Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at WeightWatchers (NASDAQ: WW) and the best and worst performers in the specialized consumer services industry.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, specialized consumer services stocks have performed well with share prices up 394% on average since the latest earnings results.

WeightWatchers (NASDAQ: WW)

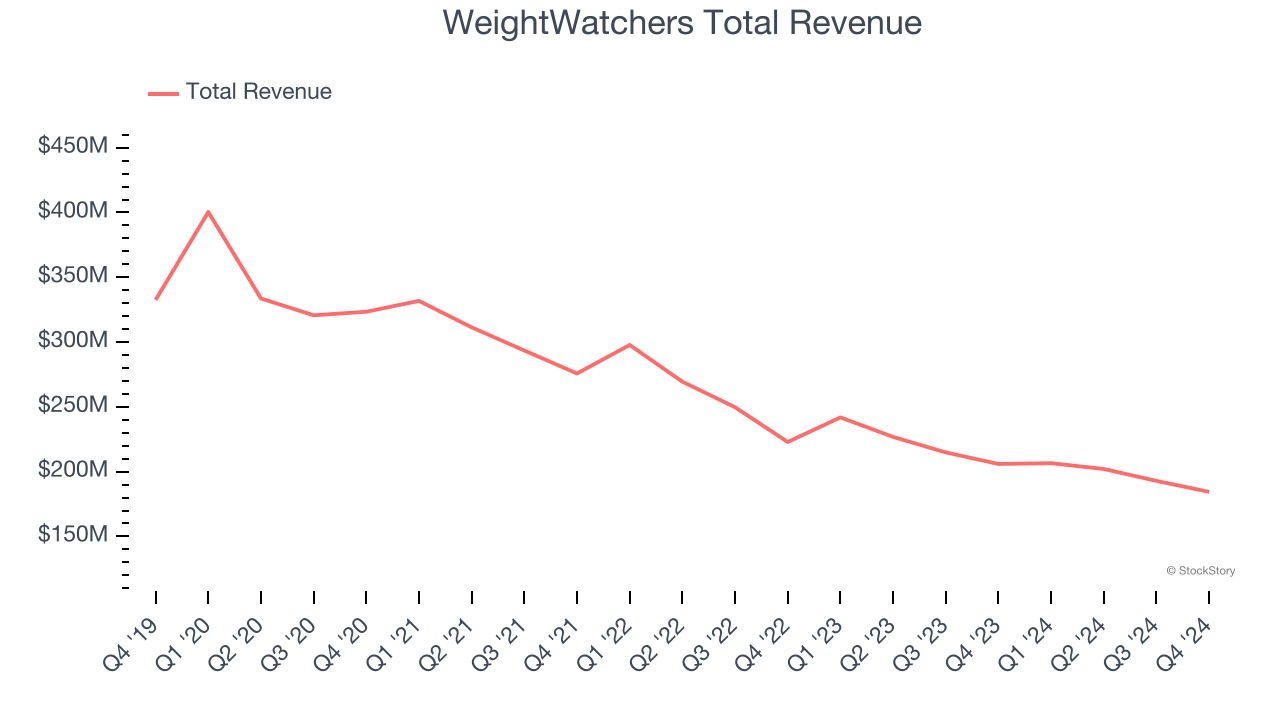

Known by many for its old cable television commercials, WeightWatchers (NASDAQ: WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WeightWatchers reported revenues of $184.4 million, down 10.5% year on year. This print exceeded analysts’ expectations by 6.5%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates.

"We are pleased with the momentum in our Clinical business in the Fourth Quarter, reflecting the increasing demand for comprehensive weight management solutions. As more people seek sustainable approaches—including those using or transitioning off medication—our unique combination of science-backed behavioral support, clinical care, and engaged global community allows us to deliver the right solutions at the right time. I am grateful for the Board’s trust in me to lead WeightWatchers through this next phase, and I look forward to building on our progress, working alongside our incredible team, and driving meaningful impact for our members," said Tara Comonte, President and CEO.

WeightWatchers scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 4,271% since reporting and currently trades at $34.75.

Is now the time to buy WeightWatchers? Access our full analysis of the earnings results here, it’s free.

Best Q4: Frontdoor (NASDAQ: FTDR)

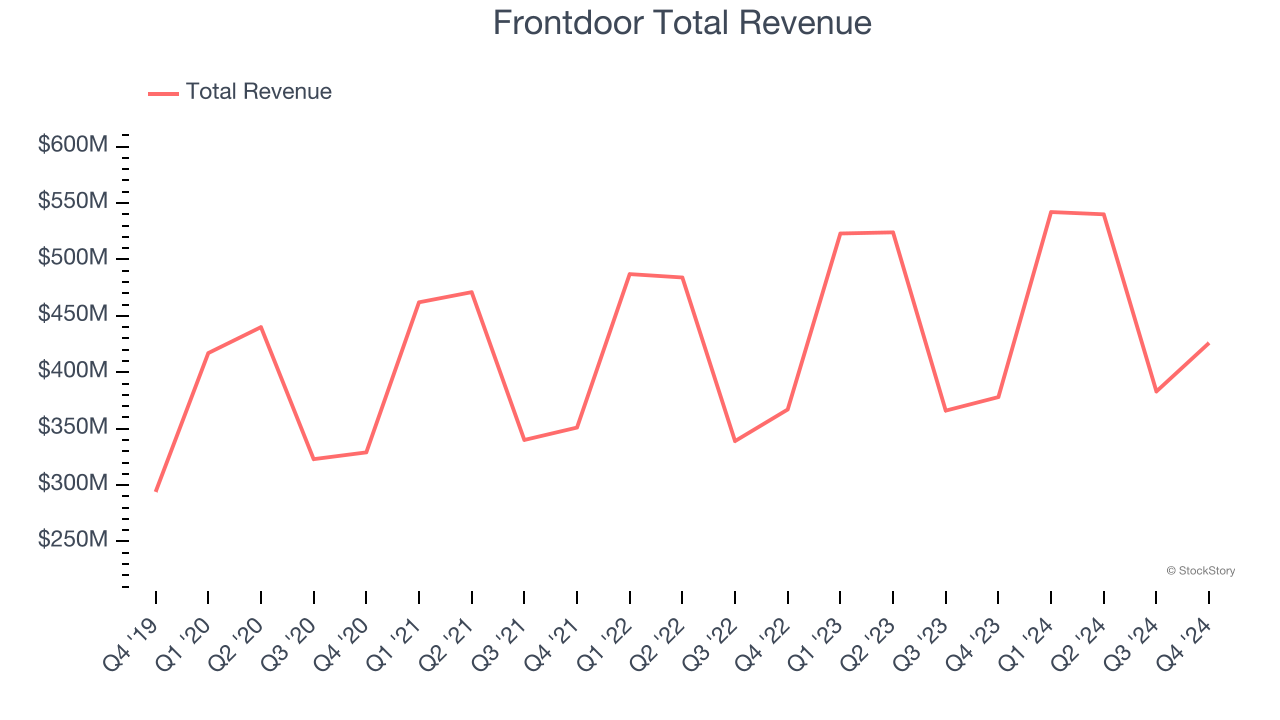

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ: FTDR) is a provider of home warranty and service plans.

Frontdoor reported revenues of $426 million, up 12.7% year on year, outperforming analysts’ expectations by 2.1%. The business had a very strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EPS estimates.

Frontdoor achieved the fastest revenue growth and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 41.6% since reporting. It currently trades at $58.19.

Is now the time to buy Frontdoor? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: 1-800-FLOWERS (NASDAQ: FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ: FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $331.5 million, down 12.6% year on year, falling short of analysts’ expectations by 9%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

1-800-FLOWERS delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 5.3% since the results and currently trades at $5.49.

Read our full analysis of 1-800-FLOWERS’s results here.

H&R Block (NYSE: HRB)

Founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, H&R Block (NYSE: HRB) is a tax preparation company offering professional tax assistance and financial solutions to individuals and small businesses.

H&R Block reported revenues of $2.28 billion, up 4.2% year on year. This number beat analysts’ expectations by 1.3%. More broadly, it was a mixed quarter as it also recorded a decent beat of analysts’ EPS estimates but a miss of analysts’ Tax Preparation revenue estimates.

The stock is down 10% since reporting and currently trades at $55.49.

Read our full, actionable report on H&R Block here, it’s free.

ADT (NYSE: ADT)

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE: ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

ADT reported revenues of $1.27 billion, up 6.5% year on year. This result surpassed analysts’ expectations by 2%. Aside from that, it was a satisfactory quarter as it also produced a decent beat of analysts’ EPS estimates but a miss of analysts’ customers estimates.

The stock is up 6.6% since reporting and currently trades at $8.44.

Read our full, actionable report on ADT here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.