Royalty Pharma has had an impressive run over the past six months as its shares have beaten the S&P 500 by 11.3%. The stock now trades at $36.72, marking a 16.2% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is it too late to buy RPRX? Find out in our full research report, it’s free.

Why Does Royalty Pharma Spark Debate?

Pioneering a unique business model in the pharmaceutical industry since 1996, Royalty Pharma (NASDAQ: RPRX) acquires rights to receive portions of sales from successful biopharmaceutical products, providing funding to drug developers without conducting research itself.

Two Things to Like:

1. Adjusted Operating Margin Rising, Profits Up

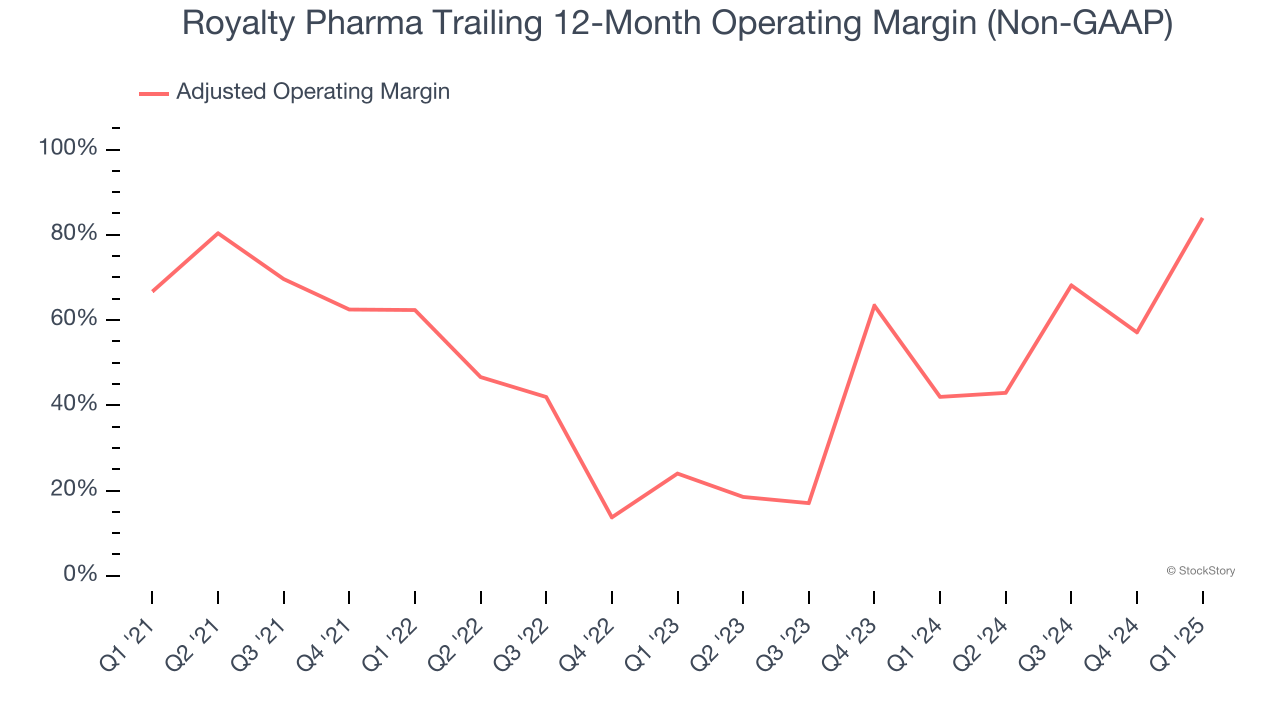

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Looking at the trend in its profitability, Royalty Pharma’s adjusted operating margin rose by 60 percentage points over the last two years, as its sales growth gave it operating leverage. Its adjusted operating margin for the trailing 12 months was 84%.

2. Increasing Free Cash Flow Margin Juices Financials

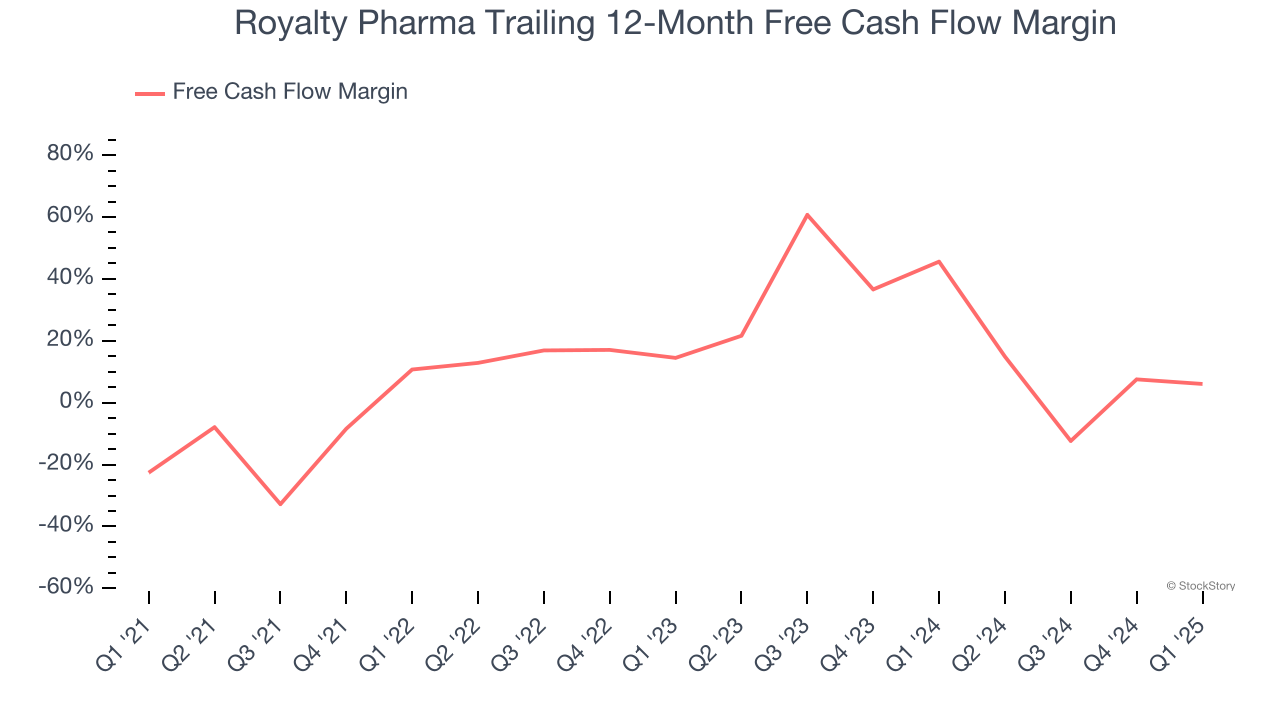

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Royalty Pharma’s margin expanded by 28.7 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Royalty Pharma’s free cash flow margin for the trailing 12 months was 6.1%.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Royalty Pharma’s sales grew at a tepid 3.8% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the healthcare sector, but there are still things to like about Royalty Pharma.

Final Judgment

Royalty Pharma’s positive characteristics outweigh the negatives, and with its shares outperforming the market lately, the stock trades at 7.8× forward P/E (or $36.72 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Royalty Pharma

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.