Hotel and casino entertainment company Caesars Entertainment (NASDAQ: CZR) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 2.7% year on year to $2.91 billion. Its GAAP loss of $0.39 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Caesars Entertainment? Find out by accessing our full research report, it’s free.

Caesars Entertainment (CZR) Q2 CY2025 Highlights:

- Revenue: $2.91 billion vs analyst estimates of $2.87 billion (2.7% year-on-year growth, 1.2% beat)

- EPS (GAAP): -$0.39 vs analyst estimates of $0.05 (significant miss)

- Adjusted EBITDA: $955 million vs analyst estimates of $965.3 million (32.9% margin, 1.1% miss)

- Operating Margin: 18.1%, in line with the same quarter last year

- Market Capitalization: $6.12 billion

Tom Reeg, Chief Executive Officer of Caesars Entertainment, Inc., commented, “Our Caesars Digital segment posted one of its strongest quarters ever, as momentum continues to build toward the financial goals that we originally laid out in 2021. In Las Vegas, we posted solid gaming results in the face of softer market demand in our hospitality verticals. Net Revenues in our Regional segment increased 4% driven primarily by Caesars Virginia and New Orleans, coupled with strategic reinvestment into our Caesars Rewards database.”

Company Overview

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ: CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

Revenue Growth

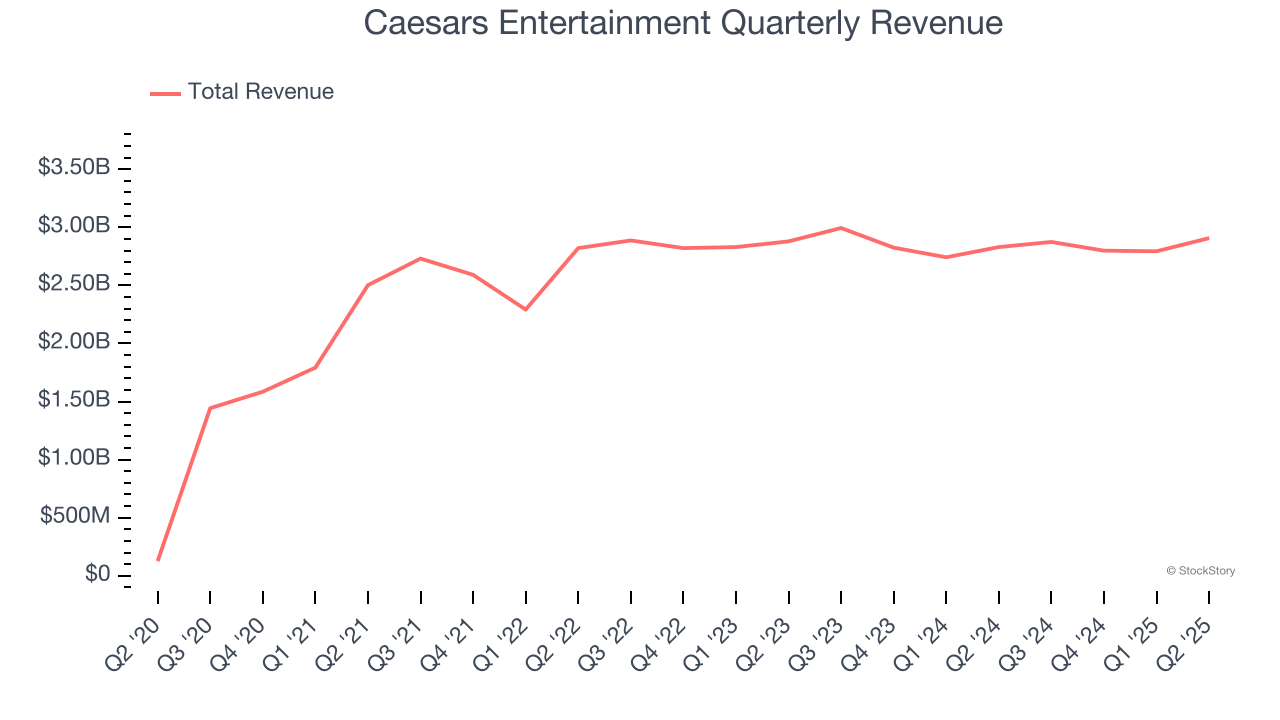

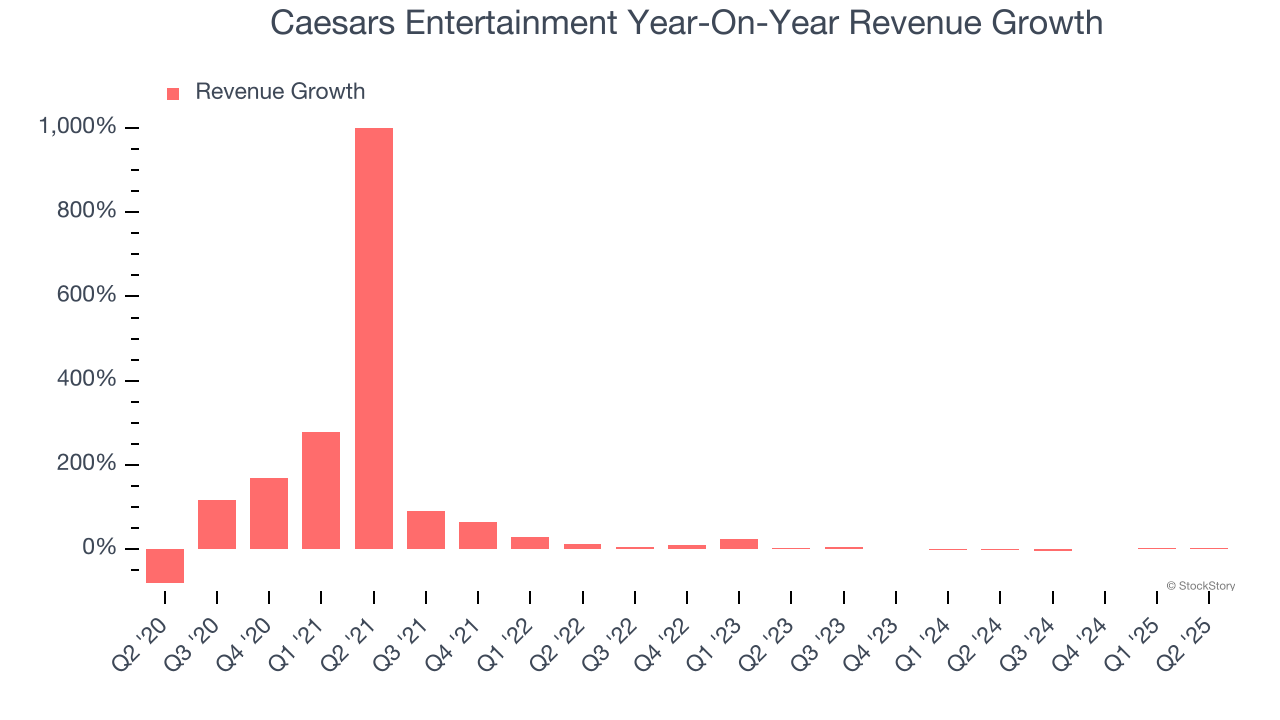

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Caesars Entertainment’s 43.7% annualized revenue growth over the last five years was incredible. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Caesars Entertainment’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years. Note that COVID hurt Caesars Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Caesars Entertainment also breaks out the revenue for its three most important segments: Casino, Hotel, and Dining, which are 57.4%, 14.7%, and 17.5% of revenue. Over the last two years, Caesars Entertainment’s Casino (Poker, Blackjack) and Dining (food and beverage) revenues averaged year-on-year growth of 24.5% and 15.6%. On the other hand, its Hotel revenue (overnight bookings) averaged 39.8% declines.

This quarter, Caesars Entertainment reported modest year-on-year revenue growth of 2.7% but beat Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

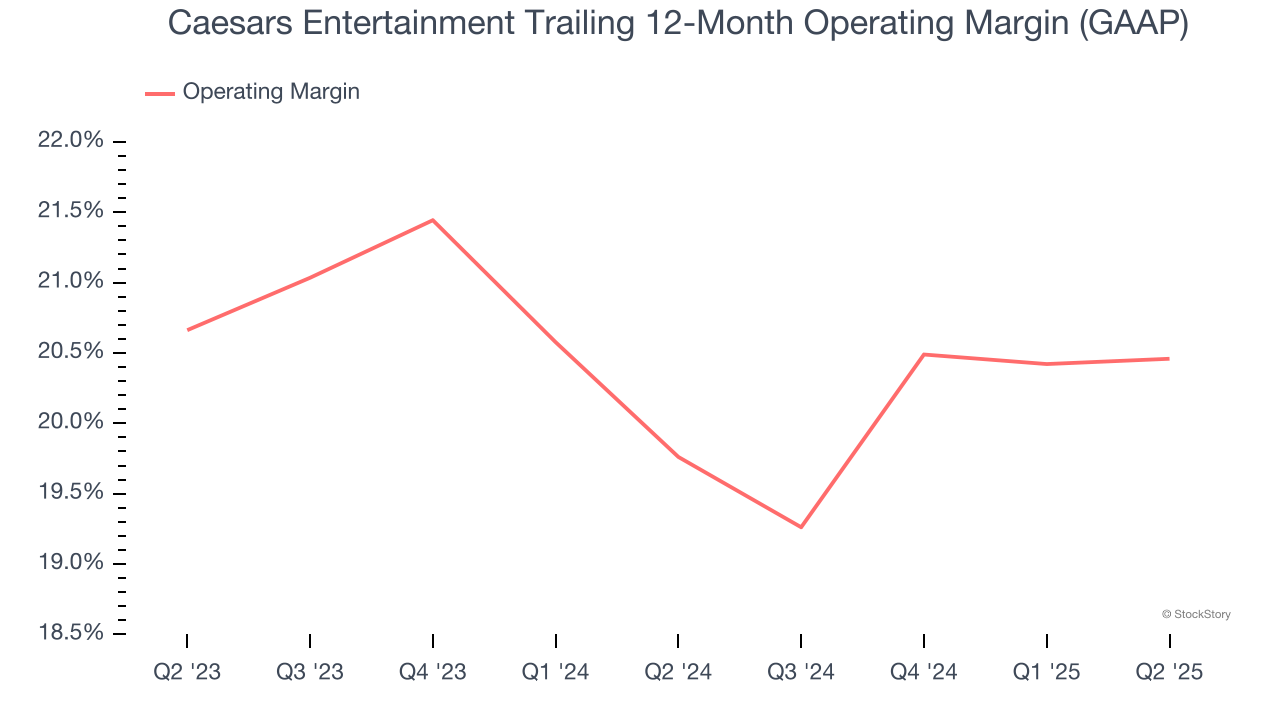

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Caesars Entertainment’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 20.1% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

In Q2, Caesars Entertainment generated an operating margin profit margin of 18.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

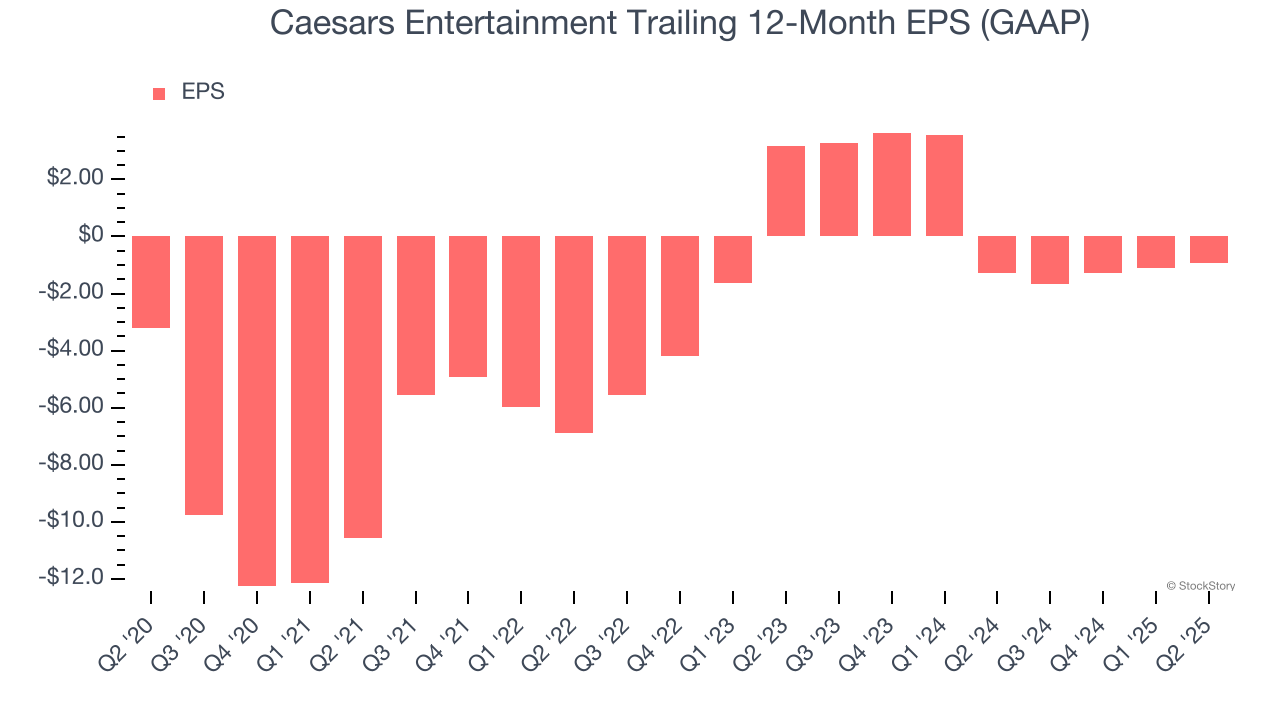

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Caesars Entertainment’s full-year earnings are still negative, it reduced its losses and improved its EPS by 22.1% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q2, Caesars Entertainment reported EPS at negative $0.39, up from negative $0.56 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Caesars Entertainment’s full-year EPS of negative $0.92 will flip to positive $0.54.

Key Takeaways from Caesars Entertainment’s Q2 Results

It was good to see Caesars Entertainment narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a weaker quarter. The stock traded down 1.2% to $28.10 immediately after reporting.

Caesars Entertainment’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.