Let’s dig into the relative performance of WeightWatchers (NASDAQ: WW) and its peers as we unravel the now-completed Q4 specialized consumer services earnings season.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, specialized consumer services stocks have performed well with share prices up 429% on average since the latest earnings results.

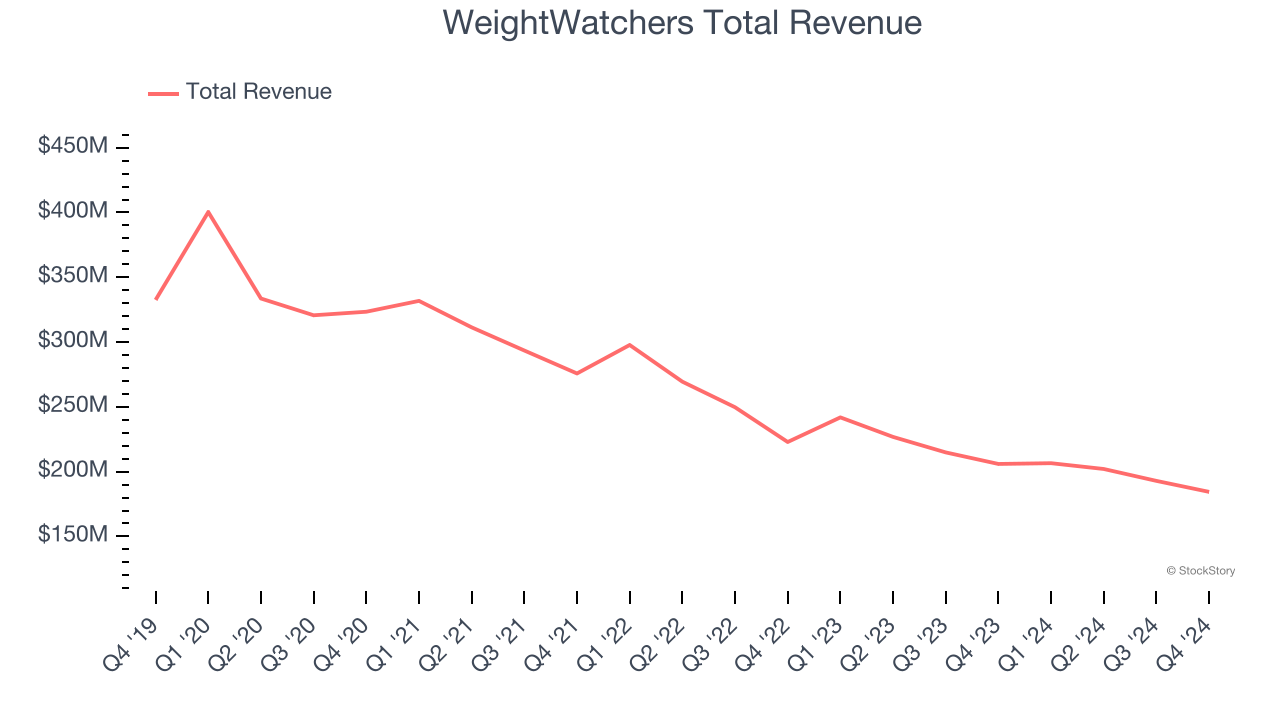

WeightWatchers (NASDAQ: WW)

Known by many for its old cable television commercials, WeightWatchers (NASDAQ: WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WeightWatchers reported revenues of $184.4 million, down 10.5% year on year. This print exceeded analysts’ expectations by 6.5%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates.

"We are pleased with the momentum in our Clinical business in the Fourth Quarter, reflecting the increasing demand for comprehensive weight management solutions. As more people seek sustainable approaches—including those using or transitioning off medication—our unique combination of science-backed behavioral support, clinical care, and engaged global community allows us to deliver the right solutions at the right time. I am grateful for the Board’s trust in me to lead WeightWatchers through this next phase, and I look forward to building on our progress, working alongside our incredible team, and driving meaningful impact for our members," said Tara Comonte, President and CEO.

WeightWatchers achieved the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 4,680% since reporting and currently trades at $38.

Is now the time to buy WeightWatchers? Access our full analysis of the earnings results here, it’s free.

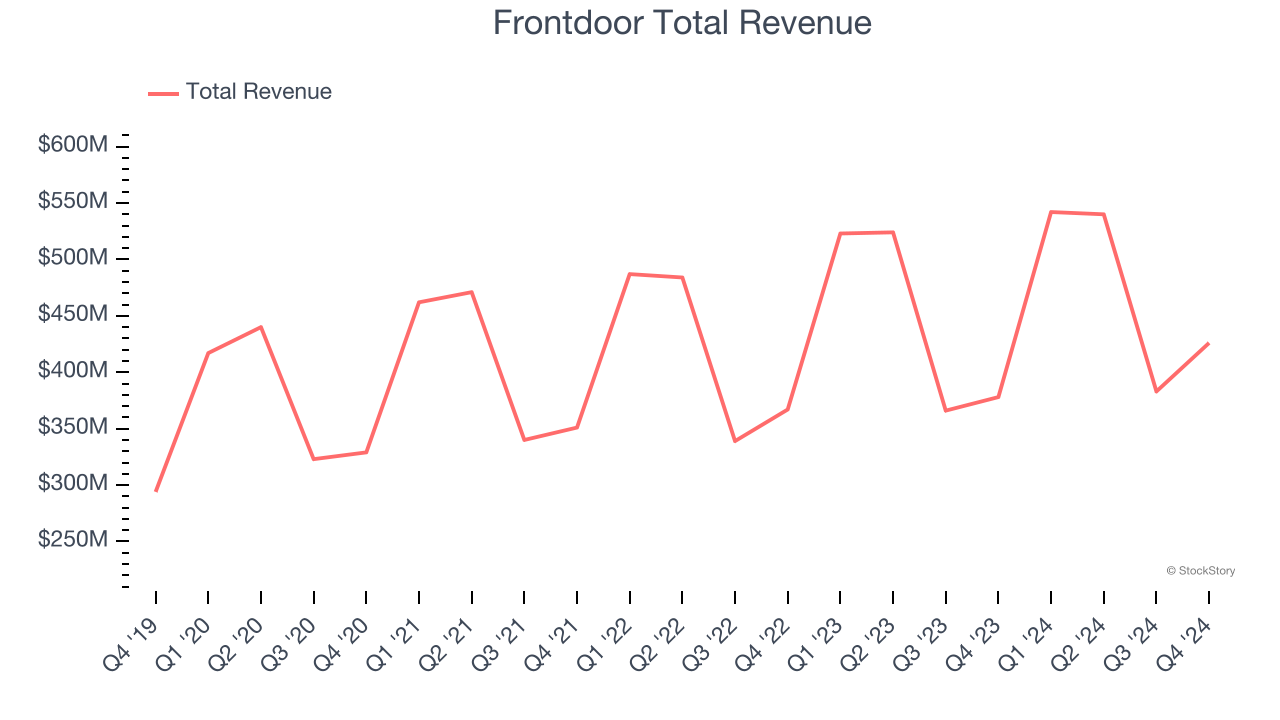

Best Q4: Frontdoor (NASDAQ: FTDR)

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ: FTDR) is a provider of home warranty and service plans.

Frontdoor reported revenues of $426 million, up 12.7% year on year, outperforming analysts’ expectations by 2.1%. The business had a very strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EPS estimates.

Frontdoor delivered the fastest revenue growth and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 39.5% since reporting. It currently trades at $57.33.

Is now the time to buy Frontdoor? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: 1-800-FLOWERS (NASDAQ: FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ: FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $331.5 million, down 12.6% year on year, falling short of analysts’ expectations by 9%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

1-800-FLOWERS delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 9.3% since the results and currently trades at $5.26.

Read our full analysis of 1-800-FLOWERS’s results here.

Pool (NASDAQ: POOL)

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ: POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Pool reported revenues of $1.07 billion, down 4.4% year on year. This result came in 2.5% below analysts' expectations. Overall, it was a slower quarter as it also produced a miss of analysts’ organic revenue estimates and a miss of analysts’ EPS estimates.

The stock is down 3.6% since reporting and currently trades at $298.22.

Read our full, actionable report on Pool here, it’s free.

Mister Car Wash (NASDAQ: MCW)

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE: MCW) offers car washes across the United States through its conveyorized service.

Mister Car Wash reported revenues of $261.7 million, up 9.4% year on year. This number beat analysts’ expectations by 1.6%. Aside from that, it was a satisfactory quarter as it also logged an impressive beat of analysts’ same-store sales estimates but full-year revenue guidance meeting analysts’ expectations.

The stock is down 6% since reporting and currently trades at $6.45.

Read our full, actionable report on Mister Car Wash here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.