Ameris Bancorp has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 7.6% to $67.45 per share while the index has gained 7.1%.

Is ABCB a buy right now? Find out in our full research report, it’s free.

Why Does ABCB Stock Spark Debate?

Tracing its roots back to 1971 and expanding significantly through both organic growth and strategic acquisitions, Ameris Bancorp (NYSE: ABCB) is a financial holding company that provides a full range of banking services to retail and commercial customers across select markets in the southeastern United States.

Two Things to Like:

1. Long-Term Revenue Growth Shows Strong Momentum

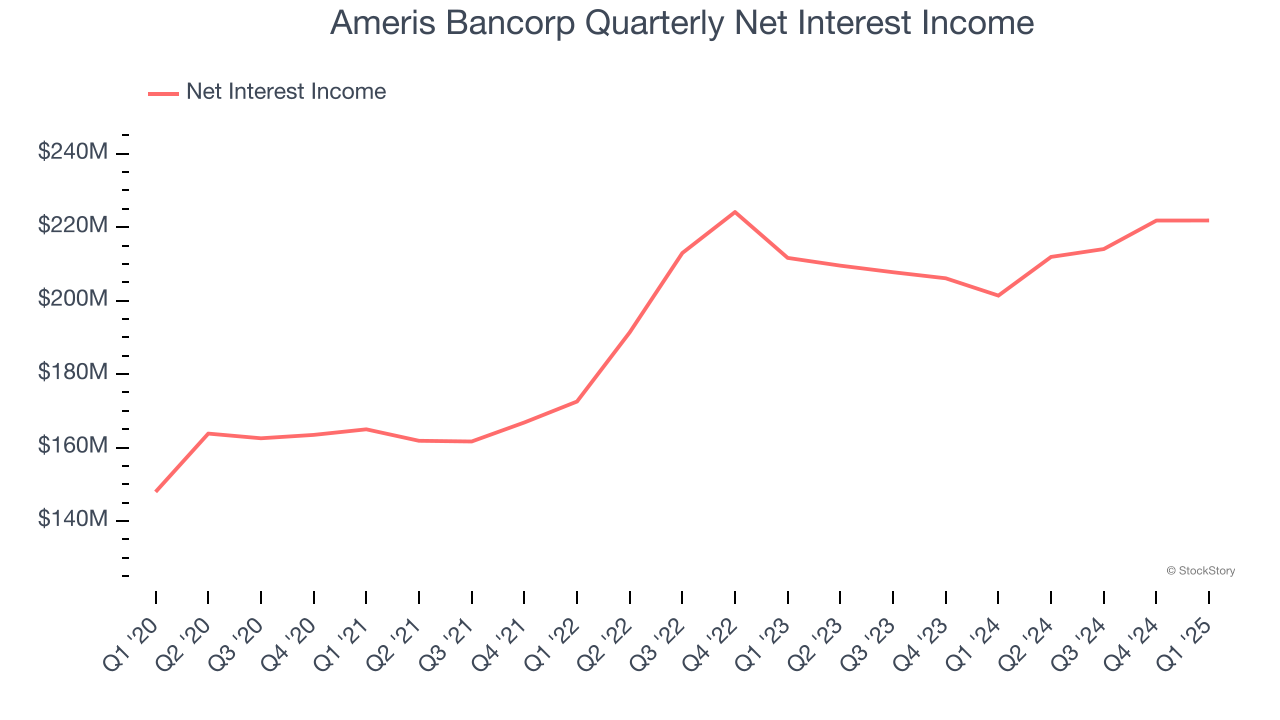

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

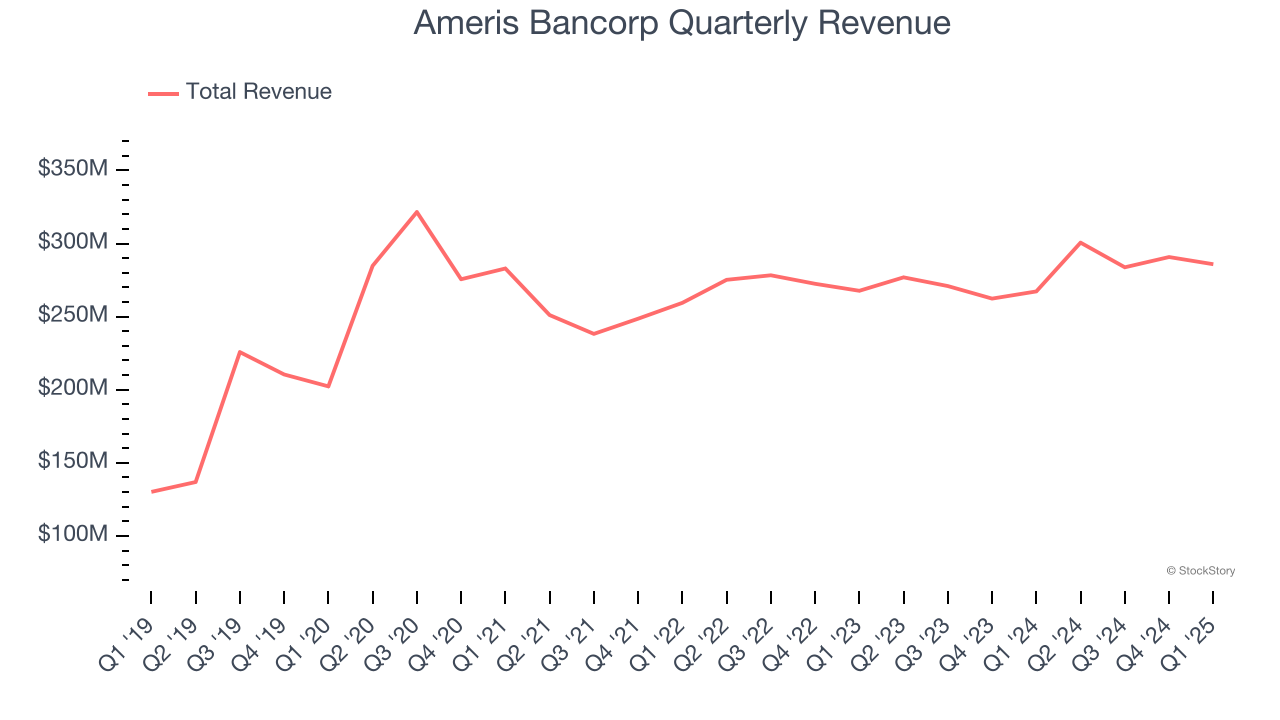

Over the last five years, Ameris Bancorp grew its revenue at a solid 8.4% compounded annual growth rate. Its growth beat the average bank company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

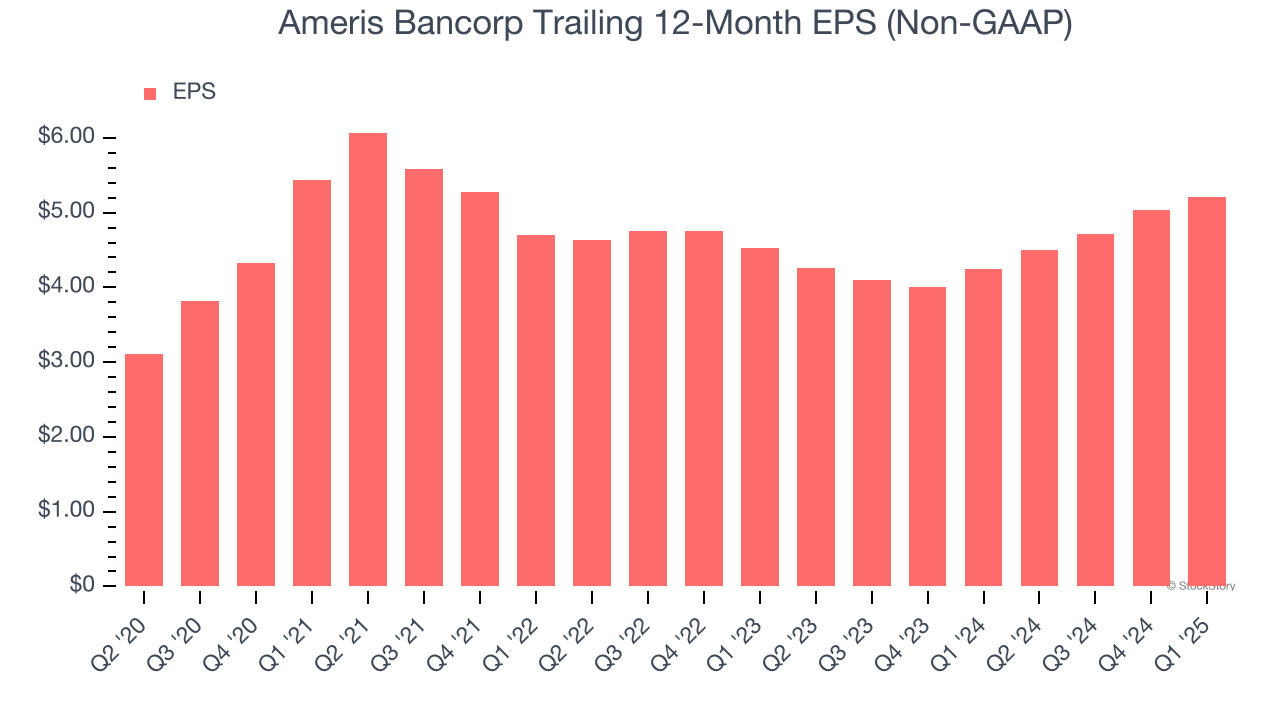

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Ameris Bancorp’s astounding 10.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

One Reason to be Careful:

Net Interest Income Points to Soft Demand

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Ameris Bancorp’s net interest income has grown at a 7.4% annualized rate over the last four years, slightly worse than the broader bank industry.

Final Judgment

Ameris Bancorp’s merits more than compensate for its flaws, but at $67.45 per share (or 1.1× forward P/B), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Ameris Bancorp

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.