Over the past six months, Butterfield Bank has been a great trade, beating the S&P 500 by 19.1%. Its stock price has climbed to $45.36, representing a healthy 24.8% increase. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy NTB? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Butterfield Bank Spark Debate?

Founded in 1784 as one of the oldest banks in the Western Hemisphere, Butterfield Bank (NYSE: NTB) provides banking, wealth management, and trust services to individuals and businesses in select offshore financial centers including Bermuda, Cayman Islands, and the Channel Islands.

Two Things to Like:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

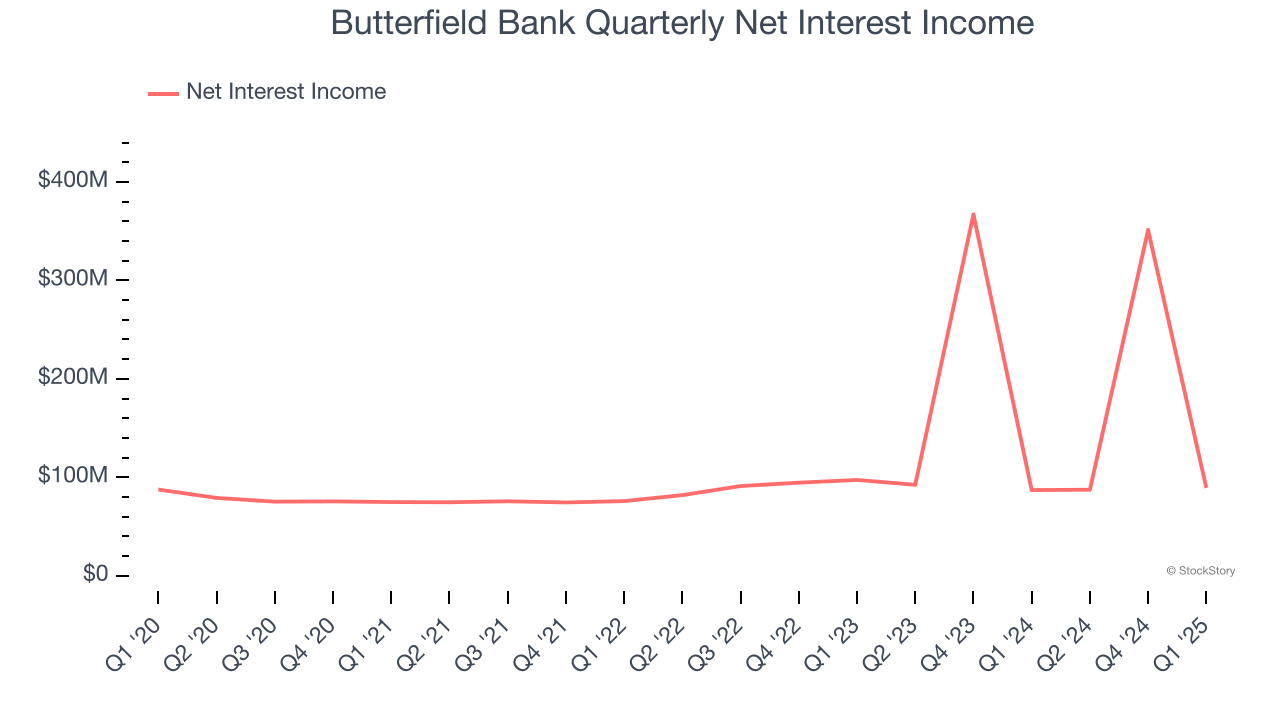

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Butterfield Bank’s net interest income has grown at a 30.8% annualized rate over the last four years, much better than the broader bank industry.

2. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity — an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Butterfield Bank has averaged an ROE of 20.9%, exceptional for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired. This shows Butterfield Bank has a strong competitive moat.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

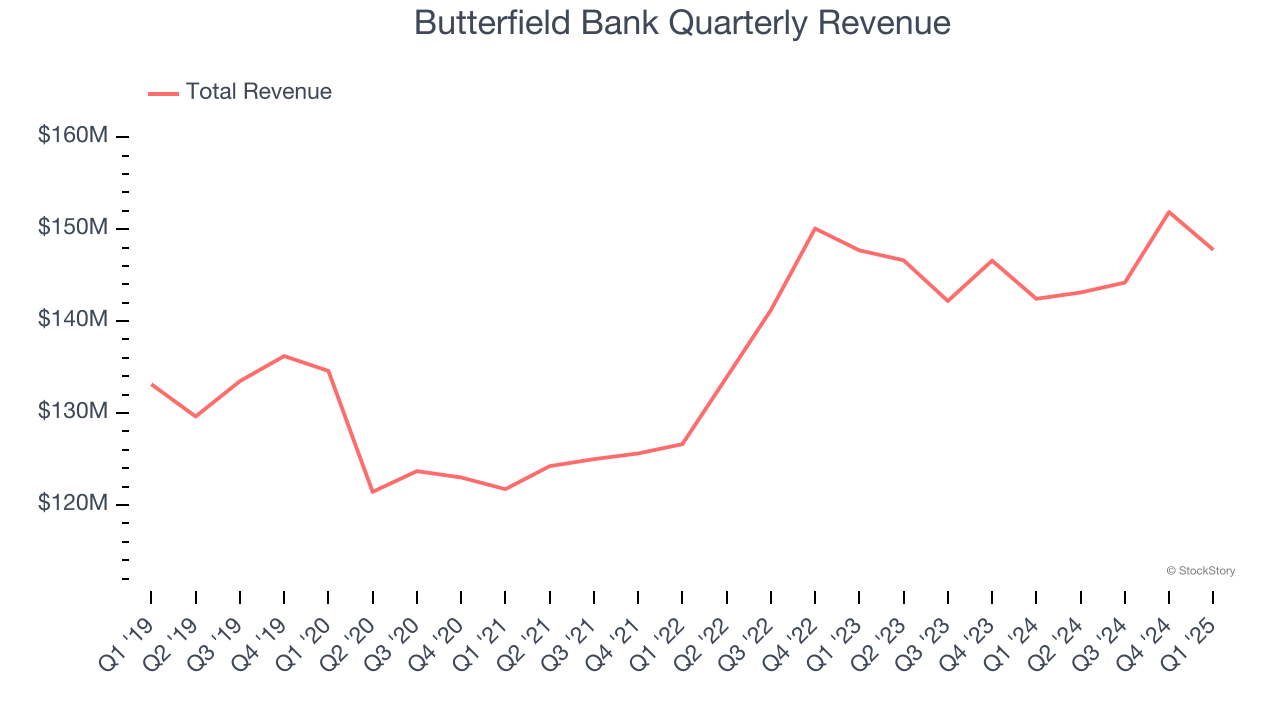

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income.

Unfortunately, Butterfield Bank’s 1.9% annualized revenue growth over the last five years was tepid. This wasn’t a great result, but there are still things to like about Butterfield Bank.

Final Judgment

Butterfield Bank’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 1.6× forward P/B (or $45.36 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.