Looking back on testing & diagnostics services stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Labcorp (NYSE: LH) and its peers.

The testing and diagnostics services industry plays a crucial role in disease detection, monitoring, and prevention, serving hospitals, clinics, and individual consumers. This sector benefits from stable demand, driven by an aging population, increased prevalence of chronic diseases, and growing awareness of preventive healthcare. Recurring revenue streams come from routine screenings, lab tests, and diagnostic imaging, with reimbursement from Medicare, Medicaid, private insurance, and out-of-pocket payments. However, the industry faces challenges such as pricing pressures, regulatory compliance, and the need for continuous investment in new testing technologies. Looking ahead, industry tailwinds include the expansion of personalized medicine, increased adoption of at-home and rapid diagnostic tests, and advancements in AI-driven diagnostics that enhance accuracy and efficiency. However, headwinds such as reimbursement uncertainties, competition from decentralized testing solutions, and regulatory scrutiny over test validity and cost-effectiveness may impact profitability. Adapting to evolving healthcare models and integrating automation will be key for sustaining growth and maintaining operational efficiency.

The 5 testing & diagnostics services stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.2%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

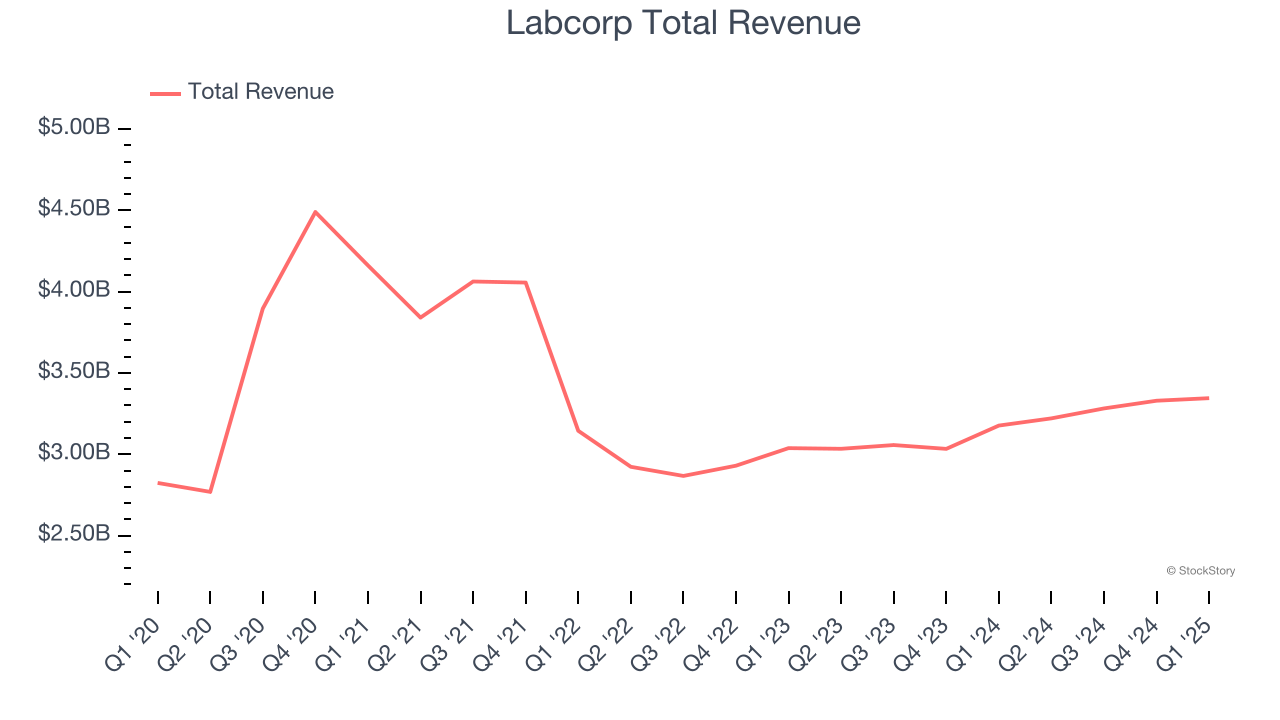

Slowest Q1: Labcorp (NYSE: LH)

With over 600 million tests performed annually and involvement in 90% of FDA-approved drugs in 2023, Labcorp (NYSE: LH) provides laboratory testing services and drug development solutions to doctors, hospitals, pharmaceutical companies, and patients worldwide.

Labcorp reported revenues of $3.35 billion, up 5.3% year on year. This print fell short of analysts’ expectations by 1.9%. Overall, it was a softer quarter for the company with a miss of analysts’ organic revenue estimates and full-year EPS guidance in line with analysts’ estimates.

"Labcorp delivered solid performance in the first quarter of 2025," said Adam Schechter, chairman and CEO of Labcorp.

Labcorp delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 10.3% since reporting and currently trades at $253.63.

Read our full report on Labcorp here, it’s free.

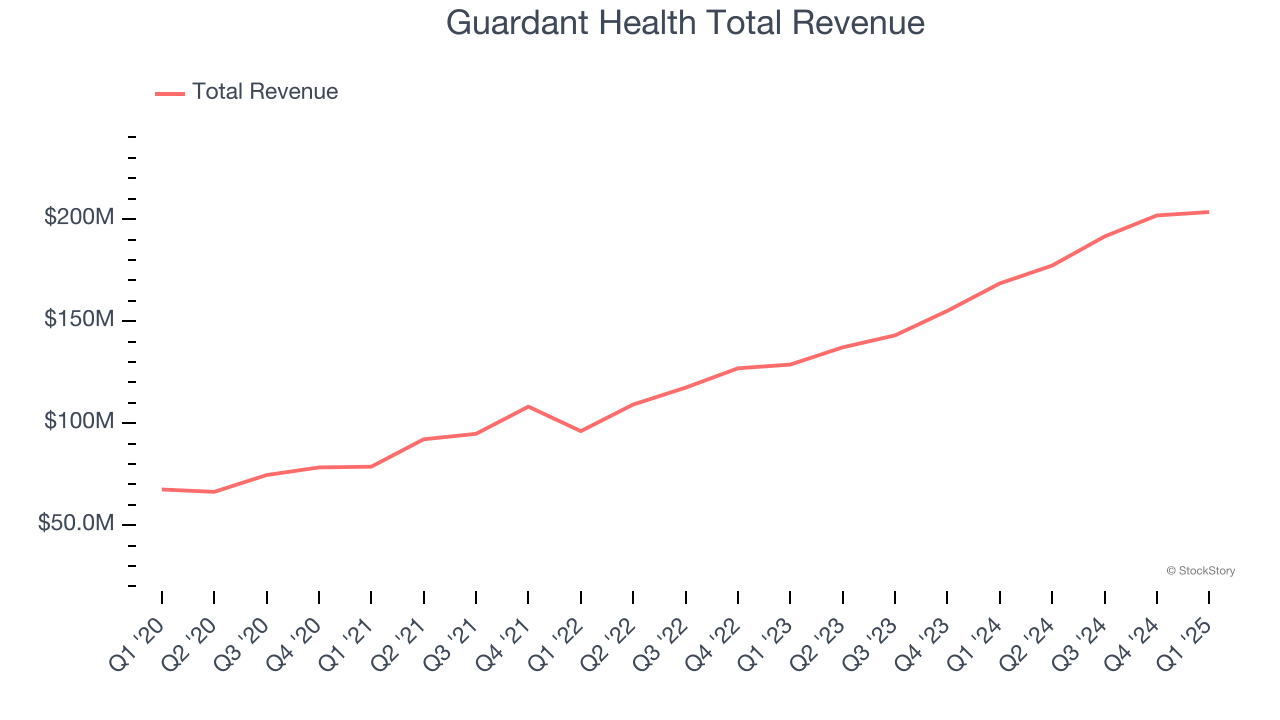

Best Q1: Guardant Health (NASDAQ: GH)

Pioneering the field of "liquid biopsy" with technology that can identify cancer-specific genetic mutations from a simple blood draw, Guardant Health (NASDAQ: GH) develops blood tests that detect and monitor cancer by analyzing tumor DNA in the bloodstream, helping doctors make treatment decisions without invasive biopsies.

Guardant Health reported revenues of $203.5 million, up 20.8% year on year, outperforming analysts’ expectations by 6.9%. The business had a stunning quarter with an impressive beat of analysts’ sales volume estimates and full-year revenue guidance exceeding analysts’ expectations.

Guardant Health delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 6.8% since reporting. It currently trades at $50.40.

Is now the time to buy Guardant Health? Access our full analysis of the earnings results here, it’s free.

Quest (NYSE: DGX)

Processing approximately one-third of the adult U.S. population's lab tests annually, Quest Diagnostics (NYSE: DGX) provides laboratory testing and diagnostic information services to patients, physicians, hospitals, and other healthcare providers across the United States.

Quest reported revenues of $2.65 billion, up 12.1% year on year, exceeding analysts’ expectations by 1.3%. It was a satisfactory quarter as it also posted a solid beat of analysts’ sales volume estimates but full-year EPS guidance in line with analysts’ estimates.

Quest delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 5% since the results and currently trades at $170.15.

Read our full analysis of Quest’s results here.

NeoGenomics (NASDAQ: NEO)

Operating a network of CAP-accredited and CLIA-certified laboratories across the United States and United Kingdom, NeoGenomics (NASDAQ: NEO) provides specialized cancer diagnostic testing services, including genetic analysis, molecular testing, and pathology consultation for oncologists and healthcare providers.

NeoGenomics reported revenues of $168 million, up 7.5% year on year. This result missed analysts’ expectations by 1.7%. More broadly, it was actually a strong quarter as it produced an impressive beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

The stock is down 26.4% since reporting and currently trades at $7.34.

Read our full, actionable report on NeoGenomics here, it’s free.

RadNet (NASDAQ: RDNT)

With over 350 imaging facilities across seven states and a growing artificial intelligence division, RadNet (NASDAQ: RDNT) operates a network of outpatient diagnostic imaging centers across the United States, offering services like MRI, CT scans, PET scans, mammography, and X-rays.

RadNet reported revenues of $471.4 million, up 9.2% year on year. This number beat analysts’ expectations by 6.4%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ same-store sales estimates.

The stock is up 2.9% since reporting and currently trades at $57.42.

Read our full, actionable report on RadNet here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.