While the broader market has struggled with the S&P 500 down 2.4% since December 2024, Gilead Sciences has surged ahead as its stock price has climbed by 21% to $111.47 per share. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy GILD? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does GILD Stock Spark Debate?

From its groundbreaking work in developing the first single-tablet regimens for HIV treatment, Gilead Sciences (NASDAQ: GILD) develops and markets innovative medicines for life-threatening diseases including HIV, viral hepatitis, COVID-19, and cancer.

Two Things to Like:

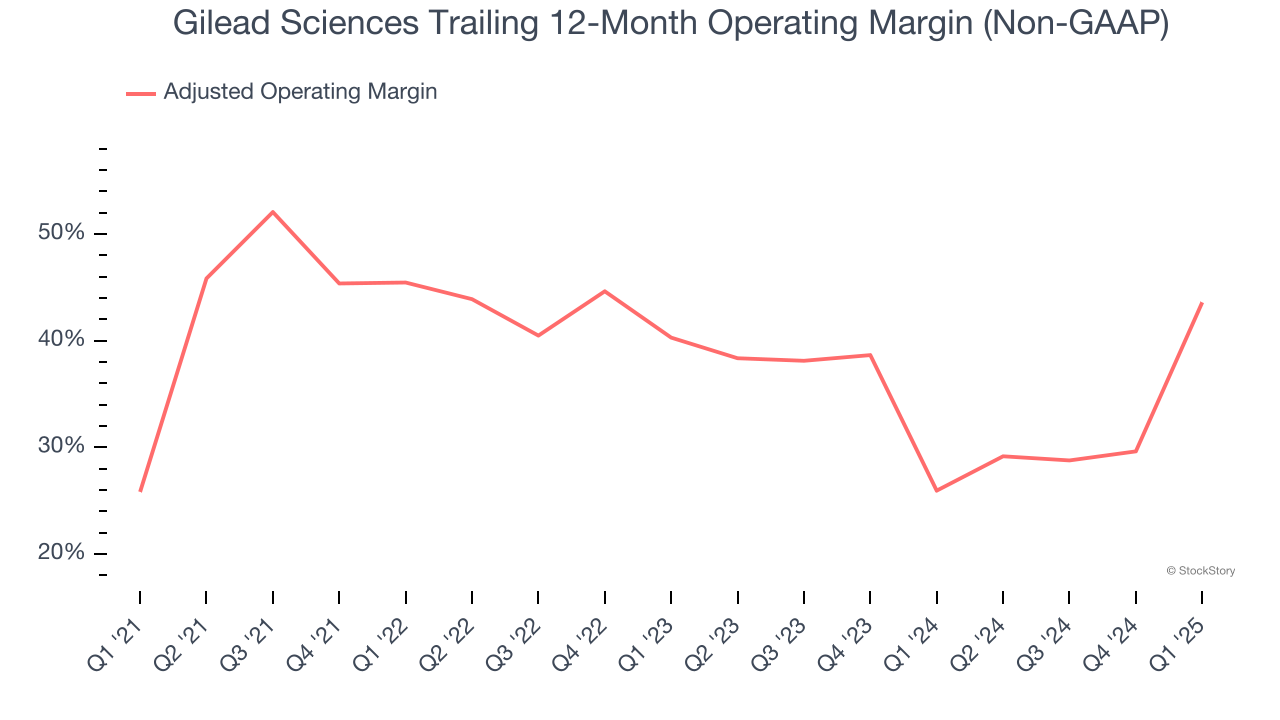

1. Adjusted Operating Margin Rising, Profits Up

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Analyzing the trend in its profitability, Gilead Sciences’s adjusted operating margin rose by 17.8 percentage points over the last five years, as its sales growth gave it operating leverage. Its adjusted operating margin for the trailing 12 months was 43.6%.

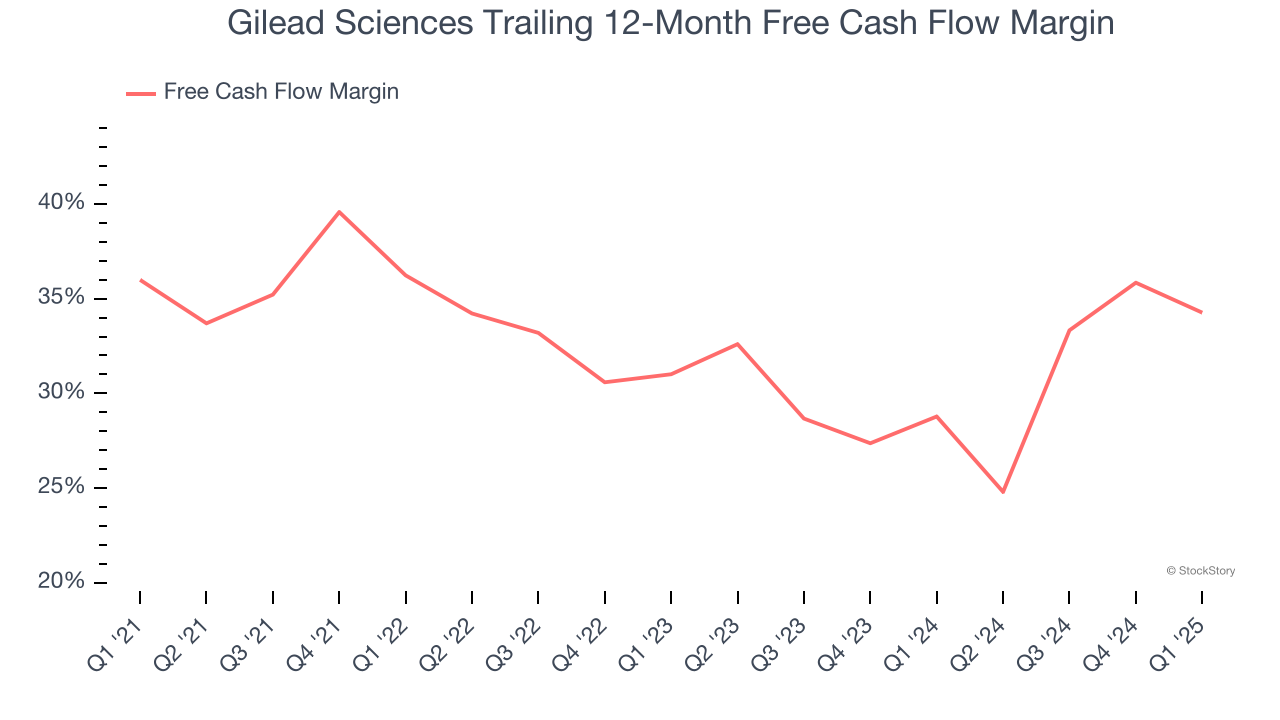

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Gilead Sciences has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 33.2% over the last five years.

One Reason to be Careful:

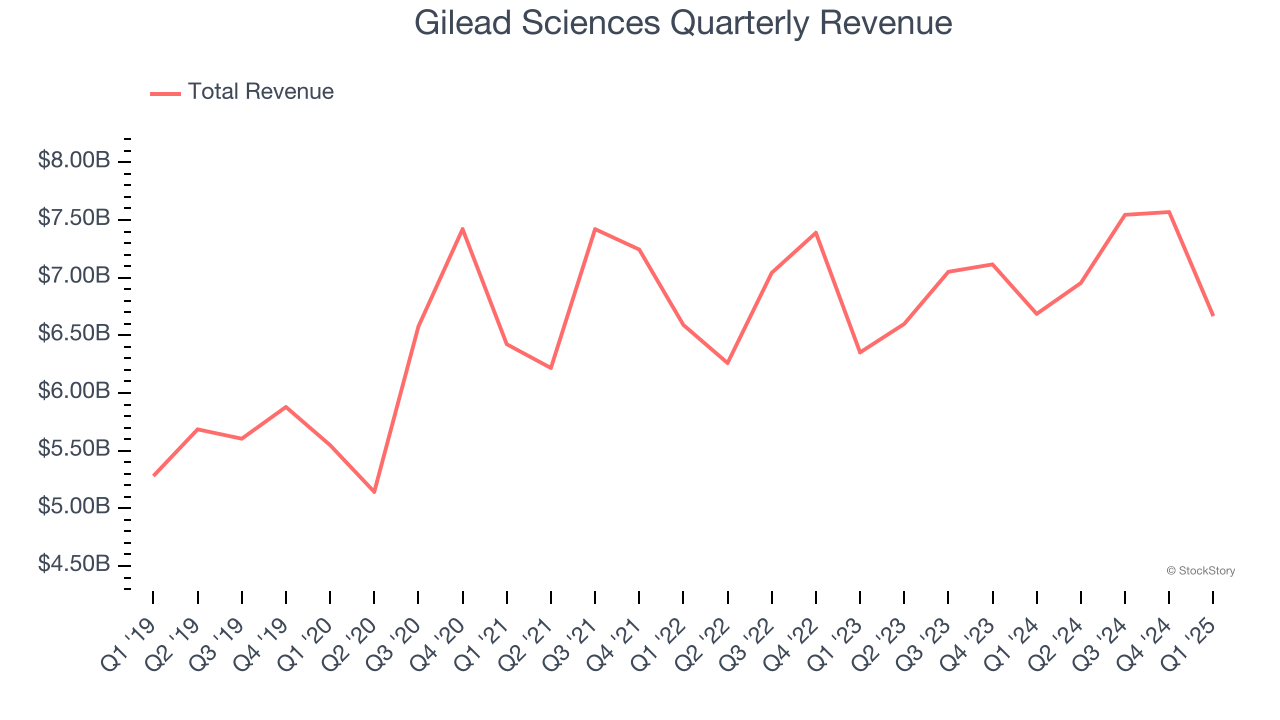

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Gilead Sciences’s 4.8% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the healthcare sector, but there are still things to like about Gilead Sciences.

Final Judgment

Gilead Sciences’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 13.5× forward P/E (or $111.47 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Gilead Sciences

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.