Trupanion’s 14% return over the past six months has outpaced the S&P 500 by 6.9%, and its stock price has climbed to $49.76 per share. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy TRUP? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does TRUP Stock Spark Debate?

Born from a vision to help pet owners avoid economic euthanasia when faced with expensive veterinary bills, Trupanion (NASDAQ: TRUP) provides medical insurance for cats and dogs through data-driven, vertically-integrated products priced specifically for each pet's unique characteristics.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

Insurance companies generate revenue three ways. The first is the core insurance business itself, represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected but not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from policy administration, annuities, and other value-added services.

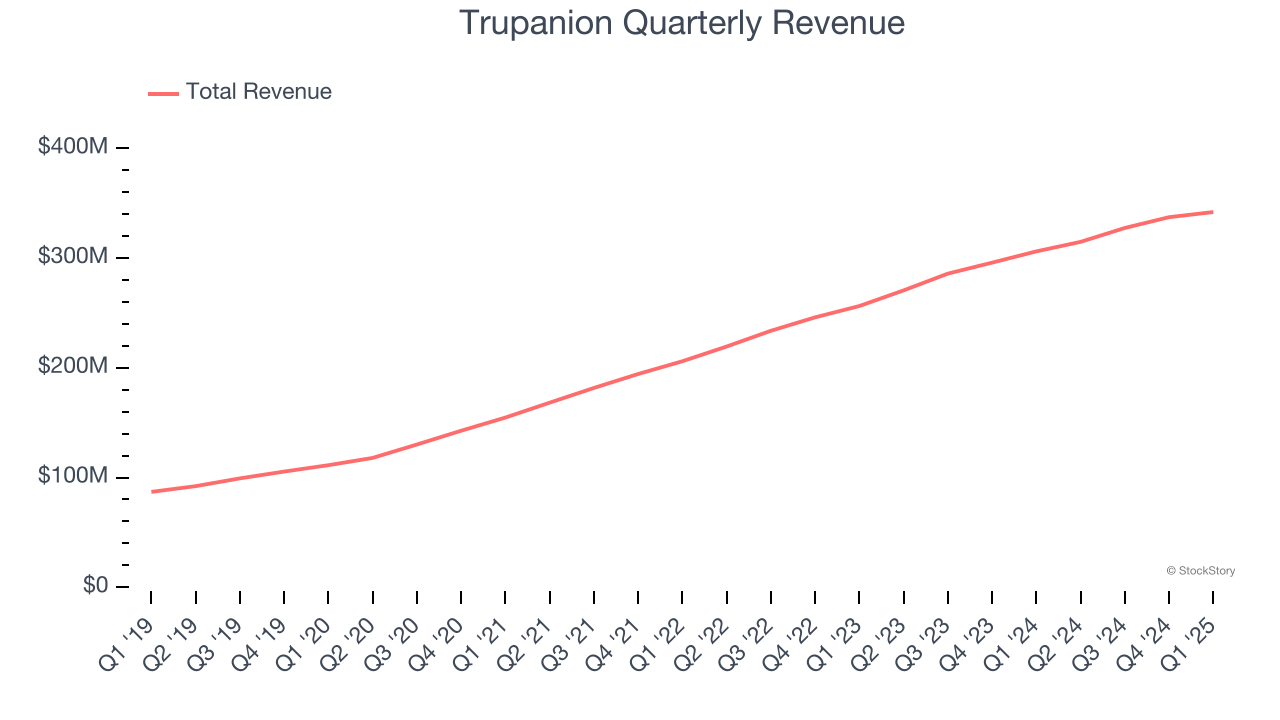

Over the last five years, Trupanion grew its revenue at an incredible 26.5% compounded annual growth rate. Its growth beat the average insurance company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

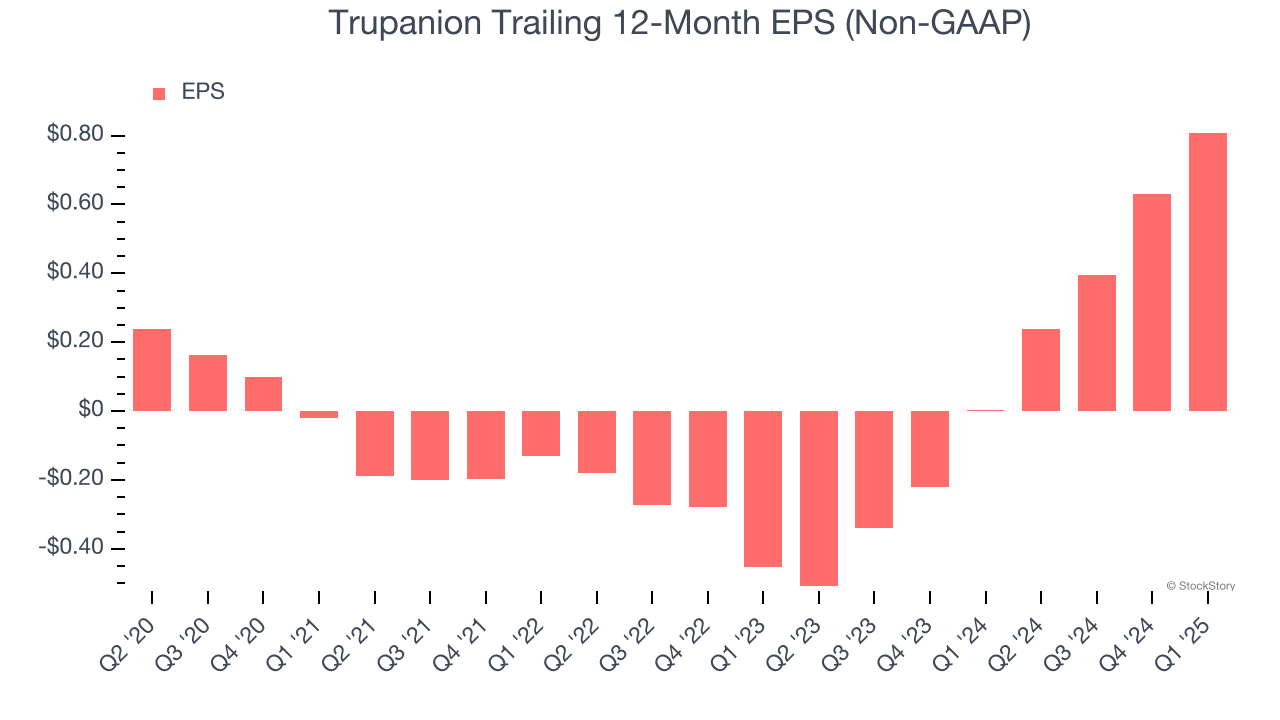

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Trupanion’s EPS grew at an astounding 39.9% compounded annual growth rate over the last five years, higher than its 26.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Projected BVPS Growth Shows Limited Upside

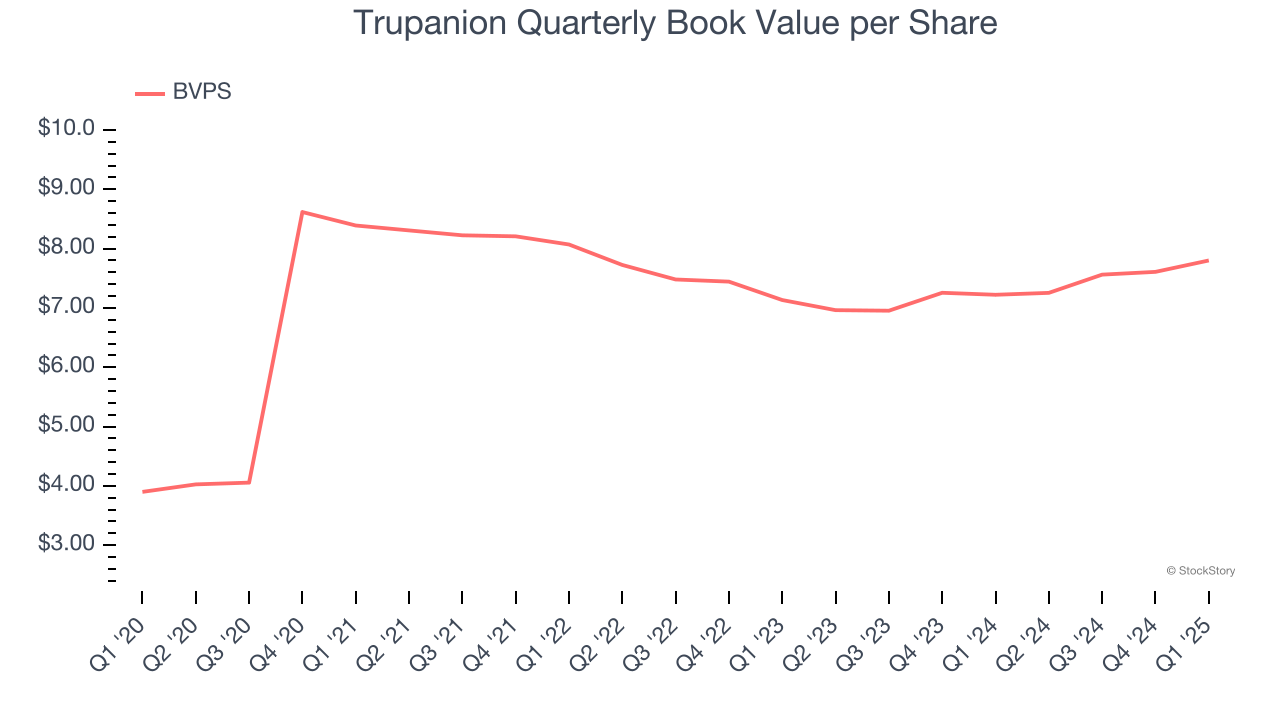

Book value per share (BVPS) growth is driven by an insurer’s ability to earn consistent underwriting profits while generating strong investment returns.

Over the next 12 months, Consensus estimates call for Trupanion’s BVPS to remain flat at roughly $7.50, a disappointing projection.

Final Judgment

Trupanion’s positive characteristics outweigh the negatives, and with its shares outperforming the market lately, the stock trades at 6.2× forward P/B (or $49.76 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Trupanion

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.