Data infrastructure software company, Confluent (NASDAQ: CFLT) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 20.1% year on year to $282.3 million. On the other hand, next quarter’s revenue guidance of $281.5 million was less impressive, coming in 3.7% below analysts’ estimates. Its non-GAAP profit of $0.09 per share was in line with analysts’ consensus estimates.

Is now the time to buy Confluent? Find out by accessing our full research report, it’s free.

Confluent (CFLT) Q2 CY2025 Highlights:

- Revenue: $282.3 million vs analyst estimates of $278.3 million (20.1% year-on-year growth, 1.4% beat)

- Adjusted EPS: $0.09 vs analyst estimates of $0.08 (in line)

- Adjusted Operating Income: $17.84 billion vs analyst estimates of $14.14 million (6,319% margin, significant beat)

- The company provided subscription revenue guidance for Q3 of $282 million at the midpoint, a slight miss

- The company maintained its subscription revenue guidance for the full year of $1.11 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $0.36 at the midpoint

- Operating Margin: -34.2%, up from -46.1% in the same quarter last year

- Free Cash Flow was $11.01 million, up from -$32.99 million in the previous quarter

- Market Capitalization: $9.18 billion

Company Overview

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ: CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

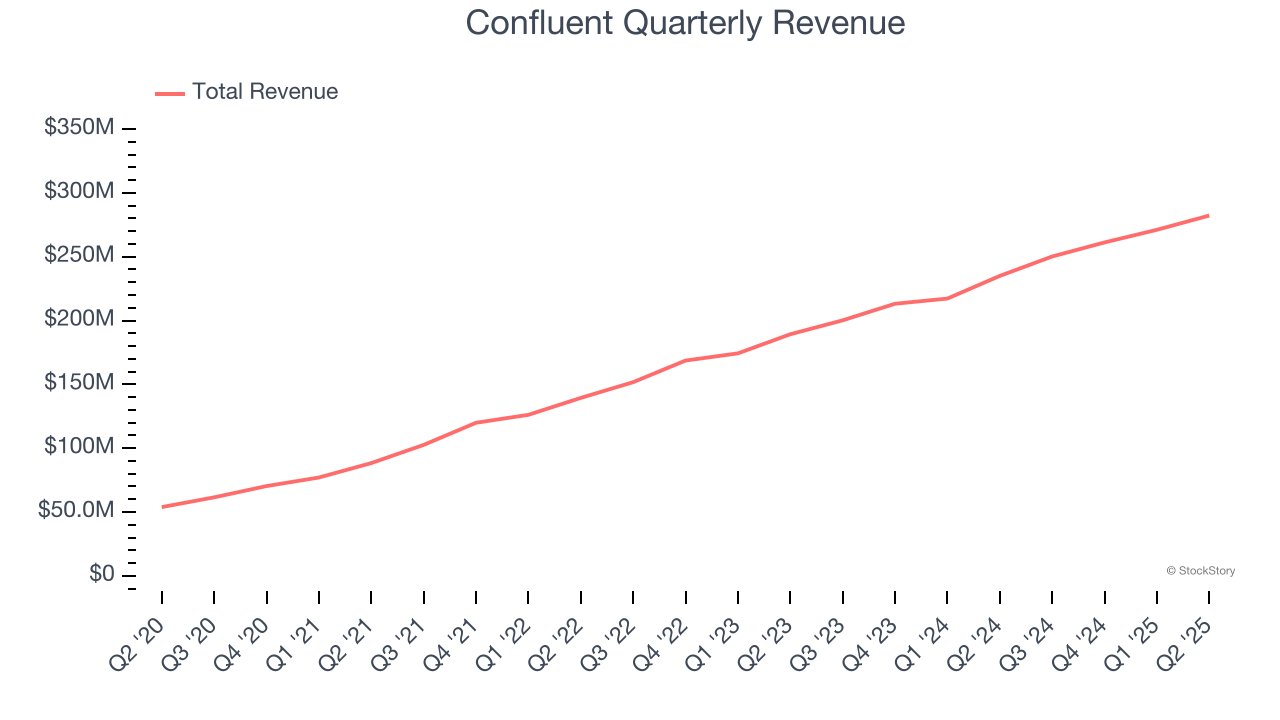

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Confluent’s 29.7% annualized revenue growth over the last three years was impressive. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Confluent reported robust year-on-year revenue growth of 20.1%, and its $282.3 million of revenue topped Wall Street estimates by 1.4%. Company management is currently guiding for a 12.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 17% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and implies the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Enterprise Customer Base

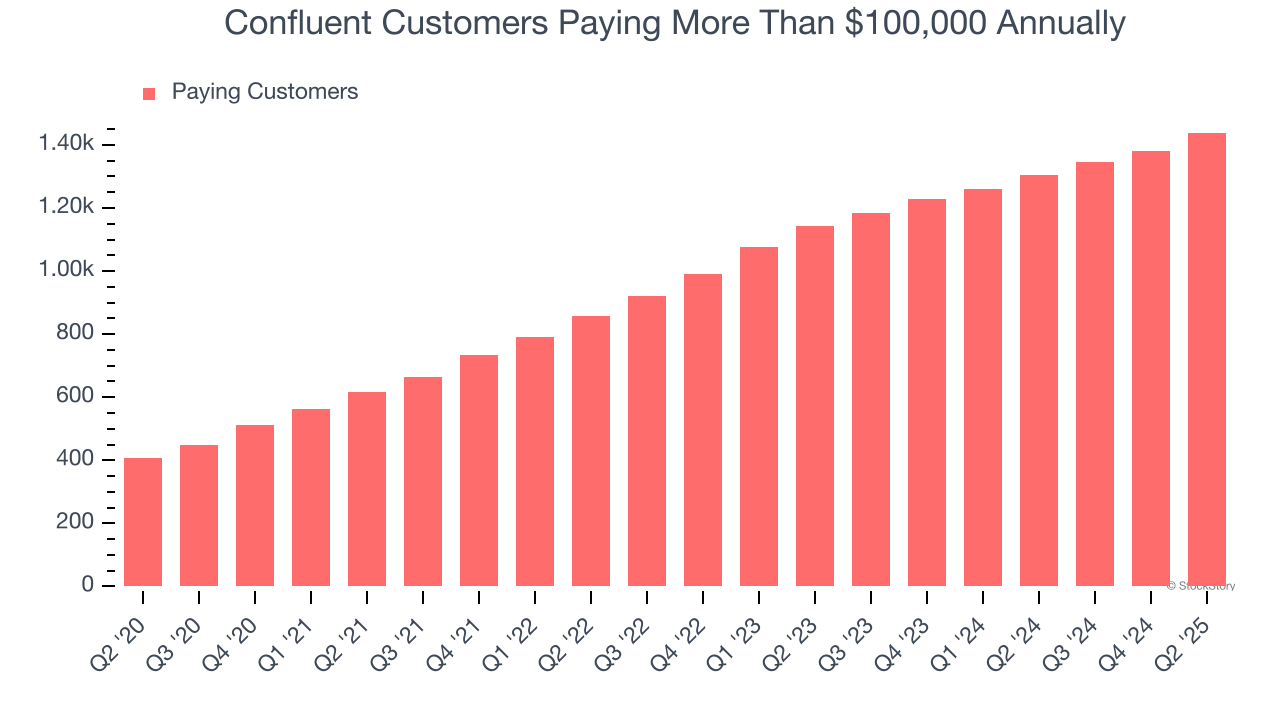

This quarter, Confluent reported 1,439 enterprise customers paying more than $100,000 annually,

Key Takeaways from Confluent’s Q2 Results

It was good to see Confluent narrowly top analysts’ revenue expectations this quarter. On the other hand, its full-year subscription revenue guidance missed and its subscription revenue guidance for next quarter also fell short of Wall Street’s estimates. After the company reported Q1 results, there were concerns about demand, especially after management commented that many large customers were optimizing spend. Overall, this quarter fed into the fears more than assuaged them. The stock traded down 30.7% to $18.28 immediately following the results.

Confluent underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.