AIG trades at $79.23 and has moved in lockstep with the market. Its shares have returned 5.1% over the last six months while the S&P 500 has gained 5.8%.

Is now the time to buy AIG, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think AIG Will Underperform?

We're sitting this one out for now. Here are three reasons why you should be careful with AIG and a stock we'd rather own.

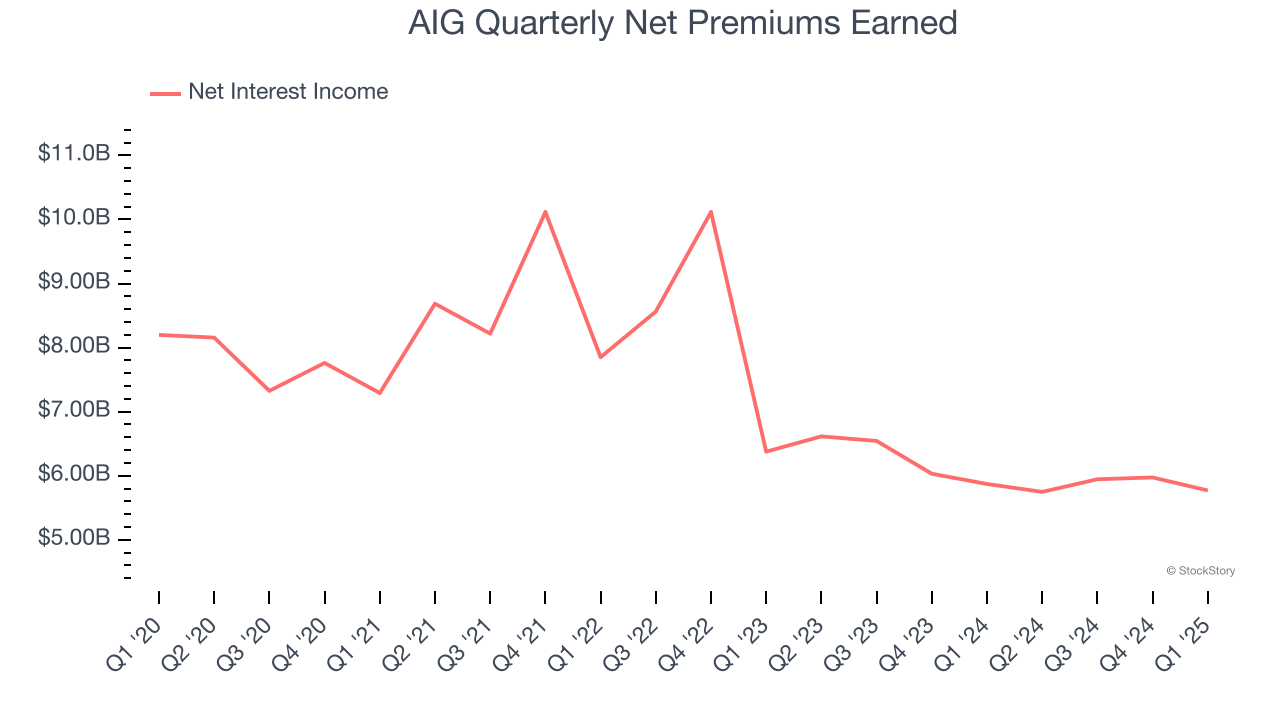

1. Declining Net Premiums Earned Reflects Weakness

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

AIG’s net premiums earned has declined by 6.4% annually over the last four years, much worse than the broader insurance industry.

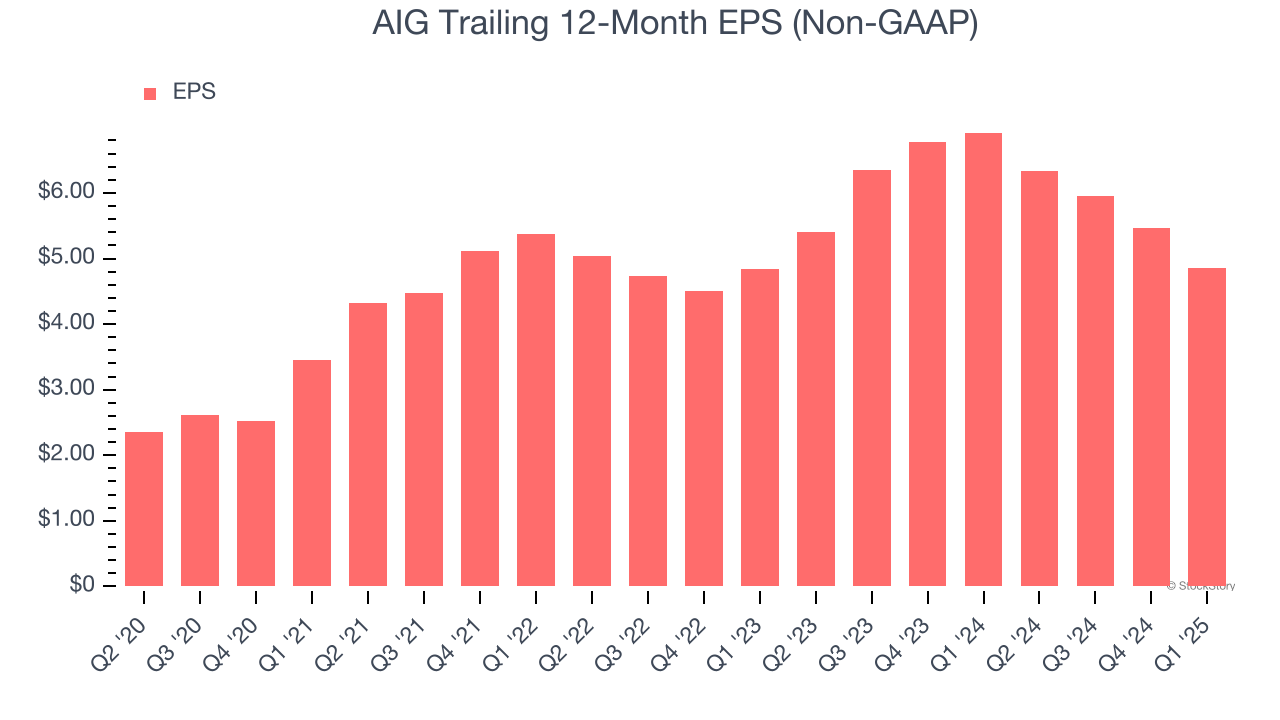

2. EPS Growth Has Stalled Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

AIG’s flat EPS over the last two years was weak. On the bright side, this performance was better than its 19.5% annualized revenue declines.

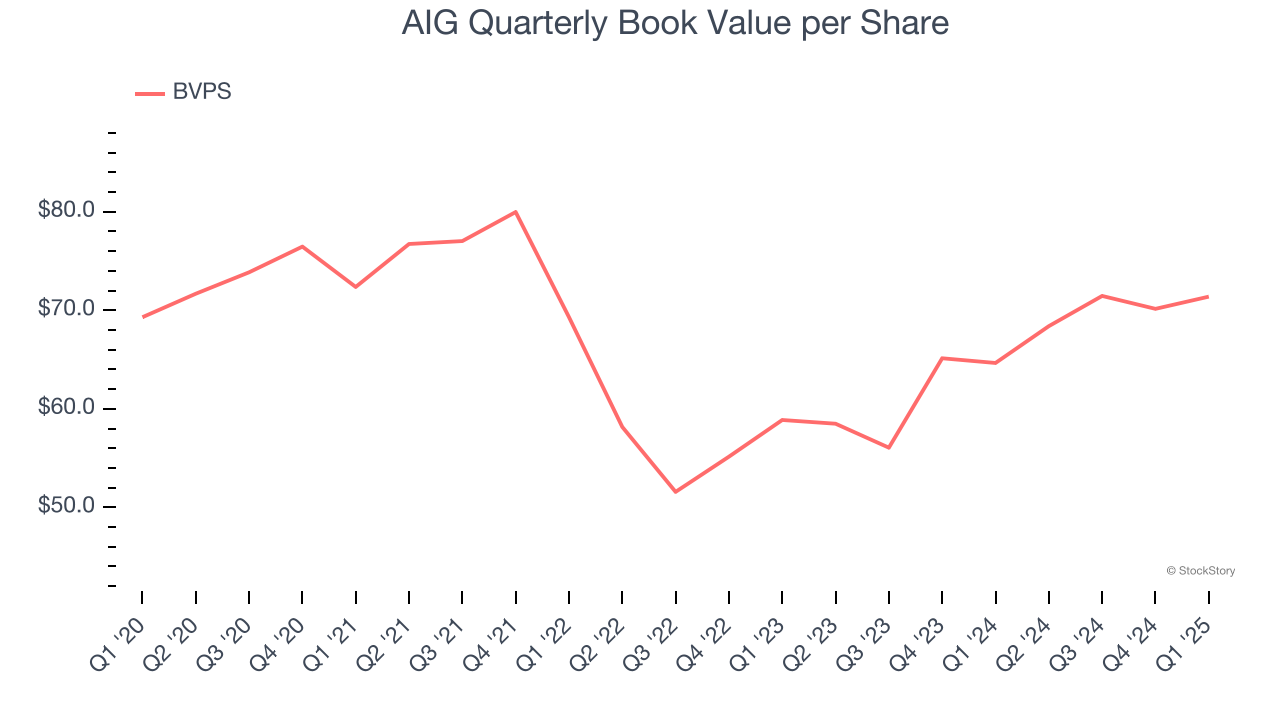

3. Substandard BVPS Growth Indicates Limited Asset Expansion

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

To the detriment of investors, AIG’s BVPS grew at a mediocre 10.1% annual clip over the last two years.

Final Judgment

We see the value of companies helping consumers, but in the case of AIG, we’re out. That said, the stock currently trades at 1.1× forward P/B (or $79.23 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of AIG

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.