Wrapping up Q1 earnings, we look at the numbers and key takeaways for the automobile manufacturing stocks, including Tesla (NASDAQ: TSLA) and its peers.

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

The 7 automobile manufacturing stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 4.7%.

Thankfully, share prices of the companies have been resilient as they are up 6.4% on average since the latest earnings results.

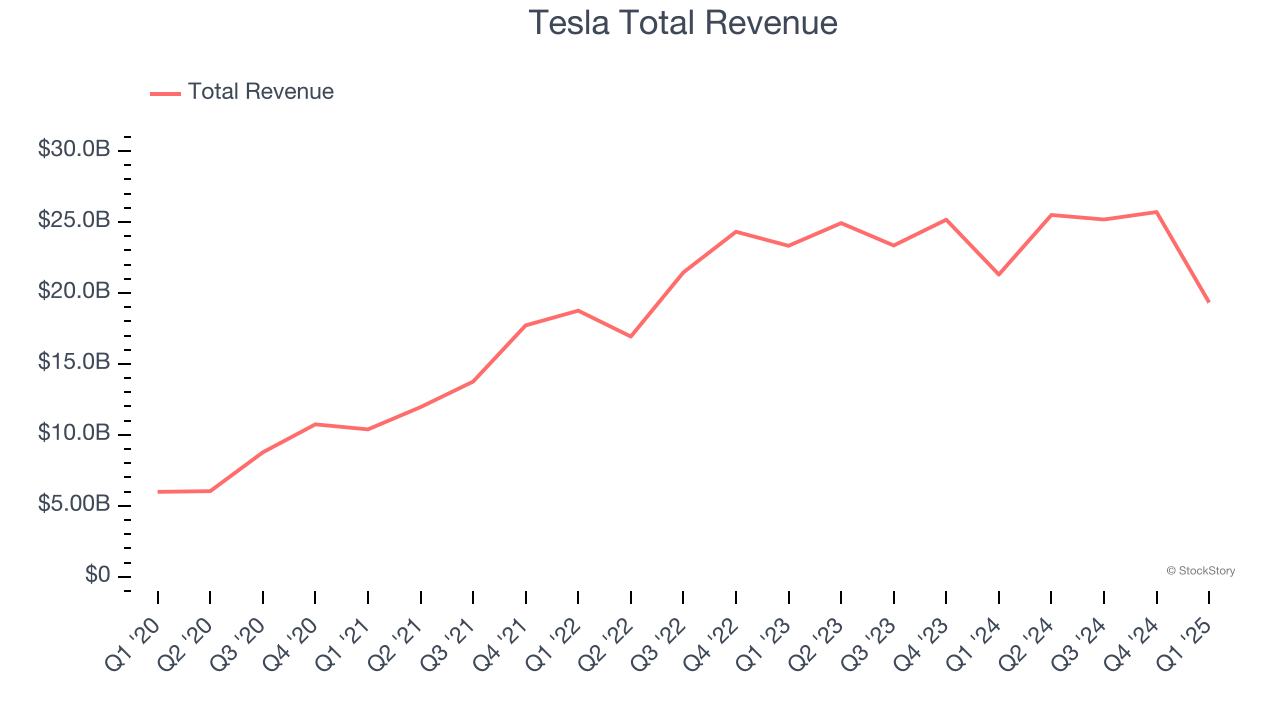

Slowest Q1: Tesla (NASDAQ: TSLA)

Originally founded by Martin Eberhard and Marc Tarpenning in 2003, Tesla (NASDAQ: TSLA) is an electric vehicle company accelerating the world’s transition to sustainable energy.

Tesla reported revenues of $19.34 billion, down 9.2% year on year. This print fell short of analysts’ expectations by 8.1%. Overall, it was a softer quarter for the company: Tesla delivered fewer vehicles than forecasted, its revenue in all three segments (Services, Automotive, and Energy) missed, and its EPS fell short of Wall Street’s estimates.

Tesla delivered the weakest performance against analyst estimates of the whole group. The stock is up 38.1% since reporting and currently trades at $328.85.

Read our full report on Tesla here, it’s free.

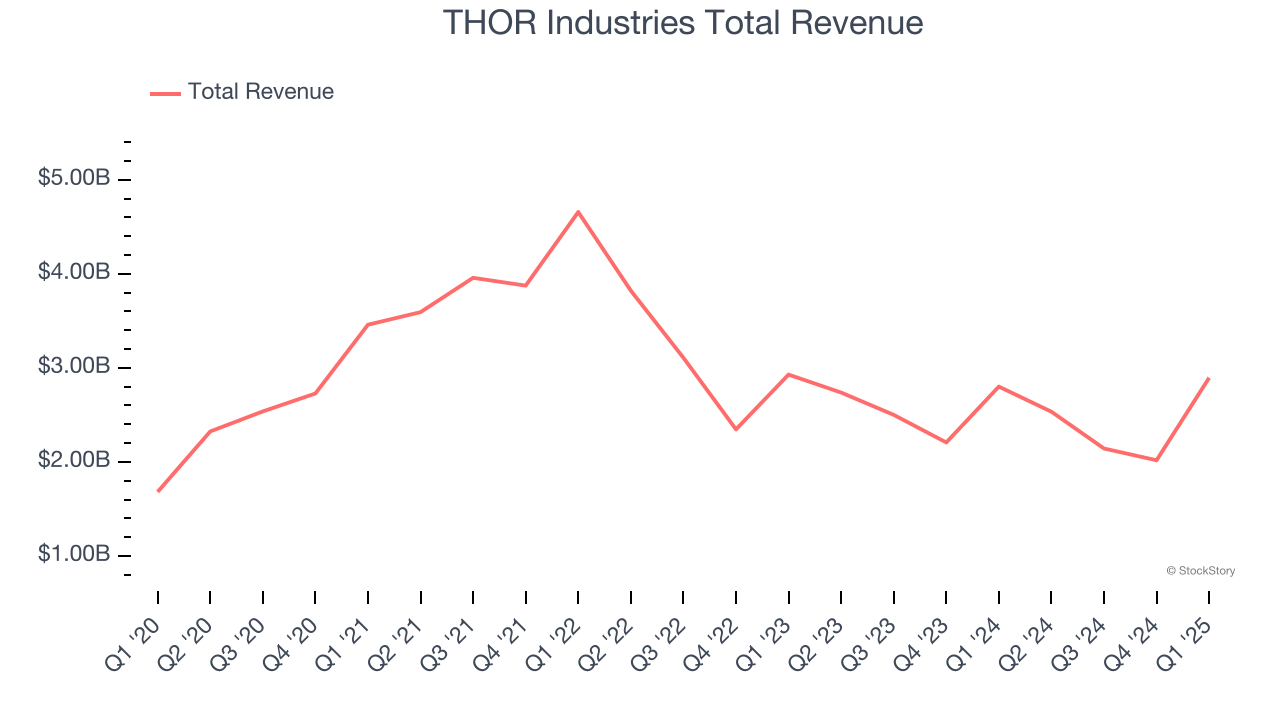

Best Q1: THOR Industries (NYSE: THO)

Created through the acquisition and merger of various RV manufacturers, THOR Industries manufactures and sells a range of recreational vehicles, including motorhomes and travel trailers, catering to consumers seeking the freedom and comfort of the RV lifestyle.

THOR Industries reported revenues of $2.89 billion, up 3.3% year on year, outperforming analysts’ expectations by 10.1%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 4% since reporting. It currently trades at $85.57.

Is now the time to buy THOR Industries? Access our full analysis of the earnings results here, it’s free.

General Motors (NYSE: GM)

Founded in 1908 by William C. Durant, General Motors (NYSE: GM) offers a range of vehicles and automobiles through brands such as Chevrolet, Buick, GMC, and Cadillac.

General Motors reported revenues of $44.02 billion, up 2.3% year on year, exceeding analysts’ expectations by 2.7%. Still, it was a mixed quarter as it posted a significant miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 1% since the results and currently trades at $47.68.

Read our full analysis of General Motors’s results here.

Winnebago (NYSE: WGO)

Created to provide high-quality, affordable RVs to the post-war American family, Winnebago (NYSE: WGO) is a manufacturer of recreational vehicles, providing a range of motorhomes, travel trailers, and fifth-wheel products for outdoor and adventure lifestyles.

Winnebago reported revenues of $620.2 million, down 11.9% year on year. This result surpassed analysts’ expectations by 0.6%. It was a strong quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EPS estimates.

Winnebago had the slowest revenue growth among its peers. The stock is up 1.3% since reporting and currently trades at $35.22.

Read our full, actionable report on Winnebago here, it’s free.

Lucid (NASDAQ: LCID)

Founded by a former Tesla Vice President, Lucid Group (NASDAQ: LCID) designs, manufactures, and sells luxury electric vehicles with long-range capabilities.

Lucid reported revenues of $235 million, up 36.1% year on year. This print came in 0.9% below analysts' expectations. In spite of that, it was a strong quarter as it logged a solid beat of analysts’ sales volume estimates and an impressive beat of analysts’ adjusted operating income estimates.

Lucid scored the fastest revenue growth among its peers. The stock is down 3.9% since reporting and currently trades at $2.23.

Read our full, actionable report on Lucid here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.