Pinterest has had an impressive run over the past six months as its shares have beaten the S&P 500 by 8.7%. The stock now trades at $36.20, marking a 12.9% gain. This run-up might have investors contemplating their next move.

Is now still a good time to buy PINS? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Pinterest Spark Debate?

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Two Things to Like:

1. Monthly Active Users Drive Additional Growth Opportunities

As a social network, Pinterest generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

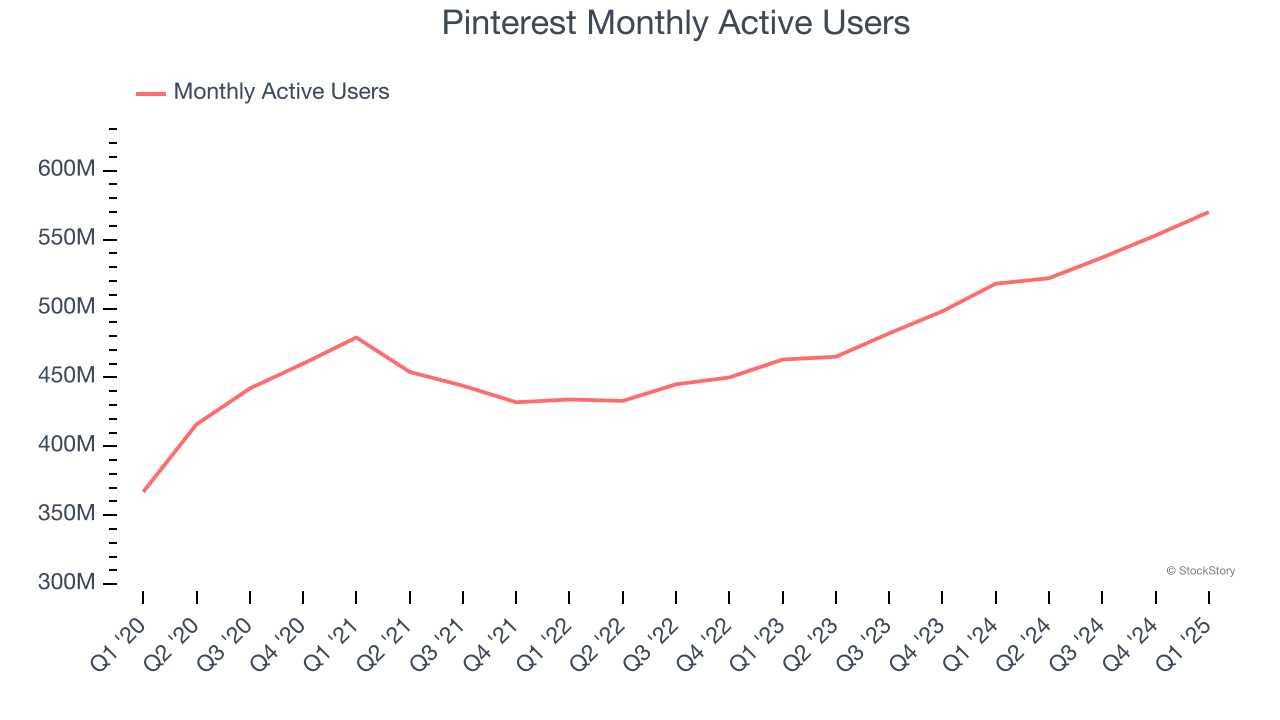

Over the last two years, Pinterest’s monthly active users, a key performance metric for the company, increased by 10.4% annually to 570 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

2. EBITDA Margin Reveals a Well-Run Organization

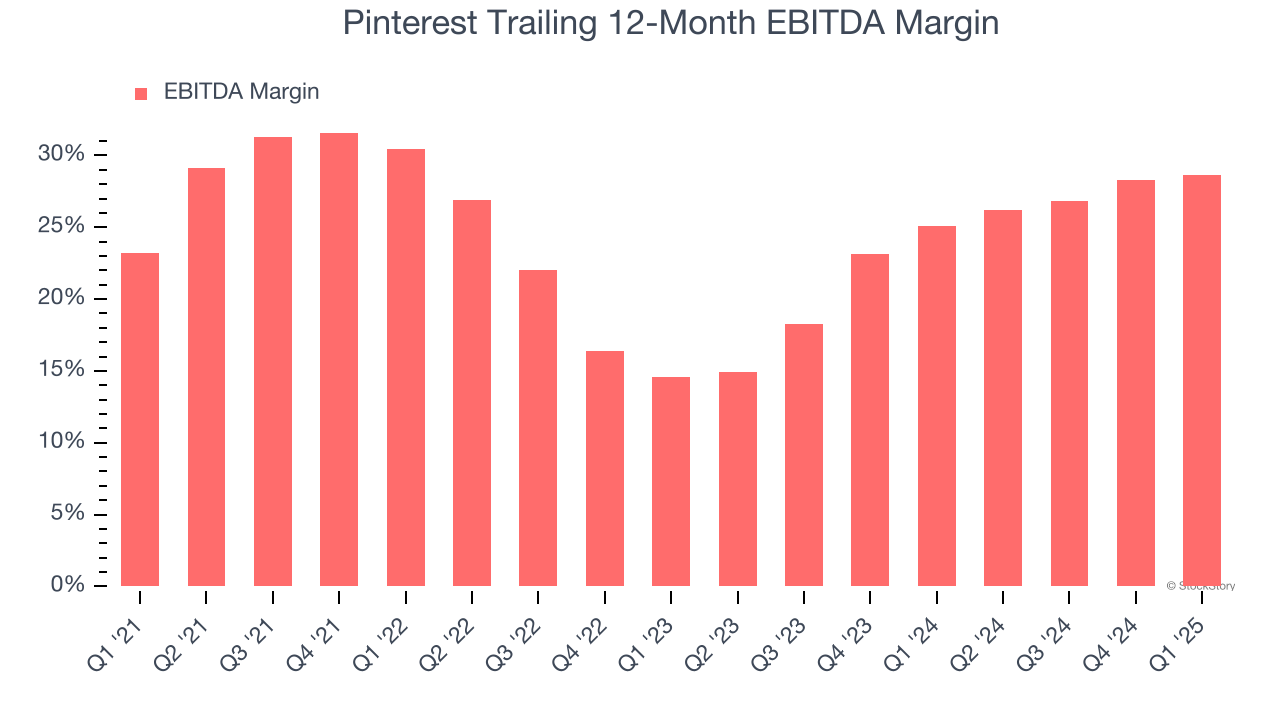

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Pinterest has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 27%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

Growth in Customer Spending Lags Peers

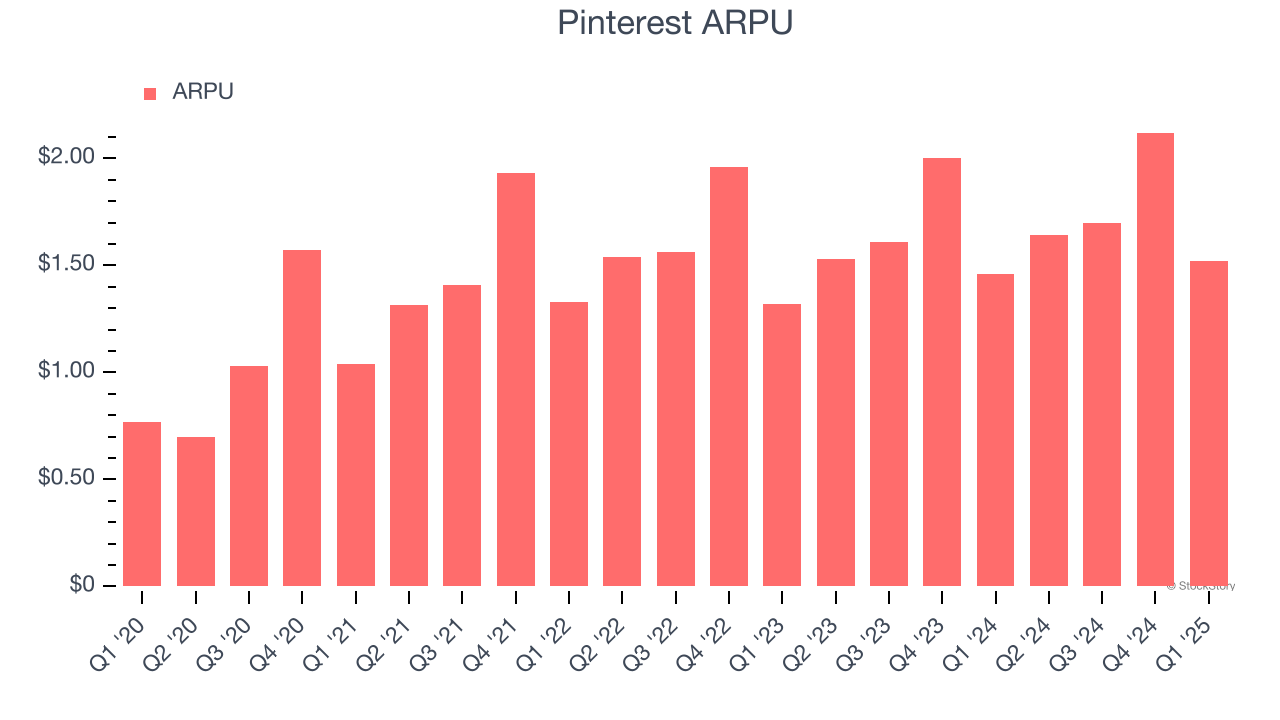

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Pinterest’s audience and its ad-targeting capabilities.

Pinterest’s ARPU growth has been mediocre over the last two years, averaging 4.8%. This isn’t great, but the increase in monthly active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Pinterest tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

Final Judgment

Pinterest has huge potential even though it has some open questions, and with its shares beating the market recently, the stock trades at 19.9× forward EV/EBITDA (or $36.20 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Pinterest

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.