As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at data infrastructure stocks, starting with Confluent (NASDAQ: CFLT).

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

The 4 data infrastructure stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was 1.1% below.

In light of this news, share prices of the companies have held steady as they are up 2.4% on average since the latest earnings results.

Best Q1: Confluent (NASDAQ: CFLT)

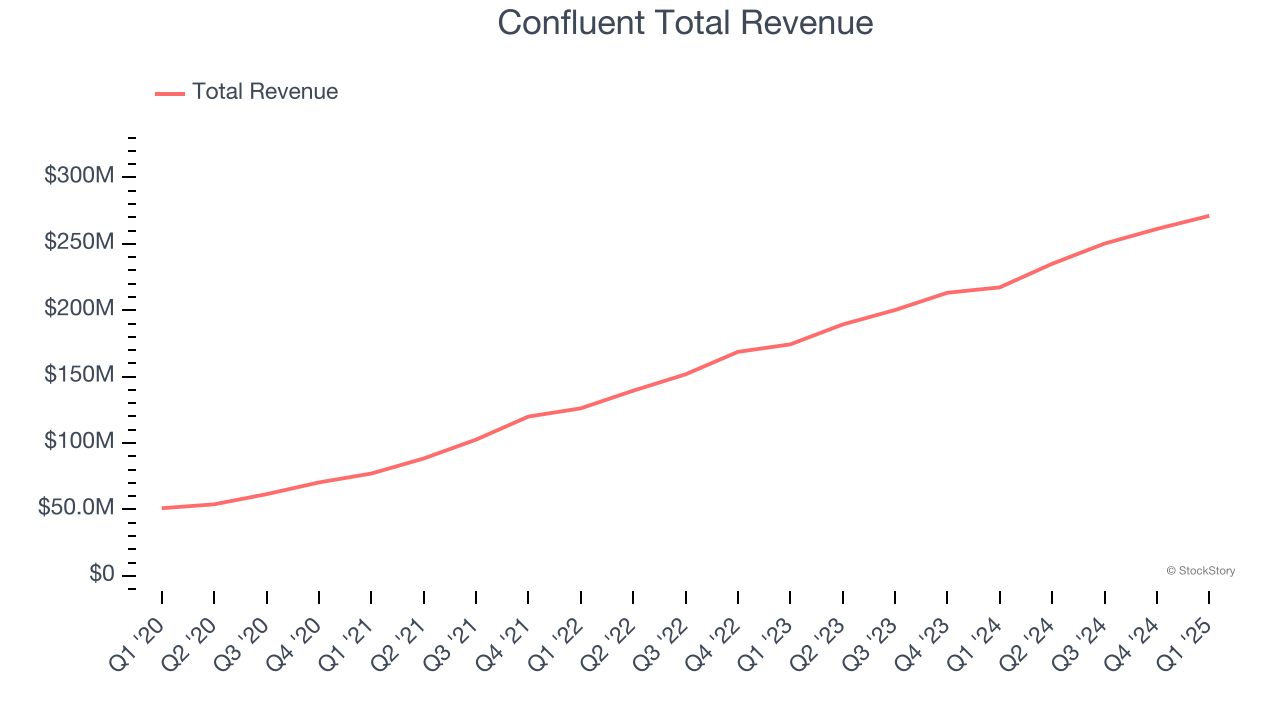

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ: CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

Confluent reported revenues of $271.1 million, up 24.8% year on year. This print exceeded analysts’ expectations by 2.6%. Overall, it was a strong quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

“Confluent started the year with solid momentum, achieving subscription revenue growth of 26% year over year,” said Jay Kreps, co-founder and CEO, Confluent.

Confluent scored the biggest analyst estimates beat but had the weakest full-year guidance update of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $23.85.

Is now the time to buy Confluent? Access our full analysis of the earnings results here, it’s free.

C3.ai (NYSE: AI)

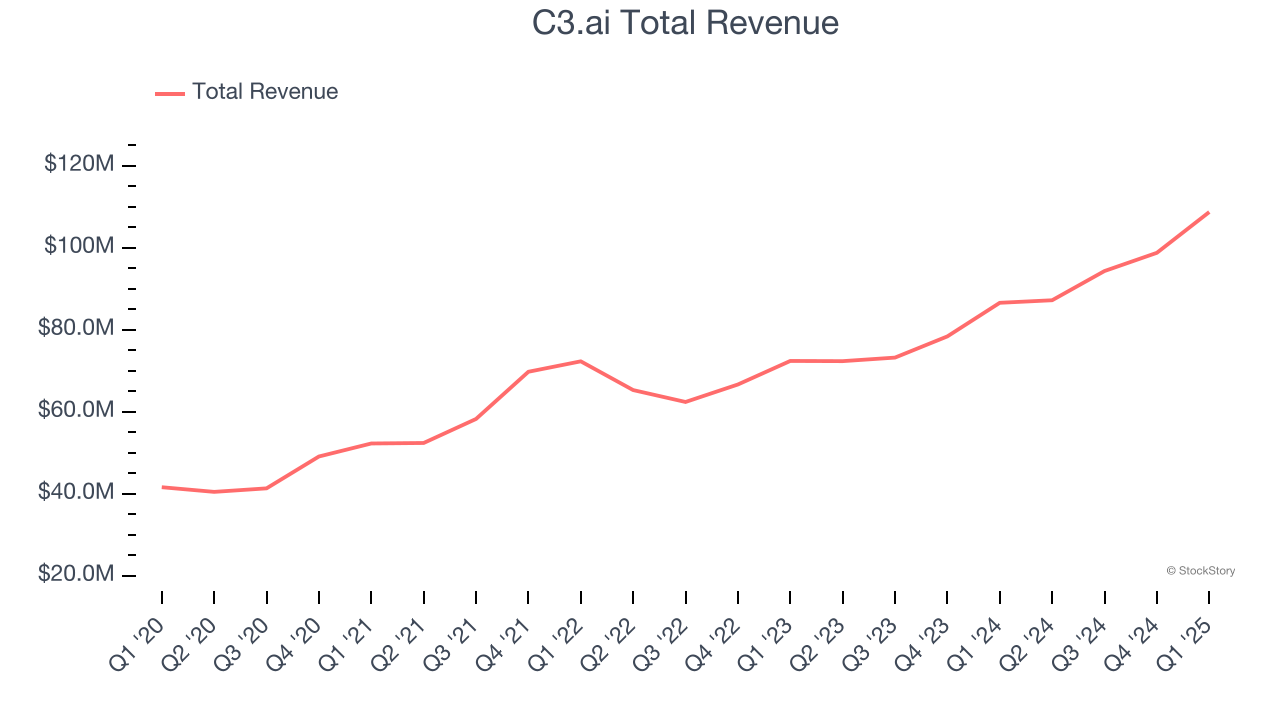

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE: AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

C3.ai reported revenues of $108.7 million, up 25.6% year on year, outperforming analysts’ expectations by 0.8%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a narrow beat of analysts’ billings estimates.

C3.ai pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 13.9% since reporting. It currently trades at $26.25.

Is now the time to buy C3.ai? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Teradata (NYSE: TDC)

Part of point-of-sale and ATM company NCR from 1991 to 2007, Teradata (NYSE: TDC) offers a software-as-service platform that helps organizations manage and analyze their data across multiple storages.

Teradata reported revenues of $418 million, down 10.1% year on year, falling short of analysts’ expectations by 2.4%. It was a slower quarter as it posted EPS and revenue guidance for next quarter slightly missing analysts’ expectations.

Teradata delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 1.7% since the results and currently trades at $22.33.

Read our full analysis of Teradata’s results here.

Elastic (NYSE: ESTC)

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE: ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

Elastic reported revenues of $388.4 million, up 16% year on year. This result beat analysts’ expectations by 2.1%. Taking a step back, it was a satisfactory quarter as it also produced accelerating customer growth.

The company added 50 enterprise customers paying more than $100,000 annually to reach a total of 1,510. The stock is down 6.6% since reporting and currently trades at $85.88.

Read our full, actionable report on Elastic here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.