American motorcycle manufacturing company Harley-Davidson (NYSE: HOG) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 35.5% year on year to $1.04 billion. Its GAAP profit of $0.88 per share was 8.6% below analysts’ consensus estimates.

Is now the time to buy Harley-Davidson? Find out by accessing our full research report, it’s free.

Harley-Davidson (HOG) Q2 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.37 billion (35.5% year-on-year decline, 23.9% miss)

- EPS (GAAP): $0.88 vs analyst expectations of $0.96 (8.6% miss)

- Operating Margin: 10.8%, down from 14.9% in the same quarter last year

- Free Cash Flow Margin: 31.8%, up from 26.7% in the same quarter last year

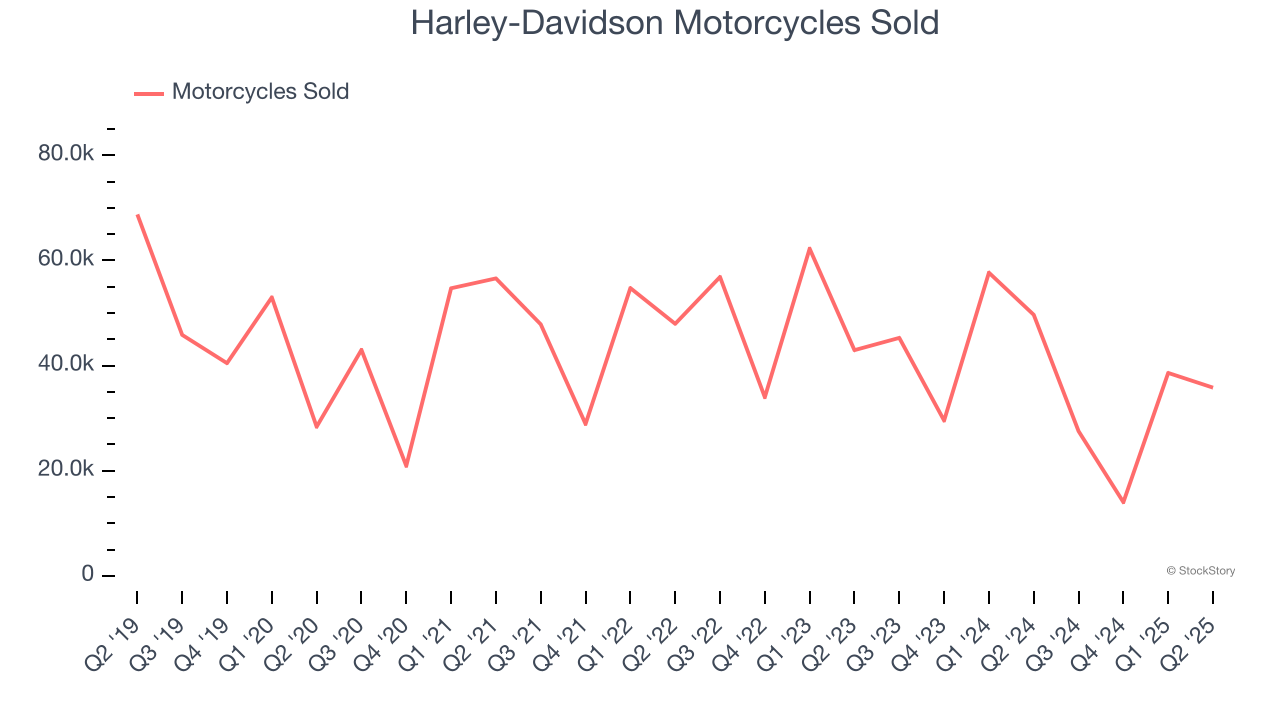

- Motorcycles Sold: 35,800, down 13,860 year on year

- Market Capitalization: $2.79 billion

"While our second quarter results continue to be impacted by a challenging commercial environment for discretionary products and an uncertain tariff situation, we are extremely pleased to announce a strategic partnership for HDFS with KKR and PIMCO that generates significant value for Harley-Davidson on all levels," said Jochen Zeitz, Chairman, President and CEO, Harley-Davidson.

Company Overview

Founded in 1903, Harley-Davidson (NYSE: HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Revenue Growth

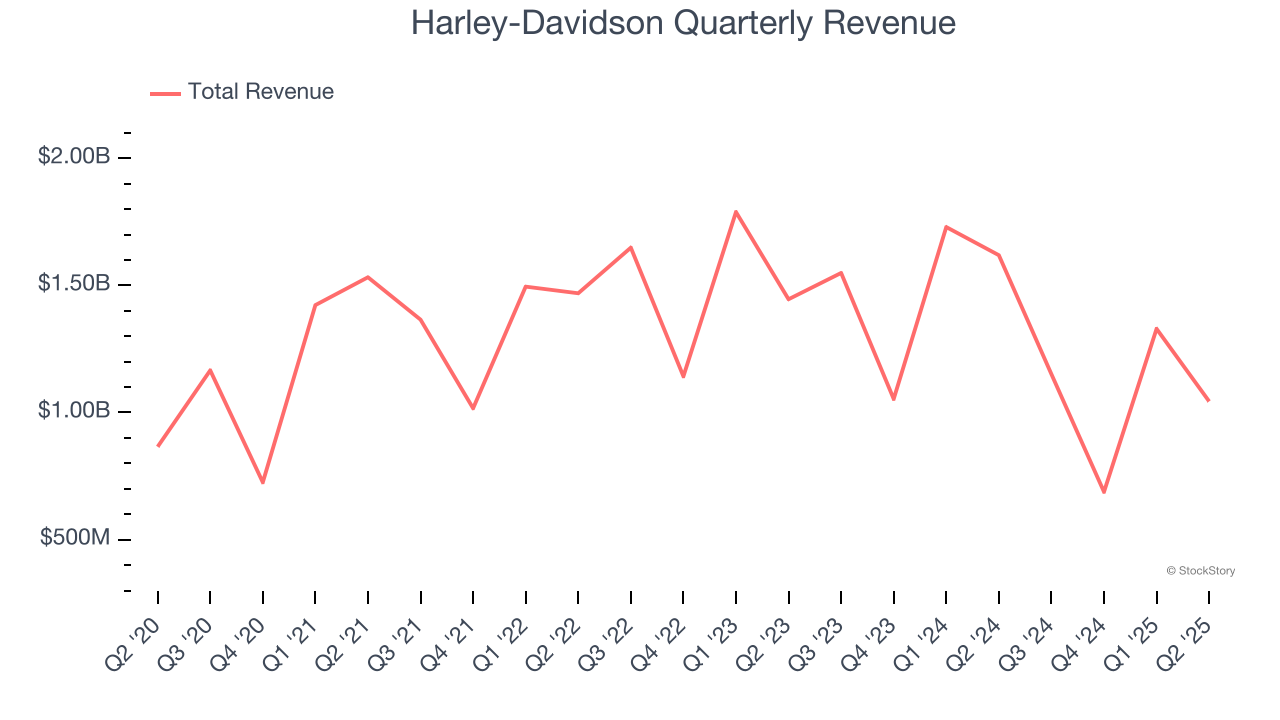

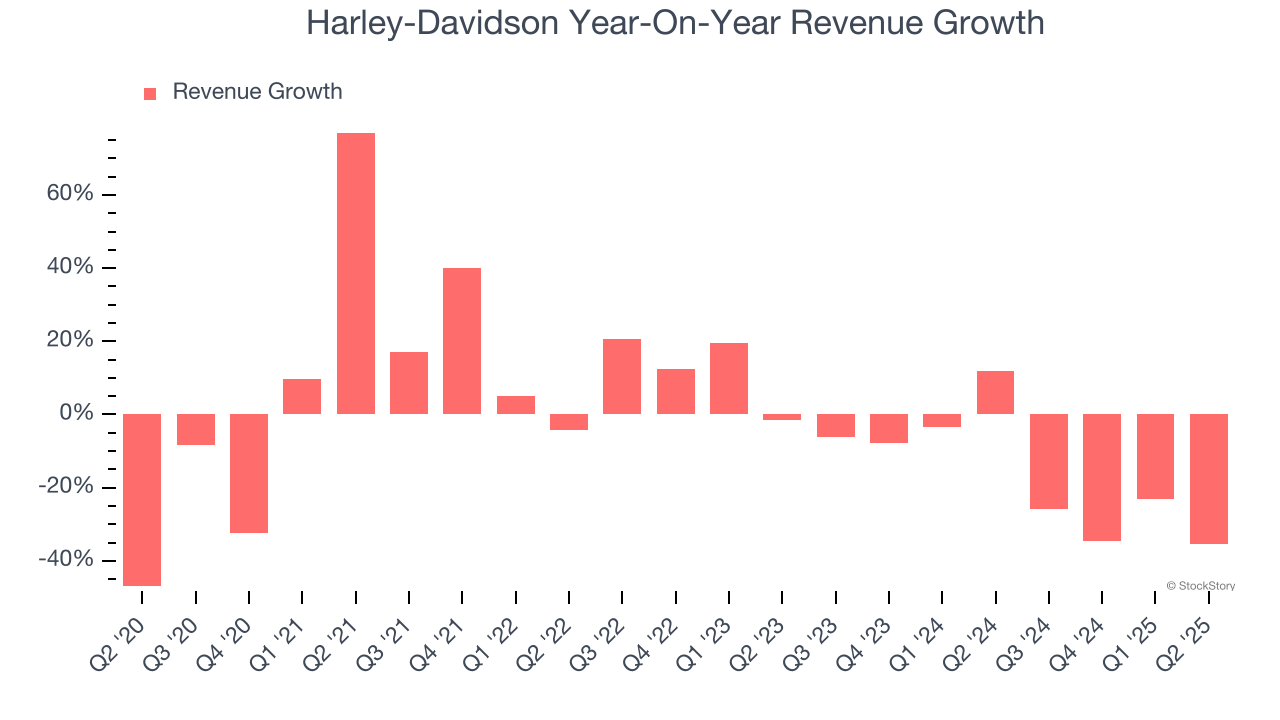

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Harley-Davidson’s demand was weak over the last five years as its sales fell at a 1.4% annual rate. This wasn’t a great result and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Harley-Davidson’s recent performance shows its demand remained suppressed as its revenue has declined by 16.4% annually over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its number of motorcycles sold, which reached 35,800 in the latest quarter. Over the last two years, Harley-Davidson’s motorcycles sold averaged 22.2% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Harley-Davidson missed Wall Street’s estimates and reported a rather uninspiring 35.5% year-on-year revenue decline, generating $1.04 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 14.5% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

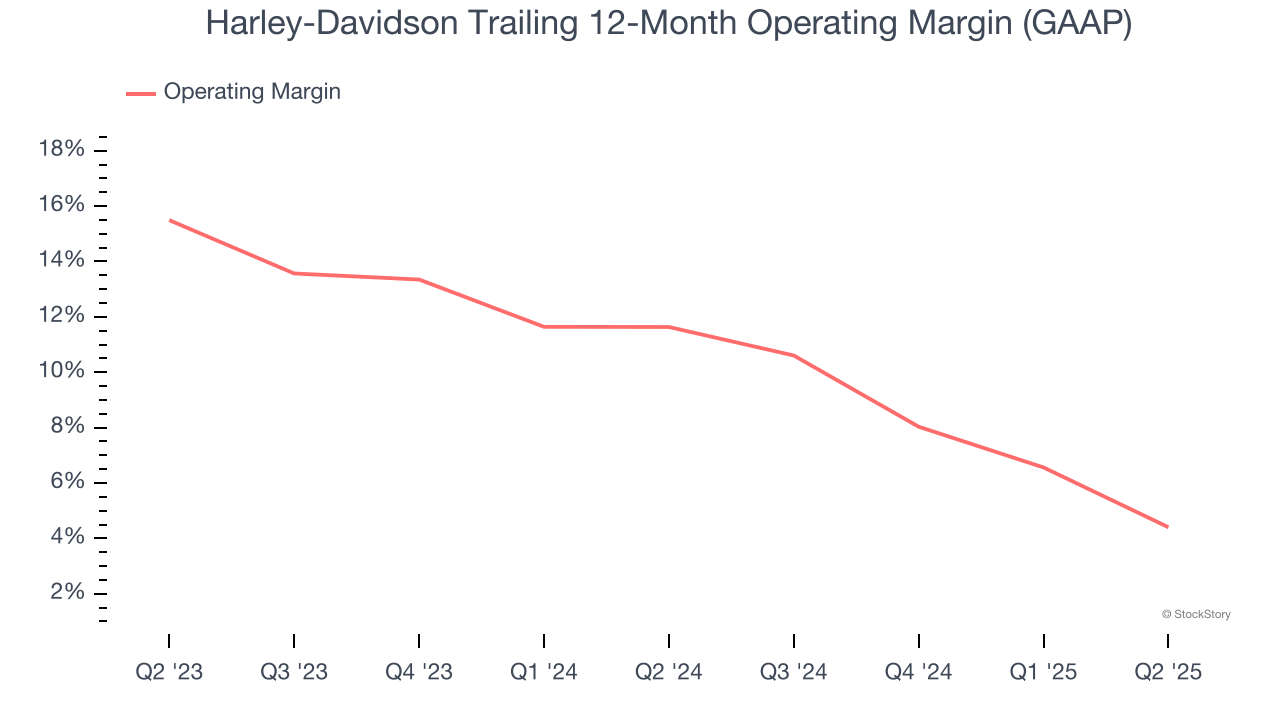

Harley-Davidson’s operating margin has been trending down over the last 12 months and averaged 8.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Harley-Davidson generated an operating margin profit margin of 10.8%, down 4.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

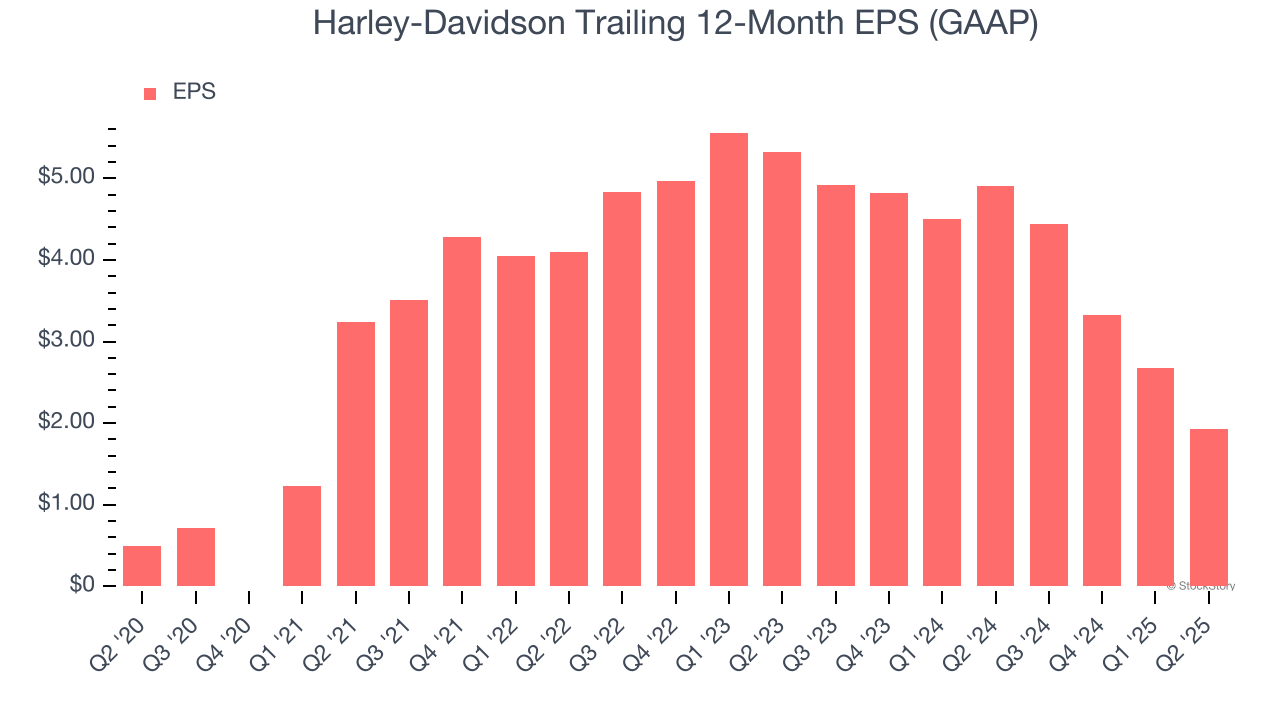

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Harley-Davidson’s EPS grew at an astounding 31.5% compounded annual growth rate over the last five years, higher than its 1.4% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

In Q2, Harley-Davidson reported EPS at $0.88, down from $1.63 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Harley-Davidson’s full-year EPS of $1.93 to grow 46.8%.

Key Takeaways from Harley-Davidson’s Q2 Results

We struggled to find many positives in these results. Its number of motorcycles sold, revenue, and EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $23.05 immediately after reporting.

Is Harley-Davidson an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.