eHealth’s stock price has taken a beating over the past six months, shedding 59.2% of its value and falling to $3.97 per share. This might have investors contemplating their next move.

Is there a buying opportunity in eHealth, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is eHealth Not Exciting?

Even with the cheaper entry price, we're cautious about eHealth. Here are three reasons why you should be careful with EHTH and a stock we'd rather own.

1. Declining Estimated Membership Reflect Product Weakness

As an online marketplace, eHealth generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

eHealth struggled with new customer acquisition over the last two years as its estimated membership have declined by 1.8% annually to 1.16 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If eHealth wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect eHealth’s revenue to drop by 3.4%, a decrease from This projection doesn't excite us and implies its products and services will face some demand challenges.

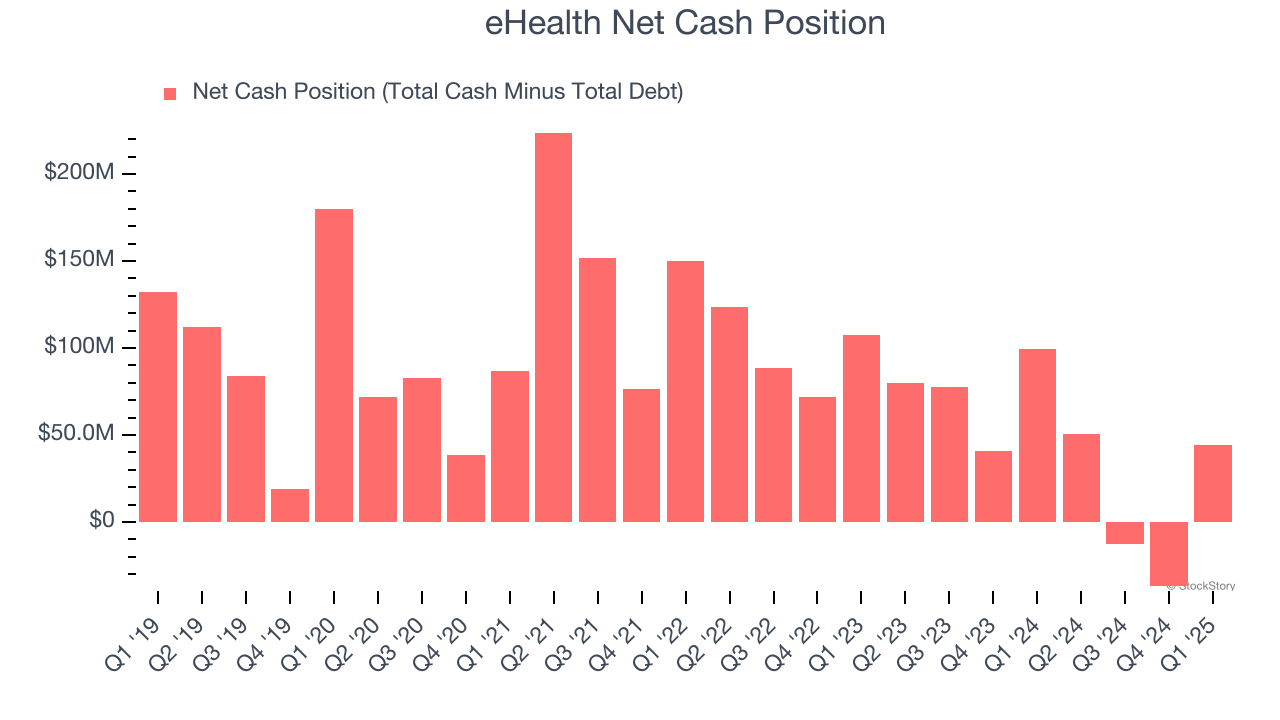

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

eHealth burned through $25.8 million of cash over the last year. With $121.1 million of cash on its balance sheet, the company has around 56 months of runway left (assuming its $76.61 million of debt isn’t due right away).

Unless the eHealth’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of eHealth until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

eHealth isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 2.6× forward EV/EBITDA (or $3.97 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Like More Than eHealth

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.