Over the past six months, Oscar Health’s stock price fell to $13.90. Shareholders have lost 19.7% of their capital, which is disappointing considering the S&P 500 has climbed by 5%. This may have investors wondering how to approach the situation.

Following the pullback, is this a buying opportunity for OSCR? Find out in our full research report, it’s free.

Why Is OSCR a Good Business?

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE: OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

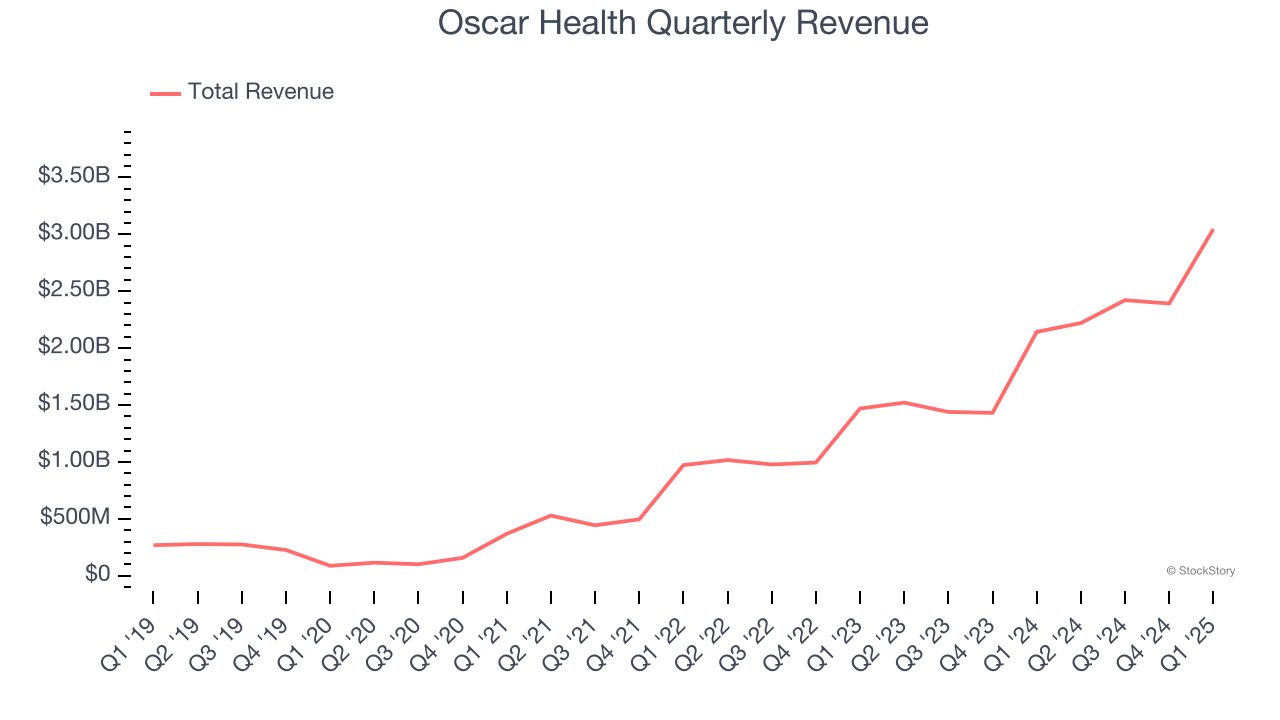

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Oscar Health grew its sales at an incredible 63.3% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

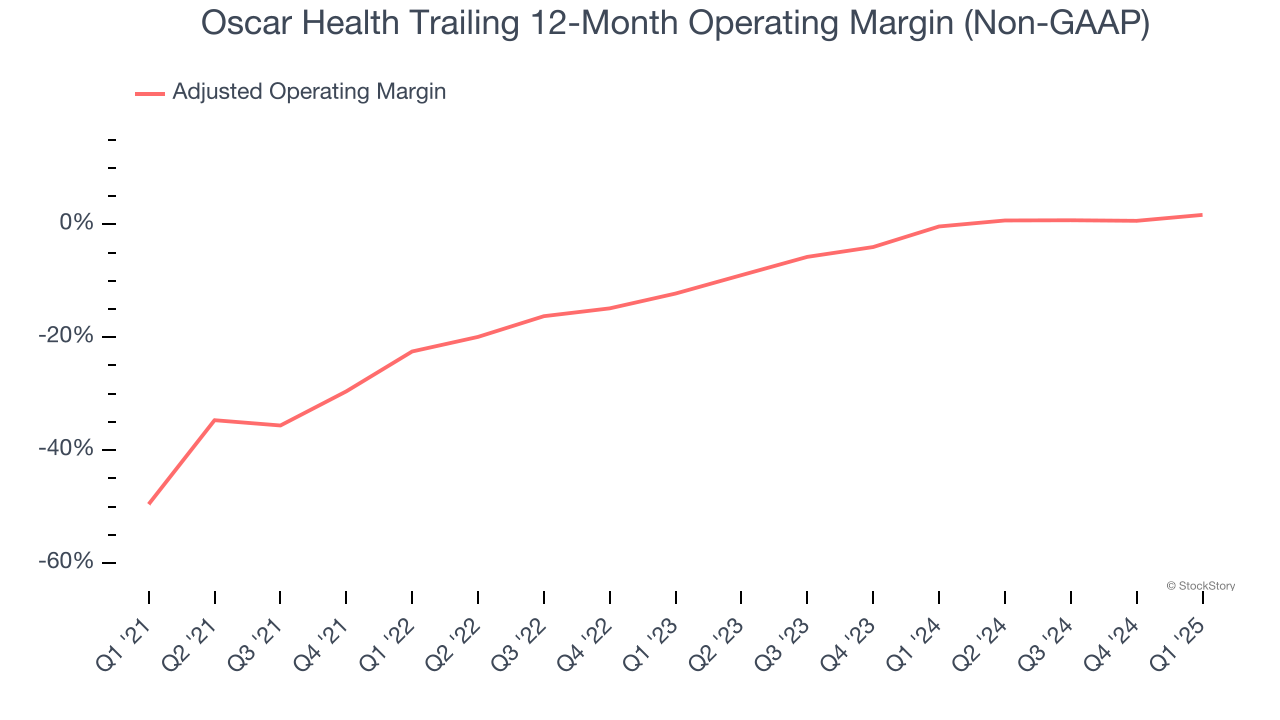

2. Adjusted Operating Margin Rising, Profits Up

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Oscar Health’s adjusted operating margin rose by 51.2 percentage points over the last five years, as its sales growth gave it operating leverage. Its adjusted operating margin for the trailing 12 months was 1.7%.

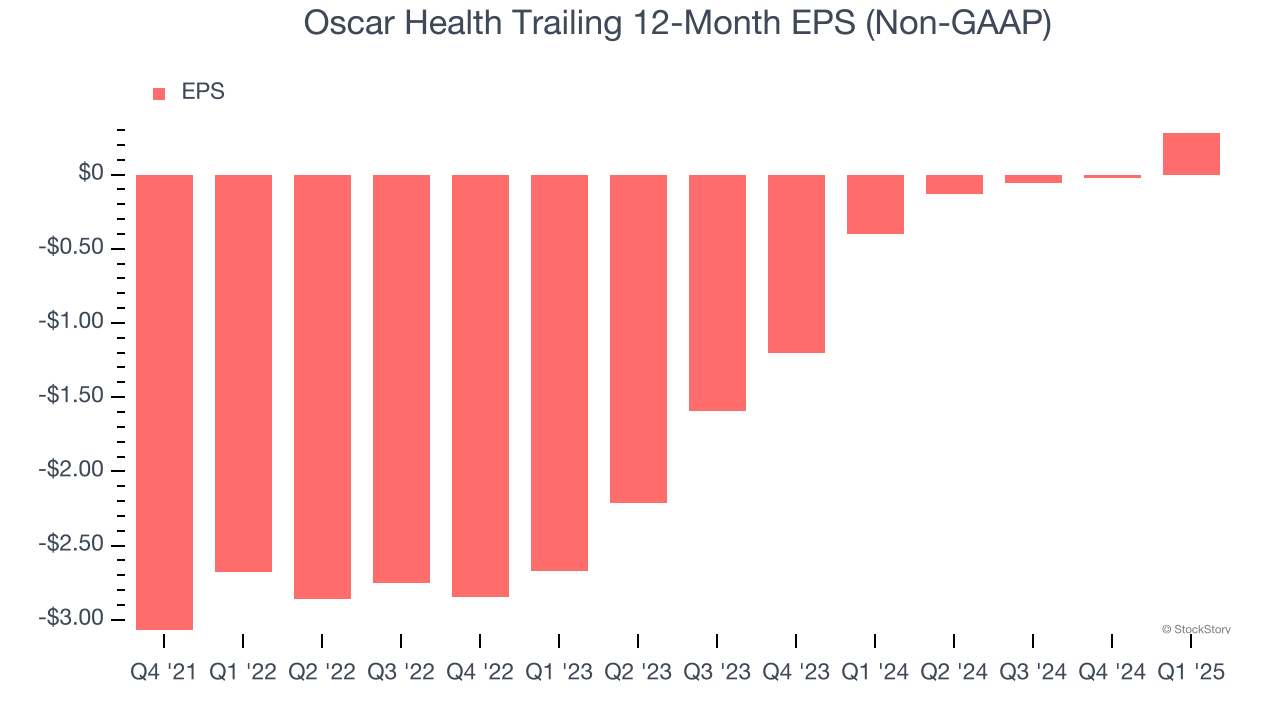

3. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Oscar Health’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons why Oscar Health ranks highly on our list. With the recent decline, the stock trades at 29.6× forward P/E (or $13.90 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Oscar Health

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.