The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Remitly (NASDAQ: RELY) and the rest of the consumer internet stocks fared in Q1.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer internet stocks have performed well with share prices up 20.6% on average since the latest earnings results.

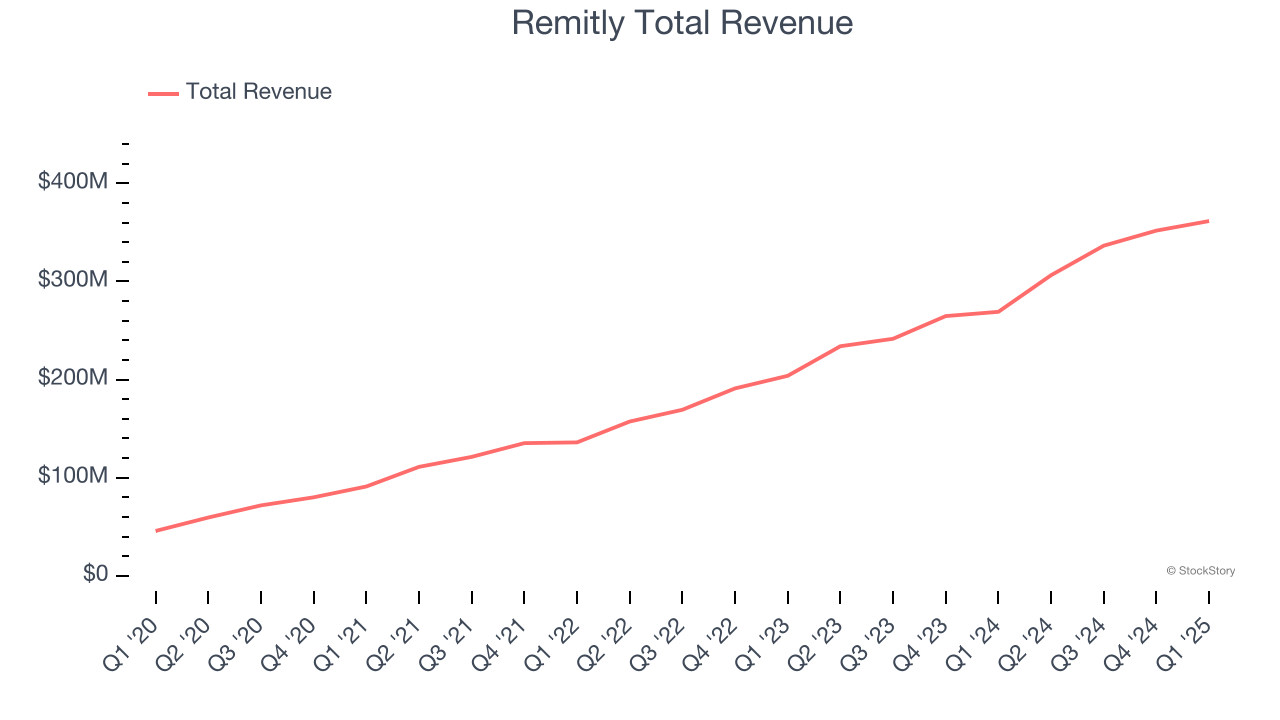

Remitly (NASDAQ: RELY)

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ: RELY) is an online platform that enables consumers to safely and quickly send money globally.

Remitly reported revenues of $361.6 million, up 34.4% year on year. This print exceeded analysts’ expectations by 4.1%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates.

“We delivered an outstanding start to the year, significantly exceeding our expectations for the first quarter,” said Matt Oppenheimer, co-founder and Chief Executive Officer, Remitly.

Unsurprisingly, the stock is down 17.3% since reporting and currently trades at $17.44.

Read why we think that Remitly is one of the best consumer internet stocks, our full report is free.

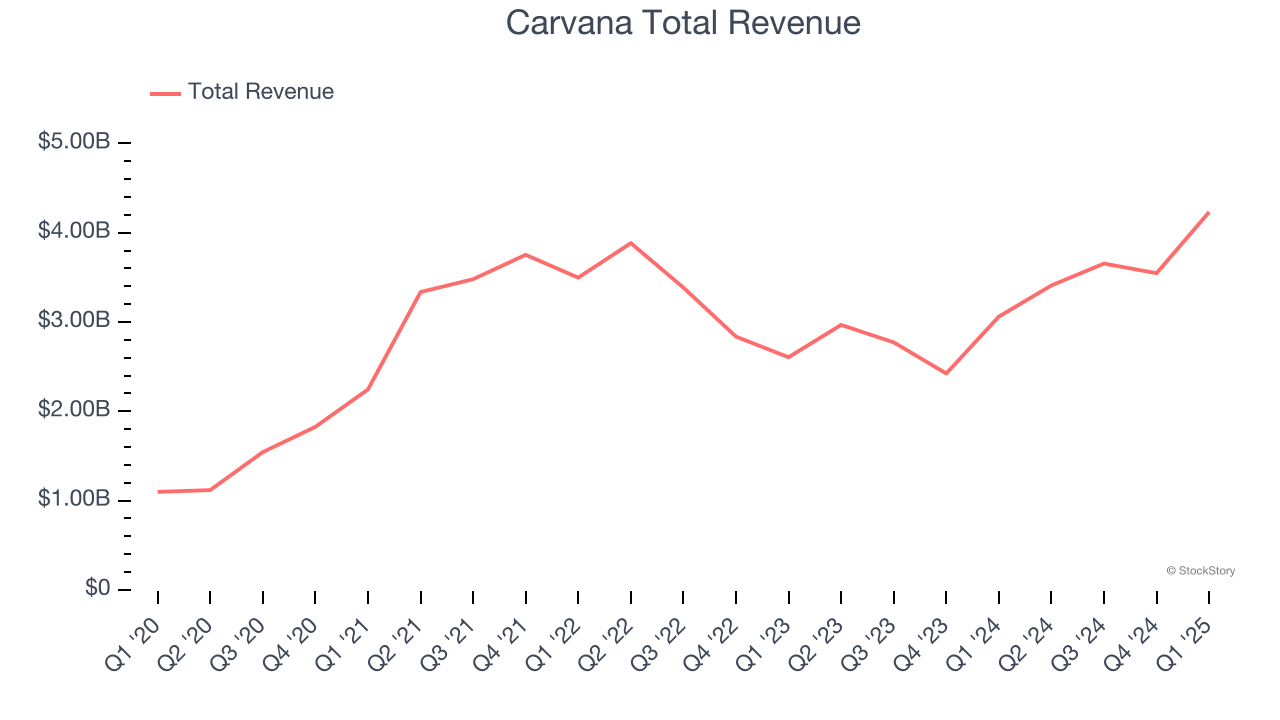

Best Q1: Carvana (NYSE: CVNA)

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $4.23 billion, up 38.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 34% since reporting. It currently trades at $346.50.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: The RealReal (NASDAQ: REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $160 million, up 11.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and EBITDA guidance for next quarter missing analysts’ expectations significantly.

As expected, the stock is down 22.5% since the results and currently trades at $5.66.

Read our full analysis of The RealReal’s results here.

Duolingo (NASDAQ: DUOL)

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ: DUOL) is a mobile app helping people learn new languages.

Duolingo reported revenues of $230.7 million, up 37.7% year on year. This result topped analysts’ expectations by 3.4%. It was a very strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Duolingo achieved the highest full-year guidance raise among its peers. The company reported 130.2 million users, up 33.4% year on year. The stock is down 9.4% since reporting and currently trades at $362.40.

Read our full, actionable report on Duolingo here, it’s free.

Etsy (NASDAQ: ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $651.2 million, flat year on year. This print surpassed analysts’ expectations by 1.4%. More broadly, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates but a decline in its buyers.

The company reported 94.78 million active buyers, down 1.7% year on year. The stock is up 26.5% since reporting and currently trades at $58.37.

Read our full, actionable report on Etsy here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.