Over the past six months, Crown Holdings has been a great trade, beating the S&P 500 by 22.3%. Its stock price has climbed to $107.45, representing a healthy 29.9% increase. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Crown Holdings, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Crown Holdings Will Underperform?

Despite the momentum, we're cautious about Crown Holdings. Here are three reasons why you should be careful with CCK and a stock we'd rather own.

1. Declining Constant Currency Revenue, Demand Takes a Hit

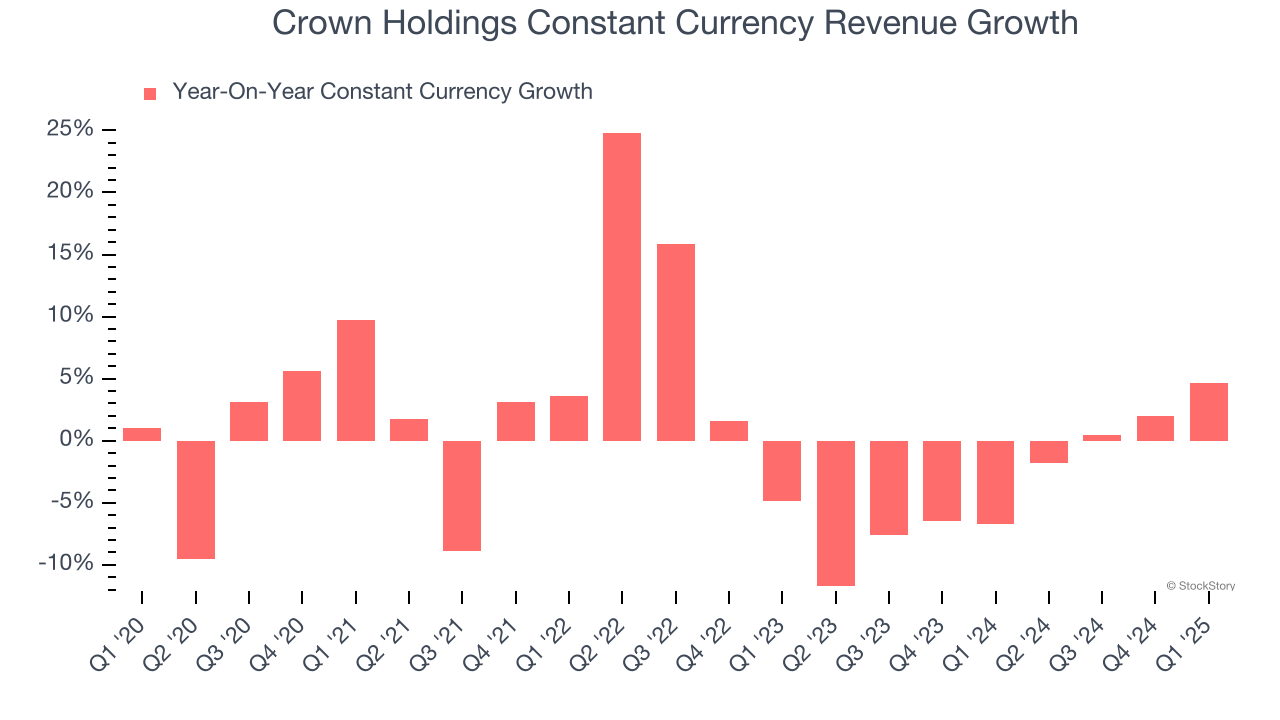

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Industrial Packaging companies. This metric excludes currency movements, which are outside of Crown Holdings’s control and are not indicative of underlying demand.

Over the last two years, Crown Holdings’s constant currency revenue averaged 3.4% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Crown Holdings might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Crown Holdings’s revenue to rise by 2.5%. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

3. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Crown Holdings has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 20.3% gross margin over the last five years. Said differently, Crown Holdings had to pay a chunky $79.72 to its suppliers for every $100 in revenue.

Final Judgment

Crown Holdings doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 15.5× forward P/E (or $107.45 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.