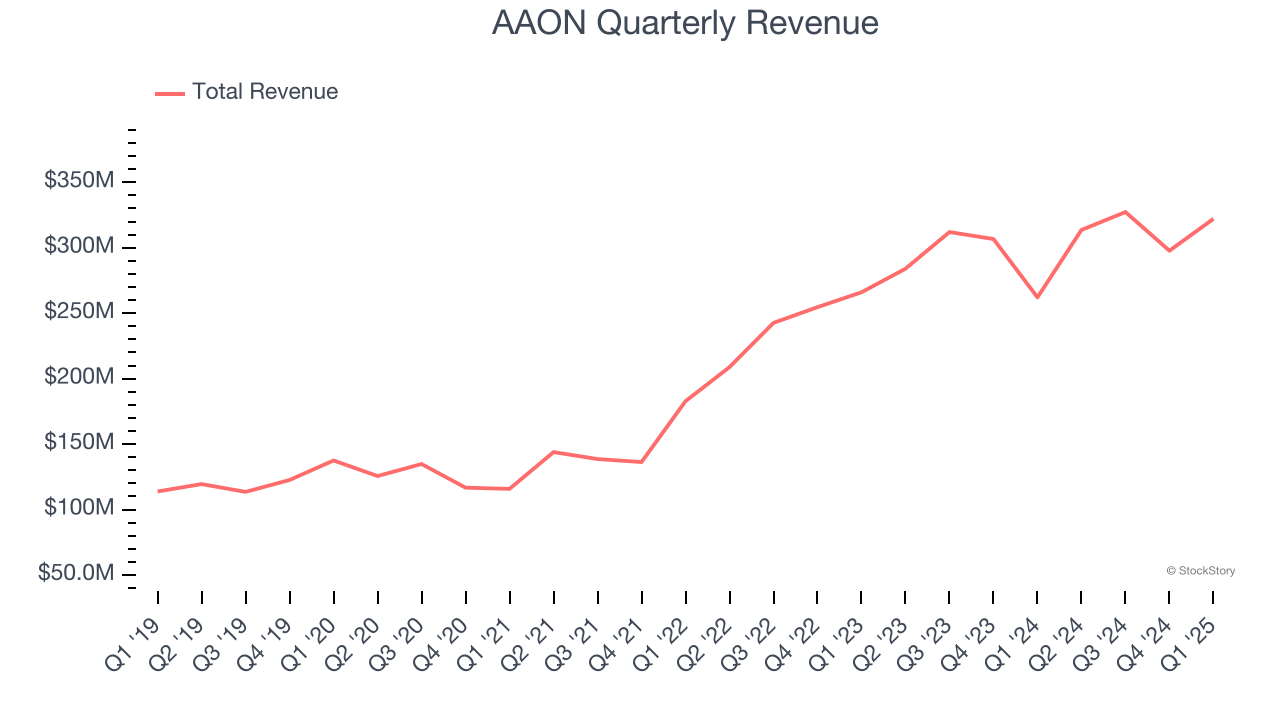

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, AAON’s 20.7% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

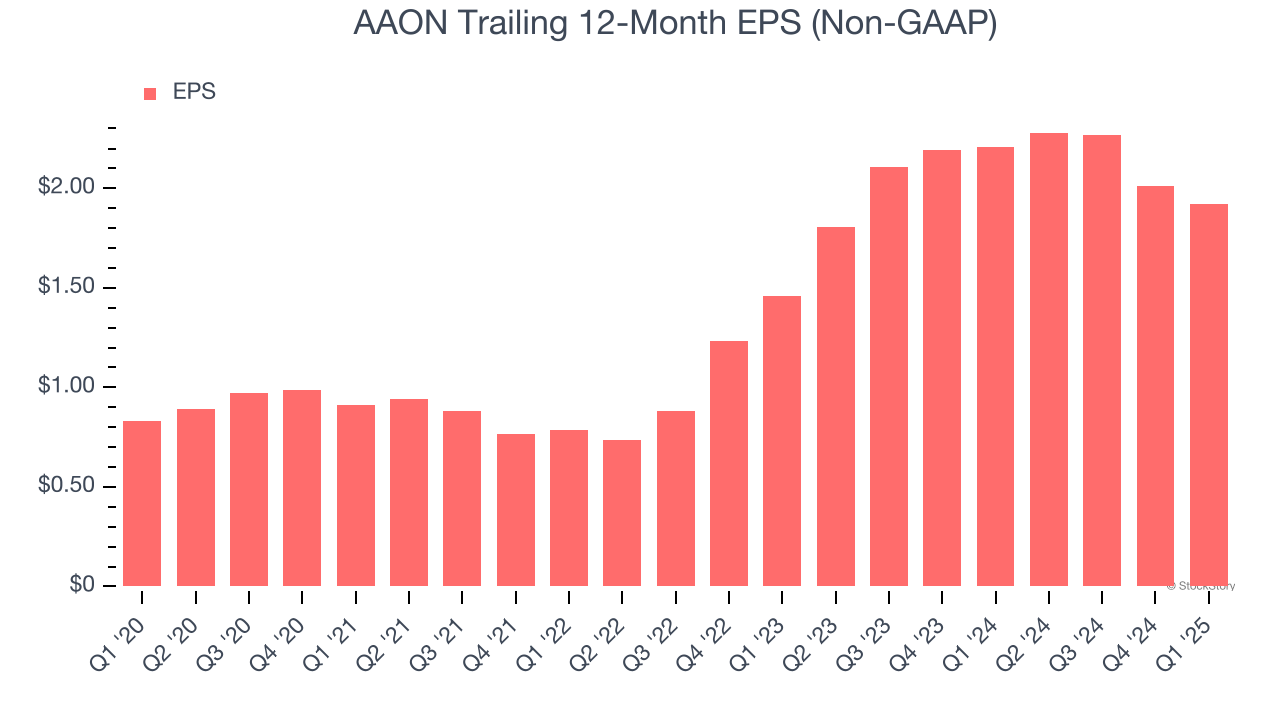

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

AAON’s EPS grew at an astounding 18.2% compounded annual growth rate over the last five years. This performance was better than most industrials businesses.

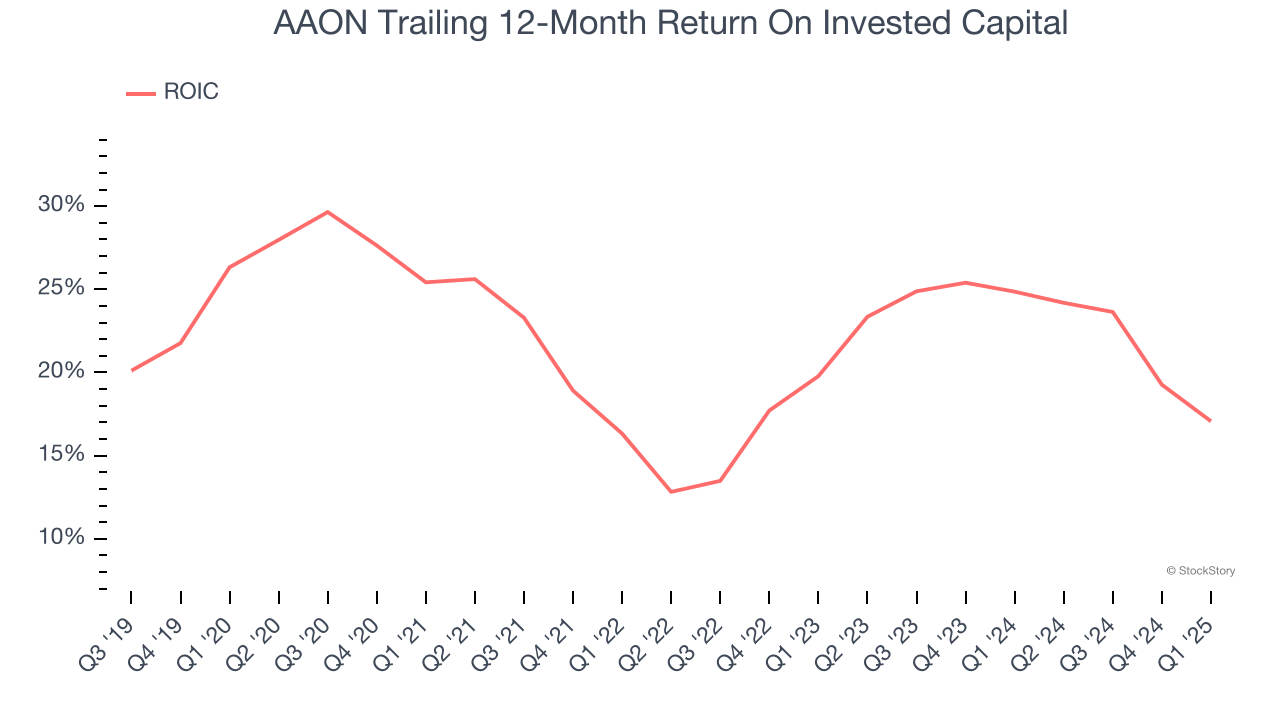

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

AAON’s five-year average ROIC was 20.7%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons AAON is a high-quality business worth owning. After the recent drawdown, the stock trades at 39.5× forward P/E (or $95.70 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than AAON

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.