Wrapping up Q1 earnings, we look at the numbers and key takeaways for the health insurance providers stocks, including Alignment Healthcare (NASDAQ: ALHC) and its peers.

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

The 11 health insurance providers stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12.1% since the latest earnings results.

Alignment Healthcare (NASDAQ: ALHC)

Founded in 2013 with a mission to transform healthcare for seniors, Alignment Healthcare (NASDAQ: ALHC) provides Medicare Advantage health plans for seniors with features like concierge services, transportation benefits, and technology-driven care coordination.

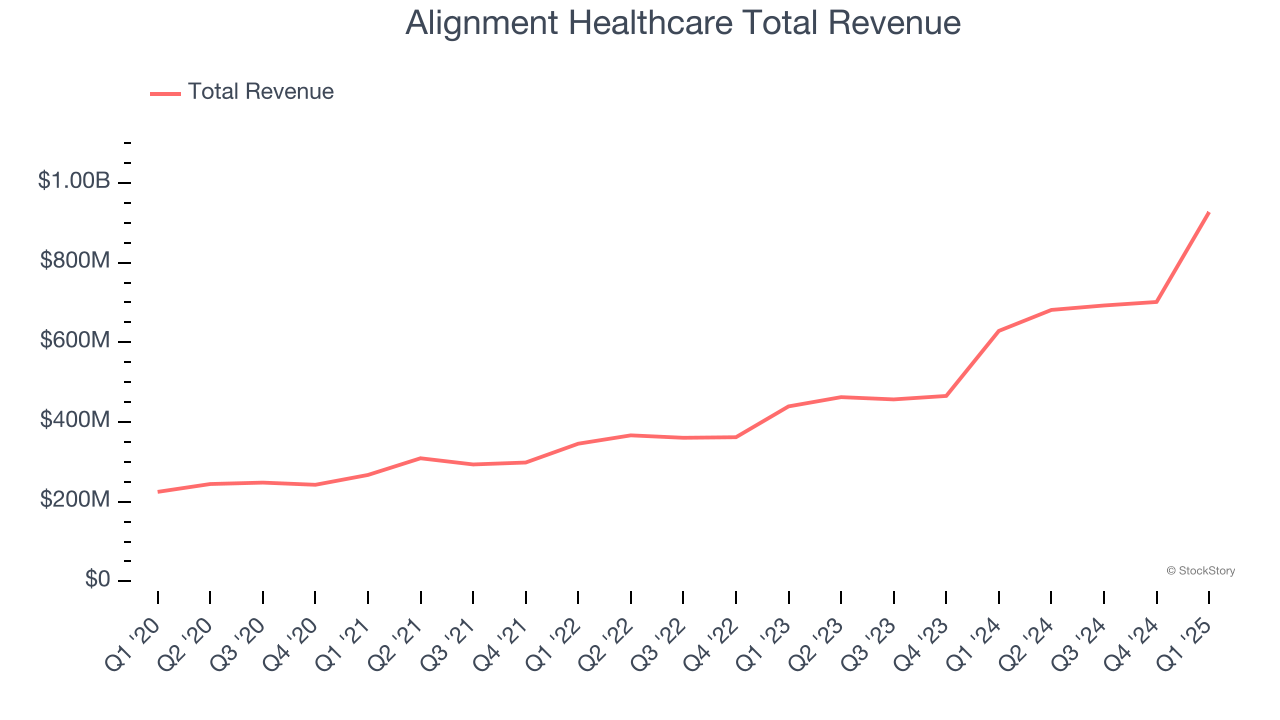

Alignment Healthcare reported revenues of $926.9 million, up 47.5% year on year. This print exceeded analysts’ expectations by 4.4%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EPS estimates.

“Alignment Healthcare’s first-quarter performance reflects the strength of our model and the discipline of our execution, showing what’s possible when technology, clinical management and member-first service operate as one,” said John Kao, founder and CEO.

Alignment Healthcare pulled off the fastest revenue growth of the whole group. The company added 28,400 customers to reach a total of 217,500. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 11.4% since reporting and currently trades at $14.81.

Best Q1: CVS Health (NYSE: CVS)

With over 9,000 retail pharmacy locations serving as neighborhood health destinations across America, CVS Health (NYSE: CVS) operates retail pharmacies, provides pharmacy benefit management services, and offers health insurance through its Aetna subsidiary.

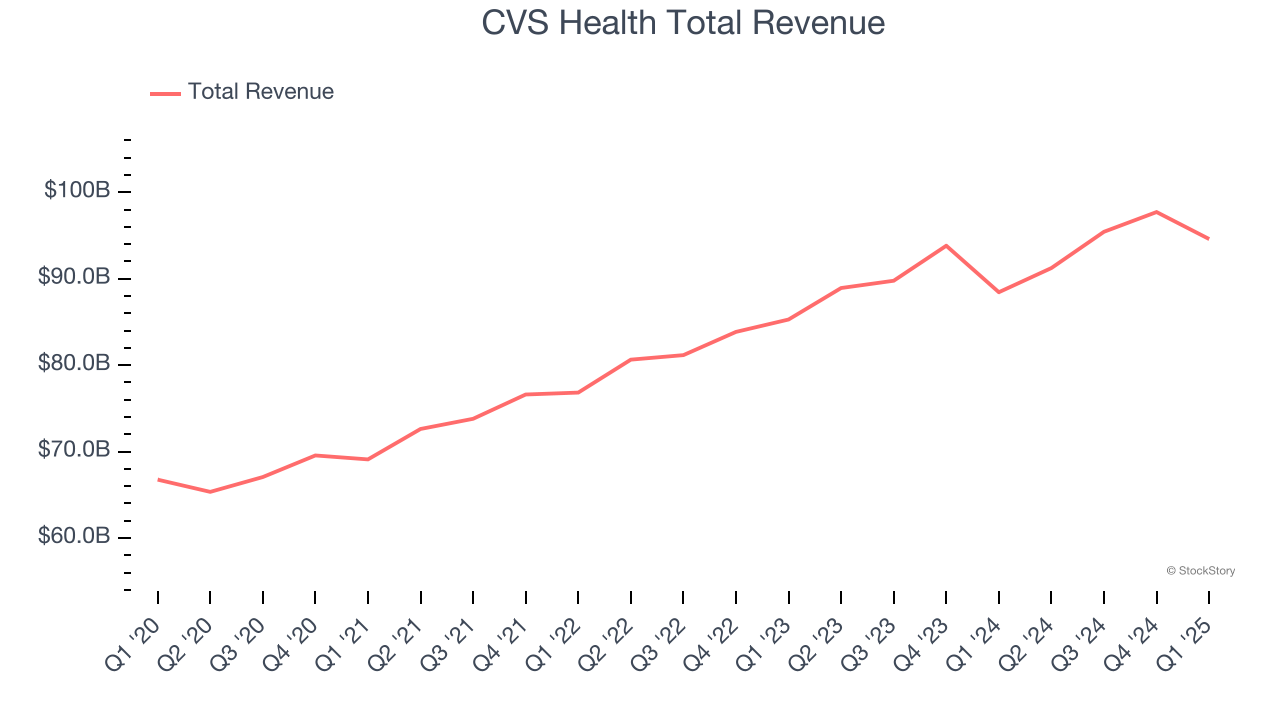

CVS Health reported revenues of $94.59 billion, up 7% year on year, outperforming analysts’ expectations by 1.5%. The business had an exceptional quarter with a solid beat of analysts’ same-store sales estimates and an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 5.3% since reporting. It currently trades at $63.14.

Is now the time to buy CVS Health? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: UnitedHealth (NYSE: UNH)

With over 100 million people served across its various businesses and a workforce of more than 400,000, UnitedHealth Group (NYSE: UNH) operates a health insurance business and Optum, a healthcare services division that provides everything from pharmacy benefits to primary care.

UnitedHealth reported revenues of $109.6 billion, up 9.8% year on year, falling short of analysts’ expectations by 1.7%. It was a softer quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates and a slight miss of analysts’ EPS estimates.

UnitedHealth delivered the weakest performance against analyst estimates in the group. The company added 395,000 customers to reach a total of 54.12 million. As expected, the stock is down 49.9% since the results and currently trades at $293.37.

Read our full analysis of UnitedHealth’s results here.

Cencora (NYSE: COR)

Formerly known as AmerisourceBergen until its 2023 rebranding, Cencora (NYSE: COR) is a global pharmaceutical distribution company that connects manufacturers with healthcare providers while offering logistics, data analytics, and consulting services.

Cencora reported revenues of $75.45 billion, up 10.3% year on year. This number met analysts’ expectations. Zooming out, it was a mixed quarter as it failed to impress in some other areas of the business.

The stock is flat since reporting and currently trades at $288.41.

Read our full, actionable report on Cencora here, it’s free.

Elevance Health (NYSE: ELV)

Formerly known as Anthem until its 2022 rebranding, Elevance Health (NYSE: ELV) is one of America's largest health insurers, serving approximately 47 million medical members through its network-based managed care plans.

Elevance Health reported revenues of $48.89 billion, up 14.8% year on year. This result beat analysts’ expectations by 5.3%. Overall, it was a strong quarter as it also logged a narrow beat of analysts’ full-year EPS guidance estimates and a decent beat of analysts’ EPS estimates.

The company added 99,000 customers to reach a total of 45.83 million. The stock is down 6.1% since reporting and currently trades at $382.

Read our full, actionable report on Elevance Health here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.