Fresh produce company Calavo Growers (NASDAQ: CVGW) fell short of the market’s revenue expectations in Q1 CY2025 as sales rose 3.3% year on year to $190.5 million. Its non-GAAP profit of $0.40 per share was 25% below analysts’ consensus estimates.

Is now the time to buy Calavo? Find out by accessing our full research report, it’s free.

Calavo (CVGW) Q1 CY2025 Highlights:

- Revenue: $190.5 million vs analyst estimates of $192.8 million (3.3% year-on-year growth, 1.1% miss)

- Adjusted EPS: $0.40 vs analyst expectations of $0.53 (25% miss)

- Adjusted EBITDA: $11.4 million vs analyst estimates of $14.74 million (6% margin, 22.7% miss)

- Operating Margin: 4%, in line with the same quarter last year

- Market Capitalization: $493.7 million

“Our second fiscal quarter performance reflects the strength of our commercial strategy and disciplined operational execution amid continued volatility in the avocado market. Revenue grew year-over-year, driven by strong pricing performance,” said Lee Cole, President and Chief Executive Officer of Calavo Growers, Inc.

Company Overview

A trailblazer in the avocado industry, Calavo Growers (NASDAQ: CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $694.5 million in revenue over the past 12 months, Calavo is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

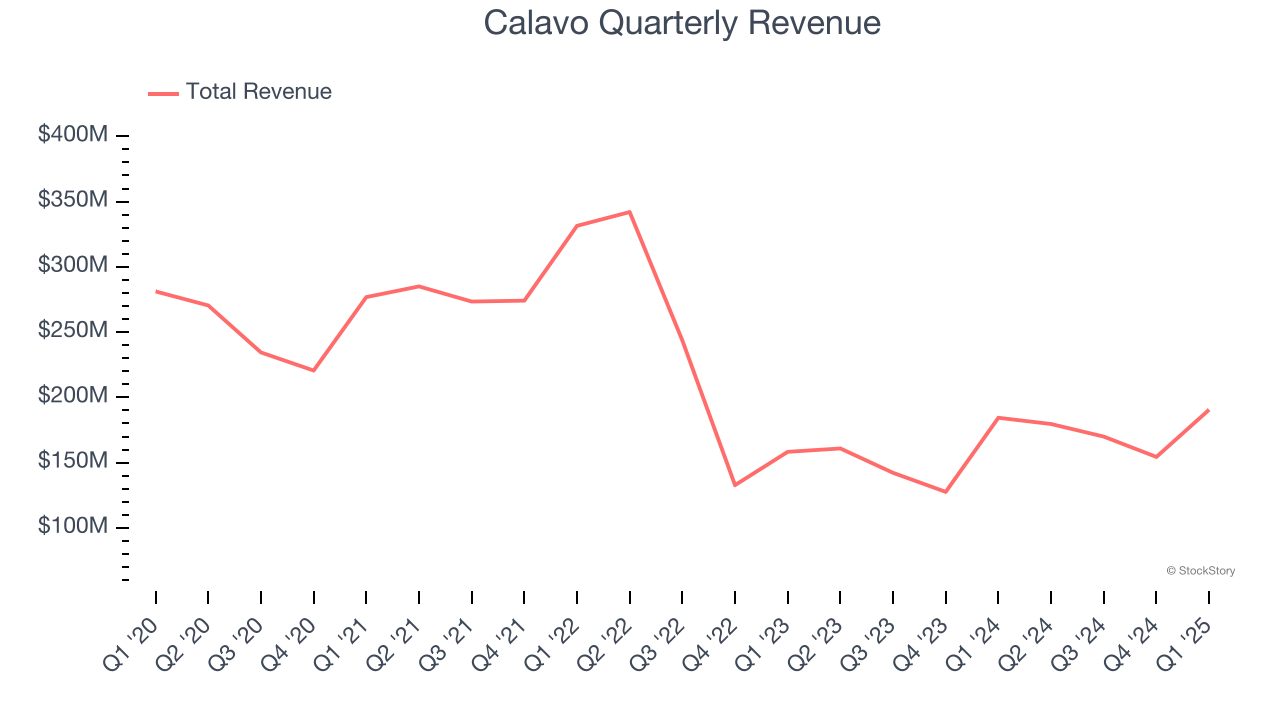

As you can see below, Calavo’s demand was weak over the last three years. Its sales fell by 15.8% annually, a tough starting point for our analysis.

This quarter, Calavo’s revenue grew by 3.3% year on year to $190.5 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 1.8% over the next 12 months. it's tough to feel optimistic about a company facing demand difficulties.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

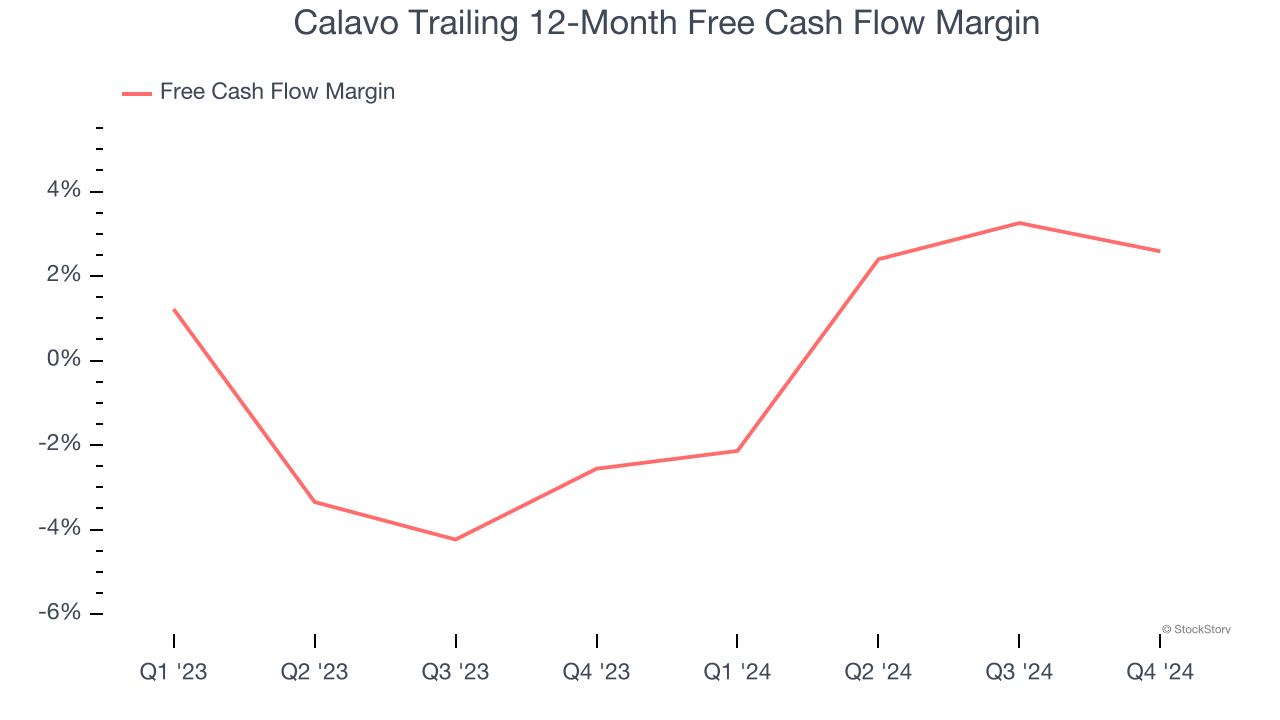

Calavo broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Key Takeaways from Calavo’s Q1 Results

We struggled to find many positives in these results as Calavo fell short of Wall Street’s estimates across all key metrics. Overall, this quarter could have been better. The stock traded down 15.3% to $23.42 immediately after reporting.

Calavo didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.