Wrapping up Q1 earnings, we look at the numbers and key takeaways for the online retail stocks, including Chewy (NYSE: CHWY) and its peers.

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

The 6 online retail stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

Luckily, online retail stocks have performed well with share prices up 31.5% on average since the latest earnings results.

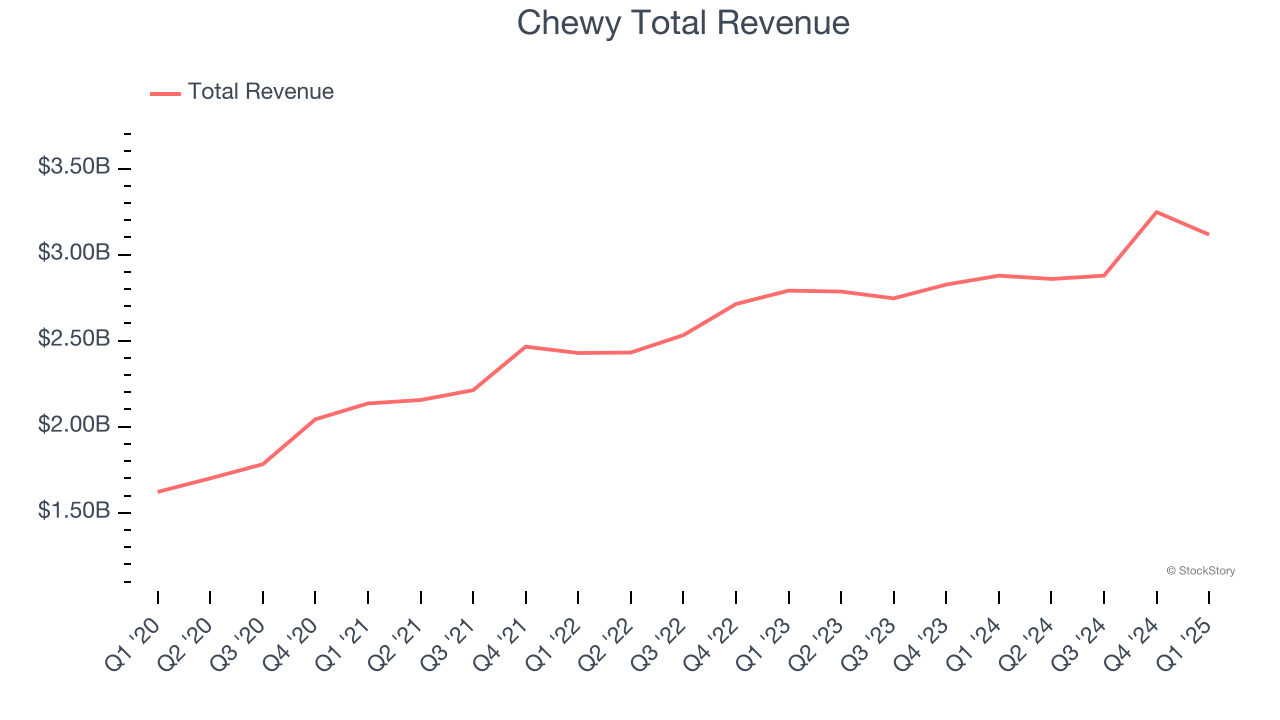

Chewy (NYSE: CHWY)

Founded by Ryan Cohen, who later became known for his involvement in GameStop, Chewy (NYSE: CHWY) is an online retailer specializing in pet food, supplies, and healthcare services.

Chewy reported revenues of $3.12 billion, up 8.3% year on year. This print exceeded analysts’ expectations by 1.1%. Overall, it was a satisfactory quarter for the company with a narrow beat of analysts’ EBITDA estimates.

Unsurprisingly, the stock is down 20.4% since reporting and currently trades at $36.44.

Is now the time to buy Chewy? Access our full analysis of the earnings results here, it’s free.

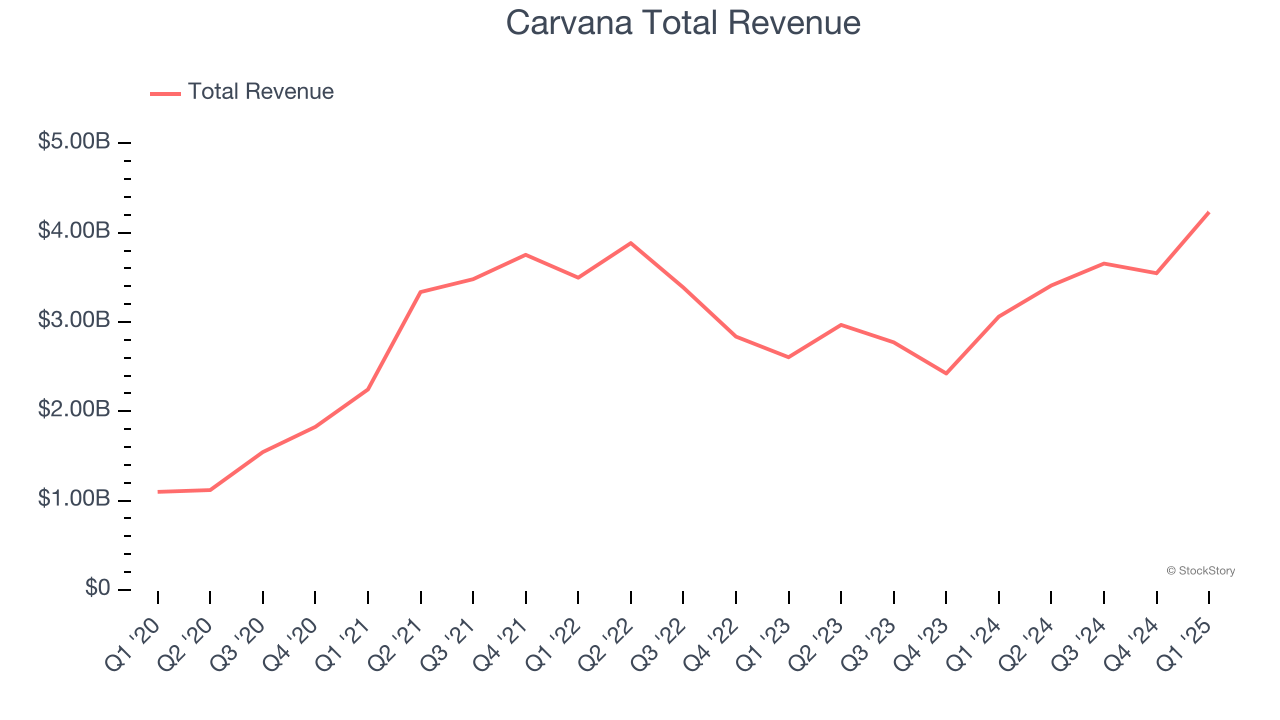

Best Q1: Carvana (NYSE: CVNA)

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $4.23 billion, up 38.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and impressive growth in its units.

Carvana pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The company reported 133,898 units sold, up 45.7% year on year. The market seems happy with the results as the stock is up 28.7% since reporting. It currently trades at $333.00.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Wayfair (NYSE: W)

Founded in 2002 by Niraj Shah, Wayfair (NYSE: W) is a leading online retailer of mass-market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $2.73 billion, flat year on year, exceeding analysts’ expectations by 0.7%. Still, it was a mixed quarter as it posted a decline in its buyers.

Wayfair delivered the slowest revenue growth in the group. The company reported 21.1 million active buyers, down 5.4% year on year. Interestingly, the stock is up 116% since the results and currently trades at $65.37.

Read our full analysis of Wayfair’s results here.

Coupang (NYSE: CPNG)

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE: CPNG) is an e-commerce giant often referred to as the "Amazon of South Korea".

Coupang reported revenues of $7.91 billion, up 11.2% year on year. This number lagged analysts' expectations by 1.9%. Overall, it was a mixed quarter for the company.

Coupang had the weakest performance against analyst estimates among its peers. The company reported 23.6 million active buyers, up 8.8% year on year. The stock is up 26.3% since reporting and currently trades at $30.29.

Read our full, actionable report on Coupang here, it’s free.

Amazon (NASDAQ: AMZN)

Founded by Jeff Bezos after quitting his stock-picking job at D.E. Shaw, Amazon (NASDAQ: AMZN) is the world’s largest online retailer and provider of cloud computing services.

Amazon reported revenues of $155.7 billion, up 8.6% year on year. This result met analysts’ expectations. More broadly, it was a mixed quarter as it also recorded a solid beat of analysts’ EPS estimates but operating income guidance for next quarter missing analysts’ expectations significantly.

The stock is up 22% since reporting and currently trades at $231.69.

Read our full, actionable report on Amazon here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.