Swimming pool distributor Pool (NASDAQ: POOL) met Wall Street’s revenue expectations in Q2 CY2025, but sales were flat year on year at $1.78 billion. Its GAAP profit of $5.17 per share was 1.2% above analysts’ consensus estimates.

Is now the time to buy Pool? Find out by accessing our full research report, it’s free.

Pool (POOL) Q2 CY2025 Highlights:

- Revenue: $1.78 billion vs analyst estimates of $1.78 billion (flat year on year, in line)

- EPS (GAAP): $5.17 vs analyst estimates of $5.11 (1.2% beat)

- Adjusted EBITDA: $292.1 million vs analyst estimates of $286.1 million (16.4% margin, 2.1% beat)

- EPS (GAAP) guidance for the full year is $11.05 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 15.3%, in line with the same quarter last year

- Free Cash Flow was -$42.86 million, down from $8.77 million in the same quarter last year

- Market Capitalization: $11.91 billion

“During the second quarter of 2025, we saw sales expansion, reflecting continued growth in maintenance products and improving trends on discretionary spending, and celebrated the opening of our 450th sales center. We remain focused on prioritizing our strategic initiatives through providing an outstanding customer experience and advancing our technology investments, positioning the business for sustained success,” commented Peter D. Arvan, president and CEO.

Company Overview

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ: POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Revenue Growth

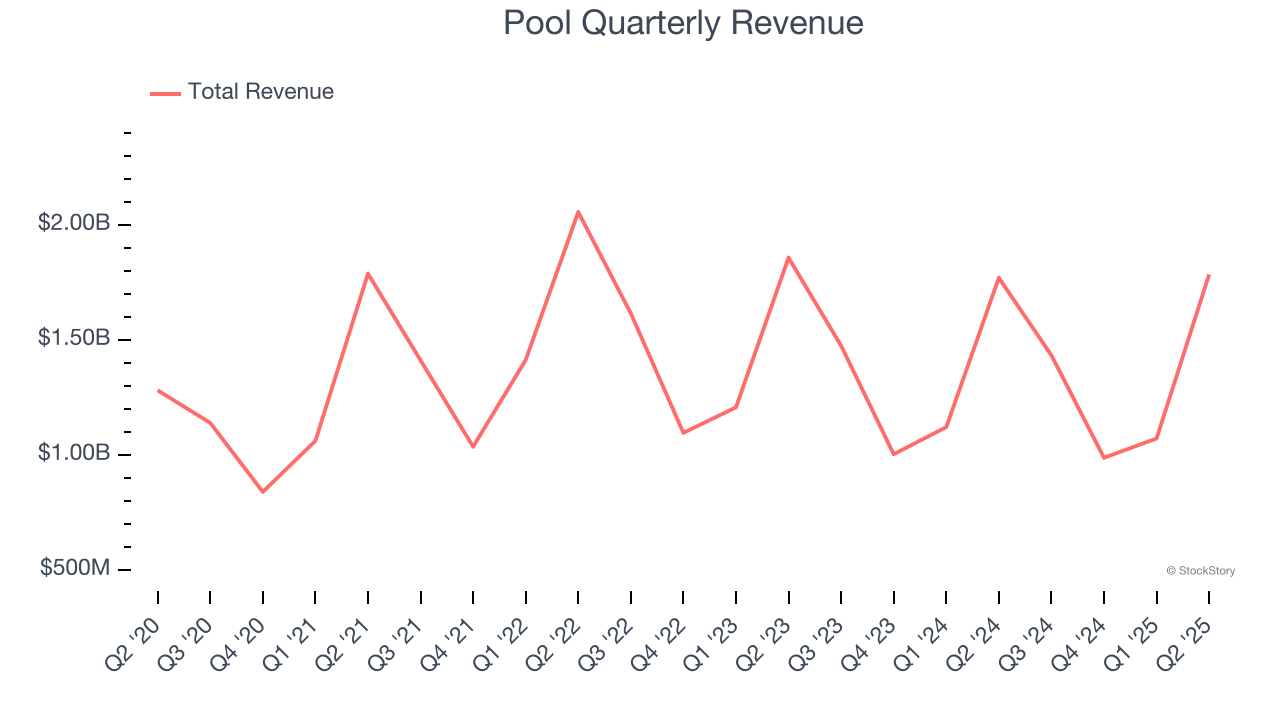

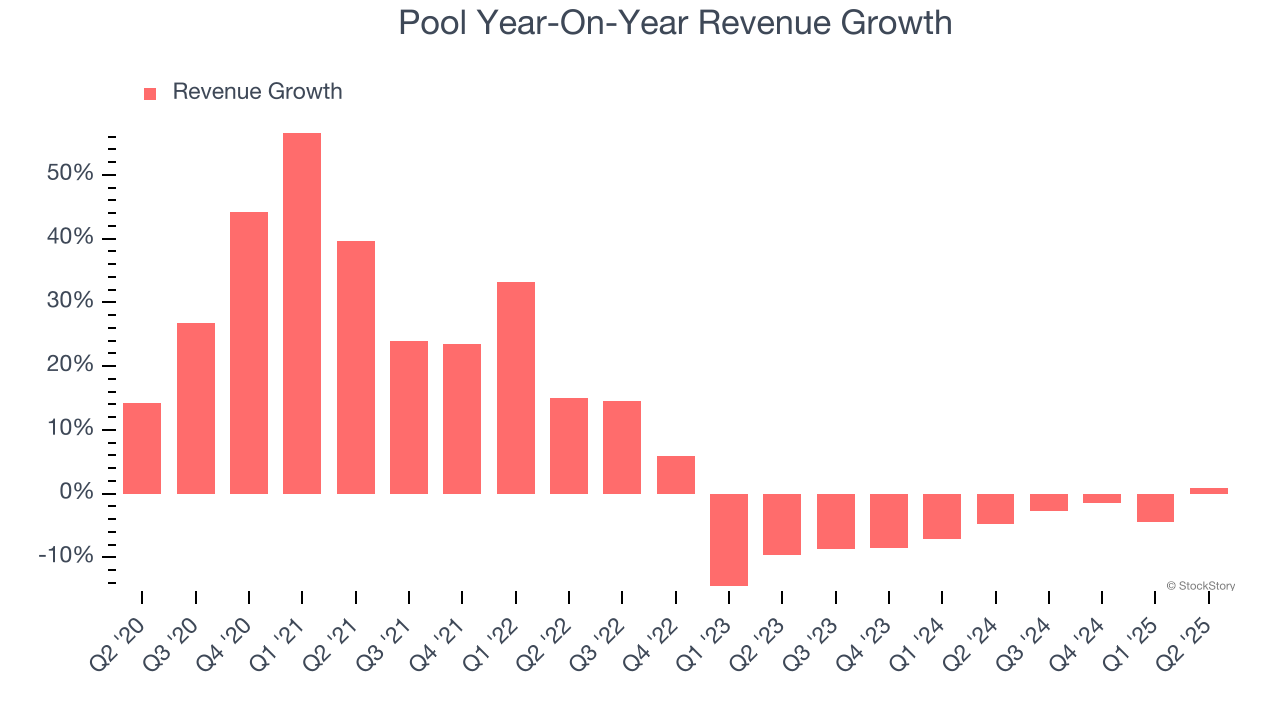

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Pool’s 8.9% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Pool’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.4% annually.

This quarter, Pool’s $1.78 billion of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

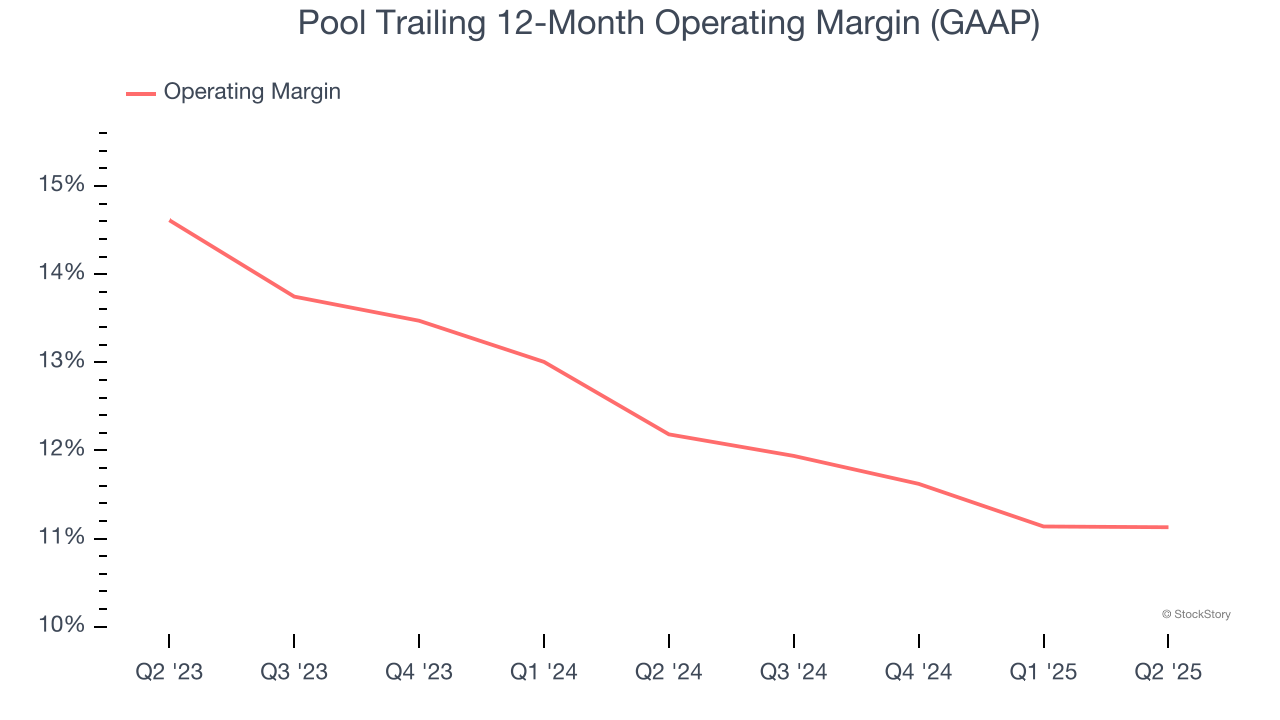

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Pool’s operating margin has been trending down over the last 12 months, but it still averaged 11.7% over the last two years, decent for a consumer discretionary business. This shows it generally does a decent job managing its expenses.

This quarter, Pool generated an operating margin profit margin of 15.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

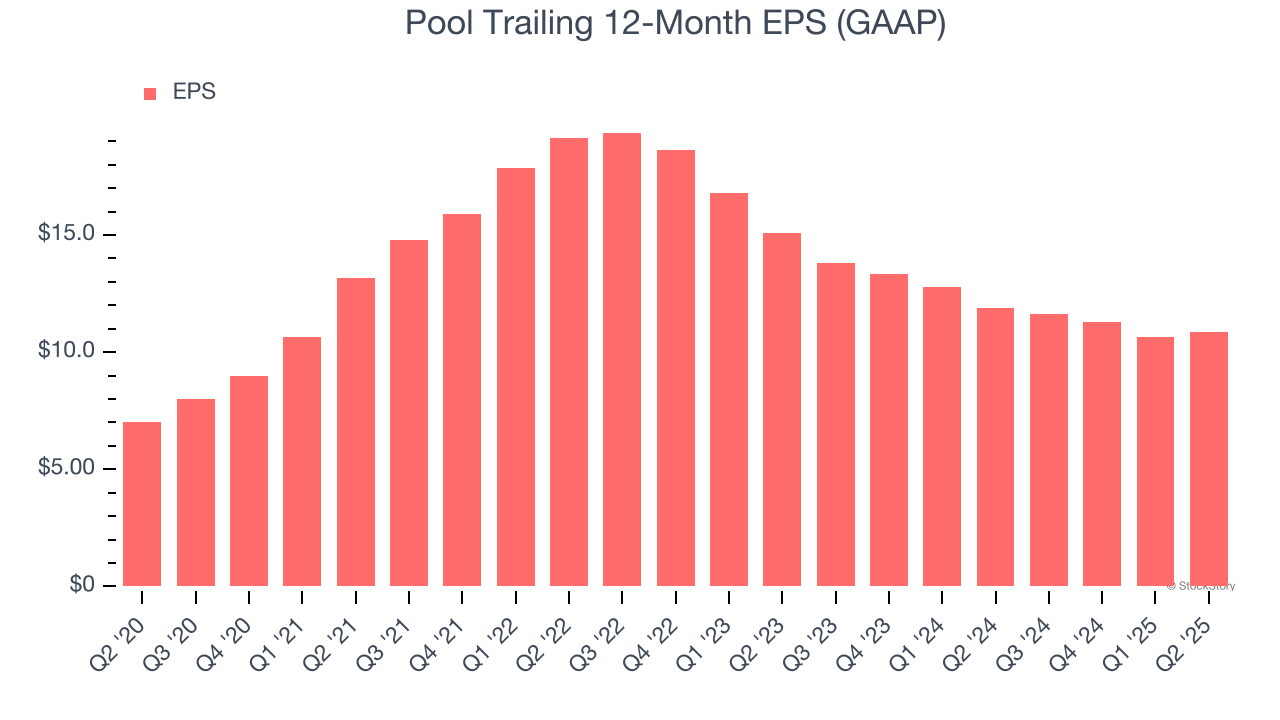

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Pool’s unimpressive 9.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q2, Pool reported EPS at $5.17, up from $4.99 in the same quarter last year. This print beat analysts’ estimates by 1.2%. Over the next 12 months, Wall Street expects Pool’s full-year EPS of $10.84 to grow 6.4%.

Key Takeaways from Pool’s Q2 Results

Revenue was in line and EPS beat. The company's full-year EPS guidance was in line with expectations. Qualitatively, management called out "improving trends on discretionary spending". Zooming out, we think this was a decent quarter. The stock traded up 8.3% to $343.20 immediately following the results.

So do we think Pool is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.